Government interventions create vicious cycles of collateral damage, larger bureaucracies, and further interventions. As one example, high taxes on cigarettes have been causing damage for years, yet governments keep jacking the tax rates up further.

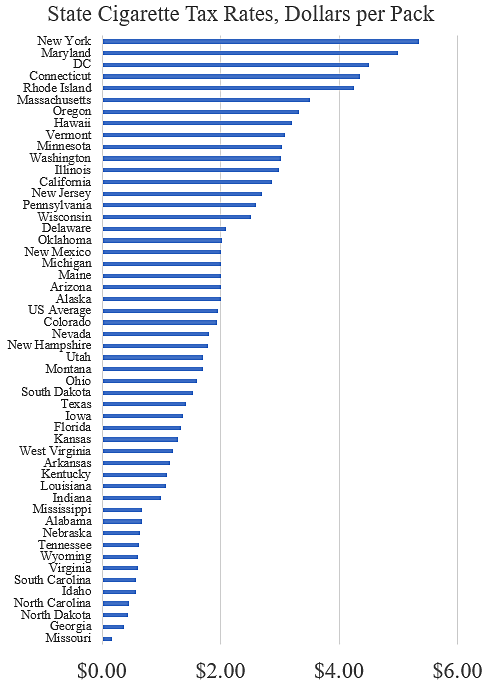

State cigarette taxes now average $1.96 per pack, as shown below. Maryland recently raised its rate from $3.75 to $5.00 per pack, and New York raised its rate from $4.35 to $5.35 per pack. Federal taxes of $1.01 per pack are stacked on top, as are local taxes in numerous cities.

This 2003 Cato study describes how high cigarette taxes generate black markets and crime. It discusses how interstate cigarette smuggling is a source of terrorism finance, including raising money for Hezbollah. This Tax Foundation study discusses cigarette taxes and smuggling, and this government study found that cigarette smuggling “fuels transnational crime, corruption, and terrorism.”

The political zeal for cigarette tax hikes creates headaches for the nation’s law enforcement. In researching the upcoming Cato Governors Report, I noticed that (paywalled) State Tax Notes reported last October 24:

Arkansas police have arrested a man for transporting hundreds of thousands of dollars’ worth of untaxed cigarettes. … a state trooper stopped a cargo van on I‑40 outside the city of Carlisle and noticed numerous cartons of cigarettes in the cargo area. The trooper and an Arkansas Tobacco Control enforcement agent seized over 3,270 cartons of unstamped cigarettes.

“Contraband cigarettes are one of the leading sources of funding for terrorism in the United States,” Arkansas State Police Colonel Mike Hagar said in the release.

… The final count amounted to 32,671 packs of untaxed cigarettes, with an estimated value of more than $311,000. Police also seized the cargo van. The driver — Ali Ali Ashabi of El Paso, Texas — was arrested and charged with possession of untaxed tobacco and unauthorized use of another person’s property to facilitate certain crimes.

Data here.