The U.S. oil industry has certainly seen better days. Surging production by Russia and Saudi Arabia along with a sharp drop in demand due to the COVID-19 pandemic have pushed global oil benchmark prices to nearly $20 per barrel. The last time oil prices were that low Bill Clinton was president. Tomorrow the heads of several U.S. oil producers will meet with President Trump to make their case for some type of relief.

One of the measures reportedly under consideration is a temporary waiver of the Jones Act. It would be an excellent move. Such a waiver would cost taxpayers nothing while bolstering the oil sector’s flagging fortunes. It would also help realize Trump’s stated goals of placing America first, confronting the DC swamp, and deregulating an overburdened economy. If a fivefer is such a thing, this is it.

Passed in 1920, the Jones Act restricts the waterborne transportation of goods from one U.S. point to another to vessels that are U.S.-flagged, U.S.-built and at least 75 percent U.S.-owned and crewed. U.S.-built ships, however, are up to five times more expensive than those constructed abroad while the operating costs of U.S. ships are significantly higher than those under foreign flags. There also aren’t many of them. Of the tens of thousands of ships in the world, a mere 99 comply with the Jones Act’s restrictions. This combination of high costs and limited numbers makes for extremely high shipping rates.

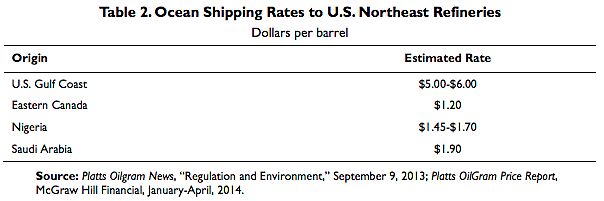

Perhaps no one can better attest to this than U.S. energy companies. Jones Act shipping rates are so high that shipping a barrel of oil from Alaska to the Gulf Coast has been shown to cost three times more than shipping the same oil on a foreign-flag ship to the U.S. Virgin Islands (which are exempt from the law) despite the latter voyage taking twice as long. Jones Act-compliant ships are so expensive that there are documented examples of oil being shipped to East Coast refineries from Saudi Arabia for three times cheaper than sending it from the Gulf Coast.

As a result, Americans buy more Saudi oil and less U.S. oil, which must be instead sold to more distant customers. Last year California refineries even bought oil from as far away as Nigeria instead of Louisiana largely due to transportation costs. This is costly, inefficient, and hurts the bottom line of U.S. oil producers.

Even those who profit from the Jones Act admit to its high costs and distortionary effects. “Jones Act is more expensive. Everybody knows that,” said the CEO of Overseas Shipholding Group, which owns a number of Jones Act tankers, in 2017. “If there was not a Jones Act, then there probably would be more movements of crude oil from Texas to Philadelphia.”

If President Trump wants to place a needed shot in the arm of U.S. oil producers, a Jones Act waiver would be just the ticket. But to issue such a waiver the president would have to show that it is in the interest of national defense. Under U.S. law waivers on purely economic grounds are not allowed.

Fortunately, this should not be much of an obstacle. As the Wall Street Journal reported last month, at least one motive behind Russia’s decision to ramp up oil production is to harm U.S. shale oil producers. That would make this a geopolitical play by Moscow aimed at a vital U.S. industry. Reduced dependence on Saudi crude would also have obvious national security benefits. One doesn’t have to squint too hard to see the rationale for issuing a Jones Act waiver.

Unfortunately, while the logic for such a waiver might be impeccable, it also seems improbable. After all, we’ve been here before. Last spring President Trump was said to be leaning in favor of granting a Jones Act waiver that would have allowed New England and Puerto Rico to bring in shipments of U.S. liquefied natural gas using foreign-flag ships (no ships capable of transporting bulk LNG exist in the small Jones Act fleet). Once word got out though, Jones Act supporters—among Washington’s most powerful special interests—who benefit from the law’s high costs and limited competition dispatched several senators to the White House to pressure the president against such a move. Trump folded, and the waiver was never issued.

But with the nation’s economy reeling, perhaps common sense will finally prevail.