Labor market and cultural disruptions in the United States are real and important, as is China’s current and unfortunate turn toward illiberalism and empire. But pretending today that there was a better trade policy choice in 2000—when Congress granted China “permanent normal trade relations” (PNTR) status and paved the way for broader engagement—is misguided. It assumes too much, ignores too much, and demands too much. Worse, it could lead to truly bad governance: increasing U.S. protectionism; forgiving the real and important failures of our policymakers, CEOs, and unions over the last two decades; and preventing a political consensus for real policy solutions. Indeed, that is happening now.

China entered the World Trade Organization (WTO) on December 11, 2001, and President George W. Bush signed a proclamation on December 27, that extended PNTR status to the People’s Republic of China (White House 2001). The benefits of granting PNTR to China were widely understood at the time. Nicholas Lardy, a respected China scholar, summarized those benefits as follows:

A positive vote [for PNTR with China] would give U.S. companies the same advantages that would accrue to companies from Europe, Japan, and all other WTO member states when China enters the World Trade Organization. It would also provide an important boost to China’s leadership, that is taking significant economic and political risks in order to meet the demands of the international community for substantial additional economic reforms as a condition for its WTO membership. A positive vote would strengthen bilateral economic relations more generally [Lardy 2000: 1].

The 20th anniversary of the U.S. law implementing PNTR with China and the Chinese government’s numerous recent offenses have caused a bipartisan chorus of American politicians and pundits to question the wisdom of that law. In particular, these critics allege that the Clinton administration and Congress rubberstamped both the law and China’s entry into the WTO, and that these events fueled China’s rise and the now-famous “China Shock”—the period between 1999 and 2011 during which a sizable increase in Chinese imports supposedly produced the loss of approximately 2.4 million U.S. jobs. In turn, critics have used the “mistake” of past economic engagement with China to justify grand rethinks of current U.S. foreign and economic policy, including withdrawal from the WTO itself.

However, a proper accounting of the relevant literature reveals most of this criticism to be mistaken on the law, economics, and history of PNTR, China’s WTO accession, and the China Shock. This analysis instead reveals that new or continued U.S. restrictions on Chinese imports would not have saved most of the U.S. manufacturing jobs destroyed between 1999 and 2011; that China would have joined the WTO and become an export powerhouse regardless of PNTR; that U.S. engagement with China in the 1990s was a gradual and pragmatic policy decision based on numerous supporting facts at the time, and with no better alternatives; and that myriad U.S. policy failures since PNTR actually did enable China or harm American companies and workers. Policymakers should focus on these errors, not PNTR, lest they risk enacting new policies that do nothing to address America’s real and serious challenges, including China, and might actually make things worse.

U.S.-China Trade: Amplified Costs and Ignored Benefits

A central flaw in the anti-PNTR thesis is that it ignores the benefits of increased U.S. trade with China over the last two decades—for American consumers, manufacturers, and workers. Economists have found, for example, that Chinese import competition between 2000 and 2007—the peak of the China Shock—had substantial procompetitive effects on U.S. firms and generated over $202 billion in consumer benefits via lower prices. That equals $101,250 in benefits to U.S. consumers per manufacturing job lost (Jaravel and Sager 2018). Another study concludes that Chinese imports “significantly reduced inflation,” cutting the price index for consumer goods by 0.19 percentage points per year between 2004 and 2015 through lower prices and an increased variety of goods available (Bai and Stumpner 2019; see also Amiti et al. 2018). Consumer benefits of trade, already tilted toward America’s poor and middle class, were even more so for Chinese imports because those consumers frequently shop at places like Target and Walmart that carry such goods (Broda and Romalis 2008; Fajgelbaum and Khandelwal 2014). One can argue that those consumer benefits are cold comfort to someone who lost a job because of Chinese import competition, but they are nevertheless real, widespread, and important.

Chinese imports have also been found to generate substantial benefits for many American companies and their workers. Import competition encouraged many American manufacturing firms to invest and innovate more and ultimately led to net welfare benefits (Gutiérrez and Philippon 2017; Caliendo, Dvorkin, and Parro 2019). After accounting for manufacturing supply chains and intermediate inputs, the effect of the China Shock on American jobs and wages has been quite positive overall, and while the China Shock produced losses for certain groups of Americans, it generated overall gains in social welfare (Wang et al. 2018; Galle, Rodriguez-Clare, and Yi 2017). In fact, researchers have estimated that about 56 cents of every dollar that Americans spent on “Made in China” imports in 2019 actually went to American firms and workers (Hale et al. 2019). Such benefits make sense: data show millions more “blue collar” American jobs that might benefit from Chinese imports—in transportation, logistics, construction, maintenance, and repair, for example—than in manufacturing (BLS 2018).

This assessment erroneously assumes, moreover, that all U.S. manufacturing jobs are potentially hurt by Chinese import competition. Yet approximately one-third of all Chinese imports were intermediate goods used by American companies to produce globally competitive products. These imports have helped, not hurt, U.S. manufacturing workers. In fact, U.S. manufacturing firms that increased direct imports from China between 1997 and 2007 experienced growing or steady employment, likely because of the importers’ ability to lower prices and raise output (even as nonimporting competitors suffered) (Antràs, Fort, and Tintelnot 2017). With respect to these types of complex value chains, the WTO estimates that China in 2015 was the third-largest user—behind only Mexico and Canada—of “Made-In-America” manufacturing inputs and the largest source of inputs for American manufacturers (WTO 2020).

Then there are the benefits that American farmers and workers have derived from exporting to China, still the United States’ third largest export destination (U.S. Census Bureau 2020). According to the U.S.-China Business Council, exports to China in 2019 supported over 1.1 million American jobs in a wide range of manufacturing, logistics, and services industries (USCBC 2019). The U.S.-China “Phase One” agreement’s heavy emphasis on American agriculture sales, as well as the massive expansion of federal farm subsidies during the countries’ trade dispute, shows just how much U.S. farmers have benefited from selling to the growing Chinese market.

Beyond the benefits of trade with China, a proper accounting of the China Shock also requires proper context. There is evidence, for example, that many U.S. manufacturers adapted during the shock, and ended up hiring many Americans and increasing output. For example, Fort, Pierce, and Schott (2018: 18–21) find that declines in “manufacturing firm workers” employed in “manufacturing plants” between 1977 and 2012 were more than offset by contemporaneous increases in employees in “non-manufacturing plants” that were owned by many of the same “manufacturing firms.”

The evolution of American manufacturing—driven by trade, automation, or other factors—raises further concerns about attempting to isolate the effects of Chinese import competition on low-skill American manufacturing employment. For example, researchers find that the decline in manufacturing employment during the 2000s was a substantial cause of rising American unemployment, especially for less-educated prime-age workers (Charles, Hurst, and Schwartz 2018). However, they also find that these declines were caused by a mix of both import competition and nontrade factors. They further speculate that persistently depressed low-skilled manufacturing employment in the United States was likely caused by nontrade issues like a skills mismatch in the U.S. manufacturing sector (which is becoming more skilled compared to other low-skill professions like retail and construction) and declining cross-region mobility among U.S. workers during the 2000s compared to earlier periods. As a result, “imposing trade barriers against the rest of the world is unlikely to substantially increase the employment prospects of workers with lower levels of accumulated schooling” (ibid.: 63).

Studies have similarly found it difficult to distinguish the employment effects of trade from those of technology. After documenting the evolution of American manufacturers in their aforementioned paper, for example, Fort, Pierce, and Schott (2018: abstract) acknowledge that the “data provide support for both trade- and technology-based explanations of the overall decline of [manufacturing] employment over this period, while also highlighting the difficulties of estimating an overall contribution for each mechanism.”

Additional China Shock context is provided by Eriksson et al. (2019), who show that the China Shock was so “shocking,” not because of China or PNTR, but because of when it hit the United States: during regional shifts in the U.S. production of certain labor-intensive goods. In particular, “late stage” industries—with now-standardized processes and low technologies that are susceptible to global competition (particularly in developing countries)—had moved out of high-education/innovation U.S. regions to places with less education and innovative capacity, thus explaining “why the shock hurt in these areas to the extent that it did.” This timing adds to the uniqueness of the China Shock, as the authors find that previous U.S. trade shocks—involving Japan and the Asian Tigers, for example—had no such dynamic (and thus far more limited labor market effects). The analysis also shows that these “late-stage” industries were well on their way out of the United States regardless of the China Shock.

Many other experts have questioned whether the China Shock literature tells the whole story about Chinese imports, U.S. manufacturing jobs, and related issues. Economists have found substantial net benefits for the United States when more fully accounting (e.g., through a general equilibrium model) for Chinese import competition. In particular, the China Shock was found to cause fewer manufacturing job losses (Caliendo, Dvorkin, and Parro 2019); to be accompanied by offsetting job gains in U.S. manufacturing exports and services (Feenstra, Ma, and Xu 2017; Feenstra and Sasahara 2017); and to result in a net loss of only 300,000 U.S. jobs—just 0.22 percent of nonfarm employment (DeLong 2017). Others found one-third fewer manufacturing job losses and different regional effects when using value-added trade flows to measure the China Shock and 20–30 percent fewer job losses when accounting for booms and busts in the U.S. housing market (Xu, Ma, and Feenstra 2019).

Others disagree with the China Shock authors’ general conclusions about the impact of Chinese imports on U.S. jobs. Alan Reynolds (2016), for example, argues that the China Shock’s “microeconomic model designed for local ‘commuting zones’ cannot properly be extended to the entire national economy,” and therefore misses important macroeconomic effects of U.S.-China trade liberalization like increased U.S. exports (to China and other countries), and that extending the period beyond 2011, during which the U.S. economy was still affected by the Great Recession, causes half of the job loss attributed to the China Shock to “disappear.”

Charles Freeman, who ran the U.S. Trade Representative’s Office of China Affairs during the George W. Bush administration, recalls, “We just didn’t see any profound direct US job losses in sectors exposed to new direct competition from China” (Freeman 2019). Phil Levy, a member of the George W. Bush administration’s Council of Economic Advisers, adds that the fungibility of Chinese and other developing country imports undermines the argument that Chinese imports—as opposed to imports more generally—were to blame for some of the manufacturing job losses that occurred during the China Shock period (Levy 2016). Levy concludes from this experience that it “calls into question the premise of [the China Shock] analysis. If the alternative to imports from China was imports from other developing nations, then the impact of China on U.S. workers was negligible.”

The data tend to corroborate Freeman’s and Levy’s claims. First, Figure 1 shows only a modest change in trend for manufacturing jobs as a share of the U.S. workforce before and after PNTR passed and China entered the WTO.1

Second, data indicate that, pace Levy, Chinese imports may have replaced other imports more than they did domestic production before, during, and after the China Shock. According to the Congressional Research Service, for example, the total share of imports into the United States from Pacific Rim countries between 1990 and 2017 remained relatively constant at 47.1 percent, but “the role of China as a supplier of U.S. manufactured products among Pacific Rim countries increased sharply, while the relative importance of the rest of the Pacific Rim (excluding China) for these products sharply decreased,” a result “partly due to many multinational firms shifting their export-oriented manufacturing facilities from other countries to China” (Morrison 2018: 10–11).

Economists at the San Francisco Federal Reserve Bank also found that Americans’ total import consumption, as measured by 2017 personal consumption expenditures (PCE), remained relatively steady during the China Shock period. According to Hale et al. (2019): “The fact that the overall import content of U.S. consumer goods has remained relatively constant while the Chinese share has increased demonstrates that Chinese gains have come, in large part, at the cost of other exporters, namely Japan.”

That economists repeatedly and openly express reservations—supported by various trade and employment data—about blaming China trade alone for massive declines in U.S. manufacturing employment should foment similar levels of caution among U.S. politicians and pundits.

Finally, there is the matter of putting the China Shock’s effects into proper perspective. For example, the 97,000 annual manufacturing job losses attributable to Chinese imports (on average) represents less than 20 percent of total involuntary job losses in manufacturing and less than 5 percent of total involuntary job losses (Lawrence 2014). Autor himself (Clement 2016) has called his estimate of 2 million jobs lost an “upper bound” (the more likely central estimate was about half that number), which includes around 1 million non-manufacturing jobs (Dubner 2017).

Overall, the aforementioned literature review reveals that the claims of harm from Chinese trade are likely wildly overstated while the substantial economic benefits are usually ignored, and that the China Shock issues are more uncertain and complex than the caricature painted by PNTR/China critics. Moreover, current calls to overhaul the U.S. economy based on the China Shock are unsupportable when placing the jobs lost to Chinese import competition in proper perspective, and when considering that the disruptions likely caused by the China Shock would still have happened in its absence.

The Reality of China’s WTO Accession and Export Competitiveness

PNTR was not responsible for first opening the United States to Chinese imports. Prior to the law’s enactment, China held “most favored nation” (MFN) trade status since 1980, meaning the country faced no greater trade barriers than most other U.S. trading partners. Only once between 1990 and 2001 was China’s MFN/NTR status truly in doubt: in 1992, when a presidential veto was needed to maintain it. As a result, Chinese imports to the United States increased more than sixfold in the decade preceding PNTR, and by the late 1990s, the rational expectation of most U.S. importers was more of the same.

Nevertheless, there is evidence that the certainty of “permanent” trade relations accelerated the growth of Chinese imports into the United States. In particular, researchers have found a substantial connection between PNTR, Chinese imports in sectors that would have faced high tariffs in the absence of MFN/NTR, and U.S. jobs (Pierce and Schott 2016; Handley and Limão 2017). Other experts, however, question the magnitude of the PNTR “uncertainty driver.” For example, 2019 research found that the annual MFN/NTR votes actually increased Chinese imports into the United States as a result of importers’ front-running (increasing shipments in advance of) any potential tariff increases (Alessandria, Khan, and Khederlarian 2019), and that the probability of NTR denial averaged only about 5.5 percent between 1990 and 2001, reaching a mere 1.4 percent in 2001. Thus, the trade-dampening effects of MFN/NTR uncertainty had evaporated by the late 1990s.

Regardless of which expert is ultimately correct, the Congressional Record and Chinese trade flow data contradict the popular assertion that an isolated U.S. policy choice in 2000 first exposed the United States to Chinese import competition. At most, PNTR merely accelerated a bilateral economic integration that was already well underway.

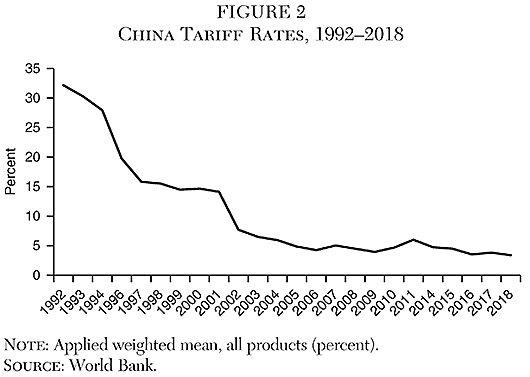

More importantly, ample evidence shows that PNTR was not the only driver of the China Shock. Multiple studies have found, for example, that the reduction in trade policy uncertainty accounted for only about one-third of the growth in Chinese exports to the United States in the 2000s, with the remaining two-thirds attributable to China’s own market reforms (Handley and Limão 2017; Amiti et al. 2018). These include privatization, trading rights, and import liberalization, often in response to new WTO commitments, which themselves were major contributors to China’s export competitiveness in the late 1990s and 2000s (Autor, Dorn, and Hanson 2018; Jakubik and Stolzenburg 2018). Indeed, as shown in Figure 2, average Chinese tariffs declined from more than 30 percent in the 1990s to less than 9 percent in 2006, and even lower on a trade-weighted scale.

Thus, PNTR probably accelerated Chinese exports to the United States, but China’s own reforms—far beyond the control of Washington policymakers—also fueled the China Shock.

Furthermore, China’s WTO accession was not “shocking” to anyone watching U.S. trade policy in the 1990s. China first applied to join the WTO’s predecessor, the General Agreement on Tariffs and Trade (GATT), in 1985, then reapplied in 1995 when the WTO came into being, and finally acceded to the body in 2001. China’s accession over this time involved dozens of bilateral and multilateral (“working party”) meetings, negotiating texts, disclosures, and internal reforms. China’s final accession package—a “Working Party Report” and “Protocol of Accession,” plus liberalization schedules for goods and services—contained hundreds of pages of commitments (by far the most of any acceding member up to that point and still today considered to be some of the deepest ever). This included many “WTO-plus” commitments that the United States and other members dictated (via bilateral accession agreements) and have since been used, for example, to challenge Chinese laws through dispute settlement or to restrict Chinese imports (Chemutai and Escaith 2017).

The United States also did not rubber-stamp China’s WTO accession or base it on Pollyannaish dreams of Chinese democratization. Instead, the United States was the final holdout among large industrialized nations to approve China’s WTO accession via bilateral negotiations, demanding ever more concessions from the Chinese government over a contentious 13-year negotiation (Nakatsuji 2001). U.S. trade representatives for multiple presidents from each major party also frequently consulted with Congress and the private sector, including labor unions, at every step of the process (as required by U.S. law).

Furthermore, creating a liberal democracy in China was not a primary reason for the United States government’s approval of China’s WTO accession. Instead, key Clinton administration speeches and policy documents demonstrate that U.S.–China engagement “was a balancing act with multiple objectives”—most of them pragmatic—including “increasing bilateral dialogues, … WMD nonproliferation in East and South Asia, preventing the nuclearization of the Korean Peninsula, cooperating on disease and environmental issues, better market access [for U.S. companies] and intellectual property rules, fighting organized crime, ensuring stability in the Taiwan Strait, and WTO accession on ‘commercial terms,’ among others” (Thomas 2019). Democratization, on the other hand, was rarely mentioned.

In reality, Washington policymakers had no good alternatives to granting PNTR to China (a move that every other WTO member had done years earlier), especially based on the facts available at that time. The two actual alternatives to PNTR—letting China in the WTO but continuing the annual NTR process (or even raising tariffs on Chinese goods), or keeping China from the WTO entirely—were inferior, in terms of both the economics and geopolitics, to granting PNTR. Neither would have prevented China’s rise, given the aforementioned realities of China’s export competitiveness (driven mainly by internal reforms), the multipolar nature of today’s global economy (offering economic options beyond the United States), and the pervasiveness of global supply chains (allowing Chinese inputs to enter the United States via finished goods made in third countries) (Levy 2018).

Regardless, marshaling the necessary WTO-wide consensus to deny more than one billion people in a modernizing economy access to an open multilateral trade organization—one that already included communist Cuba and for decades had tolerated Eastern Bloc command-and-control economies and “socialist” countries with pervasive state-owned industries—was not realistic, especially given what policymakers could have knew at the time about China’s relatively liberal leadership and impressive economic reforms. China was entering the WTO, whether critics liked it or not.

Ignoring Government Failures and Market Realities

Blaming PNTR for Chinese economic malfeasance and the problems of the American working class ignores many key facts about federal policy over the last several decades.

First, the U.S. government has missed several opportunities to check China’s actions and support domestic labor markets since Beijing undertook the economic liberalization and legal commitments required of WTO accession. Most of those actions—for example on industrial subsidies and intellectual property—are covered by WTO rules and can be litigated through dispute settlement (Bacchus, Lester, and Zhu 2018). Contrary to popular wisdom, moreover, such litigation has proven effective. For example, the United States was undefeated at the WTO when challenging Chinese trade practices between 2002 and 2018 (Schott and Jung 2019) and has won several more cases since that time. And when China loses WTO disputes, it tends to comply with the decisions. Chinese compliance is not perfect (nor is any other WTO member’s), but it is arguably better than that of the United States, which has famously shirked WTO rulings on subsidies, antidumping rules, and internet gambling.

The refusal of the United States and other WTO members to pursue more disputes against China—or open “compliance proceedings” when China does not fully comply—is a policy worth criticizing, but says nothing about the original decision to admit China to the WTO in the first place. Indeed, to claim that China’s WTO accession terms were weak and that the WTO cannot discipline China’s unfair trade practices without fully utilizing the sole means of imposing such discipline (dispute settlement) is declaring defeat without firing a shot.

Other policy mistakes since the passage of PNTR also deserve scrutiny. Among these are the United States’ (1) withdrawal from the Trans-Pacific Partnership (TPP), which was designed in part to counterbalance China’s economic and geopolitical ambitions; (2) failure to reform tax, trade, and immigration policies that inhibit American companies’ global competitiveness; (3) failure to modernize adjustment assistance and worker retraining programs intended to mitigate trade, technological, or cultural disruptions; or (4) continued imposition of tax, education, occupational licensing, criminal justice, zoning, and other policies that discourage labor adjustment and economic dynamism. Such policies are indeed worthy of criticism and debate but cannot inform the decision to pass PNTR, allow China to join the WTO, or otherwise “normalize” trade with China. And blaming China for these policies’ inevitable failures relieves them of the scrutiny that they deserve.

Second, critics of engagement with China also often ignore the United States’ own history of market interventions and their failures to help companies and workers—even during the China Shock. Most importantly, the only apparent alternative to freer trade—protectionism—has repeatedly proven both costly and ineffective. For example, International Monetary Fund economists in 2018 examined data for 151 countries over 51 years (1963–2014) and found that “tariff increases lead, in the medium term, to economically and statistically significant declines in domestic output and productivity” as well as more unemployment and higher inequality (Furceri et al. 2019). The same is true for American protectionism, which has been found to impose immense economic costs that outweigh any benefits; to fail to protect American firms and workers; and to breed corruption, cronyism, and political dysfunction (Lincicome 2017).

Nevertheless, the United States has maintained or implemented (1) significant tariffs and tariff-rate quotas on imports of “sensitive” products like trucks, apparel, footwear, and food (Lincicome 2016); and (2) a relatively high number of non-tariff trade interventions (Global Trade Alert 2020), including hundreds of special restrictions on “unfair” Chinese imports (imposed via antidumping and countervailing duty laws, and “Section 337” actions that remedy intellectual property rights violations), as well as numerous other “national security” restrictions on Chinese inbound investment or on U.S. technology exports to China.

Once again, however, these measures have proven ineffective. For example, President Barack Obama’s 2009 imposition of 35 percent “special safeguard” tariffs on Chinese tires was found to result, even under the best assumptions, in a handful of American jobs saved at an annual cost to U.S. consumers of over $900,000 per job, plus a substantial increase in non-China imports instead of new U.S. production (Hufbauer and Lowry 2012). Today, the industry’s prospects are no better. A 2017 review of all U.S. antidumping investigations against Chinese imports between 1998 and 2006 revealed that the duties simply caused Chinese imports to be replaced by other imports instead of bolstering U.S. producers (Lee, Park, and Saravia 2017).

The U.S. government also has long provided financial and other support to favored industries and workers, for example, through auto bailouts, steel industry bailouts, alternative energy subsidies, manufacturing tax credits, Export–Import Bank loans and other export assistance, procurement preferences like Buy American and the Davis–Bacon Act, shipping restrictions like the Jones Act and the Passenger Vessel Services Act, and the billions of other taxpayer dollars that the United States has doled out to “blue collar” industries and workers over the last few decades at the federal level alone. As I documented in a 2012 article on global subsidies and anti-subsidy disciplines, “despite the obvious economic, legal, and political problems associated with domestic subsidies, the United States remains one of the world’s largest subsidizers” (Lincicome 2012).

The United States government has also repeatedly tried to fund and retrain workers, most notably through the Trade Adjustment Assistance (TAA) program, which offers generous subsidies to U.S. workers affected by import competition. Unfortunately, TAA has proven to be a “notorious failure” and, “multiple studies commissioned by the Labor Department have found that TAA participants are worse off, as measured by future wages and benefits, than similarly situated jobless individuals outside the program” (Lincicome 2016).

All of these restrictions and programs refute the common claim that U.S. policymakers simply passed PNTR and walked away from the American working class out of some sort of “market fundamentalism” or rigid adherence to “laissez faire ideology.” The real problem was that the interventions just did not work very well. As a 2013 Congressional Research Service report concluded about the state of American manufacturing, “Congress has established a wide variety of tax preferences, direct subsidies, import restraints, and other federal programs with the goal of retaining or recapturing manufacturing jobs, [but] only a small proportion of US workers is now employed in factories” (Levinson 2013).

Finally, those seeking to blame PNTR or Chinese imports for the current plight of the American working class ignore the many places in the United States that were affected by Chinese import competition but did adjust and have thrived economically—often with the help of trade and foreign investment. Indeed, the fact that the longer-term effects of Chinese import competition vary dramatically from place to place, even in states or regions that faced similar import competition, undermines the notion that the China Shock was a national trade problem necessitating national protectionism, as opposed to a local adjustment problem necessitating local solutions (see Caliendo, Dvorkin, and Parro 2019).

Many cities and towns in America that were once known for low-skill manufacturing and recently faced intense import competition—places like Pittsburgh and Bethlehem, Pennsylvania; Greenville–Spartanburg, South Carolina; Hickory, North Carolina; Warsaw, Indiana; and Waterloo, Iowa—have since adapted and thrived. Several studies show that most U.S. regions ended up better off following the China Shock. Furthermore, a 2018 report finds that 115 of the 185 U.S. counties identified as having a disproportionate share of manufacturing jobs in 1970 had “transitioned successfully” away from manufacturing by 2016, and that, of the remaining 70 “older industrial cities,” 40 exhibited “strong” or “emerging” economic performance between 2000 and 2016 (Berube and Murray 2018).

Anecdotal evidence reiterates these findings: towns that once depended on low-skill manufacturing are now home to thriving companies that succeeded by adapting to the market, including through international trade and investment. Anyone doubting such successes need only take a drive down Interstate 85 from Charlotte, North Carolina, to Montgomery, Alabama, to see firsthand the impressive economic development—especially the multinational automotive facilities highlighted in a recent Federal Reserve Bank of New York study of U.S. manufacturing job growth (Abel and Deitz 2019).

The contrast between now-thriving American towns and those still reeling from a trade shock that ended a decade ago again indicates that the problem the “China Shock” revealed was not import competition but many communities’ inability to adjust to economic changes. Thus, those commentators and politicians who blame China trade for the difficulties of the American working class should stop asking, “Why did elites normalize trade with China in the 1990s?” and instead ask, “What did many American towns, companies, and workers do right in the face of intense import competition, and how can local, state, and federal policies encourage that important improvement?”

Conclusion

The historical record and numerous academic analyses of the China Shock provide a straightforward explanation for recent U.S. trade policy toward China. Engagement and liberalization were a pragmatic and bipartisan policy choice with few, if any, legitimate alternatives. This engagement produced real economic benefits for most Americans while bolstering the multilateral trading system and removing historical inequities under the previous, more protectionist U.S. trade policy regime.

This assessment of the China Shock, China’s WTO accession, and PNTR thus answers two counterfactual questions that critics seemingly never ask:

- Would U.S. manufacturing jobs have disappeared in the absence of the China Shock?

- Would denying PNTR have stopped China’s rise?

The weight of the evidence tilts strongly toward “yes” on the former and “no” on the latter: non-China imports and other disruptive forces would have eventually destroyed the U.S. manufacturing jobs whose loss is frequently blamed on China, and China was bound to emerge as a global trading power with or without PNTR.

The resulting economic disruption and adjustment were difficult for some U.S. regions and workers—more difficult than many experts expected—and certainly post-liberalization policy mistakes were made. With the benefit of hindsight, one can legitimately claim that certain specific “WTO-plus” rules should have been drafted differently during China’s accession.

That said, the facts do not support assertions from American politicians and pundits that engagement with China in the 1990s and 2000s was a mistake, and that denying China’s WTO admission would have improved U.S. economic and geopolitical standing today; or that the labor and cultural issues in America are the fault of “Washington elites” who pursued normalized trade with China to benefit corporate donors and democratize communist China, while refusing to support the working class.

References

Abel, J. and Deitz, R. (2019) “Where Are Manufacturing Jobs Coming Back?” Liberty Street Economics, Federal Reserve Bank of New York (February 6).

Alessandria, G. A.; Khan, S. Y.; and Khederlarian, A. (2019) “Taking Stock of Trade Policy Uncertainty: Evidence from China’s Pre-WTO Accession.” NBER Working Paper No. 25965.

Amiti, M.; Dai, M.; Feenstra, R. C.; and Romalis, J. (2018) “How Did China’s WTO Entry Affect U.S. Prices?” NBER Working Paper No. 23487.

Antràs, P.; Fort, T. C.; and Tintelnot, F. (2017) “The Margins of Global Sourcing: Theory and Evidence from U.S. Firms.” American Economic Review 107 (9): 2514–64.

Autor, D.; Dorn, D.; and Hanson, G. (2018) “When Work Disappears: Manufacturing Decline and the Falling Marriage-Market Value of Young Men.” NBER Working Paper No. 23173.

Bacchus, J; Lester, S; and Zhu, H. (2018) “Disciplining China’s Trade Practices at the WTO.” Cato Policy Analysis No. 856 (November 15).

Bai, L., and Stumpner, S. (2019) “Estimating US Consumer Gains from Chinese Imports.” American Economic Review 1 (2): 209–24.

Berube, A., and Murray, C. (2018) “Renewing America’s Economic Promise Through Older Industrial Cities.” Washington: Brookings Institution (April).

Broda, C, and Romalis, J. (2008) “Inequality and Prices: Does China Benefit the Poor in America?” University of Chicago Working Paper (March 10).

Bureau of Labor Statistics (BLS) (2018) “Labor Force Statistics from the Current Population Survey,” Household Data. Available at www.bls.gov/cps/cpsaat11.htm.

Caliendo, L.; Dvorkin, M,; and Parro, F. (2019) “Trade and Labor Market Dynamics: General Equilibrium Analysis of the China Shock.” Econometrica 87 (3): 741–835.

Charles, K. K.; Hurst, E.; and Schwartz, M. (2018) “The Transformation of Manufacturing and the Decline in U.S. Employment.” NBER Working Paper No. 24468 (March).

Chemutai, V., and Escaith, H. (2017) “Measuring World Trade Organization (WTO) Accession Commitments and their Economic Effects.” Journal of International Commerce, Economics and Policy 8 (2): 1–27.

Clement, D. (2016) “Interview with David Autor.” Federal Reserve Bank of Minneapolis (September 7). Available at www.minneapolisfed.org/article/2016/interview-with-david-autor.

DeLong, J. B. (2017) “NAFTA and Other Trade Deals Have Not Gutted American Manufacturing—Period.” Vox (January 24).

Dubner, S. (2017) “Did China Eat America’s Jobs?” Freakonomics (January 25). Available at https://freakonomics.com/podcast/china-eat-americas-jobs.

Eriksson, K.; Russ, K.; Shambaugh, J. C. ; and Xu, M. F. (2019) “Trade Shocks and the Shifting Landscape of U.S. Manufacturing.” NBER Working Paper No. 25646 (March).

Fajgelbaum, P. D., and Khandelwal, A. K. (2014) “Measuring the Unequal Gains from Trade.” NBER Working Paper No. 20331 (July).

Feenstra, R.C.; Ma, H.; and Xu, Y. (2017) “US Exports and Employment.” NBER Working Paper No. 24056 (November).

Feenstra, R. C., and Sasahara, A. (2017) “The ‘China Shock’, Exports and U.S. Employment: A Global Input-Output Analysis.” NBER Working Paper No. 24022 (November).

Fort, T. C. ; Pierce, J. R.; and Schott, P. K. (2018) “New Perspectives on the Decline of U.S. Manufacturing Employment,” NBER Working Paper No. 24490 (April).

Freeman, C. (2019) Twitter Thread (January 15, 1:58 p.m.). Available at https://twitter.com/AsiaPac_Freeman/status/1085249972767997954.

Furceri, et al. (2019) “Macroeconomic Consequences of Tariffs.” International Monetary Fund Working Paper No. 19/9.

Galle, S.; Rodríguez-Clare, A.; and Yi, M. (2017) “Slicing the Pie: Quantifying the Aggregate and Distributional Effects of Trade.” NBER Working Paper No. 23737 (August).

Global Trade Alert (2020) “Independent Monitoring of Policies That Affect World Commerce.” Available at www.globaltradealert.org.

Gutiérrez, G., and Philippon, T. (2017) “Declining Competition and Investment in the U.S.” NBER Working Paper No. 23583 (July).

Hale, G.; Hobijn, B.; Nechio, F.; and Wilson, D. (2019) “How Much Do We Spend on Imports?” Federal Reserve Bank of San Francisco, Economic Letter (January 7).

Handley, K., and Limão, N. (2017) “Policy Uncertainty, Trade, and Welfare: Theory and Evidence for China and the United States.” American Economic Review 107 (9): 2731–83.

Hufbauer, G. C., and Lowry, S. (2012) “US Tire Tariffs: Saving Few Jobs at High Cost.” Policy Brief 12–9 (April). Washington: Peterson Institute for International Economics.

Jakubik, A., and Stolzenburg, V. (2018) “The ‘China Shock’ Revisited: Insights from Value Added Trade Flows.” World Trade Organization Staff Working Paper ERSD-2018–10 (October 26).

Jaravel, X., and Sager, E. (2018) “What Are the Price Effects of Trade? Evidence from the U.S. and Implications for Quantitative Trade Models.” U.S. Bureau of Labor Statistics Working Paper No. 506 (September).

Lardy, N. R. (2000) “PNTR for China.” Policy Brief No. 58 (May). Washington: Brookings Institution.

Lawrence, R. (2014) “Adjustment Challenges for U.S. Workers.” In C. F. Bergsten, G. C. Hufbauer, and S. Miner (eds.), Bridging the Pacific: Toward Free Trade and Investment between China and the United States. Washington: Peterson Institute for International Economics.

Lee, M.; Park, D.; and Saravia, A. (2017) “Trade Effects of U.S. Antidumping Actions Against China.” Asian Economic Journal 31 (1): 3–16.

Levinson, M. (2013) “‘Hollowing Out’ in U.S. Manufacturing: Analysis and Issues for Congress.” Washington: Congressional Research Service. Available at https://fas.org/sgp/crs/misc/R41712.pdf.

Levy, P. (2016) “Did China Trade Cost the United States 2.4 Million Jobs?” Foreign Policy (May 8).

________ (2018) “Was Letting China into the WTO a Mistake?” Foreign Affairs (April 2).

Lincicome, S. (2012) “Countervailing Calamity: How to Stop the Global Subsidies Race.” Cato Policy Analysis No. 710 (October 9).

________ (2016) “The Truth about Trade.” National Review (April 11).

________ (2017) “Doomed to Repeat It: The Long History of America’s Protectionist Failures.” Cato Policy Analysis No. 819 (August 22).

________ (2020) “Testing the ‘China Shock’: Was Normalizing Trade with China a Mistake?” Cato Policy Analysis No. 895 (July 8).

Morrison, W. M. (2018) “China–U.S. Trade Issues.” Congressional Research Service (July 30). Available at https://fas.org/sgp/crs/row/RL33536.pdf.

Nakatsuji, K. (2001) “Essence of Trade Negotiation: A Study on China’s Entry for WTO.” Available at www.ritsumei.ac.jp/acd/cg/ir/college/bulletin/vol14‑1/015–34_nakatsuji.pdf.

Pierce, J. R., and Schott, P. K. (2016) “The Surprisingly Swift Decline of U.S. Manufacturing Employment.” American Economic Review 106 (7): 1632–62.

Reynolds, A. (2016) “Did the U.S. Lose 2.4 Million Jobs from China Imports?” Cato at Liberty (September 15).

Schott, J., and Jung, E. (2019) “In U.S.-China Trade Disputes, the WTO Usually Sides with the United States.” Peterson Institute for International Economics (March 12).

Thomas, N. (2019) “Matters of Record: Relitigating Engagement with China.” Macro Polo (September 3).

United States Census Bureau (2020) “Top Trading Partners.” Available at www.census.gov/foreign-trade/statistics/highlights/toppartners.html.

U.S.–China Business Council (USCBC) (2019) “2019 State Export Report: Goods and Services Exports by U.S. States to China over the Past Decade.” Available at www.uschina.org/reports/2019-state-export-report.

Wang, Z.; Wei, S. J.; Yu, X.; and Zhu, K. (2018) “Re-Examining the Effects of Trading with China on Local Labor Markets: A Supply Chain Perspective.” NBER Working Paper No. 24886 (October).

White House (2001) “President [George W.] Bush Grants Permanent Normal Trade Relations Status to China.” Washington: Office of the Press Secretary (December 27). Available at https://georgewbush-whitehouse.archives.gov/news/releases/2001/12/20011227–2.html.

World Trade Organization (WTO) (2020) “Trade in Value-Added and Global Value Chains: Statistical Profiles,” Profile of the United States. Available at www.wto.org/english/res_e/statis_e/miwi_e/countryprofiles_e.htm.

Xu, Y.; Ma, H.; and Feenstra, R. C. (2019) “Magnification of the ‘China Shock’ through the U.S. Housing Market.” NBER Working Paper No. 26432 (November).

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.