In “A tide that lifts all yachts,” Washington Post columnist Harold Meyerson writes, “Occupy Wall Street is not known for the precision of its economic analysis, but new research on income distribution in the United States shows that the group’s sloganeering provides a stunningly accurate picture of the economy. In 2010, according to a study published this month by University of California economist Emmanuel Saez, 93 percent of income growth went to the wealthiest 1 percent of American households, while everyone else divvied up the 7 percent that was left over. Put another way: The most fundamental characteristic of the U.S. economy today is the divide between the 1 percent and the 99 percent.”

In reality, the sample of tax returns that Piketty and Saez use to estimate pretax top incomes tells us nothing about the incomes of the bottom 90–99 percent. A footnote to Figure A1B in the Piketty and Saez study says, “Our income definition is … before individual income taxes and employee payroll taxes, and income excludes all government social transfers such as Social Security retirement and disability benefits, government health care insurance (Medicare and Medicaid), unemployment insurance, welfare assistance programs, the earned income tax credit, etc. The importance of taxes and transfers has grown over time …” Their figures also exclude all tax-free employee compensation (notably, employer-paid health insurance), and all investment income and capital gains accruing inside tax-favored savings accounts for college and retirement. The result, as Brooking Institution economist Gary Burtless points out, is that the Piketty and Saez measure excluded 37 percent of personal income in 2008 [and 38 percent in 2010] − up from 24 percent in 1970.

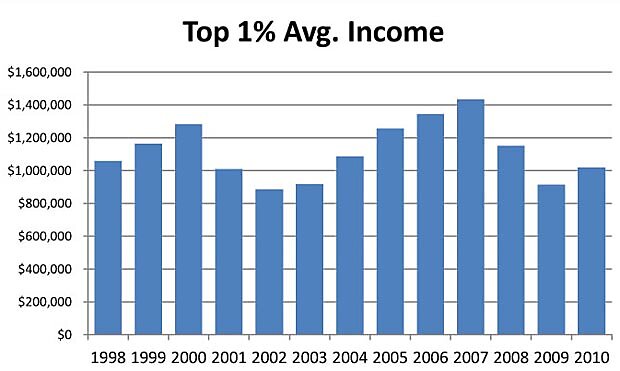

In 2010, average incomes of the top 1 percent were down 29 percent from 2007, according to Piketty and Saez. Does Occupy Wall Street envy that decline? The graph below shows that average incomes of the top 1 percent from rose and fell from 1998 to 2010, yet ended up lower in 2010 ($1,019,089) than in 1998 ($1,058,891).

Myerson writes, “As Saez points out, there has been “an explosion of top wages and salaries” since 1970. Does Saez ever look at his own data? If he had, he would see that the “explosion” (largely an artifact of the 1986 Tax Reform and the 1997–2000 boom in high tech stock options) stopped a dozen years ago. Measured in 2010 dollars, average salary, bonus and stock option of the top 1 percent were $494,593 in 2010 – down from $544,858 in 2007 and down from $558,986 in 2000.

Alan Krueger, chairman of President Obama’s Council of Economic Advisers, once provided “Another Look at Whether a Rising Tide Lifts All Boats.” The answer, of course, is an emphatic yes. Whenever the top 1 percent income share has gone down, poverty and unemployment rates went up, and vice-versa. That makes top 1 percent shares a paradoxical if not ridiculous measure of “inequality.”