The US Department of Justice (DOJ) has charged Keonne Rodriguez and William Lonergan Hill with “conspiracy to commit money laundering and conspiracy to operate an unlicensed money-transmitting business.” Better known as the co-founders behind Samourai Wallet, Rodriguez and Hill are now facing upwards of 25 years in prison, according to the DOJ.

While there’s little defense for where Rodriguez and Hill appeared to have openly and deliberately marketed their services for criminal activity, the news still marks yet another example of the US government’s ever-growing intolerance for financial privacy.

Bitcoin and Privacy

Although I won’t go into the weeds here to explain how Bitcoin works from scratch, some context is likely helpful. One of the features that makes Bitcoin unique is that it operates on an open and decentralized blockchain—often referred to as a public blockchain. This feature is special because it allows anyone at any time to look to see what transactions are taking place and audit the system. Yet that also poses a problem for privacy.

Users are pseudonymous insofar as they are identified only by digital addresses, but those addresses can be linked to people with some clever sleuthing. An entire industry has arisen to do just that. This industry (including companies such as Chainalysis, TRM Labs, and Elliptic) looks at public blockchains and works to untangle transactions to narrow down and even directly identify the people behind them.

It’s here that Samourai Wallet comes in.

Samourai Wallet was designed to be a digital wallet with access to privacy-enhancing features. More specifically, it offered access to features referred to as “Whirlpool” and “Ricochet.” These features offered users the ability to either mix funds or create additional transactions to add a layer of privacy on an otherwise transparent blockchain. Yet in the eyes of the DOJ, these features are nothing more than tools for criminals to launder their money.

For others, however, these services are vitally important. As Anna Chekhovich, CFO for the Anti-Corruption Foundation and non-profit Bitcoin adoption lead at the Human Rights Foundation, told Bitcoin Magazine,

At the Anti-Corruption Foundation, we use mixers because we need to protect [the identity of] our donors. We’re responsible for the safety of our donors because we encourage them to support us financially, and for supporting us, they risk being imprisoned up to eight years. We have a huge responsibility to do everything we can [to] not to let that happen. We also need mixers to protect [the identity] of the recipients of our funds.

The Charges

With that said, the news of the charges broke on April 24 when the DOJ announced that Samourai Wallet allegedly had “executed over $2 billion in unlawful transactions and facilitated more than $100 million in money laundering transactions.”

To be clear, however, the $2 billion is later clarified as “unlawful” because Samourai Wallet was allegedly operating without a money transmitter license, not because it was linked to serious crimes. Yet, even then, it’s worth taking the claim with a grain of salt. What the court has to say is still to be seen. But, as Coin Center’s Peter Van Valkenburgh has explained at length, Samourai Wallet could very well have been operating within the bounds of guidance previously issued by the Financial Crimes Enforcement Network (FinCEN) in 2013 and again in 2019.

So, what’s perhaps more accurate to say is that 95 percent of the $2 billion in total activity was likely made by normal people seeking to simply preserve their privacy.

A Chilling Moment for Cryptocurrency, Privacy, and Innovation

Beyond those directly affected, the news of the charges marked a chilling moment for cryptocurrency defenders, human rights activists, privacy defenders, and software developers. Wasabi Wallet, for instance, announced it would block Americans from using its service, and Phoenix Wallet is set to be removed from US app stores on May 3 despite no publicly known issues. Others may likely follow.

When commenting on the news of Phoenix Wallet’s departure from US markets, investment strategist Lyn Alden wrote, “It’s increasingly the case that a lot of good bitcoin apps work in dozens of other countries but not in the United States. The US is kind of slowly firewalling itself from the rest of the world in terms of financial innovation.”

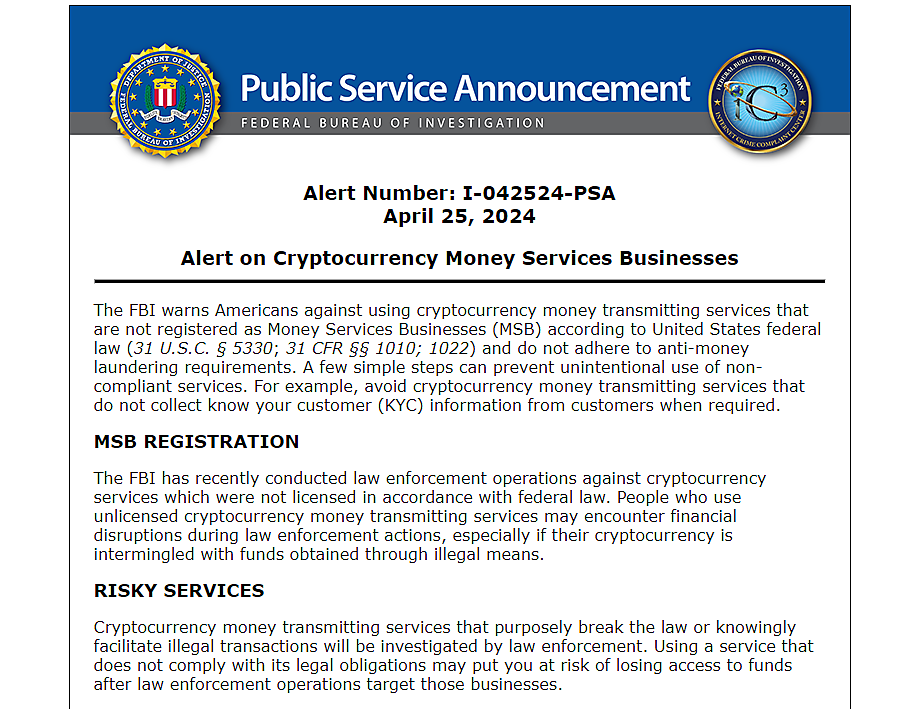

While Alden’s take may be grim, it seems to be correct. For instance, the day after the DOJ announced its charges, the FBI specifically cautioned Americans from using services like Samourai Wallet in a public service announcement (pictured below). The announcement effectively told Americans not to do business with others unless those businesses collect your identifying information.

In other words, in an age of increasingly sophisticated fraud and cyber risks, the FBI said not to do business with anyone unless they collect your name, date of birth, address, and social security number.

To be clear, this information doesn’t just sit idly by in a database after it is collected. On the contrary, businesses are then required to report much of it to the government. In a single year, US financial institutions are required to report Americans tens of millions of times under the Bank Secrecy Act.

Given this nearly “all access pass” to our financial information, it’s easy to understand why law enforcement might find it jarring to learn someone is providing any semblance of an alternative. Yet, at the same time, it should be as easy to understand why Americans want an alternative when they learn how sweeping the financial surveillance status quo is.

If Congress truly cares about the Constitution, it should step in and reform the sweeping surveillance that is now the norm. Americans would be much less likely to seek out privacy tools in the first place if companies were not required to collect all of their information just to open an account.

(As the DOJ noted in its press release, “The charges contained in the Indictment are merely accusations and the defendants are presumed innocent unless and until proven guilty.”)