This Reuters headline says it all: “Cigna CEO: Don’t repeal U.S. health law.”

Cato at Liberty

Cato at Liberty

Topics

Tax Cuts vs. Government Checks … NRO Conclusion and Correction

VerBruggen signs off on the tax cut/government check debate by doubling down on the core issue; he believes that there is no meaningful difference between government spending and a tax cut. I will quote him in full: “If some libertarians want to keep insisting that there’s a meaningful difference between (A) the government spending $500 on something and (B) a person “donating” $500 to that thing and then getting a $500 break on his taxes in return, there’s nothing I can do to stop them.”

In this, he has the company of the 9th Circuit and the Progressive wing of SCOTUS.

VerBruggen has also rightly asked for a correction to one of the numerous quotes I pulled from his blog posts on tax cuts vs government spending. I thank him sincerely for reading through to the end of my interminable post. The correct quote is below, with the omitted, qualifying language in italics, a new note on charitable giving and government spending, and my otherwise unchanged commentary:

He insists that “much (most?) deducted charity spending does not offset government spending in the slightest,” yet also agrees that “voucherizing the tax subsidies for charity would remove the incentive to donate” to the range of charitable and social welfare activities the government supports. [Note: There is much evidence that government spending on “charity” crowds out charitable giving. And most, not to mention much, charitable giving in the U.S. is devoted to health, educational, social welfare and religious organizations which in turn focus on assistance to the poor, health and educational activities. Needless to say, the government is deeply involved in health, education and welfare spending. See the index of Arthur Brooks’ fascinating book, Who Really Cares, for more details.]

Charity does not reduce pressure on the welfare state? The billions of dollars donated to health, education, welfare … these offset nothing in the public sector? In the absence of tax expenditures for employer-provided health care, how likely is it that the U.S. would have retained a relatively robust private medical market?

The charitable deduction allows the people who earned the money our governments spend on public “charity” to keep some portion of what the government would otherwise have spent on government “charity” or some other wasteful project.

If VerBruggen is concerned that the tax burden will marginally increase on some citizen as the result of another’s charitable deduction then the answer is to balance that lost revenue with a reduction in government “charity,” not to eliminate the deduction.

Perhaps most concerning is VerBruggen’s breezy assumption that all income belongs to the government. He insists that “taxpayer money is already allocated” in the form of deductions for charity, and therefore that “voucherizing the total amount of the deductions wouldn’t change that …”

Really? Tax credits and deductions belong to the taxpayer who earned them. They are not government funds; that is a legal and logical statement. To insist otherwise is to argue that all income is the governments, and what it does not claim is ours. The money that a taxpayer spends is HIS money, not the government’s.

And, as is noted above, voucherizing charitable deductions will convert a huge portion into direct welfare payments and eliminate the core of the charitable act; giving away one’s own money.

All of Your Money Belongs to the State … NRO Edition!

I have to say, I never thought I’d read a blogger on NRO endorse the notion that all of the money you earn belongs to the state. I certainly never thought that read it twice in a year. But here we are, again … and I feel compelled to engage in an excruciating debate with Robert VerBruggen of Phi Beta Con.

Question: Is there any substantive difference between the government cutting you a check or cutting your taxes?

VerBruggen agrees with the Progressives on the Supreme Court: Nope, all your money is the goverment’s!

But his odd insistence that government checks and tax cuts are the same began months ago, when he expounded more extensively if not coherently on this same subject.

I attempted to illustrate where he had gone wrong in his thinking by taking his positions to an extreme. To my surprise, VerBruggen agreed with my modest proposal to eliminate all charitable tax deductions and credits and capitulate comprehensively to the welfare state

More specifically: “The feds should eliminate the charitable tax deduction and send out the average (tax-forgiven) amount donated per adult to every citizen in the country to donate as they wish!”

VerBruggen supports a “charity entitlement” over charitable tax deductions. He favors a “social security” model for “kind of a ‘forced charity’” over tax deductions.

I’m not sure if he’s thought his rather radical and odd argument through to the end point.

Many of the citizens receiving their “charitable donation” check would be low-income. That means they didn’t earn the money they have been given, someone else did. Furthermore, they are qualified for government “charity,” which means they can use their “charitable donation” check on themselves; housing, food, healthcare, addiction treatment, maybe the opera or a class on origami.

What VerBruggen supports is not charity; it’s a massive new welfare program.

And in addition to the new, wildly unrestricted welfare program, he supports forcing wealthier folks to hand money to less wealthy folks to “donate” to things those folks like. What is it that someone wrote on PhiBetaCon about how careful we are with other people’s money? Oh, right, George Leef referenced some guy named Friedman.

And just imagine how one might go about enforcing the use of the voucher in the first place. What happens if a person never donates it? Do we need special accounts from which to spend the money, or should we mandate one donation, with the check signed over to a single registered charity? What does this interesting new program look like?

The citizens who earned VerBruggen’s “charity” money can’t decide how it should be used. The government, in conjunction with citizens who did not earn the money, decides how it is to be used.

VerBruggen claims none of this matters. After all, tax deductions are a subsidy of private charity. “Charity” vouchers are a subsidy too. Ergo, there is no difference between vouchers and deductions. “The better solution,” writes Robert, “End charitable deductions (and most other deductions!) entirely.” I’m curious what deductions he thinks worthy of survival.

VerBruggen’s formulation is a cartoon version of the real world and the issues at stake. And his proposed “solution” would be an unmitigated disaster.

Government is heavily invested in the business of “charity.” The government supports health, housing, parenting, addiction, jobs and retirement programs. It supports scientific research, the humanities, the arts, recreation and of course education at all levels and in every field and stage of life. Federal, state and local governments are massive “charity” machines which collect some people’s money according to their success in earning it, allocate it to other people according to the preferences of still another set of people, as translated through the relevant political and bureaucratic system, who then spend said money on one final set of people. The support of all these people and things is required by the government.

In the libertarian Shangri-La, no subsidies of charity would exist. Let’s say the government collects taxes only for the common defense, policing, the courts, etc. In this state of nature thought game, he is correct that any charitable tax deduction would raise the effective tax burden on those who did not use the deduction. It’s a subsidy, and each non-deducting taxpayer is effectively compelled to support to some degree the donation of a deducting taxpayer.

Of course if every taxpayer takes a deduction, then there is no coercion; everyone benefits and the required increase in the tax rate would fall equally as well. In addition, each taxpayer would be free to direct his donation. In the case of a “charity” voucher, however, each taxpayer would be compelled to support the choice of non-taxpayers and lesser taxpayers. (There is also the minor difficulty of how one might enforce the use, and legal use, of a “charity” voucher sent to every citizen.)

In other words, vouchers require compulsion, and tax expenditures do not.

Much more important, however, the government would not be in the business of providing “charity” itself. In our libertarian state of nature, which would be the least of evils; equal taxation in support of government-provided “charity,” or an equal amount forgone in charitable deductions available to all taxpayers? In the former case, everyone is compelled to support all government “charity.” In the latter, only those not claiming a deduction are compelled to subsidize the charitable deductions of others. Fewer people are compelled to support a particular kind of charity, but those who are compelled pay comparatively more.

But instead of proposing as his solution the elimination of the welfare state, VerBruggen promotes the elimination of the charitable deduction as his preferred state of affairs and the redistribution of charitable donations as an improvement on the status quo.

He insists that “charity spending does not offset government spending in the slightest,” yet also agrees that “voucherizing the tax subsidies for charity would remove the incentive to donate” to the range of charitable and social welfare activities the government supports.

Charity does not reduce pressure on the welfare state? The billions of dollars donated to health, education, welfare … these offset nothing in the public sector? In the absence of tax expenditures for employer-provided health care, how likely is it that the U.S. would have retained a relatively robust private medical market?

The charitable deduction allows the people who earned the money our governments spend on public “charity” to keep some portion of what the government would otherwise have spent on government “charity” or some other wasteful project.

If VerBruggen is concerned that the tax burden will marginally increase on some citizen as the result of another’s charitable deduction then the answer is to balance that lost revenue with a reduction in government “charity,” not to eliminate the deduction.

Perhaps most concerning is VerBruggen’s breezy assumption that all income belongs to the government. He insists that “taxpayer money is already allocated” in the form of deductions for charity, and therefore that “voucherizing the total amount of the deductions wouldn’t change that …”

Really? Tax credits and deductions belong to the taxpayer who earned them. They are not government funds; that is a legal and logical statement. To insist otherwise is to argue that all income is the governments, and what it does not claim is ours. The money that a taxpayer spends is HIS money, not the government’s.

And, as is noted above, voucherizing charitable deductions will convert a huge portion into direct welfare payments and eliminate the core of the charitable act; giving away one’s own money.

In merciful conclusion, VerBruggen is confused and incorrect on a long list of issues.

Related Tags

WaPo’s Fiscal Truths

A Washington Post editorial today discusses the National Academy of Sciences “Fiscal Future” study. The NAS report modeled four possible tax and spending paths for the nation over the next 70 years. I was one of the NAS report’s co-authors.

The Post focuses on the “low spending and revenue” path, which would keep federal revenues below about 19 percent GDP and keep spending below about 21 percent of GDP. The Post argues that both tax hikes and spending cuts will be needed to fix the government’s budget problem because the “pain and sacrifice” would be too large if we just cut spending, as under this “low” path. But the Post’s conclusion is based on faulty one-sided accounting, only considering the recipients of government largesse.

The reality is that every dollar the government spends imposes “pain and sacrifice” on current or future taxpayers. Thus, spending cuts may impose temporary pain on people whose benefits are withdrawn, but they create equal or greater pain on the taxpayers who foot the bill. Indeed, standard economic theory suggests that the economy gets a “free lunch” when spending and taxes are reduced in tandem because the deadweight losses caused by government coercive actions are reduced.

Note that I say “temporary” pain because to a substantial degree, benefit recipients will adjust their lives as subsidies are withdrawn, and most people will prosper without government help, as we saw following welfare reform in 1996. Misguided government spending programs–like welfare–cause damage to society and the economy, so that reducing spending doesn’t increase pain, it ultimately reduces it. Consider how government housing subsidies ended up causing widespread damage, including for many people who initially benefited. For a guide to damaging federal programs, see www.downsizinggovernment.org.

The Post is right that the NAS study’s “low spending” path would require “broad areas” of federal spending to be cut, such as K‑12 school subsidies and other state aid programs. But that would be a good thing for citizens, the economy, and for responsible government. Federal spending on properly state and local activities has been a giant failure, and it should be ended whether or not there is a budget deficit.

The Post is on sounder footing with its observation that many Republicans do not seem to grasp the magnitude of spending reforms that are needed in the years ahead. The GOP does need to “get specific” and push for particular cuts. Let’s have national debates on federal involvement in K‑12 schools, raising the Social Security retirement age, and cutting the corporate welfare programs mentioned by the Post. Let’s start that “adult conversation” right now, because as the NAS report warns, the longer we wait, the more the federal debt monster grows.

For the record, the NAS report did not endorse tax hikes or any other particular fiscal solution. It simply provided four possible combos of future tax and spending levels as starting points for discussion. It also usefully described how to overhaul the income tax and replace it with a much simpler and flatter tax system, as I’ve described here.

Related Tags

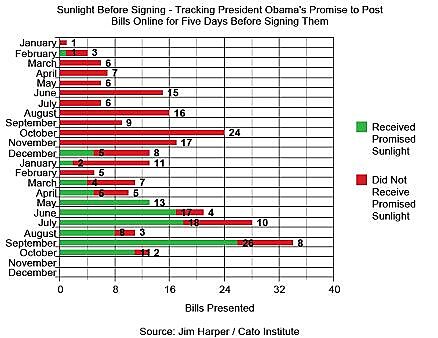

Sunlight Before Signing Updated—With a Graph!

As a campaigner, President Obama promised that bills sent him by Congress would be posted online for five days before he would sign them. It’s a simple, measurable transparency promise that we have followed on this blog.

With attention beginning to turn to the 2012 presidential election (believe it or not!), President Obama’s fealty to campaign promises will become a focus. So here’s an update on his Sunlight Before Signing promise.

First, a brief summary table. Congress has presented President Obama 283 bills, 124 in 2009 and 159 in 2010. He posted six online for the requisite number of days in 2009, and 103 in 2010. (One emergency bill did not require posting. It’s non-posting is consistent with the president’s promise so we treat it as “compliant” in summary materials.)

| Number of Bills | Emergency Bills | Bills Posted Five Days | |

|---|---|---|---|

| 2009 | 124 | 0 | 6 |

| 2010 | 159 | 1 | 103 |

| Overall | 283 | 1 | 109 |

The graph below illustrates well that the administration has improved on the, frankly, lousy start it got with Sunlight Before Signing. In the month of May, every bill was posted on Whitehouse.gov for five days before the president signed it.

There remains a residuum of bills that don’t seem to get Sunlight Before Signing, and those may be the ones where political expedience takes precedence over the president’s campaign promise to his voters. But the White House is clearly positioned to fulfill this promise completely in the second half of the president’s term.

The chart below (that is, after the break) exhibits the same data—Sunlight Before Signing compliance by month—with percentages of non-compliance and compliance. After that, you’ll find a table of every bill the president has signed and its treatment in terms of sunlight.

There will be a short spate of bills during the lame duck session. The next report in late December will capture the entire first half of the president’s term, setting the stage for reporting on the White House’s 100% success rate in 2011 and 2012.

Full compliance will give the press and public a way to know exactly what hits the president’s desk, and an opportunity to make a habit of reviewing Congress’ work before bills become laws.

Sunlight Before Signing, Month-by-Month (%)

| Did Not Receive Promised Sunlight | Received Promised Sunlight | |

|---|---|---|

| January | 1 (100%) | 0 (0%) |

| February | 3 (75%) | 1 (25%) |

| March | 6 (100%) | 0 (0%) |

| April | 7 (100%) | 0 (0%) |

| May | 6 (100%) | 0 (0%) |

| June | 15 (100%) | 0 (0%) |

| July | 6 (100%) | 0 (0%) |

| August | 16 (100%) | 0 (0%) |

| September | 9 (100%) | 0 (0%) |

| October | 24 (100%) | 0 (0%) |

| November | 17 (100%) | 0 (0%) |

| December | 8 (62%) | 5 (38%) |

| January | 11 (85%) | 2 (15%) |

| February | 5 (100%) | 0 (0%) |

| March | 7 (64%) | 4 (36%) |

| April | 5 (50%) | 5 (50%) |

| May | 0 (0%) | 13 (100%) |

| June | 4 (19%) | 17 (81%) |

| July | 10 (36%) | 18 (64%) |

| August | 3 (27%) | 8 (73%) |

| September | 8 (24%) | 26 (76%) |

| October | 2 (15%) | 11 (85%) |

Sunlight Before Signing, Bill-by-Bill

(Parentheses indicate a separate Whitehouse.gov page with a link to Thomas legislative database)

* Page now gone, but it was either directly observed, evidence of it appears in Whitehouse.gov search, or White House says it existed.

[Brackets indicate a link from Whitehouse.gov to Thomas legislative database]

† Bill was posted for five days after final passage, though not formal presentment. Counted as “Yes.”

‡ Link to final version of bill on impossible-to-find page.

E! Emergency legislation not subject to five-day posting. Counted as “Yes” in simplifying graphs and tables.

Related Tags

This Month at Cato Unbound

This month at Cato Unbound we’re debating campaign finance regulation, with a panel of notable contributors and a big, new idea.

That idea is semi-disclosure, in which information about campaign funding is collected and disseminated, but, much like the census, personal names and addresses aren’t attached. Political scientist Bruce Cain suggests semi-disclosure might break the impasse between privacy and the right to know. Others? Well… you’ll just have to wait and see. Joining us will be Nikki Willoughby of Common Cause, election law scholar Richard Hasen of Loyola Law School, and the Cato Institute’s own John Samples. Discussion will run through the rest of the month on this vital issue to our nation’s democracy.

Debunking White House Pro-Tax Increase Propaganda

The White House recently released a video, narrated by Austan Goolsbee of the Council of Economic Advisers, asserting that higher tax rates on the so-called rich would be a good idea.

Since Goolsbee’s video made so many unsubstantiated assertions and was guilty of so many sins of omission, here’s a rebuttal video, narrated by yours truly.

This new Center for Freedom and Prosperity video includes the full footage of the White House production, so viewers can decide for themselves which side is correct.