The MAHA Commission released its Make Our Children Healthy Again strategy report on September 9. While parents are the primary audience for direct-to-consumer (DTC) drug ads, the government now plans to regulate what they see more heavily. The question is simple but crucial: who should decide what information patients can access—the regulators or the patients themselves?

Page 9 of the strategy report states, among its policy reform goals:

FDA, HHS, the Federal Trade Commission (FTC), and Department of Justice will increase oversight and enforcement under current authorities for violations of direct-to-consumer (DTC) prescription drug advertising laws. Egregious violations demonstrating harm from current practices will be prioritized, including by social media influencers and DTC telehealth companies (including dissemination of risk information and quality of life through misleading and deceptive advertising on social media and digital platforms).

Kennedy vs. Kennedy

Health and Human Services Secretary Robert F. Kennedy, Jr., has long opposed direct-to-consumer (DTC) advertising by pharmaceutical companies, even calling for a ban. This contradicts what he told a NewsNation Town Hall on June 28, 2023 (1:01:25): “We don’t have a priesthood here. We don’t have high priests who are telling us … we’re in charge of our own lives. Americans need to do their own research, and you know, listen, people say ‘trust the experts.’ That became a mantra during COVID.…”

Apparently, Secretary Kennedy doesn’t want to let Americans do “their own research” when it comes to learning about new drugs. He only wants the high priests to have that information.

Why an Outright Ban Won’t Work

Fortunately, the September 9 strategy report doesn’t call for an outright ban. That would be difficult given previous Supreme Court opinions. As Zac Morgan of the Washington Legal Foundation recently wrote:

The Supreme Court has repeatedly ruled that “business or economic activity” is “entitled to the protection of the First Amendment.” That free-speech right includes not just generally “paid advertisement[s] of one form or another,” but the “speech of pharmaceutical marketing” itself. DTC drug ads just cannot be banned—even if they “affect[] treatment decisions, increase demand (and therefore undercut government efforts to control prices), or are merely “‘unpopular, annoying[,] or distasteful.’”

A Strategy of “Death by a Thousand Cuts”?

However, on page 9, the commission is signaling that it won’t push for a direct ban but will lean on regulators to tighten the screws—using existing laws and agencies to make drug ads harder and riskier to run.

Does this portend a strategy that will make DTC drug advertising face “death by a thousand (regulatory) cuts?”

Maybe.

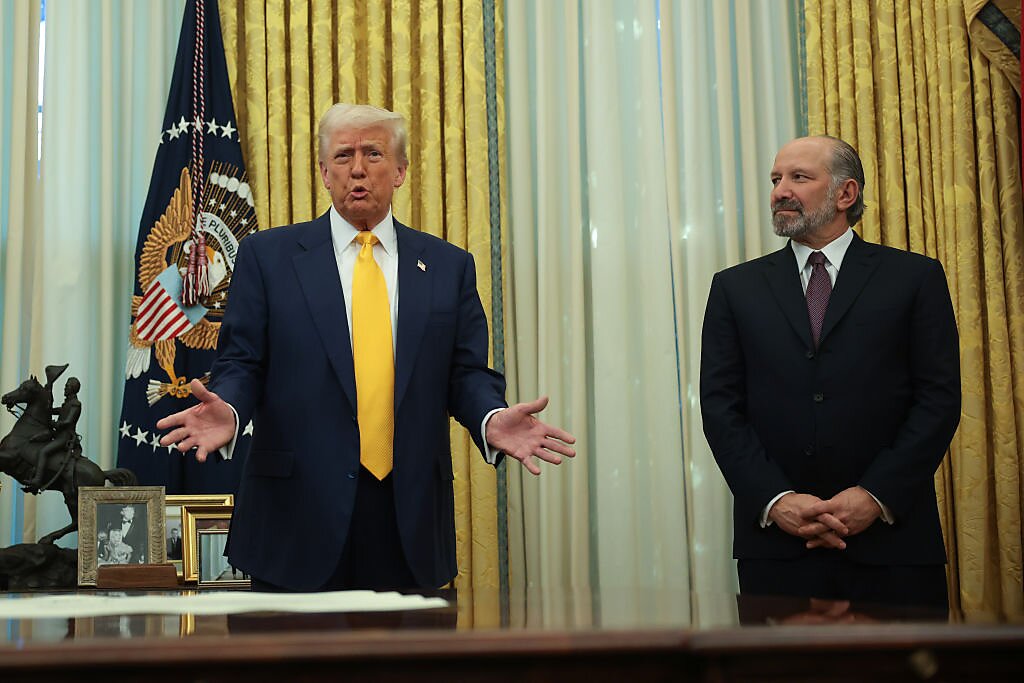

That impression only deepened the next day. On September 10, the Department of Health and Human Services (HHS) issued a press release announcing a stricter scrutiny of pharmaceutical ads. In the release, Secretary Kennedy declared, “Pharmaceutical ads hooked this country on prescription drugs,” while Food and Drug Administration Commissioner Marty Makary, MD, added, “For far too long, the FDA has permitted misleading drug advertisements, distorting the doctor-patient relationship and creating increased demand for medications regardless of clinical appropriateness.”

“Hooked on prescription drugs?” That kind of hyperbole ignores the lifesaving drugs developed over the past several decades—medicines that turned once-fatal diseases into manageable conditions and extended millions of lives.

“Distort the doctor-patient relationship?” By giving patients enough information to ask about new treatments? Kennedy himself once praised Americans for doing exactly that.

“Create demand regardless of appropriateness?” Appropriate according to whom—Dr. Makary? A patient asking about a drug isn’t a problem; it’s often the first step toward getting better care.

Do the Studies Hold Up?

To back up their claims, Kennedy and Makary cite four studies. One, published in 2023, estimates that DTC ads caused a 31 percent increase in pharmaceutical spending since 1997. But that headline number is an extrapolation: the researchers actually studied a narrow set of already-advertised drugs in five chronic conditions, then projected their results onto the entire drug market. The study also relies on a questionable instrument (elderly utilization) and a limited set of regions, so its claims likely reflect local patterns rather than a reliable guide for policy.

More importantly, the authors overlook a key fact: over the past 28 years, pharmaceutical companies have introduced a wave of new, effective drugs that treat or even cure conditions that previously had few or no options. While the study controls for patent expirations, it does not account for the entry of new, often costly drugs, so part of the spending increase it attributes to advertising may simply reflect new product launches. Isn’t it obvious that this kind of progress also drives higher spending?

Another driver of pharmaceutical spending is the harmful combination of third-party payment systems and patent protections. This creates the worst of both worlds: insurers and government programs hide prices from patients, while patent laws protect drug companies from competition. Patients don’t shop around, manufacturers face little resistance, and patents, along with regulatory exclusivity, prevent generics from entering the market—leading to soaring drug prices. Taxpayers often fund the research upfront, only to pay monopoly rents at the pharmacy counter.

The solution isn’t more bureaucracy or price controls, but reducing distortion: let consumers see and feel the real prices, eliminate opaque rebates, reform patent laws so publicly funded research isn’t locked away for private gain, and open the market to genuine competition. Only then can we make medicines affordable without hindering innovation.

The second study they cite is from 2003, which used surveys to conclude that patients who requested a DTC-advertised drug were 17 percent more likely to receive a doctor’s prescription. However, by comparing only two cities with self-reported ad exposure, the study overstates its case—its bold claims about drug ads influencing prescriptions are on shaky ground. Besides, why is this a bad thing? If patients hadn’t asked, their doctors might not have prescribed something that could have helped them, either because the doctors were unaware of the new drug or simply hadn’t considered it.

A third study they cite indicates that low-risk patients who saw DTC ads for statin drugs were 16 to 20 percent more likely to start using them. However, the authors of that study caution about its limitations:

While control variables were included in our design, and a replication of the analysis with DTCA for antidepressants serves as a comparison, this study cannot make any claims regarding the causal direction of relationships between exposure to DTCA, high cholesterol diagnosis, and statin use.

The final study they cite reports that 91 percent of ads featured social approval for taking the drug, and 94 percent appealed to positive emotions. However, the authors of the paper cautioned:

This study had several limitations. Content analysis does not account for advertising effects on audience members. The findings warrant further research testing the efficacy of ad features to educate the public on health conditions and assessing consumers’ interpretations of the emotional and psychological benefits found in DTCA.

None of these studies proves that DTC ads harm patients. At worst, they’re inconclusive; at best, they show patients asking informed questions that sometimes lead to better care.

Patients Deserve Information, Not Gatekeeping

If Secretary Kennedy truly believes Americans should “do their own research,” then he should trust them with the information—not try to keep it hidden behind Washington’s gatekeepers. True progress in health care comes not from government interference, but from transparency, competition, and trusting patients to make their own decisions. Americans have the right—and deserve the freedom—to learn, ask, and choose.