More people are taking notice each day of the risks of central bank digital currencies (CBDCs). These concerns have been voiced in the media, in testimonies before Congress, and elsewhere. However, the officials driving the charge for CBDCs appear undeterred. Instead, some of these officials have taken up a marketing effort to rebrand CBDCs as “digital cash.”

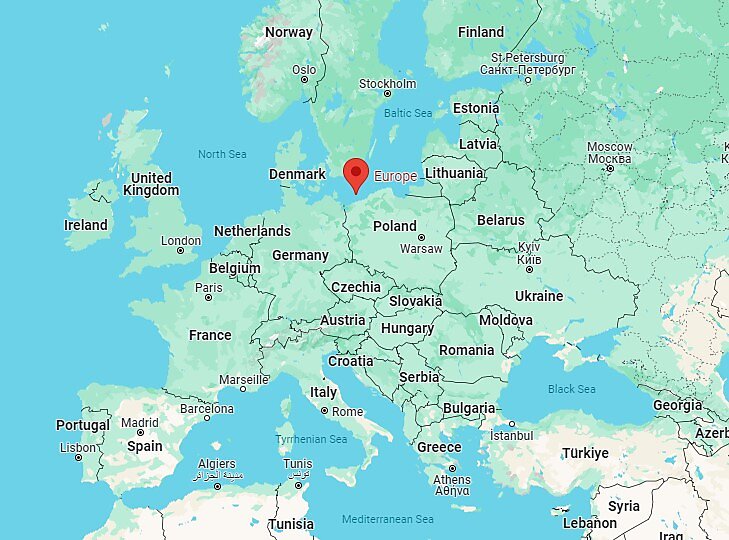

Consider just a few examples. The European Central Bank has said, “A digital euro would be an electronic form of cash for the digitalised world.” The Norges Bank has said a CBDC would be a “digital version of cash.” Similarly, the Sveriges Riksbank has said a CBDC would be “just like cash.” Or, in a more striking example of this rebranding, the Reserve Bank of New Zealand published a CBDC consultation paper that said “CBDC” just eight times. In contrast, the paper said “digital cash” 370 times.

Finally, at a World Economic Forum event, Central Bank of Bahrain governor Khalid Humaidan said, “We’re probably going to stop calling it ‘central bank digital currency.’ It’s going to be a digital form of the cash, and at some point in time hopefully we will be able to be one hundred percent digital.”

A CBDC is Not Just Another Form of Money

Despite the claims, a CBDC is not “cash for the digitalised world.” Yes, like cash, a CBDC would be a liability of the central bank. However, unlike cash, a CBDC would offer neither the privacy protections nor the finality that cash provides.

First, on the issue of privacy, a CBDC would be a radical departure from cash. When I present a five-dollar bill to someone for payment, we are the only ones who truly know the transaction’s details. Maybe a person nearby saw the transaction, but they are unlikely to know just how much money I handed off. It’s even more unlikely that they know the serial number of the note that I handed over. And unless they know me well, they are unlikely to know my name and address.

In contrast, central bankers—including Federal Reserve Chair Jerome Powell, Bank for International Settlements General Manager Agustín Carstens, European Central Bank President Christine Lagarde, and Bank of England Governor Andrew Bailey—have openly and repeatedly said that anonymity and complete privacy would not be an option with a CBDC. To share just one example, President Lagarde said, “When we surveyed Europeans, the first concern that they had … was privacy. Privacy is first and foremost on their mind when we divvy up the digital euro. [But] there would not be complete anonymity as there is with [cash.]”

Second, a CBDC would be a radical departure from cash in terms of finality as well. In simple terms, when I hand over cash to make a payment, that payment has settled. There are no pending updates that require me to wait for the transaction to be approved or cleared. There are no chargebacks. There are no interventions. The payment is final.

In contrast, a CBDC payment would not be final. Much like the electronic money used today with credit cards, debit cards, and payment apps, transactions would not settle instantly. More so, transactions could be charged back after the fact. But going further than today’s electronic money, basic programmability with a CBDC could limit, or otherwise restrict, payments based on a whole host of criteria—criteria that would likely vary depending on the political party in power.

Conclusion

Central bankers and other policymakers are likely to continue their efforts to rebrand CBDCs as “digital cash,” but the public shouldn’t be fooled by these marketing efforts. Given governments have consistently chipped away at financial privacy and CBDCs are positioned to be the capstone in financial surveillance, it’s unlikely that promises made to tamp down concerns are going to hold true in practice.

Are you interested in learning more about central bank digital currency? My new book, Digital Currency or Digital Control? Decoding CBDC and the Future of Money, is out now and available here.