The foundations of economic freedom are personal choice, voluntary exchange, and open markets. As Adam Smith, F. A. Hayek, and Milton Friedman stressed, freedom of exchange and minimally regulated markets provide the fuel for economic progress. Without exchange and entrepreneurial activity that is coordinated through markets rather than by governments, modern living standards would be impossible. Cato scholars explore policy reforms that could increase growth by strengthening property rights and the rule of law, safeguarding the value of money, reducing excessive taxes and regulations, scaling back government interference with trade and immigration, and reducing federal spending on programs that harm economic productivity.

Featured Project

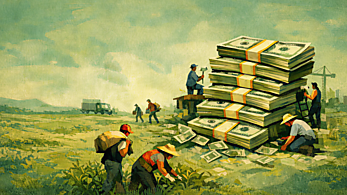

Defending Globalization

Globalization today faces renewed attention—and criticism. Like any market phenomenon, the free movement of people, things, money, and ideas across natural or political borders is imperfect and often disruptive. But it has also produced undeniable benefits—for the United States and the world—that no other system can match. Defending Globalization is a new Cato Institute multimedia project on all aspects of the fundamentally human activity that we call “globalization.”