“Roosevelt had conducted an active monetary and fiscal program of recovery…working along lines suggested by Keynes.” Eric Rauchway, The Money Makers, p. xvi.

As we saw in the last installment to this series, New Deal fiscal policies did little to help the U.S. economy recover from the Great Depression. Yet the U.S. did see substantial gains in output and employment between 1933 and 1937. If those gains weren’t a result of fiscal stimulus, what caused them? And just what did New Deal policies have to do with these causes?

A Money-Fueled Recovery

The answer to the first question, according to most economic historians, is growth in the U.S. money stock, which rose from just over $4 billion in late 1933 to nearly under $23 billion by late 1941. “Nearly all of the observed recovery,” Christina Romer says in the abstract to her influential 1992 article, “was due to monetary expansion.” Just as the monetary collapse of 1929–33 contributed to the “Great Contraction” of 1929–33 (to use Milton Friedman and Anna Schwartz’s famous term for it), money growth fueled a “Great Expansion” between 1933 and 1937, reviving the overall demand for goods and services, raising equilibrium prices, and boosting output.

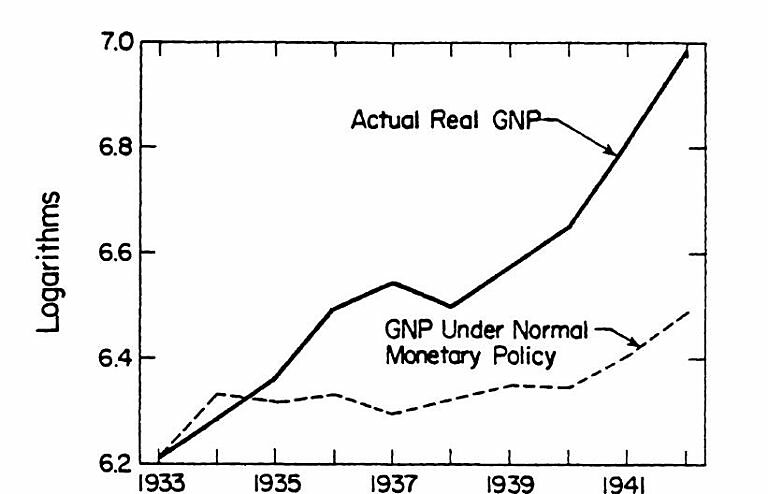

According to Romer’s calculations, illustrated in the chart below, if instead of growing exceptionally rapidly the U.S. money stock had only grown at its average historical rate, “real GNP would have been approximately 25 percent lower in 1937 and nearly 50 percent lower in 1942 than it actually was.”

Figure 1. United States Real GNP and Predicted GNP, 1933–1942

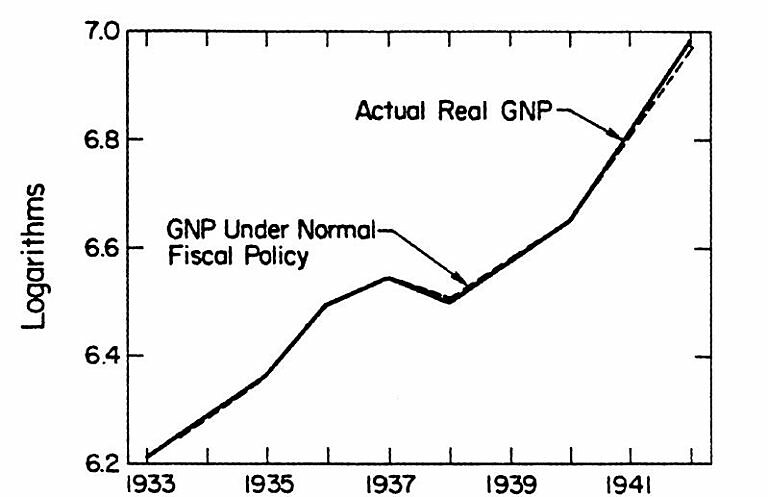

For comparison’s sake, here is Romer’s chart showing how much New Deal fiscal policy contributed to the post-1933 recovery:

Figure 2. The Contribution of New Deal Fiscal Policy to the Post-1933 Recovery

But before we assign credit to the New Deal for any part of the Great Expansion, we have to ask what role New Deal policies played in boosting money growth. As we’ll see in a moment, that growth depended both on the extent of the Fed’s net purchases of commercial paper and Treasury securities and on growth in the Fed’s gold reserves. This post will concentrate on the Fed’s direct contribution to money growth and the New Deal’s bearing on it. My next post will look into the effect of New Deal policies on the Fed’s gold reserves.

Sources of Money Growth

To assess the New Deal’s role in the Great Expansion, we must first consider the proximate causes of that period’s money growth. The most important of these causes consisted of growth in the size of the Fed’s balance sheet. As that grew, so did the sum of bank reserves and the public’s holdings of Federal Reserve notes. The size of the Fed’s balance sheet in turn depended on the amount of gold (or “gold certificates”) that came its way, and also on the nominal value of commercial paper (“bills”) and Treasury securities the Fed acquired through its lending and open-market operations. The other source of changes to the money stock consisted of changes in the ratio of the total money stock to the quantity of Fed assets, which itself depended mainly on what ratio of reserves to deposits banks wished or were required to maintain.

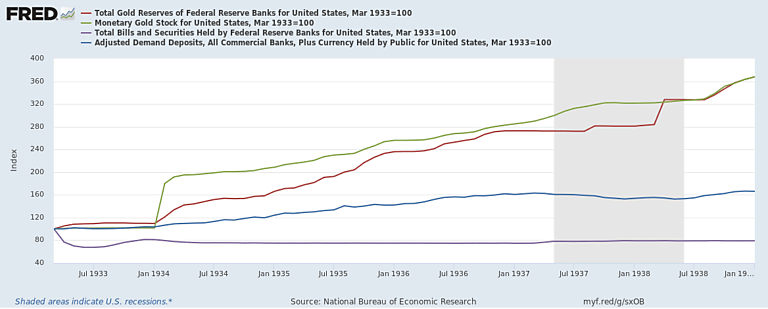

The progress of these different money stock determinants can be seen or inferred from the following chart, in which the blue line shows the U.S. “M1” money stock (currency in circulation plus bank demand deposits), the red one shows the Fed’s gold holdings, and the purple one shows the Fed’s holdings of bills and securities. I’ll come to the green line later. The values are all index numbers, with March 1933 = 100. Using these makes it easier to assess the relative importance of the different factors driving money growth.

Figure 3. Growth within the Great Expansion

A remarkable conclusion that emerges from this chart is that the rapid money growth between 1933 and 1937 was entirely due to growth in the Fed’s gold holdings. The banks, for their part, increased their reserve ratios over time, causing both bank deposits and the total money stock to grow less than proportionately with the Fed’s gold holdings. Finally, the Fed’s bill and security holdings remained almost constant. Its commercial paper holdings, very modest to begin with, actually fell by $10 million between December 1933 and December 1934, after which they were virtually constant. And although the Fed bought $600 million in Treasury securities between April and December 1933, it made no more purchases between then and 1937, when it added a measly $50 million to its holdings.[1]

In short, although the Fed let its balance sheet and bank reserves grow passively in response to gold inflows, contributing to money growth to that extent, it did next to nothing to actively encourage money growth.

The New Deal and Fed Policy

Why did the Fed do so little? It certainly wasn’t because there was no “Keynesian” case for additional monetary stimulus: for all the progress the U.S. economy made between 1933 and 1937, at the end of that upturn it was still running well below full capacity, with output barely above its 1929 level, and an unemployment rate still well into double digits.

Yet instead of taking steps to ramp-up the money stock, Fed officials became increasingly worried about…inflation! Noticing that banks had been storing-up excess reserves, they feared that a revival of bank lending might lead to excessive money growth, and therefore refrained from contributing directly to that growth. Then, finding a merely passive stance inadequate, they joined forces with the Treasury to offset gold inflows. These steps were among several that contributed to the “Roosevelt Recession” of 1937–8, which undid many of the gains of the preceding four years. Far from regarding these anti-inflation measures as consistent with his own theories, Keynes is supposed to have complained that Fed and Treasury officials “professed to fear that for which they dared not hope.” Only after the ’37-’38 debacle did “Keynesian” ideas begin to inform Roosevelt’s fiscal and monetary policies.[2]

What role did the New Deal play in all this? The answer is, a much bigger one than you might think. The 1932 Glass-Steagall Act (not to be confused with the 1933 New Deal measure of the same name) had somewhat relaxed gold’s grip on U.S. monetary policy by allowing the Fed to issue “Federal Reserve Bank Notes” backed by certain Treasury securities instead of bills or gold.[3] The Emergency Banking Act of 1933 in turn made all direct U.S. obligations, as well as the Fed’s holdings of notes, drafts, bills of exchange and bankers’ acceptances, temporarily eligible as collateral for Federal Reserve Bank Notes. Finally, Roosevelt made the gold constraint almost entirely irrelevant, first by suspending gold payments and then (in January 1934) by officially devaluing the dollar. Following these steps, although the Fed could and generally did allow its balance sheet to grow passively with its gold receipts, it also enjoyed considerable freedom to alter the supply of currency and bank reserves independently of changes to its gold holdings.

Had these changes alone occurred, they would only have enhanced the Fed’s discretionary powers, making it, rather than FDR or the New Deal, responsible for any subsequent lack of monetary stimulus. But other New Deal steps dramatically reduced the Fed’s independence, placing monetary policy almost entirely under the administration’s control. It follows that, if the money stock didn’t grow as much as it should have, the blame ultimately rested with the administration.

The Thomas Amendment

After the Emergency Banking Act, which allowed FDR to put the gold standard on ice, the next significant increase in FDR’s monetary policy powers came with the controversial Thomas Amendment to the Agricultural Adjustment Act of May 12th, 1933. That amendment allowed FDR to ask the Fed to buy up to $3 billion in Treasury securities directly from the Treasury or (if the Fed demurred) to have the Treasury itself issue up to $3 billion in its own “greenbacks.” It also allowed him to revive bimetallism by authorizing the minting of full-bodied (as opposed to token or subsidiary) silver coins and the tendering of silver certificates for silver received by the Treasury for that purpose. Finally, the Thomas Amendment gave the president the power to reduce the gold content of the dollar by as much as 50 percent, paving the way to devaluation.

These were sweeping powers—or so it seemed, at least, to the amendment’s conservative critics, including Lewis Douglas, FDR’s very orthodox budget director, who thought they’d put paid to Western Civilization! Testifying in 1941 before the Senate Banking Committee, Edwin Kemmerer, the famous “Money Doctor” and gold-standard champion, was only slightly less melodramatic. The Thomas Amendment, he said,

gives to the President and his appointees a legal authority over the nation’s currency that is almost complete. A Stalin or a Hitler could hardly have more. The things that the President has legal authority to do to the currency directly and their necessary implications could give us a gold standard, a silver standard, a bimetallic standard, a paper money standard or a commodity dollar standard. They could give us serious deflation or a runaway inflation.

It’s doubtful, though, that FDR ever intended to take full advantage of the powers the Thomas Amendment gave him. Although he certainly welcomed and would soon make use of the power to devalue the dollar, he was neither a greenbackist nor a silverite. As the late Elmus Wicker (1971, pp. 866–7) explains, much as he may have looked forward to raising gold’s price, FDR

did not view with favor the expedient of simply adding to stock of money to achieve the desired price level. He objected to outright money creation as ‘inflationary’ because [it] had historical connotations of reckless spending by government, extreme difficulty in funding the public debt, and a general wage and price spiral.

According to Wicker and most other historians, FDR went along with the Thomas Amendment’s “inflationary” provisions to kill another amendment, proposed by Montana Senator Burton Wheeler, that would have authorized additions to the money stock whether FDR approved of them or not. Fearing Congress might override his veto of the Farm bill so amended, he accepted Thomas’s alternative, which merely gave him the option of calling for outright money creation.[4]

Whatever FDR’s true intentions, the Thomas Amendment made it possible for him to compel the Fed to create more of its own money by threatening to have the Treasury issue greenbacks or silver money instead. Yet he wielded that threat but once when, in September 1933, he said he’d issue greenbacks if the Fed didn’t roll-over $50 million in maturing securities. FDR also went on to authorize Treasury silver purchases. But he did so not to encourage monetary expansion but to placate the powerful silver lobby and those senators and representatives beholden to it. For that reason it made no difference to him that the Treasury retired enough national banknotes to offset most of the new silver currency it issued.[5] In short, despite the Thomas Amendment, FDR did very little to encourage money growth beyond what gold inflows alone would accomplish.

The Gold Reserve Act

Two other New Deal measures further strengthened the administration’s grip upon monetary policy. This time the administration was to take full advantage of the changes. But it would do so, not for the sake of further boosting money growth, but to put an end to that growth, with dire consequences I’ll treat in full in later segments.

Fed economist Gary Richardson and his coauthors have called the first of these measures, the Gold Reserve Act of 1934, “the culmination of Roosevelt’s controversial gold program.” Having ordered Americans to surrender most of their monetary gold holdings to the Fed in April 1933, FDR now secured Congress’ permission (1) to have the Fed transfer its gold to the U.S. Treasury in exchange for Treasury “gold certificates,” and (2) to alter the dollar’s gold value by proclamation, which he did on January 31st, the day after signing the new law, by raising gold’s official price from $20.67 per ounce to $35 per ounce. The dollar was thus deprived of 41 percent of its former gold content.

Although Richardson et al. suggest that the government compensated the Federal Reserve “at a rate of $35 per ounce,” that’s not so. As a different Fed publication points out, because the Treasury took possession of the Fed’s gold before FDR announced gold’s new price, it paid for it at the old statutory price of $20.67 per ounce. The Fed’s nominal “gold” reserves therefore stayed unchanged, except that they now consisted not of actual gold but of Treasury gold certificates.

It’s here that the green line in the FRED chart above becomes relevant. To save you some scrolling here’s that chart again:

Figure 4. Growth within the Great Expansion (Same as Figure 3)

National Bureau of Economic Research, retrieved from FRED, Federal Reserve Bank of St. Louis

Because the nominal “gold profit” from the devaluation went not to the Fed but to the Treasury, it didn’t result in any immediate increase in the Fed’s assets, bank reserves, or the money stock. The way in which devaluation was handled thus demonstrated, in an especially neat fashion, FDR’s desire and willingness to try and raise prices generally by raising the price of gold, but not by encouraging growth in the money stock.

As for what the Treasury did with its gold profit, $2 billion of it went to establish an “Exchange Stabilization Fund.” According to Roosevelt’s proclamation announcing the dollar’s devaluation, that fund would serve “to stabilize domestic prices and to protect the foreign commerce against the adverse effect of depreciated foreign currencies.” But Fed officials saw it rather differently: according to an internal Fed memo sent to Fed Board governor Eugene Black, it would allow the Treasury Secretary “to assume complete control of general credit conditions and to negate any credit policies that the Federal Reserve might adopt.” Precisely what use the Treasury made of this newly acquired control is something I’ll take up in the next installment in this series. Suffice it to say that there was nothing “Keynesian” about it.

Marriner Eccles and the 1935 Banking Act

While the Farm and Gold Reserve Acts awarded FDR money creating powers he could employ without the Fed’s cooperation, or appeal to compel it to cooperate, by appointing Marriner Eccles as the Fed’s new governor in November 1934 and letting him draft the Banking Act of 1935, FDR got himself a Fed that would sing his tune.

Unlike Eugene Black, who was himself a Roosevelt appointee who stepped down after clashing with him when he made the Fed banks surrender their gold, Eccles was said (by the New York Evening Post ) to have “views on monetary policy…even more liberal than those already embraced by the New Deal.” Henry Morganthau, who was then FDR’s secretary of the Treasury, recommended Eccles to FDR for this reason and so that the Treasury could count on a highly cooperative Fed.

But Eccles agreed to take Black’s place only on one condition: FDR had to let him author a radical Fed overhaul that would substantially increase both his own and other politically-appointed officials’ influence upon Fed policy, while reducing that of the governors of the 12 Reserve banks.

Eccles’s proposal became the Banking Act of 1935, which Roosevelt signed that August. The Act replaced the former Federal Reserve Board with the present seven-member presidentially-appointed “Board of Governors.” It also changed the composition of the FOMC, which had been established by the Banking Act of 1933 to coordinate the Fed’s open-market operations. That committee’s voting members had originally consisted solely of the “governors” (as they were then styled) of the 12 regional Fed banks. The new law established the one in place today, with the “presidents” of only five Fed banks (New York’s and four others chosen on a rotating basis) serving on the committee at any one time, and doing so along with the seven members of the Board of Governors.

Besides allowing the Board of Governors to make up a majority of the FOMC, the new law also allowed it to set Fed bank discount rates and reserve requirements. The Act’s ultimate goal, according to Peter Conti-Brown (p. 32), was nothing less than that of subsuming monetary policy under administration policy. “It is no surprise, then,” says Brown,

that the Eccles Fed of the 1930s saw less of a need to declare formal independence from government, as the Banking Act of 1935 had done in a declaration of independence from private bankers. Even during a brief and painful interlude of further recession in 1937–38, the Fed’s policy during the 1930s was fully congenial to the administration’s.

In their 2014 paper, “Navigating Constraints: The Evolution of Federal Reserve Monetary Policy, 1935–59,” Fed economists Mark Carlson and David Wheelock reach a more or less identical conclusion. “New Deal legislation,” they write, “limited the Fed’s ability to conduct an independent monetary policy. The Fed was forced to cooperate with the Treasury in the 1930s, and fully ceded monetary policy to Treasury financing requirements during World War II.”

***

To sum up: if ever an administration had control over Fed policy, and monetary policy more generally, FDR’s was it. It follows that, if monetary policy did less than it should have to end the Great Depression, the Roosevelt administration must bear a good share of the blame.

But everything is relative: until the last months of 1936, the Roosevelt administration’s monetary policy errors were errors of omission only: unlike Hoover, who acquiesced to Fed policies that contributed to the Great Contraction, FDR and his Treasury team merely failed to encourage the Fed to contribute more to money growth than it did, or to contribute more to that growth themselves. Alas, this ceased to be so toward the end of 1936, when actions by both the Fed and the Treasury resulted in a second severe monetary contraction that would reverse many of the gains achieved over the course of the preceding four years.

It’s also true that, if New Deal policies failed to encourage monetary expansion beyond what gold inflows alone provided for, those policies deserve much of the credit for those gold inflows. Just how much credit they deserve will be the main topic of this series’ next installment.

Continue Reading The New Deal and Recovery:

- Intro

- Part 1: The Record

- Part 2: Inventing the New Deal

- Part 3: The Fiscal Stimulus Myth

- Part 4: FDR’s Fed

__________________

[1] The Fed’s 1937 purchases were part of its “flexible portfolio policy”—an early version of “Operation Twist”—aimed not at promoting money growth but at arresting the decline in Treasury bond prices that began in late 1936. To prop those prices up, the Fed actually bought $200 million in Treasury bonds. But it simultaneously sold $150 million in shorter-term Treasury notes and bills. For further details see Chandler (1949).

[2] See Renshaw (1999, especially pp. 349–50). According to this very well-informed article, the decisive change occurred while Roosevelt was at Warm Springs in March 1938. Here he “was finally converted to the idea of a package of federal spending to act counter-cyclically on the now seriously depressed economy.” It was also subsequent to this meeting that the administration’s monetary policy, which “had been crucial in deepening” the recession, was “abruptly reversed.”

[3] Federal Reserve Bank Notes resembled national bank notes, and could be issued on precisely the same terms, though by individual Federal Reserve banks rather than national banks. They were first used during WWI, but had been withdrawn afterwards.

[4] Eric Rauchway (2015, pp. 65–6) rejects this interpretation, which rests upon the testimony of original brain trust members Raymond Moley and Paul Warburg. “Roosevelt,” he says, “operated so deftly that even people close to him believed his hand had been forced.” In fact, Rauchway says, Roosevelt “told [George] Warren to keep pushing” for the Thomas Amendment’s inflationary provisions so he’d have “the tools…he wanted” to manage the dollar. But according to Warren’s theory, to which FDR fully subscribed by this time, the only tool Roosevelt needed was the authority to alter gold’s price. There is no reason to suppose, therefore, that he welcomed, much less encouraged Warren or anyone else to “push for,” the Thomas Amendment’s other provisions.

[5] Although Treasury silver purchases added $1.22 billion to Fed member bank reserves between late 1933 and the end of 1938, most of these purchases resulted not from the Thomas Amendment but from the Silver Purchase Act of 1934. In any case their effect on the money stock was largely offset by the Treasury’s concurrent retirement of $900 million in national bank notes. The Treasury’s net contribution to bank reserves was just $320 million, a very small share of the total increase of about $6 billion, most of which was due to gold inflows.