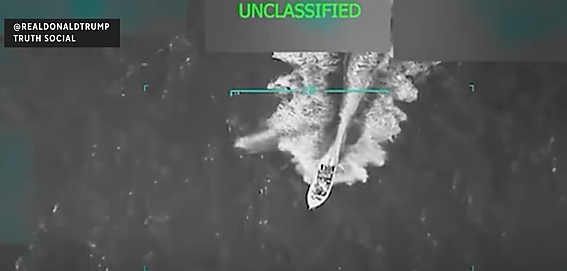

With Secretary of War Pete Hegseth embroiled in controversy over the extrajudicial killings of alleged drug smugglers operating a small, short-range boat off the coast of Venezuela, it’s worth examining how this all began.

President Trump has repeatedly claimed that “narcoterrorists” are on these boats, transporting large quantities of fentanyl and other illegal drugs into the US to poison Americans, and he wants them obliterated. He asserts that each boat destroyed by the Navy with missiles saves 25,000 lives. As of this writing, 22 boats have been sunk, which amounts to 550,000 lives saved since early September—more than five times the nation’s annual overdose toll.

First, drug smugglers do not sneak into the US, abduct random Americans, and forcibly inject them with fentanyl. They sell products to willing customers. These are voluntary commercial transactions, not acts of terrorism. If Americans did not want to buy illicit substances, traffickers would not profit from smuggling them and would quickly stop.

Putting that aside, it’s also important to consider Venezuela’s role in supplying the illegal drug market in the US. A review of the data indicates that Venezuela’s role is very minor.

For one, Venezuela likely has nothing to do with smuggling fentanyl into the US. The Drug Enforcement Administration’s (DEA) annual National Drug Threat Assessment (NDTA)—its definitive statement on drug sources and trafficking routes—makes the picture clear: fentanyl is produced overwhelmingly in Mexico, using precursor chemicals that come primarily from China and India.

Across every edition of the NDTA, Venezuela never appears as a fentanyl source or transit country. In other words, even the federal government’s own drug-intelligence apparatus does not link Venezuela to the US fentanyl supply.

The United Nations Office on Drugs and Crime (UNODC) World Drug Report conveys the same message. Its global sourcing maps and trafficking analyses reveal no fentanyl production in Venezuela, no identified fentanyl-trafficking networks based there, and no South American involvement in the synthetic-opioid supply chain. Instead, the pattern remains consistent year after year: precursors originating in Asia (e.g., China, India, Myanmar), production in Mexico, and distribution into the United States, with Venezuela completely absent from the scene.

Interdiction data tell the same story. Recent, publicly available US Coast Guard and Joint Interagency Task Force (JIATF)–South’s seizure data do not show any fentanyl coming from Venezuelan-linked maritime routes. The Coast Guard’s drug-interdiction reports are filled with seizures of cocaine, marijuana, and occasional heroin in the Caribbean—but essentially no fentanyl, and none linked to Venezuela. Given that the arrests and offloads are heavily dominated by cocaine and the frequency of reports, the absence of fentanyl in hundreds of listed shipments is significant, not a trivial oversight.

There has never been a US Department of Justice indictment involving fentanyl trafficked from Venezuela or the Caribbean corridor.

Venezuela can indeed be linked to the cocaine trade, but mainly as a transit route rather than a producer. The US State Department’s 2024 International Narcotics Control Strategy Report describes it as a “major drug-transit country” and a key corridor for Colombian cocaine moving toward the Caribbean and, to a lesser extent, the United States. The White House’s 2025 Presidential Determination goes further, claiming that the Maduro government “leads one of the largest cocaine trafficking networks in the world”—an assertion, but not a precise estimate. UNODC’s World Drug Report, however, provides context by estimating that only about five percent of Colombian cocaine passes through Venezuela, much of it headed to the Caribbean or Europe. Independent analysts, including the Washington Office on Latin America (WOLA), also note that Venezuela is not a major gateway for US-bound cocaine; most of America’s supply still arrives through Mexico and Central America. And the DEA’s National Drug Threat Assessment scarcely mentions Venezuela at all, focusing instead on Mexican cartels and Pacific or land routes.

In short, everyone agrees that some cocaine passes through Venezuela—the real question is how much of it is actually destined for the United States.

Even if President Trump views cocaine trafficking as a direct threat to national security, it still doesn’t explain why he has deployed a large fleet off the Venezuelan coast or why Secretary Hegseth has authorized the destruction of small boats and the killing of their passengers on suspicion alone. Most of the cocaine trafficking happens in Mexico and Central America, an awkward fact given Trump’s recent pardon of former Honduran President Juan Orlando Hernández, convicted of cocaine trafficking.

So drug war scholars are now asking the obvious question: Why Venezuela?

I’ll leave that to foreign policy and international law experts to figure out.