As regular Alt‑M readers know, I’ve been saying for over a year now that, despite their promise to “normalize” monetary policy, Fed officials have been determined to maintain the Fed’s post-crisis “floor” system of monetary control, in which changes to the Fed’s monetary policy stance are mainly achieved by means of adjustments to the rate of interest the Fed pays on banks’ excess reserve balances, or the IOER rate, for short.

Until recently the Fed’s intentions had to be inferred by reading between the lines of its official press releases, or by referring to personal preferences expressed by leading Fed officials. But with today’s release of the Fed’s official Monetary Policy Report by the Board of Governors, it’s no longer necessary to speculate. The section “Interest on Reserves and Its Importance for Monetary Policy,” on pp. 44–46, leaves hardly any room for doubt that the Board of Governors still regards the IOER rate as “the principal tool the FOMC [sic] uses to anchor the federal funds rate,” and that it plans to keep on doing so after it “normalizes” monetary policy by completing its ongoing balance sheet unwind and by further raising its fed funds rate target upper limit by another percentage point or so.[1]

An Awkward Start

Having already spilled several gallons of ink criticizing the Fed’s floor system, on these pages and in Floored!, my forthcoming book on the subject, I don’t see the point of reviewing those criticisms here, by way of a comprehensive reply to the Board’s recent remarks defending that arrangement. Still I can’t resist pointing out some especially galling aspects of those remarks, starting with this opening passage:

The financial crisis that began in 2007 triggered the deepest recession in the United States since the Great Depression. In response, the Federal Open Market Committee (FOMC) cut its target for the federal funds rate to nearly zero by late 2008. Other short-term interest rates declined roughly in line with the federal funds rate. Additional monetary stimulus was necessary to address the significant economic downturn and the associated downward pressure on inflation. The FOMC undertook other monetary policy actions to put downward pressure on longer-term interest rates, including large-scale purchases of longer-term Treasury securities and agency-guaranteed mortgage-backed securities.

These policy actions made financial conditions more accommodative and helped spur an economic recovery that has become a long-lasting economic expansion.

Although the passage itself doesn’t refer to interest on reserves, its purpose is to introduce a discussion devoted to singing the praises of that policy instrument. It’s in light of that intention that the passage raises my hackles. For what the Fed’s report doesn’t say is that, when the Fed introduced IOER in early October 2008, it did so, not because it thought “monetary stimulus was necessary to address the significant economic downturn and the associated downward pressure on inflation,” but because it was determined to prevent its then-ongoing emergency lending from having any stimulus effect, and from thereby becoming a source of unwanted upward pressure on inflation! IOER was, in other words, originally intended to serve as a contractionary monetary policy measure, just when monetary expansion was desperately needed.

And boy did it work! NGDP, which had been growing, albeit at a snail’s pace, went into a tailspin. Nor was that all. Because the Fed’s IOER rate — first set at 75 basis points, briefly lowered to 65 bps, then quickly raised to 100 basis points, and finally lowered again (in early December 2008) to 25 basis points, where it remained for the duration of the crisis — was designed to prop-up the fed funds rate by encouraging banks to accumulate excess reserves, when the Fed finally determined that the U.S. economy could use a little stimulus after all, it had no choice but to resort to “other monetary policy actions to put downward pressure on longer-term interest rates, including large-scale purchases of longer-term Treasury securities and agency-guaranteed mortgage-backed securities.”

But we mustn’t be too hard on the authors of the report. After all, it would have been awkward for them to laud the Fed’s floor system after first pointing out how, during the last months of 2008 and the start of 2009, that system played an important part in bringing the U.S. economy to its knees.

Not a Popular System

Another irksome passage in the Board’s report is the one declaring that “Interest on reserves is a monetary policy tool used by all of the world’s major central banks.” Yes, and no. Plenty of central banks pay interest on bank reserves. But the policy the report defends isn’t simply that of paying interest on bank reserve balances, including excess reserve balances. It’s that of using the IOER rate as the Fed’s chief instrument of monetary control, which is the essence of a “floor” operating system. And that means setting an IOER rate high enough to encourage banks to stock-up on excess reserves, instead of trading them for other assets.

Although the central banks of several other nations have employed floor systems in the past, today, besides the Fed itself, only the Bank of England and the ECB still rely on floor systems — or something close. Most central banks now rely on “corridor” systems of some kind, in which the central bank’s IOER (“deposit”) rate sets a lower bound on movements in its policy rate, and open-market operations are routinely employed to keep the actual policy rate at a target set somewhere between that lower bound and an upper bound consisting of the central bank’s own lending rate. Finally, a number of other central banks that either used floor systems before the crisis or adopted such systems during it, including the Swiss National Bank, the Bank of Japan, Norges Bank, and the Reserve Bank of New Zealand, switched to “tiered” or “quota” systems afterwards. In a tiered system, reserves may earn interest at a rate that makes them seem attractive relative to other safe assets, but they do so only up to a fixed limit. Beyond that limit they earn only a relatively modest return — if not a zero or negative return. Because the marginal opportunity cost of reserves remains positive in tiered systems, such systems operate more like corridor systems than like a floor system.

Just How Low Has the Fed Really Gone?

But of all the irritating claims of the Board’s report, the one that has gone furthest in putting me in high dudgeon is this one:

The rate of interest the Federal Reserve pays on banks’ reserve balances is far lower than the rate that banks can earn on alternative safe assets, including most U.S. government or agency securities, municipal securities, and loans to businesses and consumers. Indeed, the bank prime rate — the base rate that banks use for loans to many of their customers — is currently around 300 basis points above the level of interest on reserves.

To which the following footnote is appended:

The Congress’s authorization allows the Federal Reserve to pay interest on deposits maintained by depository institutions at a rate not to exceed the “general level of short-term interest rates.” The Federal Reserve Board’s Regulation D defines short-term interest rates for the purposes of this authority as “rates on obligations with maturities of no more than one year, such as the primary credit rate and rates on term federal funds, term repurchase agreements, commercial paper, term Eurodollar deposits, and other similar instruments.” The rate of interest on reserves has been well within a range of short-term interest rates as defined in Board regulations.

Where to begin?

It’s absurd, first of all, to treat interest rates on “loans to businesses and consumers,” the prime rate included, as rates on safe assets. But don’t take my word for it: consider what two Fed senior economists, one of whom works at the Board of Governors, have to say on the subject, in a Liberty Street Economics post entitled, “What Makes a Safe Asset?” Safe assets, they write,

are those with a very high likelihood of repayment, and are easy to value and trade …. As a result, safe assets typically trade at a premium, known in the academic literature as a “convenience yield,” which reflects the nonpecuniary benefits investors receive for holding them …

In today’s financial system, the prime example of a safe asset is U.S. Treasury securities. These securities are considered to have zero credit risk, can be easily sold, and can be used as collateral either to raise funding or to post as margin in derivatives positions. … Treasuries’ safe asset status translates into an average yield reduction of 73 basis points. This yield spread can be interpreted as a measure of the convenience yield embedded in Treasuries.

However, Treasuries differ significantly in maturity and that affects their safe asset characteristics. Treasury bills (T‑bills) have the shortest maturities and are often thought of as “money-like” assets, that is, assets similar to physical currency. Because of this moneyness, yields on short-term T‑bills are typically lower than those on comparable assets….

The private sector can also create safe assets. For example, many of the benefits ascribed to public safe assets are also attributed to private short-term debt of certain issuers. An important difference between public and private safe assets, however, is that the reliability of private safe assets can come into question.

Stretch the notion as much as you like, you will never get “safe assets” to include even the safest bank loans. That is, you won’t be able to do it unless you are a Fed official trying to claim that the Fed’s IOER rate has been “far lower than the rate that banks can earn on alternative safe assets.”

Nor is it possible to justify comparing the Fed’s IOER rate — a rate on assets (reserves) of essentially zero maturity — to rates on otherwise safe longer-term assets. Instead, to sustain the claim that the Fed’s IOER rate has been low relative to that on assets of comparable safety, including comparably low exposure to interest-rate (or duration) risk, Fed officials would have to show that the IOER rate is below rates on safe assets with very short (if not zero) maturities. That rules out comparisons to Treasury and agency bonds and notes, leaving only Treasury bills. Even then the comparison is a bit unfair, as even the shortest-term Treasury bills have longer terms — and are therefore less liquid and safe — than bank reserves.

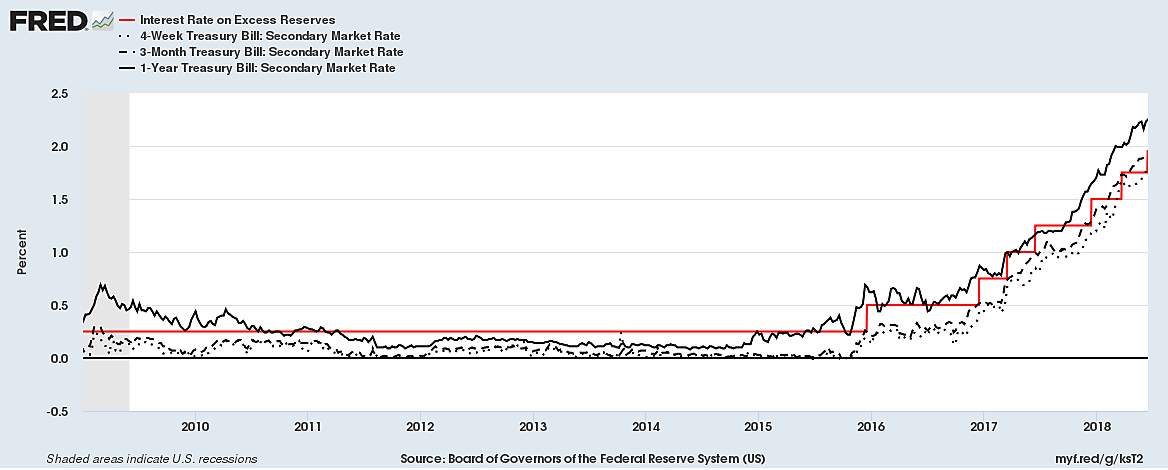

But let that pass. Instead, let’s just consider how the report’s assertion that the Fed’s IOER rate “is far lower than the rate that banks can earn on alternative safe assets” stacks up against the record regarding yields on various Treasury bills. Let FRED do the talking:

As the chart shows, throughout most of its existence the IOER rate has been well above, not just rates on shorter-term Treasury Bills, but those on 1‑year T‑bills; indeed, for a long interval banks had to hold T‑bills of 2‑year maturities or longer to earn as much interest as excess reserves paid. And while the situation isn’t nearly so bad today, it remains the case that reserves pay more than one-month Treasury bills. That’s not “far lower than the rate that banks can earn on alternative safe assets.” It’s not even a little lower. It’s higher. Nor could things be otherwise, because having a floor system means having an IOER rate that’s high enough “to remove the opportunity cost to commercial banks of holding reserve balances,” which it wouldn’t be if it were really “far lower than the rate that banks can earn on alternative safe assets.”

“D” for Deception

And what about that footnote? It just adds insult to injury by showing the lengths to which the Fed has been willing to go to twist and bend the law authorizing it to pay interest on bank reserves. As the note correctly observes, that law requires that the Fed’s IOER rate not exceed “the general level of short-term interest rates.” Since the IOER rate is itself, as we’ve seen, a rate on a riskless zero-maturity asset, any reasonable interpretation of the statute would have it refer to the general level of rates on other short-term, riskless assets, such as 4 week-Treasury Bills or, perhaps, overnight Treasury-secured repos.

So, in preparing Regulation D, how did the Fed define short-term rates for the purpose of implementing the statute? Why, as “rates on obligations with maturities of no more than one year, such as the primary credit rate and rates on term federal funds, term repurchase agreements, commercial paper, term Eurodollar deposits, and other similar instruments” (my emphasis). If you can’t see how self-serving — not to say dishonest — the Fed’s definition is, please read it again, carefully, bearing in mind what “term” rates are and that the Fed’s “primary credit rate” is what’s more commonly known as its “discount” rate — that is, “the interest rate charged to commercial banks and other depository institutions on loans they receive from their regional Federal Reserve Bank’s lending facility–the discount window.”

That Regulation D refers to “term” rates rather than overnight rates, when the latter are obviously more appropriate, is the least of it. The inclusion on the Fed’s list of comparable rates of the Fed’s primary credit rate is the real kicker. First of all, that rate isn’t a market rate but one that the Fed itself administers. What’s more, the Fed has long had a policy of setting it well “above the usual level of short-term market interest rates” (my emphasis again). These days, for example, it sets it “at a rate 50 basis points above the Federal Open Market Committee’s (FOMC) target rate for federal funds.” Because the IOER rate once defined the upper limit of the FOMC’s fed funds target rate range, and is now set 5 basis points below that limit, any interest rate that the Fed pays on reserves is bound to be lower than the Fed’s primary credit rate. Thus the Fed has cleverly interpreted and implemented the statute in a manner that allows it to claim that it is obeying the law requiring that its IOER rate not exceed “the general level of short-term interest rates” no matter how it sets that rate, including when it sets it well above truly comparable market-determined short-term rates!

Now I hope you’re at least starting to see why the Fed’s report has got my goat.

_______________________

[1] “Sic” because it is the Board of Governors, rather than the FOMC, that sets the IOER rate. Concerning this anomalous exception to the rule assigning responsibility for the conduct of monetary policy to the FOMC, see my January 10, 2018 testimony before the Monetary Policy and Trade Subcommittee of the House Financial Services Committee.