Monetarism is often misunderstood, overlooked, forgotten, or even derided. Yet its basic logic, resting on the quantity theory of money, is evident and remains important in a world of pure fiat monies.

Most major central banks have abandoned monetary targeting in favor of setting interest rates to achieve long-run price stability and full employment. China is an exception. Since 1998, the People’s Bank of China (PBC) has used money growth targets to guide monetary policy aimed at maintaining stable nominal income growth and preventing excess inflation (see Figure 1).

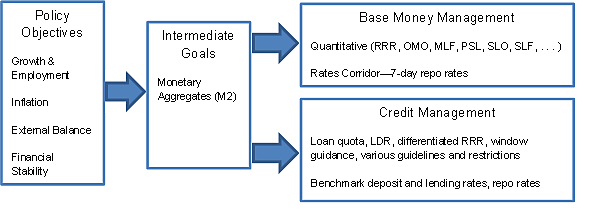

Figure 1: PBC Monetary Framework[1]

That said, the PBC’s use of monetary targeting is embedded within China’s centrally planned and largely nationalized financial system. The PBC is subject to oversight by the State Council; the financial system is dominated by state-owned banks; capital markets are highly regulated; and interest rates and exchange rates are distorted. Just as the Chinese government refers to its unique mix of markets, statism, and communist ideology as “Socialism with Chinese Characteristics,” we can call the PBC’s monetary targeting “monetarism with Chinese characteristics.”

Use of Monetary Targets in China

UBS economist Tao Wang and her team describe the PBC’s use of monetary targets:

Unlike some developed central banks that directly target certain policy interest rates or inflation, the PBC has targeted broad monetary aggregates such as M2 since 1998 to achieve its key macroeconomic objectives. The M2 growth target is usually set by adding together the GDP growth and CPI inflation targets plus a few percentage points for “financial deepening.” Although the PBC has tried to increase the use of price-based policy instruments, to date it still relies mainly on managing the quantity of base money supply and directly controlling credit growth to help achieve its desired broad money growth [Wang et al. 2017: 2].

The PBC is not an independent central bank. It is governed by, and reports to, the State Council. Policymakers set targets for the growth of monetary aggregates based on plans for CPI inflation and real GDP growth—the sum of which is equal to the growth of nominal income. The simple quantity theory of money, which lies behind monetarist logic, specifies that to achieve nominal income growth of x percent per year, the quantity of money should grow at a similar rate, with some adjustment made for changes in the income velocity of money:

(1) ΔM/M = ΔP/P + Δy/y – ΔV/V.

The PBC does not directly control the money supply, which can be expressed as

(2) M = mB,

where m is the money multiplier and B is base money (i.e., currency held by the public plus bank reserves).

To achieve its target for money growth, the PBC relies on controlling the monetary base and uses various instruments to regulate the flow of credit (see Figure 1).[2] The state-run banking system in China means that newly created base money can be multiplied into a much larger stock of bank money (Figure 2). When state-owned commercial banks have excess reserves, they lend them out to meet the credit plans handed down to them, creating a multiple expansion of demand deposits. The increase in M will then flow into the economy, first impacting output and employment, and later the price level.

Figure 2. The M1 Money Multiplier in China Is Working

Adherence to a monetary rule with Chinese characteristics since 1998 prevented nominal GDP growth from dipping below 10 percent from 2000–13, even during the 2008 global financial crisis (Figure 3).[3] However, with the slowdown in real GDP growth during the last several years, NGDP growth has slowed as well.

Figure 3. Real and Nominal GDP Growth, China

Financial Repression in China

On the surface, it may seem that PBC has been reasonably successful in using monetary targeting to maintain steady nominal income growth and prevent excessive inflation. But any assessment ought to consider that Chinese monetary policy is implemented in the context of China’s illiberal and inefficient financial system.

The Chinese financial system is characterized by financial repression—in the form of low or negative real interest rates on deposits at state-owned commercial banks, capital controls, and credit rationing. State-owned banks favor lending to state-owned enterprises (SOEs), rather than more efficient private enterprises, resulting in a misallocation of capital. Deposit rates are purposefully kept below lending rates to keep state-owned banks profitable and generate tax revenue. Inflation can turn real deposit rates negative, adversely affecting savers. Finally, below-market lending rates at state-owned banks create an excess demand for loanable funds and result in the use of quotas to ration credit.

China has allowed more flexibility in setting interest rates but still uses benchmark rates to maintain a positive net interest margin at state-owned banks. Private enterprises that find it difficult to obtain low-interest loans in the state sector move to the shadow banking system where they must pay a much higher interest rate. The lack of investment alternatives, and strict control of capital outflows, has resulted in more than 50 percent of national income being saved. Financial deepening and liberalization have reduced the scope of financial repression, but the financial sector is still under strong state control.

While it is true that China has intervened to lower the foreign exchange value of the yuan, more recently the PBC has tried to stem capital outflows by defending the yuan against the U.S. dollar, and in so doing is using up scarce foreign exchange reserves. That is, the PBC is propping up the yuan-dollar rate by buying yuan in the foreign exchange market and selling dollars. To offset the decrease in base money—and prevent deflation—the PBC must sterilize the foreign exchange intervention by buying securities (central bank bills, etc.) from state-owned banks, adding reserves to the banking system. But this is a tricky business because the larger the capital outflows, which put downward pressure on the yuan, the higher the probability of further downward pressure on the yuan-dollar exchange rate. This reality makes it increasingly difficult to defend the peg and manage the money supply.

Monetarism with Chinese characteristics— in which the PBC targets M2 in line with planned NGDP growth— is therefore compromised by inconsistent, competing policy goals (see “Policy Objectives” in Figure 1), and hindered by heavy state intervention in capital markets. The dominance of state-owned banks in China’s financial system, which lend to SOEs and take their marching orders from the PBC under the visible hand of the State Council, means constant fine-tuning of monetary and credit policy.

Lessons

In a fiat money world, central banks need an anchor in the form of a monetary rule. The quantity theory of money predicts a close relationship between money growth and NGDP growth over the longer-run. By targeting monetary aggregates since 1998, China has helped prevent severe inflation and recession. Nevertheless, the lack of PBC independence, the existence of multiple objectives for monetary policy, and financial repression weaken the implementation of monetarism in the form of either a Friedman-style constant money growth rule or a McCallum rule targeting NGDP.

The Fed and other central banks could learn from China’s experience with money supply targeting while recognizing the dangers of credit allocation. China pays interest on both required and excess reserves, but the rate on excess reserves is far below lending rates.[4] Unlike the United States, the money multiplier has not collapsed in China: increases in base money have increased the money supply and nominal income.

If the Fed adopted a simple monetary rule, abolished interest on excess reserves, reduced the size of its balance sheet, ended credit allocation, and lessened onerous macro-prudential regulation, there would be a much higher probability that the money multiplier would return to normal and another financial crisis avoided.

___________________________________________

This blogpost is drawn from a recent Cato Institute working paper, James A. Dorn, “Monetarism with Chinese Characteristics,” [Cato Institute Working Paper No. 42, February 14, 2017]. Please see this paper for more detail on Chinese monetary targeting and more thorough recommendations for American and Chinese policymakers.

[1] Notes: RRR is required reserve ratio; OMO is open market operations; MLF is medium-term lending facility; PSL is pledged supplementary lending; SLO is short-term liquidity operations; SLF is standing lending facility; LDR is the loan-to-deposit ratio. Source: Wang et al. (2017: 2).

[2] Burdekin and Siklos (2008a: 84–85) argue that interest-rate controls preclude the PBC from targeting interest rates. Thus, a better fit for China is to target monetary aggregates and use a McCallum-type monetary rule. See McCallum (1988).

[3] I chose 10 percent NGDP growth as a reasonable target based on planned real output growth of 7 percent per year and inflation of 3 percent per year.

[4] The PBC pays 1.62 percent on required reserves and 0.72 percent on excess reserves, which is substantially less than the prime lending rate of 4.35 percent.