Last Friday, President Obama revisited Elizabeth Warren’s reasoning for higher taxes on the wealthy. Like Warren, the President stated that:

If you’ve been successful, you didn’t get there on your own… If you were successful, somebody along the line gave you some help. There was a great teacher somewhere in your life… Somebody invested in roads and bridges.

The President then took Warren’s reasoning up a rhetorical notch and said “If you’ve got a business — you didn’t build that. Somebody else made that happen.”

President Obama’s statement begs an obvious question: If it is so easy to be a businessman — just put together all the services that the government provides you with — why isn’t everyone a successful businessman?

As Israel Kirzner reminds us, successful businessmen tend to be people who are alert to the opportunities that surround us but others cannot see.

Kirzner describes alertness as the fundamental quality of the entrepreneur. Alertness is the entrepreneur’s ability to perceive new economic opportunities that no prior economic actor has yet recognized… The entrepreneurial function is possible due to the presence of sheer ignorance on the part of some economic actors. Sheer ignorance, in Kirzner’s definition, consists of not only not knowing a given piece of information but also of not knowing that one does not know it: no consideration of the information – positive or negative – even enters the economic actor’s mind.

That goes for Art Fry who invented the humble Post-it note as well as for Bill Gates’ vision of a personal computer in every household. Thus, while there are many practical reasons for not begrudging the wealth of successful businessmen — they often risk their own capital, provide us with goods and services we need, create employment and pay taxes — let us not lose sight of the moral angle either.

Paradoxically, President Obama comes close to undermining his entire argument later in his speech. He says:

I’m always struck by people who think, well, it must be because I was just so smart. There are a lot of smart people out there. It must be because I worked harder than everybody else. Let me tell you something — there are a whole bunch of hardworking people out there.

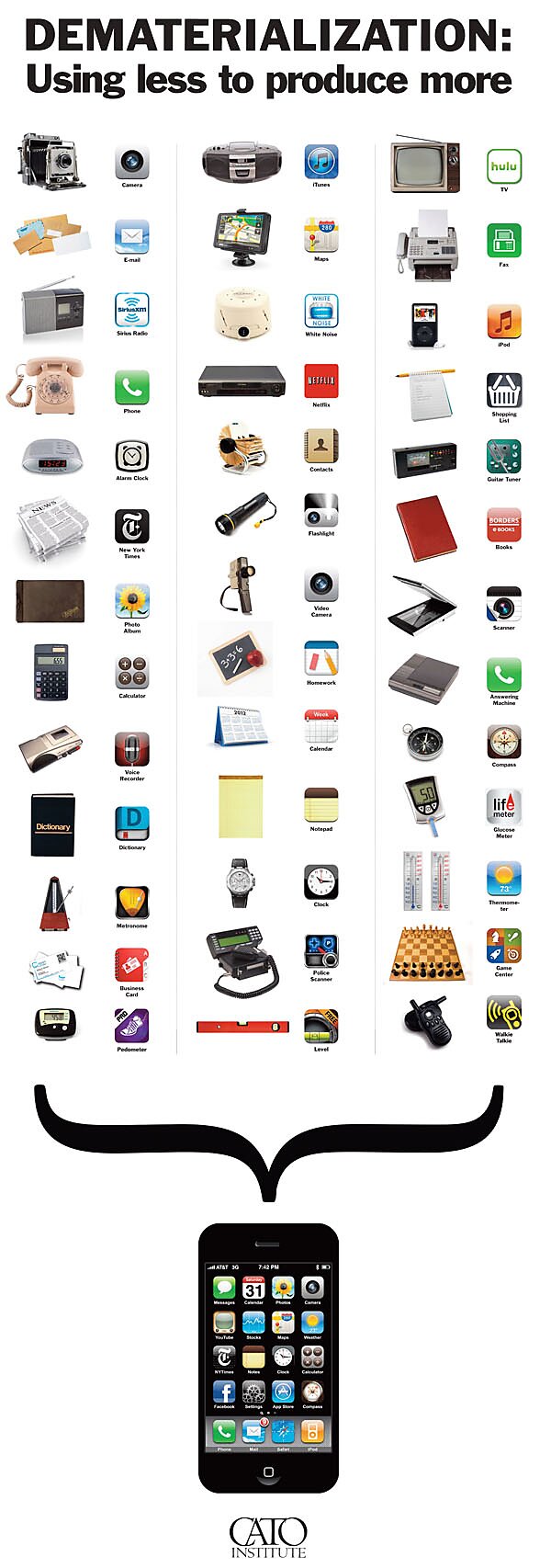

Precisely. There are a lot of good hard-working people out there. But not everyone has the aptitude to be a businessman. If it were otherwise, I would not be typing these words. I would be out there inventing the next iPhone.