One story lost in all the Obamacare coverage last week, was the new law concerning jury nullification in New Hampshire. In a post over at our police misconduct site, I try to explain what impact that new law will have in the New Hampshire courts.

Cato at Liberty

Cato at Liberty

Topics

Is the Individual Mandate a Tax?

From my 2010 paper “Obama’s Prescription for Low-Wage Workers; High Implicit Taxes, Higher Premiums”:

President Obama argues that a legal requirement for individuals to purchase health insurance is not a tax. Yet many economists, including some of President Obama’s economic advisers, consider it to be a type of tax.

Princeton University health economist Uwe Reinhardt writes, “[Just because] the fiscal flows triggered by [the] mandate would not flow directly through the public budgets does not detract from the measure’s status of a bona fide tax.”

MIT health economist Jonathan Gruber writes, “Suppose … the government mandated that everyone buy full insurance at the average price.… This would not be a very attractive plan to careful consumers … who could view themselves as essentially being taxed in order to support this market, by paying higher premiums than they should based on their risk.”

President Obama’s National Economic Council chairman Larry Summers writes, “Essentially, mandated benefits are like public programs financed by benefit taxes.”

Sherry Glied, President Obama’s appointee to assistant secretary for planning and evaluation at the Department of Health and Human Services, writes, “The individual mandate … is in many respects analogous to a tax. It requires people to make payments for something whether they want it or not.”

When the Clinton administration proposed an individual mandate in 1993, the CBO went so far as to treat the mandatory premiums that Americans would pay as federal revenues and include them in the federal budget. So far, the CBO has not done the same for the mandates in the House and Senate bills. (As Reinhardt suggests, that does not imply that those mandates are not a tax.)

Each bill would also impose penalties on individuals (and employers) who do not comply with the health-insurance mandates. Those penalties would be paid to the Internal Revenue Service along with one’s income taxes.

Related Tags

An ObamaCare Silver Lining?

Today POLITICO Arena asks:

Was the health care ruling actually a long-term victory for conservative jurisprudence?

My response:

It will take some time to fully digest the Court’s massive and often opaque split decision on ObamaCare, but whether the ruling will eventually lead to a victory for conservative jurisprudence will now be in the hands of the voters. If the reaction to this decision brings the majority of citizens who’ve consistently opposed ObamaCare to the polls, not only might ObamaCare be repealed, but the Court itself may eventually change in the direction the dissent marked out, and that would be good.

To be sure, some have suggested that this decision is not as bad as it seemed at first, but here are just a few responses to that contention: (1) the Commerce Clause “victory” is extremely limited; Congress cannot compel people to engage in commerce so it can then regulate that commerce, but this is the first time Congress has ever tried such a thing, so it’s not an everyday affair; (2) the vast post-New Deal regulatory power that Congress has practiced remains untouched by this decision; (3) a good case can be made that this Commerce Clause “victory” will be read as dicta and hence will not be binding in future cases; and finally, (4) Congress can now do the same thing under its taxing power, so as a practical matter there was no change.

Yes, that last point puts the matter “on budget,” and that’s no small matter, politically. But it will take a political reaction and then a change on the Court before this decision can be read, doubtless by historians, as having precipitated a victory, not so much for “conservative jurisprudence,” which is not of a piece, but for the Constitution.

“Conservatives’ Last Legal Option to Invalidate Obamacare”

The New Republic reports on an issue that Jonathan Adler and I have been highlighting: an IRS rule that will tax employers and subsidize private health insurance companies without congressional authorization. Why would the IRS issue such a rule? Perhaps because ObamaCare could collapse without it.

The post quotes another law professor who acknowledges the Obama administration faces a serious problem:

“It’s fairly decent textual case,” says Kevin Outterson, a professor at Boston University Law School, and health care blogger for The Incidental Economist. And if it stood, he says, the consequences could be disastrous.

Disastrous for ObamaCare, that is. But as Adler and I have written previously, if saving ObamaCare means letting the IRS tax employers without congressional authorization, then ObamaCare is not worth saving.

Iraq’s Oil-Fueled State Socialism

Over the weekend, the New York Times reported on rising consumerism in Iraq, as evidenced by the popularity of American-style shopping malls. I was more intrigued by the tales of cronyism and a wholly dysfunctional state. Here are a few tidbits:

economists and other experts…say the emerging consumer culture masks fundamental flaws in an economy that, like those of other energy-rich countries like Saudi Arabia and Qatar, stifles productive enterprise by relying almost solely on oil profits and the millions of government salaries those profits finance as part of the country’s vast patronage system.

“Basically, Iraq is trying to build a consumer society, not on state capitalism like in China, but on socialism,” said Marie-Hélène Bricknell, the World Bank’s representative in Iraq.

[…]

experts worry [the expected boom in government revenues] will finance more of what Iraq already has: corruption and a huge government work force.

Most of the major industries remain in the hands of the state, and the greatest ambition of many Iraqis is to secure a government job. According to statistics from the Iraqi Ministry of Planning, almost a third of the labor force works for the government. That is more than five million people, and the number is rising, as political parties that run government ministries use paychecks to expand their constituencies.

[…]

Because government salaries are much higher than those in the private sector, independent businesses operate at a disadvantage because, among other disincentives, would-be entrepreneurs cannot afford to hire the most skilled workers. The World Bank ranks Iraq 153rd out of 183 countries on the ease of doing business.

“Building a consumer society on top of nothing is like building a bubble that will burst in the future,” Ms. Bricknell said. With the shopping malls, she said, “you are putting a veneer over a rotting core, basically.”

File these sorts of stories away for the next time that you encounter (maybe at a 4th of July celebration?) patriotic, red-blooded, so-called conservatives bragging about their commitment to limited government and the free market, and who then declare that the Iraq war was a great victory for such principles.

Related Tags

Looking at Austerity in Portugal

Portugal is “on edge of abyss” reads the headline of a Reuters story last week. Despite receiving a $104.5 billion bailout last year from the EU and the IMF, the country’s economy continues to shrink as unemployment soars and uncertainty about its permanence in the euro remains steady. Just like Greece, Portugal might need a second bailout soon.

As has been the case elsewhere, some pundits claim that austerity is in part responsible for Portugal’s current economic malaise. Even the IMF has said that deficit targeting “may not be the best policy” if the country falls deeper into recession. The question then is what we understand by “austerity.”

First, it is important to point out that Portugal got in trouble for having a government that spent too much over a long time. Back in 2001 the country was the first to breach the 3% of GDP deficit ceiling agreed to as part of the Stability and Growth Pact. Since then, it ran significant budget deficits, and in 2009, as a reaction to the global downturn, Portugal implemented a massive stimulus package that shot its deficit to 9.4% of GDP. (It is worth noting that the stimulus didn’t work, unemployment went up from 9.5% in 2009 to 14.9% now).

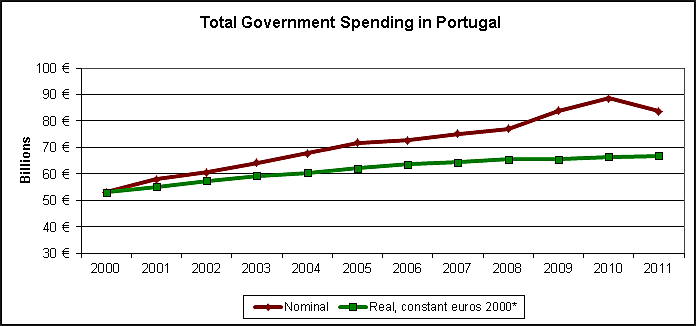

* Using GDP deflator.

Source: European Commission, Economic and Financial Affairs.

Spending in nominal terms increased on average by 5.6% every year from 2000 to 2010. As we can see in the graph, it accelerated in 2009 as the Socialist government of José Socrates tried to fend off the global recession with a Keynesian-style stimulus. It was not until 2011 that the new government of Pedro Passos Coelho began implementing spending cuts, which reduced overall spending by 5.5% from the previous year. Still, government spending in 2011 was at the same level of 2009. In real terms, there has been no decline in spending levels.

As a percentage of the size of the economy, total government spending in Portugal in 2011 stood at 45.2% of GDP, just a whisker down from its 2009 peak of 45.8%.

Early on Socrates tried to tame the deficit with tax increases. He raised the VAT rate from 19% to 21%. As part of last year’s the bailout agreement, Passos Coelho raised the VAT further to 23%, one of the highest rates in Europe. His government also introduced changes in the income tax: some rebates were scrapped; a surtax of 1.5% and 2.5% was introduced for middle and high income earners, respectively. A special corporate tax rate of 12.5% for small businesses was raised to 20%, and a surtax of 3% and 5% was created for medium and big companies, respectively. There were also tax increases on alcohol, fuel and tobacco.

The evidence suggests that even though in the last year there have been measurable spending cuts in Portugal (and I’m sure that people there are feeling the pinch from those cuts), tax increases constitute a significant chunk of the austerity policies implemented in that country.

Related Tags

It’s “Declaration of Internet Freedom” Day!

… or at least I should have said so back on March 4th.

That was the anniversary of the day that Congress proposed to append a Bill of Rights to our Constitution. With a lovely preamble that went a little somethin’ like this:

THE Conventions of a number of the States, having at the time of their adopting the Constitution, expressed a desire, in order to prevent misconstruction or abuse of its powers, that further declaratory and restrictive clauses should be added: And as extending the ground of public confidence in the Government, will best ensure the beneficent ends of its institution.

The Bill of Rights contains gems like “Congress shall make no law … abridging the freedom of speech, or of the press,” (Amendment 1) and, “The right of the people to be secure in their persons, houses, papers, and effects, against unreasonable searches and seizures, shall not be violated” (Amendment 4).

I think this original Declaration of Internet Freedom is the bee’s knees. Yes, it’s taking some work to apply its strictures to the modern communications environment, but that’s a much more contained problem than starting over.

Starting over. That’s what a collection of really lovely groups–some highly pro-regulation, others handmaidens of government growth–are doing. They’ve come up with a “Declaration of Internet Freedom” whose principal virtue is a pretty cool graphic. The actual “principles” in it are so weasel‑y that I wouldn’t trust ‘em as far as I could throw ‘em.

When you’re done pondering how one could “throw” a principle, consider an alternative to the “mainstream” declaration put out by our friends at TechFreedom. Their Declaration of Internet Freedom has a bunch of principles like “Humility” and “Rule of Law.”

Their thing on “Free Expression” cites the First Amendment. Remember that one? That’s the “Congress shall make no law” one. So that’s pretty good.

But I’m really hoping that nobody living today gets to define the basic principles by which the Internet is ruled. We’ve got that. It’s a neato collection of negative rights, preventing the government from interfering with society’s development, whether that development occurs online or off.

So happy Declaration of Internet Freedom day! I’ll be celebrating the real one.

In case you’ve gotten confused in all the jostling around, the real one is the Bill of Rights.