President Obama recently got himself in hot water with his “you didn’t build that” remark, which trivialized the hard work of entrepreneurs.

But he is right—in a perverse way—about government playing a big role in the life of small businesses. Thanks to a maze of regulations, the government is an unwelcome silent partner for every entrepreneur. And we’re not talking small numbers.

- Americans spend 8.8 billion hours every year filling out government forms.

- The economy-wide cost of regulation is now $1.75 trillion.

- For every bureaucrat at a regulatory agency, one study estimated that 100 jobs are destroyed in the economy’s productive sector.

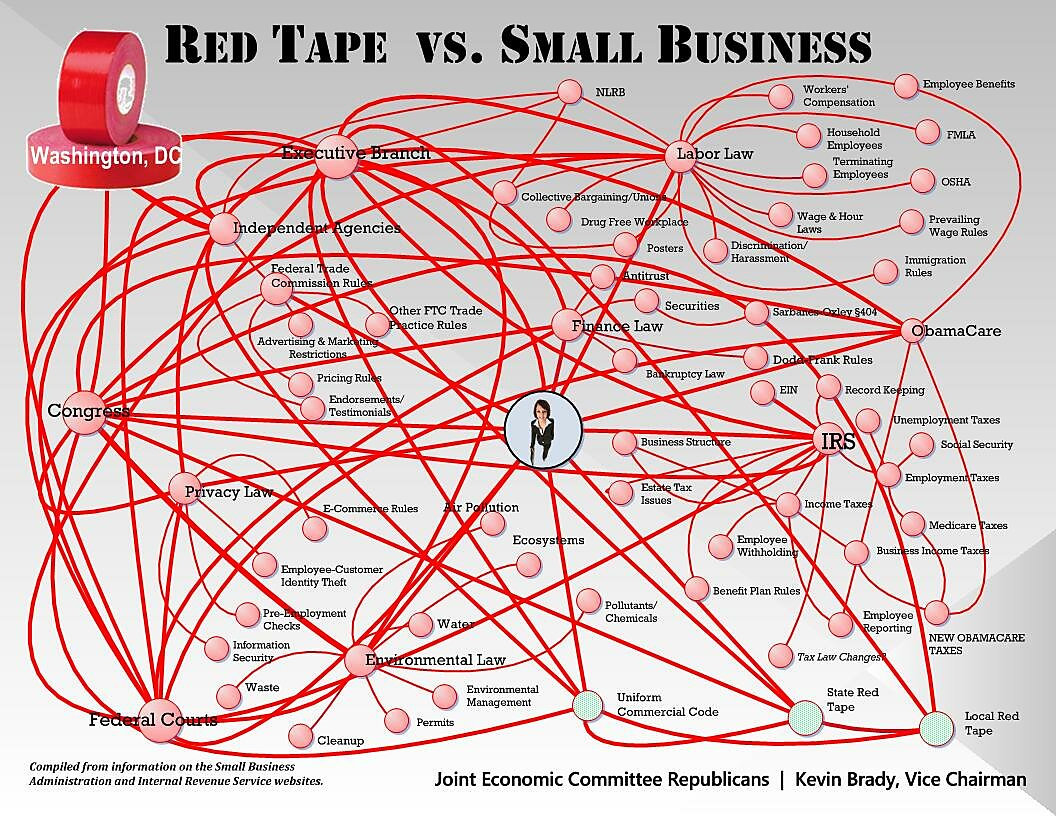

But sometimes an image helps to make things easy to understand. Here’s a chart from the Joint Economic Committee, which maps out the web of regulation imposed by Washington: