The politically convenient media fascination with incomes of the top 1 percent has degenerated into a new obsession with the top one-tenth of one percent – the top 0.1 percent. As before, the blame game points to greedy corporate executives.

One affluent member of the Top One Percent club, Paul Krugman, has narrowed his sights to the even more affluent top 0.1 percent in his new book, End This Depression Now! He claims that, “Recent work by the economists Jon Bakija, Adam Cole and Bradley Heim gives us a good sense of who the top 0.1 percent are. The short answer is that they’re basically corporate executives or financial wheeler-dealers.”

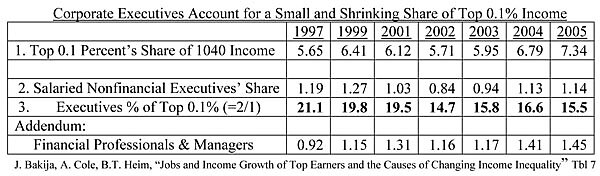

The phrase “corporate executives” clearly suggests CEOs and other top executives of publicly-traded corporations. Unfortunately, the paper Krugman refers to (“Jobs and Income Growth of Top Earners and the causes of Changing Income Inequality”) shows that corporate executives account for a small and declining share of the income reported by the top 0.1%.

This table, adapted from that paper, shows that corporate executives in public companies accounted for only 15.5% of the very highest incomes in 2005, down from 21.1% in 1997. If we include capital gains, corporate executives accounted for 16.8% of top 0.1 percent incomes in 2005, down from 23.9% in 1997.

Bakija, Cole and Heim come up with a bigger number by lumping corporate executives together with all “supervisors” and managers in any sort of nonfinancial business, including proprietorships and partnerships. But that hodge-podge is not what anyone understands as “corporate executives.” Moreover, the famously huge windfalls of hedge funds managers, Warren Buffet and other “wheeler dealers” (which the study lumps together with accountants, analysts and bankers) likewise has next to nothing to do with corporate executives.

One part of the study, however, is quite relevant. Despite excluding tax-sensitive capital gains and using gross income rather than taxable income, Bakija, Cole and Heim find an elasticity of about 0.72 for the top 0.1 percent “suggesting a high degree of responsiveness to incentives for income-earning efforts (or income reporting) among those with the highest incomes, and a correspondingly large deadweight loss from imposing highly progressive tax rates on these taxpayers.”

Krugman’s book asks “why should [top] incomes have skyrocketed beginning around 1980?” He doesn’t like my answer (calling me a “hired gun protecting the interest of the wealthy”), but my explanation is not much different from the elasticity estimates in this and many other studies cited in my recent Wall Street Journal article. My explanation is that top incomes reported on individual tax returns always rise whenever top tax rates on salaries, business income, dividends and capital gains come down. For example, the pay packages of corporate executives (which are now mainly tied to stocks and paid by stockholders) were tilted away from tax-exempt perks toward taxable stock options after tax rates came down. But that is an example of high elasticity rather than a separate issue.