State and local subsidies and narrow tax breaks for businesses are growing. These benefits—called incentives—include grants, loans, tax credits, and tax exemptions to favored businesses investing in a jurisdiction.

It makes headlines when governments give incentives to big corporations such as Amazon. But the states routinely dish out subsidies and tax breaks to thousands of businesses of all sizes under a vast array of programs.

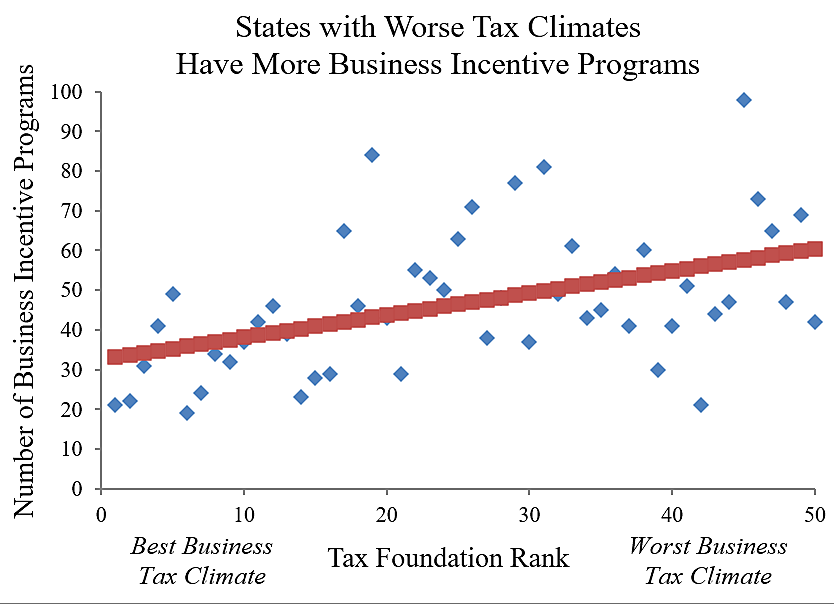

In researching Cato’s governor report cards, I’ve found that high-tax states appear to hand out the most special-interest breaks and subsidies. Let’s look at some supporting data.

The Council for Community and Economic Research maintains a database of 2,425 business subsidy and tax break programs in every state. New York has a tax credit for digital games businesses, Virginia has a tax credit for vineyards, California has a tax credit for cannabis businesses, and Georgia spends more than $1 billion a year on film tax credits.

We can compare the number of such programs in each state to how pro-growth the overall state tax climate is. The Tax Foundation (TF) business tax climate report gives the highest scores to states with the lowest rates and most neutral and simple tax systems. That is, systems that minimize burdens and are fair to all businesses.

The chart shows my regression results using the TF rank of the 50 states to explain the number of business incentive programs. The rank of “1” is the best tax climate. (The regression was highly significant with an F‑statistic of 12.7 and a t‑statistic on the rank variable of 3.6.)

States with the best tax climates have the fewest subsidies and breaks. Wyoming (TF rank #1) and South Dakota (TF rank #2) have low tax burdens, few incentives, and no corporate or individual income taxes.

The most business handouts are in Maryland, which has a poor business tax climate (TF rank #45). On Cato governor reports, I criticized former Maryland Governor Larry Hogan for pushing narrow business breaks rather than overall tax reforms.

Why are these two variables related? Some states favor a big-government approach that includes both high taxes and interventionist economic development. Leaders in these states favor raising taxes to increase spending, but they also want photo-ops at factory openings to highlight how their special-interest incentives are creating jobs.

Politicians in high-tax states know that to attract investment under a bad tax structure they need to cut special deals. At the same time, politicians in low-tax states know that they do not need to dish out special-interest benefits because their economies are booming without them.

The bottom line: if you don’t like corporate subsidies and favoritism, you should support the simple low-tax structures of Tax Foundation’s top-ranked states.

Krit Chanwong contributed to this blog.