Congress is debating bills to address police misconduct as well as to provide further aid to state and local governments struggling with budget deficits. But the states can address both issues themselves with one reform: repealing collective bargaining for public workers.

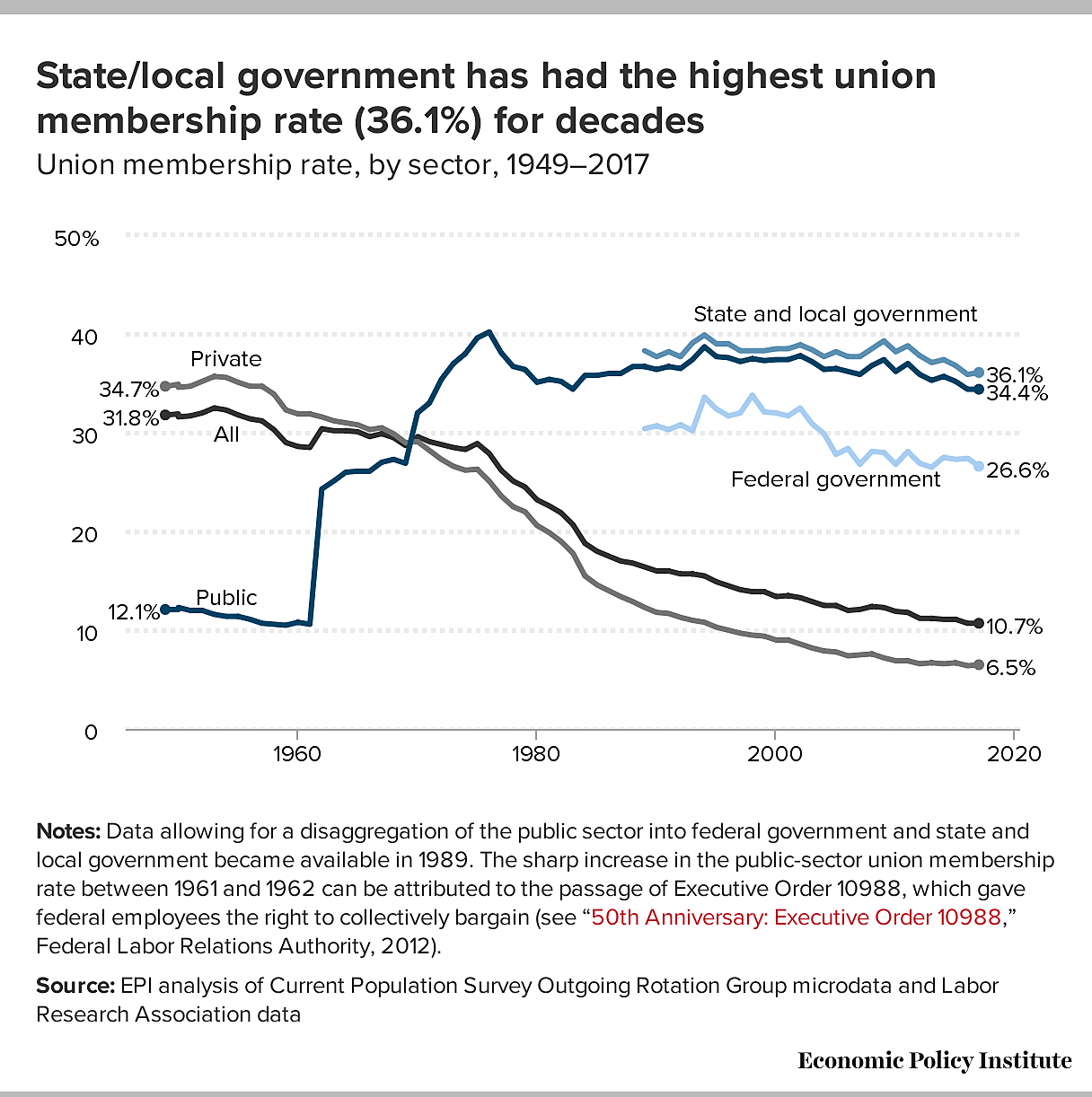

State and local workforces are heavily unionized with 39 percent of workers covered by collective bargaining compared to just 7 percent in the private sector. Large majorities of public school teachers and police in big-city departments are covered by collective bargaining.

Public sector union shares vary widely across the states based on state collective bargaining rules. Many states, such as New York, mandate collective bargaining for most workers. At the other end of the spectrum, North Carolina and Virginia completely ban collective bargaining in government, which is the best policy approach.

I discuss government unions further in my new Examiner op-ed and in studies here and here.

This study by the Economic Policy Institute presents data on union membership, some of which I’ve posted below. The first chart reveals the revolution in public-sector unionism during the 1960s and 70s. The second chart reflects the large differences in union policies between the states.