It seemed like the big 2021 school choice party was finally winding to an end around August. 18 states had created 7 new programs and expanded 21. It had been quite a blowout, but no new guests were expected. Then, North Carolina showed up.

At the end of November, the Tar Heel State passed a new budget, signed by Democratic Gov. Roy Cooper, that greatly enhanced private school choice. It boosted the value of Opportunity Scholarships from $4,200 to $5,900 and pegged their size going forward to 90 percent of state per-pupil funding for public schools. It also raised the family income maximum from $73,00 to $85,000 and added a couple of new categories of children who automatically qualify. In addition, the state combined its Children with Disabilities Grant and Education Savings Account programs and increased the funding for those now-combined initiatives by $6 million and $9 million, respectively.

The beyond-fashionable lateness and size of North Carolina’s expansion were surprising. But not the most curious thing that has happened with choice in Carolina. That was Governor Cooper, long a staunch opponent of private school choice, signing a proclamation marking National School Choice Week, which he had never done before.

Importantly, National School Choice Week is not just about private school choice. It celebrates everything from homeschooling to intra-district public school choice. But when most people hear “School Choice Week,” they likely think about voucher programs and other private choice vehicles. Indeed, that appears to be why Rhode Island Gov. Dan McKee (D) may have tentatively approved a proclamation celebrating the week, then put the breaks on it.

“The governor has been on the record for years supporting public money going toward public schools which includes public charters, but he does not support public money going towards private school vouchers,” said a McKee spokesperson after a proclamation surfaced but was disclaimed as having received a premature electronic signature.

So what gives in North Carolina? Why does it appear the governor there may have learned to stop worrying and love school choice?

The short answer is that he did not embrace private school choice. As Geoff Coltrane, Cooper’s senior education adviser, wrote in response to a query from Sen. Deanna Ballard (R‑Watauga) about the governor’s apparent change of heart:

school choice is not just about public schools vs. non-public schools…In addition to public charter schools, many of our state’s public school districts offer families a variety of schools of choice, such as magnet schools and early college high schools…As you know from the Governor’s budget proposals, he opposes and will continue to oppose the expansion of the Opportunity Scholarship program.

If he is against private choice, and at least some people view supporting National School Choice Week as endorsing private choice, why didn’t he repudiate his proclamation like it appears Gov. McKee might have done?

The answer may be in another part of Coltrane’s letter: “The past two years have been challenging for many of our state’s residents, but especially for our children. Educators in all schools – both public and non-public – have responded to these unprecedented challenges with grace, flexibility, and determination.”

Quite possibly, Cooper is sticking with his proclamation, even if many see it as an endorsement of private choice, because circumstances necessitate it.

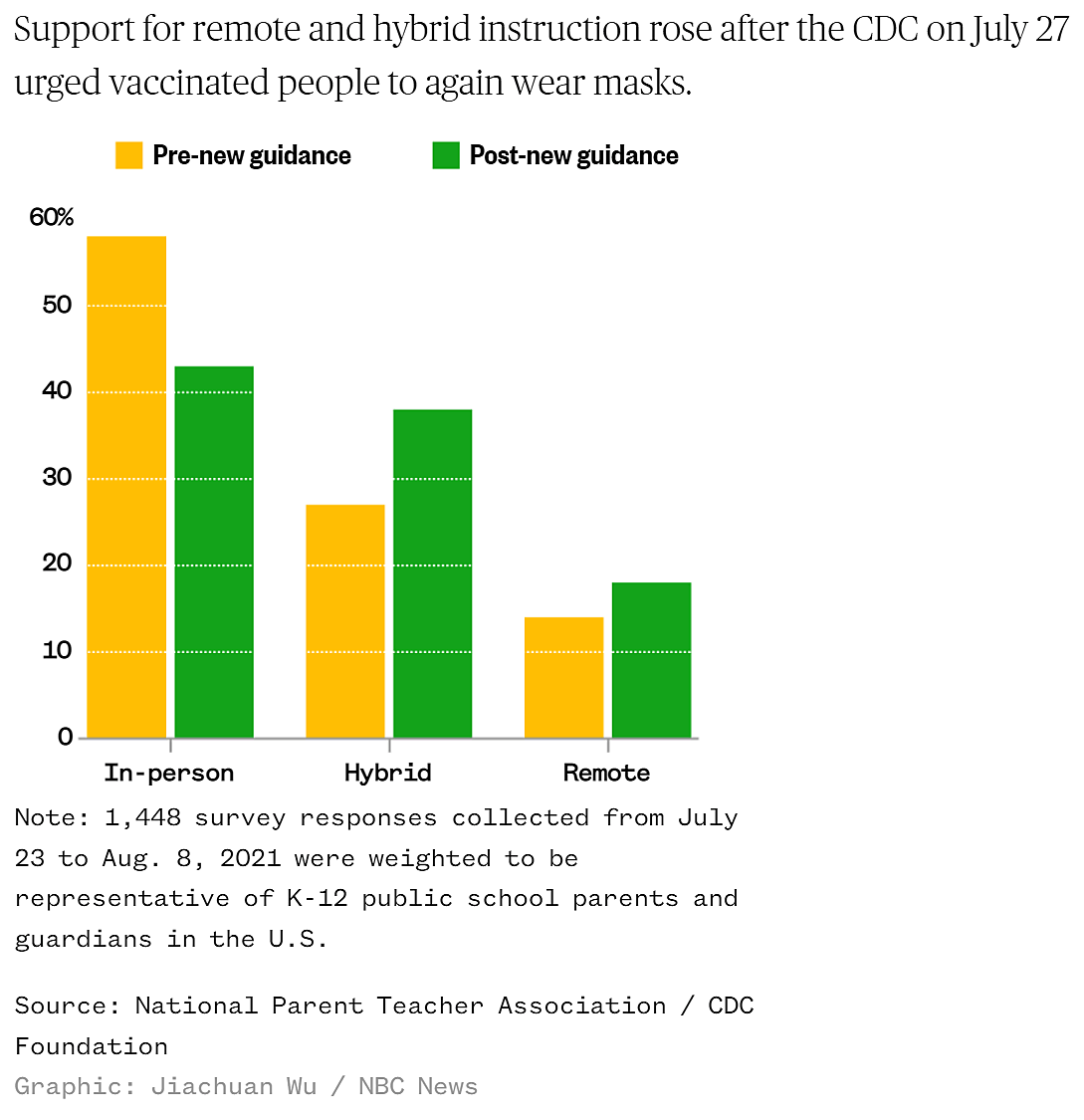

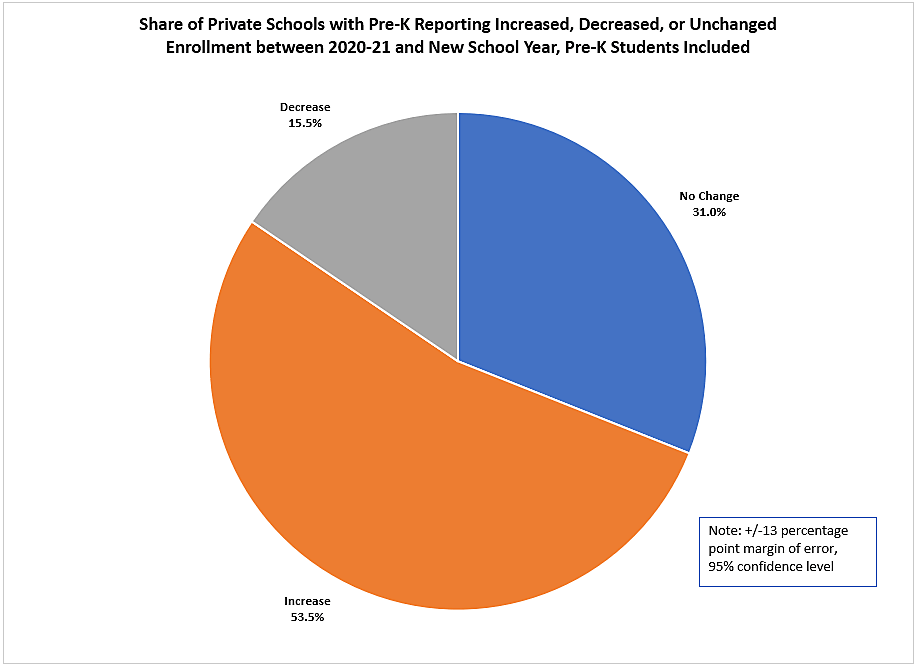

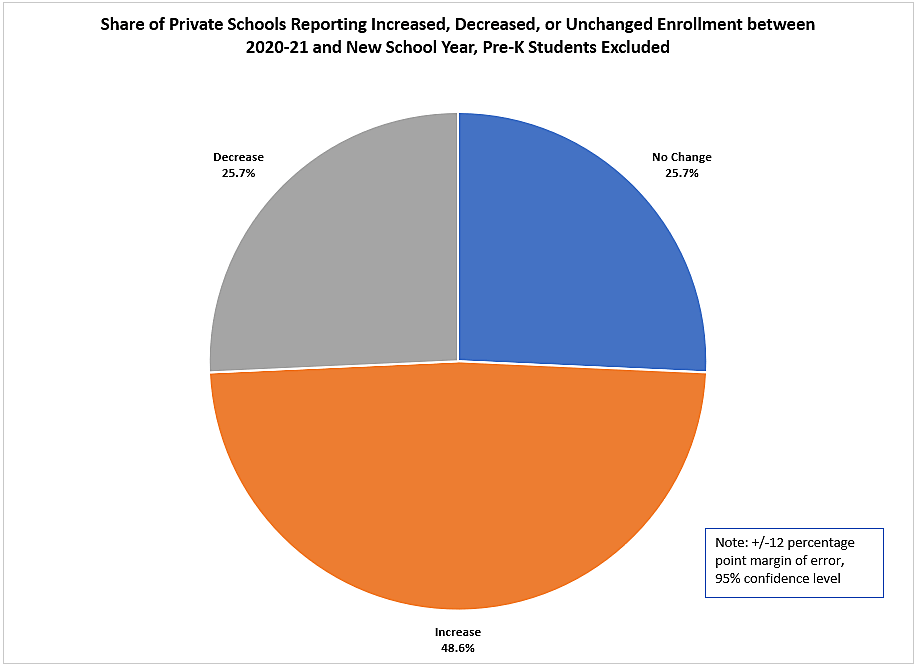

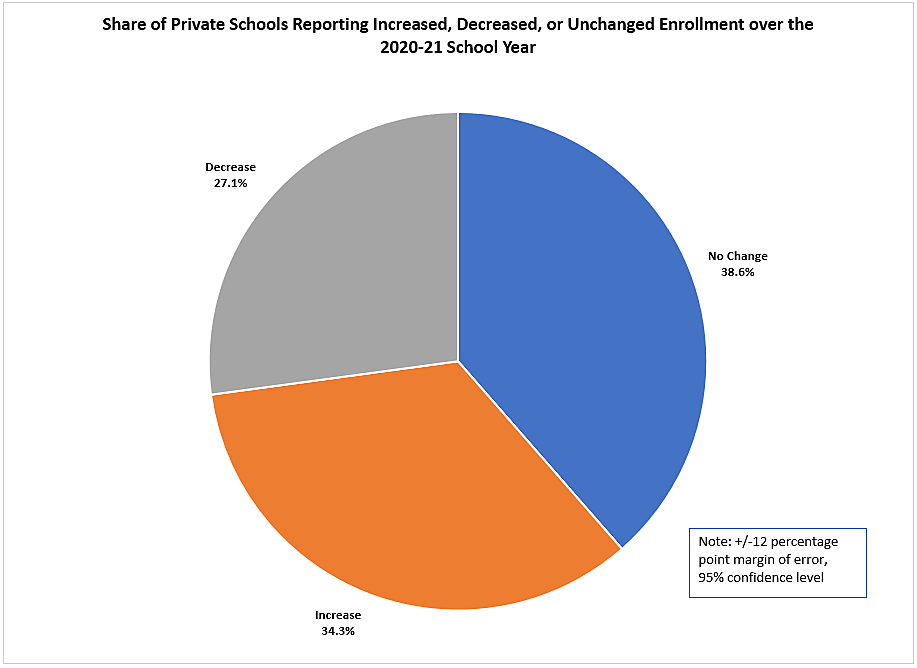

While all educators have been in tough spots under COVID-19, the evidence indicates that private schools have been more responsive to families’ needs than public schools, opening in-person faster and generating greater parent satisfaction. Perhaps this has opened Cooper’s eyes to the need for expansive choice, even if he does not endorse every choice mode. More cynically, unlike McKee in blue Rhode Island, Cooper is a Democratic governor in a pretty reliably red state. It might be too politically dangerous right now to seem cold to parent-empowering choice. And maybe North Carolina is just be evolving into a more choice-embracing place.

Maybe this is a misreading of the Old North State. North Carolinians can set this straight if it is. But whatever the reason, something curious is going on in North Carolina.