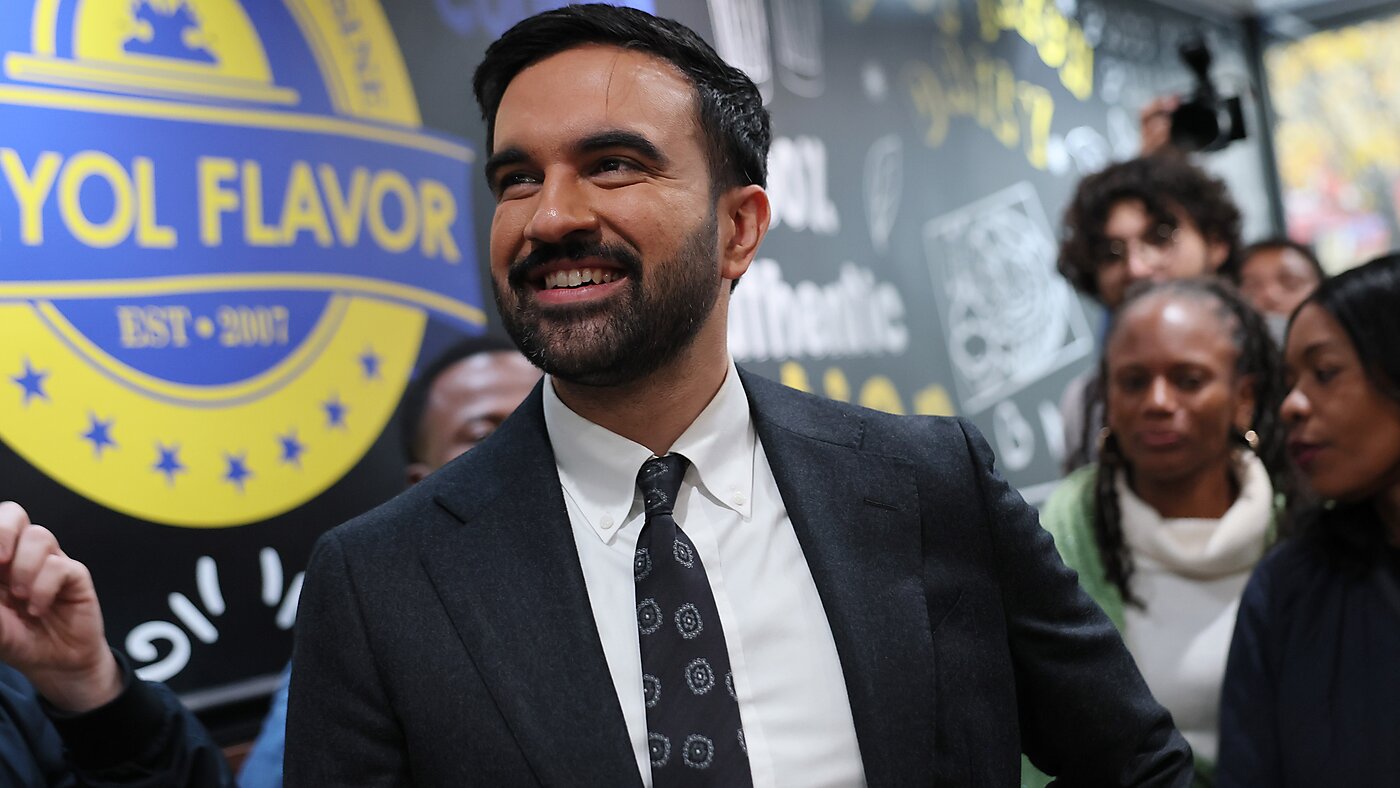

Across North America, from New York City (courtesy of mayoral candidate Zohran Mamdani) to ballot initiatives in St. Paul, Minnesota, and Portland, Maine, rent control is making a comeback.

For decades, this policy had been left in the dustbin of economic history. An overwhelming consensus of economists agreed with the Nobel laureate Assar Lindbeck, who described it as “the most efficient technique presently known to destroy a city—except for bombing.”

Rent control reduces the profitability of rental units, causing property owners to convert units to owner-occupied condos, reduce maintenance, or halt new construction. This makes the housing shortage chronic and helps a few long-term tenants while driving up costs and reducing quality for newcomers.

If policymakers truly want to solve the housing crisis, they must cut regulatory barriers, eliminate exclusionary zoning, and streamline the permitting process to allow more homes to be built.

So, why the obsession with rent control?

Because in the short term, rent control is a visible response to high housing costs; it promises voters an end to pain without the long-term work of deregulation. For policymakers, this immediate political gain outweighs the delayed, negative economic consequences for their constituents.

Cross-posted from Substack. Yannick Feussi, a high school student from Guayaquil, Ecuador, co-wrote this piece.