After the Supreme Court blocked Hawaii’s race-based election pending appeal, its organizers—a government contractor named Na’i Aupuni—canceled it and decided instead to seat all the candidates as delegates to a special constitutional convention for the purported new nation of “native Hawaiians.” The plaintiffs have asked the Supreme Court to find the election/convention organizers in contempt of its earlier order. Meanwhile, the appeal of the district court’s earlier denial of an injunction proceeds in the U.S. Court of Appeals for the Ninth Circuit. Cato has joined the American Civil Rights Union on a brief supporting the challengers. We point out that this is the second time that Hawaii has attempted to conduct a discriminatory voter-registration procedure to facilitate a racially exclusionary election. The first time this occurred, the Supreme Court held that such elections violate the Constitution. Rice v. Cayetano (2000). Things are no different this time. The voter qualification requirements here again make eligibility contingent on ancestry and bloodlines, which are nothing more than proxies for race. (There’s a further requirement that voters affirm a belief in the “unrelinquished sovereignty of the Native Hawaiian people,” which is an ahistorical assertion.) Such a discriminatory scheme is per se unconstitutional under the Fifteenth Amendment.

Cato at Liberty

Cato at Liberty

Topics

Constitutional Law

Government Can’t Censor Digital Expression Just Because Someone Somewhere Might Use It for Unlawful Purposes

It’s alas old news when the government couples an imposition on liberty with an exercise in futility—security theater, anyone?—but it’s still finding inventive ways to do so in a nifty case that combines the First Amendment, the Second Amendment, and 3D printing.

Defense Distributed, a nonprofit organization that promotes popular access to constitutionally protected firearms, generates and disseminates information over the Internet for a variety of scientific, artistic, and political reasons. The State Department has ordered the company to stop online publication of certain CAD (Computer-Aided Drafting) files—complex three-dimensional printing specifications with no intellectual-property protection—even domestically. These files can be used to 3D-print the Liberator, a single-shot handgun. The government believes that the files that could be used to print the Liberator are subject to the International Trafficking in Arms Regulations, because they could be downloaded by foreigners and thus are “exports” of arms information that could cause unlawful acts.

When Defense Distributed, ably represented by Alan Gura and Josh Blackman, challenged this restriction of its right to disseminate information to Americans—which the State Department’s own guidance says is protected by the First Amendment—the federal district court ruled for the government. Cato has now filed an amicus brief in the U.S. Court of Appeals for the Fifth Circuit, urging it to defend the First Amendment right of Americans to share open-source technical information.

Defense Distributed is not in the business of distributing arms. What it distributes, as properly recognized by the district court, is computer code in the form of CAD and other files. Code and digital files are speech for purposes of the First Amendment, as several federal appellate courts have recognized. Most importantly, simply because speech may be used for unlawful purposes by third parties doesn’t mean it loses constitutional protection.

Since the 1930s, the Supreme Court has consistently held that “the mere tendency of speech to encourage unlawful acts is not a sufficient reason for banning it,” and that “[p]rotected speech does not become unprotected merely because it resembles the latter. The Constitution requires the reverse.” Ashcroft v. Free Speech Coalition (2002). In the seminal case of Brandenburg v. Ohio (1969), the Court provided a baseline for judging statutes that ban protected speech because of the chance it could enable crime. Unless such encouragement is “inciting or producing imminent lawless action and is likely to incite or produce such action,” it’s protected by the First Amendment.

Moreover, the First Amendment requires “precision of regulation” in cases like this to survive even “rational basis” review—the lowest form of judicial scrutiny. But blanket restraints on methods of mass dissemination aren’t precise; the Supreme Court has said that such actions “burn the house to roast the pig.” Butler v. Michigan (1957).

To add practical insult to constitutional injury, attempting to shut down all Internet transfers of these files is an exercise in futility. The State Department would be better served by a more targeted approach that doesn’t infringe on the right to disseminate and receive information. The Fifth Circuit should reverse the lower court when it hears Defense Distributed v. U.S. Dep’t of State.

Hill Democrats Renew Push for “Assault Weapons” Ban

“1. We must do something. 2. This is something. 3. Therefore, we must do this.” That’s not just a famous line from the BBC’s old comedy Yes, Minister, it might serve as a philosophy of government for about 90 Democrats on Capitol Hill led by Rep. David Cicilline (D‑R.I.), who are seeking to revive a failed Clinton-era ban on so-called assault weapons that Congress let lapse a decade ago. (Gun homicide rates have plunged since the Clinton era.)

The lawmakers’ timing could hardly be worse, with both the New York Times/CBS and ABC News/Washington Post polls showing American public opinion has turned against such bans, which once drew support at levels of 80% or higher. In the latest ABC poll, a 53–45 percent majority of Americans are opposed to such a ban.

That trend in opinion has been in progress for years, since well before this year’s shocking round of mass shootings in Charleston, San Bernardino, and elsewhere. And it owes much to the steady accumulation of evidence on such laws and their effect. Cato has long made gun control one of its topics of interest, with at least three recent publications shedding light on the assault-weapons controversy: David Kopel’s magisterial overview (summary) of the poor track record of supposed common-sense reforms, Jonathan Blanks’s distinction between the actual incidents that dominate gun crime statistics and the outlier episodes that are seized on as symbolic, and Trevor Burrus’s response to the New York Times’s recent overwrought front-page editorial.

At the Volokh Conspiracy blog, UCLA law professor Eugene Volokh has been doing a series of posts (first, second, third, fourth so far) on why even a liberal gun-control advocate like Prof. Adam Winkler has come to see assault weapons bans as “largely ineffectual…bad policy and bad politics,” and why gun rights advocates are not unreasonable to see such bans as strengthening (desirably, for some proponents) the likelihood of future bans on conventional handguns. I’ve also covered the topic a couple of times at my Cato blog Overlawyered, including here (noting columnist Steve Chapman’s description of the ban as part of a “Potemkin Village” array of reforms with no discernible effect) and more recently here (noting false claims in circulation about mass shootings).

What Do Police Think About Body Cameras?

Police body cameras are overwhelmingly popular across political and socio-economic demographics. However, while it is important to consider how the public views police body cameras, it is also worth noting what police law enforcement leadership thinks about the technology. Researchers from Florida Atlantic University and the University of West Florida have conducted a body camera survey on a small number of law enforcement leaders. The results show that half of police commanders would support body cameras being used in their agency and that two-thirds of commanders believe that the public supports body cameras because “society does not trust police officers.”

Survey participants were from Sunshine County, “a large southern county with 27 local law enforcement agencies, home to a number of state and federal law enforcement agencies, and a population of approximately 1.3 million people.” Each month, the leadership staff within the Sunshine County law enforcement community meet. Surveys were sent to the staff in March this year. Twenty-four surveys were completed.

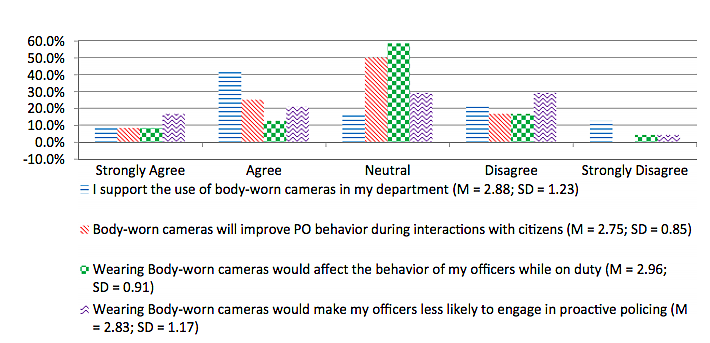

The graph below shows how the respondents answered questions about the use of body cameras and their influence on police officer behavior. Fifty percent of the respondents support using body cameras in their department. The same percentage was also neutral when asked whether body cameras would improve officers’ behavior, although one-third agreed or strongly agreed.

It is too early to say definitively how the use of police body cameras affects officers’ behavior. A widely cited body camera trial in Rialto, California found that the deployment of police body cameras was followed by a reduction in complaints and use-of-force incidents (see chart below).

However, Rialto’s experience has not been replicated in every city where body cameras have been used, and it is important to keep in mind that some of Rialto’s findings could be attributed to citizens changing their behavior around officers wearing body cameras rather than officers changing their behavior. Nonetheless, as I have argued before, police body cameras should be used regardless of the relative lack of data on their impact on officers’ behavior.

The survey did show that a majority (54 percent) of respondents believe that body cameras will reduce the number of unwarranted complaints against officers. This isn’t surprising. Body camera footage has already proven useful in dismissing unwarranted complaints. For instance, body camera footage showed that a woman suspected of drunk driving had lied when she accused an Albuquerque, New Mexico police officer of sexual assault.

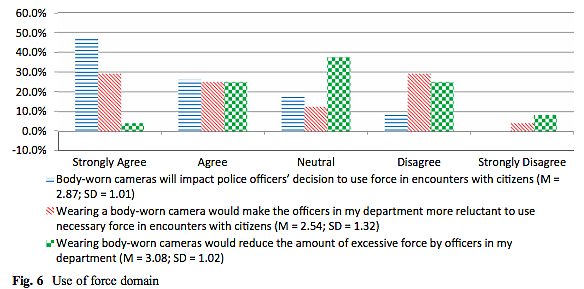

When it comes to use-of-force, police leaders are divided on whether body cameras will reduce officers’ use of excessive force, but a clear majority agree or strongly agree that body cameras “will impact police officers’ decisions to use force in encounters with citizens” (see graph below).

This isn’t surprising. Recently, there has been widespread coverage of police misconduct and the need for more accountability and transparency in law enforcement. Body camera footage or cell phone footage has proven invaluable in cases against officers involved in the killings of Walter Scott, Samuel DuBose, James Boyd, and 6‑year-old Jeremy Mardis. Thanks to advances in technology, many instances of alleged police misconduct can be filmed and shared widely.

Videos of police encounters, of course, don’t just include bad behavior. Body camera footage has provided us with examples of police officers behaving appropriately in difficult circumstances. Nonetheless, 66.7 percent of the law enforcement leadership indicated in the survey that they strongly agree or agree that “The use of body-worn cameras is currently supported by the public because society does not trust police officers.”

Polling data from Gallup suggests that confidence in the police is declining. As the graph below shows, the portion of Americans who say that they have a “great deal” or “quite a lot” of confidence in police is the lowest it has been since 1993. In addition, the portion of Americans who say that they have “very little” confidence in the police is the highest it has been in twenty-two years.

Of the 24 survey respondents, only three said that their agency was using body cameras. Those respondents who haven’t outfitted their officers with body cameras ought to consider that while public confidence in police is not as high as it once was, body cameras–when used with the right policies in place–offer an opportunity to highlight good policing while showing the public that they are committed to accountability and transparency. It’s an opportunity worth seizing.

Today Is Bill of Rights Day

Let’s consider each amendment in turn.

The First Amendment says that “Congress shall make no law… abridging the freedom of speech.” Government officials, however, have insisted that they can gag recipients of “national security letters” and censor broadcast ads in the name of campaign finance reform and arrest people for simply distributing pamphlets on a sidewalk.

The Second Amendment says the people have the right “to keep and bear arms.” Government officials, however, make it difficult to keep a gun in the home and make it a crime for a citizen to carry a gun for self-protection.

The Third Amendment says soldiers may not be quartered in our homes without the consent of the owners. This safeguard is one of the few that is in fine shape – so we can pause here for a laugh.

The Fourth Amendment says the people have the right to be secure against unreasonable searches and seizures. Government officials, however, insist that they can conduct commando-style raids on our homes and treat airline travelers like prison inmates by conducting virtual strip searches.

The Fifth Amendment says that private property shall not be taken “for public use without just compensation.” Government officials, however, insist that they can use eminent domain to take away our property and give it to other private parties who covet it.

The Sixth Amendment says that in criminal prosecutions, the person accused is guaranteed a right to trial by jury. Government officials, however, insist that they can punish people who want to have a trial—“throwing the book” at those who refuse to plead guilty—which explains why 95 percent of the criminal cases never go to trial.

The Seventh Amendment guarantees the right to a jury trial in civil cases where the controversy “shall exceed twenty dollars.” Government officials, however, insist that they can impose draconian fines on people without jury trials.

The Eighth Amendment prohibits cruel and unusual punishments. Government officials, however, insist that a life sentence for a nonviolent drug offense is not cruel.

The Ninth Amendment says that the enumeration in the Constitution of certain rights should not be construed to deny or disparage others “retained by the people.” Government officials, however, insist that they will decide for themselves what rights, if any, will be retained by the people.

The Tenth Amendment says that the powers not delegated to the federal government are reserved to the states, or to the people. Government officials, however, insist that they will decide for themselves what powers they possess, and have extended federal control over health care, crime, education, and other matters the Constitution reserves to the states and the people.

It’s a disturbing snapshot, to be sure, but not one the Framers of the Constitution would have found altogether surprising. They would sometimes refer to written constitutions as mere “parchment barriers,” or what we call “paper tigers.” They nevertheless concluded that having a written constitution was better than having nothing at all.

The key point is this: A free society does not just “happen.” It has to be deliberately created and deliberately maintained. Eternal vigilance is the price of liberty. To remind our fellow citizens of their responsibility in that regard, the Cato Institute has distributed more than six million copies of our pocket Constitution. At this time of year, it’ll make a great stocking stuffer.

Let’s enjoy the holidays (and remember many of the positive trends that are underway) but let’s also resolve to be more vigilant about defending our Constitution. To learn more about Cato’s work in defense of the Constitution, go here. To support the work of Cato, go here.

You Should Be Able to Go to Federal Court with Your Federal Constitutional Claims

Thirty years ago, in the case Williamson County Regional Planning Commission v. Hamilton Bank (1985), the Supreme Court created a rule that effectively bars regulatory-takings plaintiffs from ever receiving the just compensation they are due under the Fifth Amendment. Williamson County’s noxious rule says that federal courts won’t hear Takings Clause claims until the state has not only issued a final order taking the plaintiff’s property but the plaintiff has been denied just compensation after seeking it “through the procedures the State has provided for doing so.”

This state-litigation requirement means that when the government issues a regulation that diminishes property values—for instance, by saying that the owner can’t do any excavation on rocky terrain that can’t be developed without it, as was the case in Arrigoni Enterprises v. Town of Durham—the landowner can’t file its claim in federal courts until it has lost in state court. Not only does this state-litigation rule severely delay the landowner’s remedy; in most cases, it means that the taking will go unremedied altogether.

One reason to have federal courts is to ensure that citizens whose rights have been violated by their state can have their rights vindicated by a truly impartial judge. The state-litigation requirement, however, often prevents federal courts from ever seeing such cases because a number of legal doctrines intended to promote fairness and efficiency bar the plaintiff from even seeking redress in federal court after a state court has already considered the matter. This means that the only way for many plaintiffs to get federal judicial review is to ask the U.S. Supreme Court to take their case after exhausting state courts—an uphill battle to say the least.

Arrigoni Enterprises decided not to pursue its federal Takings Clause claim in state court, and thereby presents the Supreme Court with the opportunity to overrule Williamson County’s state litigation requirement once and for all. Cato has filed a brief supporting Arrigoni’s petition. We argue that Williamson County’s rule was not tenable when written and has proven unworkable. The rule relegates Takings Clause claims to second-class status among other federal constitutional provisions, even though these claims are no more premature and state courts have no greater experience to address them than any other constitutional claims.

Four justices indicated 10 years ago in San Remo Hotel v. San Francisco (2005) that they would be willing to reconsider the wisdom of the state-litigation requirement in an appropriate case. That case has arrived, but if the Court declines to overrule the requirement outright it should at least resolve the current circuit split by ruling that the state-litigation rule is merely prudential such that federal courts can disregard it under the right circumstances and hear Takings Clause cases not litigated through state courts.

This post, and the brief it discusses, was co-authored by Cato legal associate Jayme Weber.

The Year of Educational Choice: Final Tally

This is the seventh and likely final entry in a series on the expansion of educational choice policies in 2015. As I noted at the outset, the Wall Street Journal declared 2011 “The Year of School Choice” after 13 states enacted new school choice laws or expanded existing ones. As of my last update in late September, 15 states had adopted 21 new or expanded educational choice programs, including three education savings account laws, clearly making 2015 the “Year of Educational Choice.” As I wrote previously:

ESAs represent a move from school choice to educational choice because families can use ESA funds to pay for a lot more than just private school tuition. Parents can use the ESA funds for tutors, textbooks, homeschool curricula, online classes, educational therapy, and more. They can also save unused funds for future educational expenses, including college.

Readers will find a complete tally of the new and expanded programs at the bottom of this post, as well as a list of anti-school-choice lawsuits decided in 2015 or still pending.

Lawmakers across the nation are already beginning to consider educational choice proposals for the 2016 legislative session, including Maryland, Oklahoma, South Dakota, Tennessee, Texas, and several others, but Florida will likely be the first state to expand choice next year.

Florida: Expanded Choice on the Horizon But Legal Threats Loom

Florida’s legislature is currently considering legislation to expand both the number and types of students who are eligible to receive ESAs, known in Florida as Personalized Learning Scholarship Accounts. The legislation has already cleared committees in both the Florida House and Senate, but the legislation is not expected to reach the governor’s desk until the new year.

Meanwhile, a Florida judge delivered a partial legal victory to families using tax-credit scholarships. Leon County Circuit Judge George Reynolds ruled that petitioners in a lawsuit contending that the state is not adequetely funding district schools do not have standing to challenge the constitutionality of the state’s scholarship tax credit law. However, the judge allowed the petitioners to proceed in their challenge to the constitutionality of the McKay Scholarships for students with special needs. The petitioners may also present any evidence that either of the choice programs contribute to what they argue is the inadequate level of funding of district schools. That will be a hard case to make, given that Florida’s nonpartisan Office of Program Policy Analysis and Government Accountability estimated that the state saves $1.44 for every $1.00 in reduced revenue resulting from the tax credits. Likewise, a Friedman Foundation fiscal analysis calculated that the McKay Scholarships have saved the state more than $835 million over 12 years.

The scholarship tax credit law is also still facing a second legal challenge to its constitutionality.

Pennsylvania: Budget Stalemate Threatens Scholarships

Earlier this year, Pennsylvania appeared poised to expand the amount of tax credits available for its two scholarship programs. Now, however, a stalemate over budget negotiations has jeopardized even this year’s tax credits because some state officials say the state cannot award the credits without a state budget:

Approval letters have not gone out to businesses for the 2015–16 year.

“Without those approval letters, businesses are not going to be willing to write those checks without knowing they’re going to get credit for it,” said Aaron Anderson, CEO and Head of School at Logos Academy. “By Dec. 31 if this hasn’t happened, they’re going to have to pay their tax bills.”

Jeff Sheridan, spokesman for Gov. Tom Wolf, said letters can’t go out until there is a 2015–16 state budget. Without a budget, the state doesn’t know what limits will be put on the amount of tax credits that can be legally issued, he said.

“The Department of Community and Economic Development has been accepting and reviewing all applications and is prepared to issue award letters as soon as possible once there’s a budget,” he said.

However, proponents of the choice laws disagree with that interpretation. According to Ina Lipman, executive director of Children’s Scholarship Fund Philadelphia, the scholarship tax credit laws require the state to issue the credits whether or not the state adopts a new budget:

“This is not a matter of appropriation that needs yearly approval,” Lipman said. “So many of the arguments that Gov. Wolf’s administration are setting forth are smokescreens. The governor is in full control of whether the DCED can issue these approval letters and issue them in time for this tax credit year and not jeopardize so many organizations that are really in the field to help low-income children to gain access to educational opportunities across the board.”

More than 40,000 low-income students depend on the tax-credit scholarships, so community leaders are speaking out and holding prayer vigils and rallies to encourage lawmakers to take action. If legislators fail to reach a budget compromise or fix the issue outside of the budget process, it’s not only the scholarship students who will suffer. The state would soon find that failure to approve the credits was a costly error. According to a 2014 Show-Me Institute report, if every scholarship student were to enroll at their local district school instead, the schools “would require an additional $892 million in revenue to handle the additional enrollment.”

Montana and Colorado: Exclusion of Religious Schools Invites Lawsuits

Earlier this year, Montana adopted a new scholarship tax credit law. Unfortunately, not only did the law have several flaws that will limit the ability of scholarship organizations to raise money and issue scholarships, but bureaucrats at the Montana Department of Revenue (DOR) unilaterally decided to forbid scholarship organizations from granting scholarships to students to attend religious schools. Legislators who passed the law are not pleased. According to a poll of Montana legislators, a majority believe the revenue department officials are not following the legislature’s intent.

The Montana DOR officials claim that the state’s constitution prohibits using tax-credit scholarships at religious schools, but the state attorney general’s office sent a letter to the DOR advising them that they are in error:

The DOR has proposed excluding religious schools from the rule on the grounds that the Montana Constitution bars appropriations to sectarian schools, organizations or affiliated groups.

However, in his letter, [Solicitor General Dale] Schowengerdt argues, “The Montana Constitution does not authorize, much less require, the wholesale exclusion of religious entities from being considered qualified education providers under SB 410.”

He later argues that the rule’s rationale “that the Montana Constitution requires categorical exclusion of religious entities from SB 410’s tax credit program is in error because the tax credit envisioned by SB 410 is not a direct or indirect appropriation by the state to a religious entity.” And he said it excludes religious entities from a neutral benefits program without good reason.

Schowengerdt said Attorney General Tim Fox did not believe the proposed rule would be defensible in court.

The attorney general’s office also warned the DOR that it is their proposed rule, not the scholarship law, that is unconstitutional because discriminating against religious schools would put “Montana’s Constitution in potential conflict with the U.S. Constitution.”

Indeed, the U.S. Supreme Court may soon consider that very issue. In June, a plurality of the Colorado Supreme Court interpreted the state constitution’s historically anti-Catholic Blaine Amendment to prohibit the use of vouchers at religious schools. Now four educational choice organizations are asking SCOTUS to review that decision and consider striking down Blaine Amendments across the United States. The Goldwater Institute, the Foundation for Excellence in Education, the Hispanic Council for Reform and Educational Options, and the American Federation for Children argue that the Blaine Amendments were “motivated by bigotry” and “present an obstacle to the provision of high-quality educational opportunities for millions of American schoolchildren” that must be removed in order “to vindicate our nation’s sacred promise of equal educational opportunities.”

Likewise, in an interview with RedefinED, Michael Bindas of the Institute for Justice argued that the First and Fourteenth Amendments forbid discriminating against religious schools. “Singling out religious schools is not even handedness,” Bindas argues. “It is discrimination.”

Louisiana: Legal Victory for a Flawed Voucher Program

In a stinging rebuke, the Fifth Circuit Court of Appeals rejected the U.S. Department of Justice’s “disingenuous” attempt to use a decades-old desegregation lawsuit to curb or control Louisiana’s voucher program for low-income students assigned to failing district schools. The DOJ claimed the voucher program imperiled desegregation efforts but two studies showed that the vouchers actually improved racial integration. Indeed, since the vast majority of voucher recipients are black, a victory for the DOJ would have meant keeping black students trapped in failing schools. Fortunately, the court ruled differently.

Educational choice advocates can issue three cheers for the court’s decision, but the voucher program itself deserves only one. Unfortunately, the program is hobbled by excessive regulations that are intended to guarantee quality but might actually be undermining it. For example, the state requires private schools that accept vouchers to administer state test, which drives what schools teach and even how and when they teach it. As I explained in a recent symposium on testing and educational choice at RedefinED:

First, the mandate puts significant pressure on schools to teach subjects at the same time and in a similar manner. A school that taught subjects in years that they are not tested or taught them in a manner that is not aligned with the test would be putting its students at an unnecessary disadvantage. That creates a powerful incentive to conform.

Second, such mandates drive down school participation in school choice programs. A recent American Enterprise Institute study found that states with lightly regulated school choice programs had much higher rates of school participation than highly regulated states. Nearly every private school in Arizona is willing to accept tax-credit scholarship students while only about one-third of Louisiana private schools are willing to accept voucher students due to the program’s regulatory burden.

What’s the difference between the schools that accept the vouchers with all their attached strings and those that don’t? We don’t yet know for certain, but Professor Jay P. Greene warns that it’s likely the least successful and most desperate private schools that accept the regulations:

“The only schools who are willing to do whatever the state tells them they must do are the schools that are most desperate for money,” Greene said. “If you don’t have enough kids in your private school and your finances are in bad shape, you’re in danger of closing — probably because you’re not very good — then you’re willing to do whatever the state says.”

Pelican State lawmakers should study the impact of the excessive regulations and consider modifying the law to allow private schools to administer one of the many nationally norm-referenced tests as an alternative to the state exam.

The Year of Educational Choice: The Final 2015 Tally

Here is the (likely) final tally for new and expanded choice programs in 2015, as well as the private educational choice lawsuits decided this year or still pending:

New Educational Choice Programs (8 in 7 states)

- Arkansas: Vouchers for students with special needs.

- Mississippi: ESAs for students with special needs.

- Montana: Universal tax-credit scholarship law.

- Nevada: Tax-credit scholarships for low- and middle-income students.

- Nevada: Nearly universal ESA for students who previously attended a public school.

- South Carolina: Voucher-like “refundable” direct tuition tax credit for students with special needs.

- Tennessee: ESAs for students with special needs.

- Wisconsin: Vouchers for students with special needs.

Expanded Educational Choice Programs (13 in 9 states)

- Alabama: Raised the annual scholarship tax credit cap from $25 million to $30 million and raised the contribution cap from $7,500 to $50,000. However, the expansion came at a price: the legislation lowered income eligibility threshold from 275 percent of the federal poverty level to 185 percent (from about $67,000 to about $45,000 for a family of four). Current scholarship recipients are grandfathered in.

- Arizona: Expanded ESA eligibility to include students living in Native American tribal lands.

- Arizona: Expanded the types of businesses that can receive tax credits for donations to scholarship organizations.

- Florida: Expanded ESA eligibility to include more categories of students with special needs and increased the budget from $18.4 million to nearly $55 million.

- Indiana: Increased amount of tax credits available for donations to scholarship organizations ($2 million over two years).

- Indiana: Eliminated cap on the value of each voucher. Vouchers are worth 90 percent of the state’s per-pupil funding.

- Louisiana: Expanded school voucher program (funding roughly 600 additional vouchers).

- North Carolina: Expanded school voucher program for low-income students ($17.6 million in 2015–16, $24.8 million in 2016–17).

- North Carolina: Expanded school voucher program for students with special needs(vouchers increased from $6,000 to $8,000, total funding increased by $250,000 to $3.25 million annually).

- Ohio: Increased the value of several categories of vouchers.

- Ohio: Raised the funding caps for special-needs vouchers.

- Oklahoma: Expanded eligibility for its special-needs tax-credit scholarships and raised the tax credit value from 50 percent–tied with Indiana for the lowest in the nation–to 75 percent.

- Wisconsin: The state budget raises and eventually eliminates the statewide voucher cap.

Legal Challenges to Educational Choice Laws Decided in 2015

- Alabama: The state supreme court upheld the state’s refundable scholarship tax credit law against a Blaine Amendment challenge.

- Colorado: A plurality of the state supreme court declared that the state’s Blaine Amendment prohibits the use of public funds at religious schools. One justice held that vouchers violated other statutes.

- Florida: A judge tossed out a procedural challenge to the legislation creating the state’s ESA program.

- Louisiana: The Fifth Circuit Court of Appeals ruled against the U.S. Department of Justice’s “disingenuous” attempt to use a decades-old desegregation lawsuit to curb or control the state’s voucher program.

- North Carolina: The state supreme court upheld the state’s voucher law.

Pending Educational Choice Lawsuits

- Alabama: Public school superintendents claim that the Alabama Accountability Act, which created the state’s refundable scholarship tax credit law (among other things), was improperly adopted by the state legislature in violation of certain provisions of the state constitution.

- Florida: The state’s largest teachers union claims that the scholarship tax credit law violates the state’s Blaine Amendment and “uniformity” clause, which they claim bars the state from funding or otherwise aiding any school system besides the public schools. A lower-court judge previously threw out the lawsuit, but the union has appealed.

- Florida: A public education group claims the state is failing in its constitutional duty to adequately fund public schools. They amended their lawsuit to challenge two school choice programs as well. A county circuit judge denied standing for petitioners to challenge the constitutionality of the state’s scholarship tax credit law, but allowed them to proceed with their challenge to the constitutionality of the McKay Scholarships for students with special needs. Petitioners may also present evidence that either or both programs contribute to the supposed inadequacy of the state’s funding of public education.

- Georgia: The Southern Education Foundation claims Georgia’s scholarship tax credit law violates the state’s Blaine Amendment.

- Nevada: The ACLU claims Nevada’s ESA program violates the state’s Blaine Amendment and other provisions of the state constitution.

- Nevada: A public education group, Educate Nevada Now, claims Nevada’s ESA program is improperly funded because it violates the state constitution’s requirement that the legislature fund “a uniform system of common schools,” among other provisions. The Institute for Justice is seeking intervenor status to defend Nevada’s ESA from both lawsuits.

- Oklahoma: Plaintiffs claim Oklahoma’s voucher program for students with special needs violates the state’s Blaine Amendment.

To learn more about how educational choice benefits students — and how defenders of the status quo are attempting to use the courts to deprive families of that choice — watch the Cato Institute’s short documentary, “Live Free and Learn”: