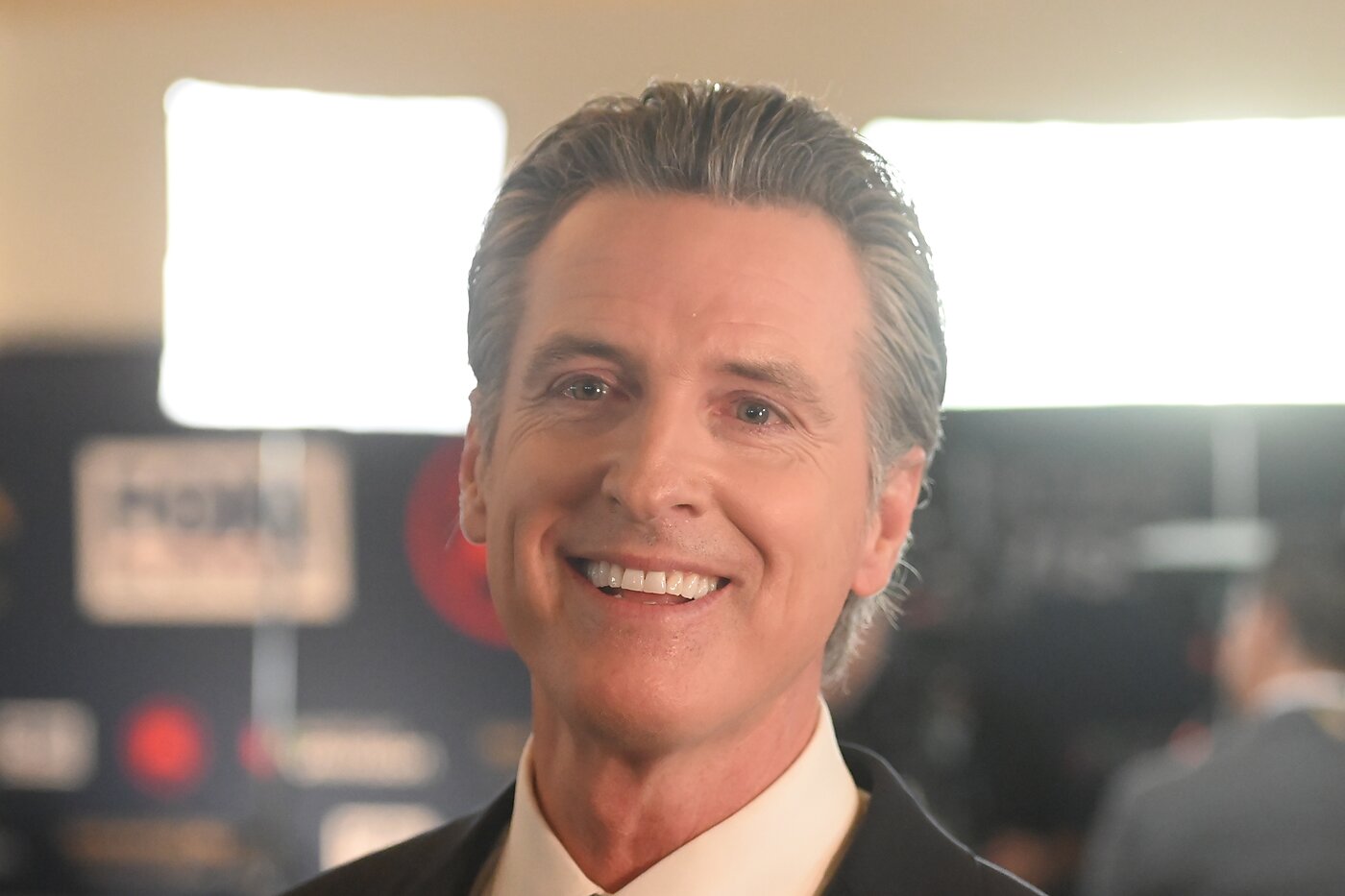

California Governor Gavin Newsom (D) is demonstrating one of the pitfalls of putting the government in charge of public health.

Public health officials are monitoring the spread of H5N1 avian influenza among animals and even a few humans. Reports indicate the virus has appeared in animals in 16 states, including at more than 600 dairies in California. There have been 61 human cases. Most have been mild disease. There has been one severe case.

It appears that federal Centers for Disease Control officials are doing what they should be doing right now. They are monitoring the situation and providing non-alarmist judgments (“the immediate risk to the public’s health from H5N1 bird flu…remains low”) and recommendations (don’t lick dead birds).

One cannot say the same of Newsom, who is sending the public confusing signals. On the one hand, he says, “the risk to the public remains low.” At the exact same time, he also says,

I find that conditions of extreme peril to the safety of persons and property exist due to Bird Flu…

I, GAVIN NEWSOM…HEREBY DECLARE A STATE OF EMERGENCY…

All residents are to obey the direction of emergency officials…in order to protect their safety…

I FURTHER DIRECT…that widespread publicity and notice be given of this proclamation.

So sayeth The Great and Powerful Oz. The last time I checked, “the risk is low” means the exact opposite of “emergency.” So which is it?

The reason for the contradictory messages is power. Newsom can claim additional, unilateral powers to spend additional taxpayer dollars, to command California officials and residents to take action, and even to suspend certain government regulations. To wield these powers, he must first declare California to be in a “state of emergency.”

On the surface, it makes sense to give government agencies additional funding and flexibility during public health emergencies. The late, great Californian Shirley Svorny and I hailed states’ suspension of clinician-licensing regulations during Covid-19, for example.

But it’s not hard to see the moral hazard problem. When legislatures authorize governors to release more spending and give more orders during emergencies, governors will have incentives to jump the gun and declare situations to be emergencies when they otherwise would not. When you subsidize emergencies, you get more “emergencies.”

That appears to be happening here. Newsom wants to protect people from bird flu. He probably also wants the favorable press that would come from people seeing him taking steps to contain bird flu. Then there’s also the possibility that Newsom wants something from someone who wants Newsom to do more to contain bird flu. So, instead of requesting that the legislature give him additional powers to address what he acknowledges is a non-emergency, Newsom declares a state of emergency.

Crying wolf is not harmless. Even libertarians believe some government public health activities are defensible. But for those actions to be defensible, they must be effective. For them to be effective, the public must trust government public health officials. When government officials cry wolf, they give the public additional good reason to ignore them on those rare occasions when the public really shouldn’t.

Ironically, even though the CDC is behaving better than the governor, Newsom is inadvertently making the case for leaving public health decisions to state rather than federal officials. Whatever harm Newsom does to public trust in government will affect only his state. Indeed, under a federalist system, his mistakes can help other states by showing them how to improve their public health strategies.

Were Newsom and current CDC officials to switch places, his errors would affect all 50 states and frustrate the process of experimentation and learning. The prospect that either public health alarmists or anti-vaxxers could end up making policy for the entire nation is a powerful argument for not letting the federal government make public health policy at all. (I don’t know about you, but I’m starting to lose my faith in the political system’s ability to filter those candidates.) It is at least a powerful argument for severely restricting the federal government’s powers in this area.