Poll: Only 16% of Americans Support the Government Issuing a Central Bank Digital Currency

74% Would Oppose a CBDC if the Government Could Control What People Buy

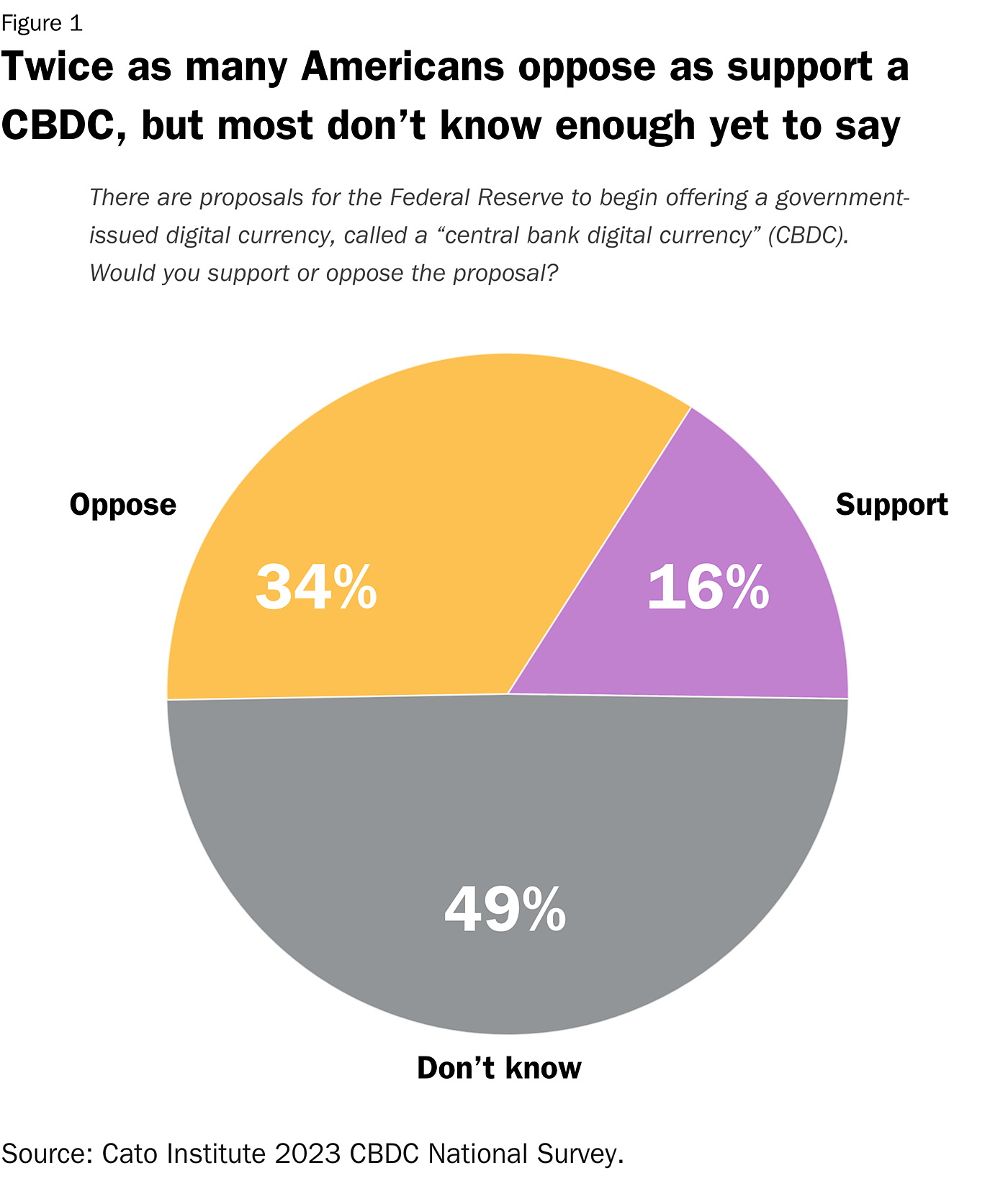

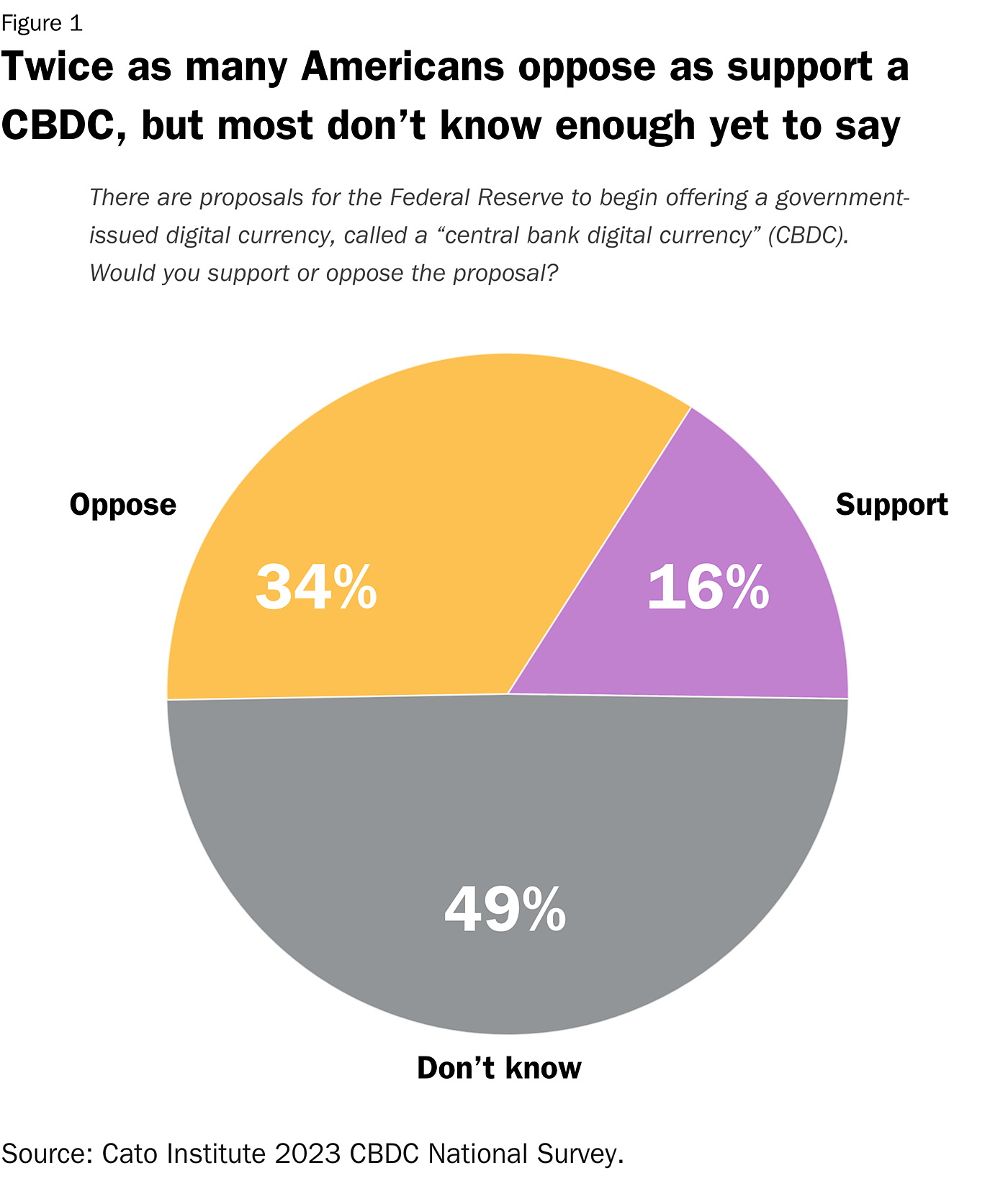

Countries around the world are exploring the possibility of adopting central bank digital currencies (CBDCs), which are digital national currencies. The Federal Reserve, the United States’ central bank, is also considering whether the United States should follow suit. The Cato Institute 2023 CBDC National Survey finds that few Americans—only 16%—support the adoption of a CBDC.

Americans Are Skeptical of CBDCs

While Americans regularly use digital dollars via credit cards, debit cards, and other digital platforms to purchase things, those dollars are a liability of the private commercial bank (e.g., Bank of America or Chase Bank) that issued them. However, a CBDC would be a liability of the government’s central bank, or the Federal Reserve. Thus, a CBDC would create a direct link between citizens and the government’s central bank.

Related Study

Central Bank Digital Currency: Assessing the Risks and Dispelling the Myths

There is no reason for the federal government to issue a CBDC when the costs are so high and the benefits are so low. Congress should ensure that the federal government does not issue a CBDC.

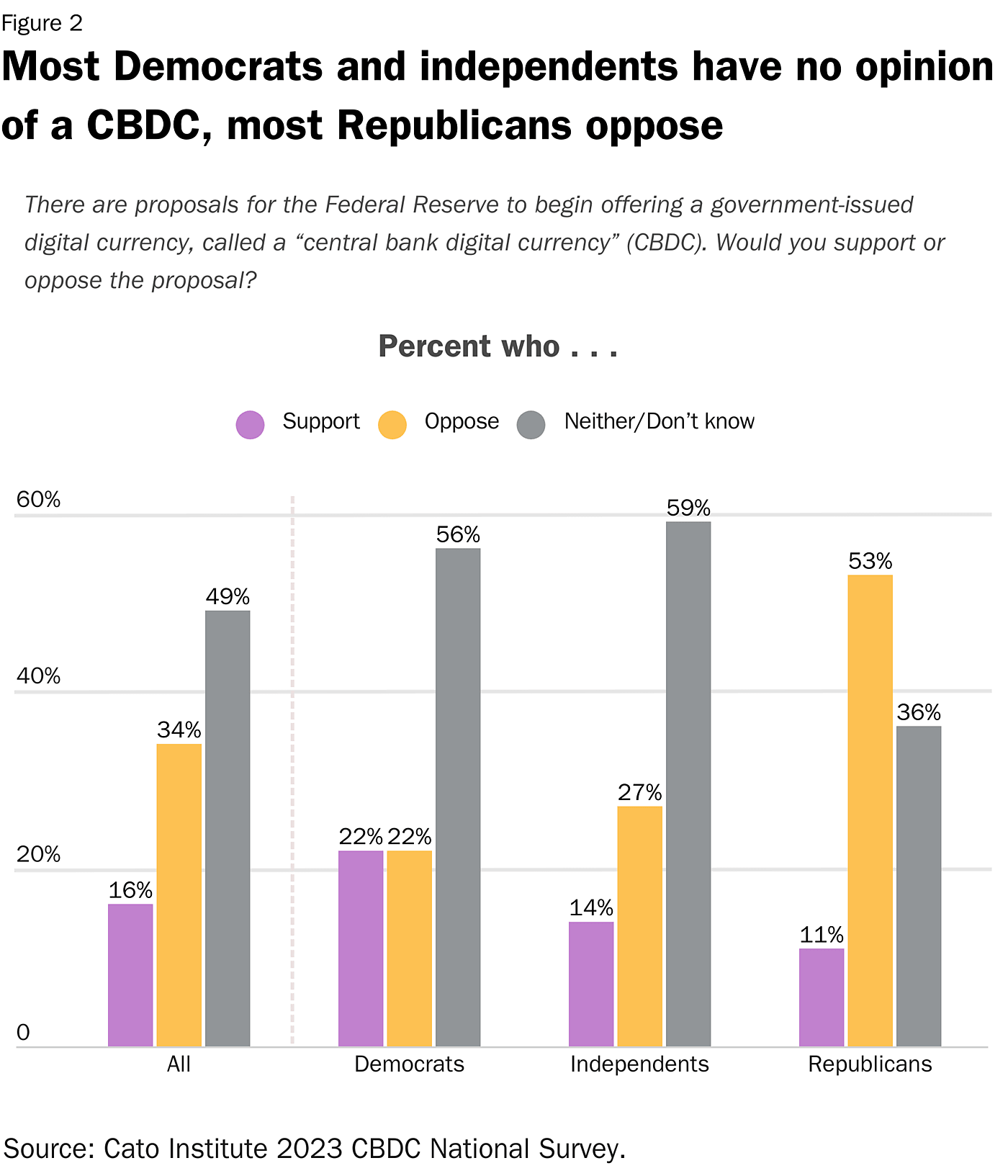

Twice as many Americans oppose (34%) the Federal Reserve offering a central bank digital currency as favor it (16%), the survey found. Nevertheless, the plurality of Americans (49%) have not formed an opinion. This likely stems from the fact that only 28% of Americans are familiar with CBDCs and 72% are not.

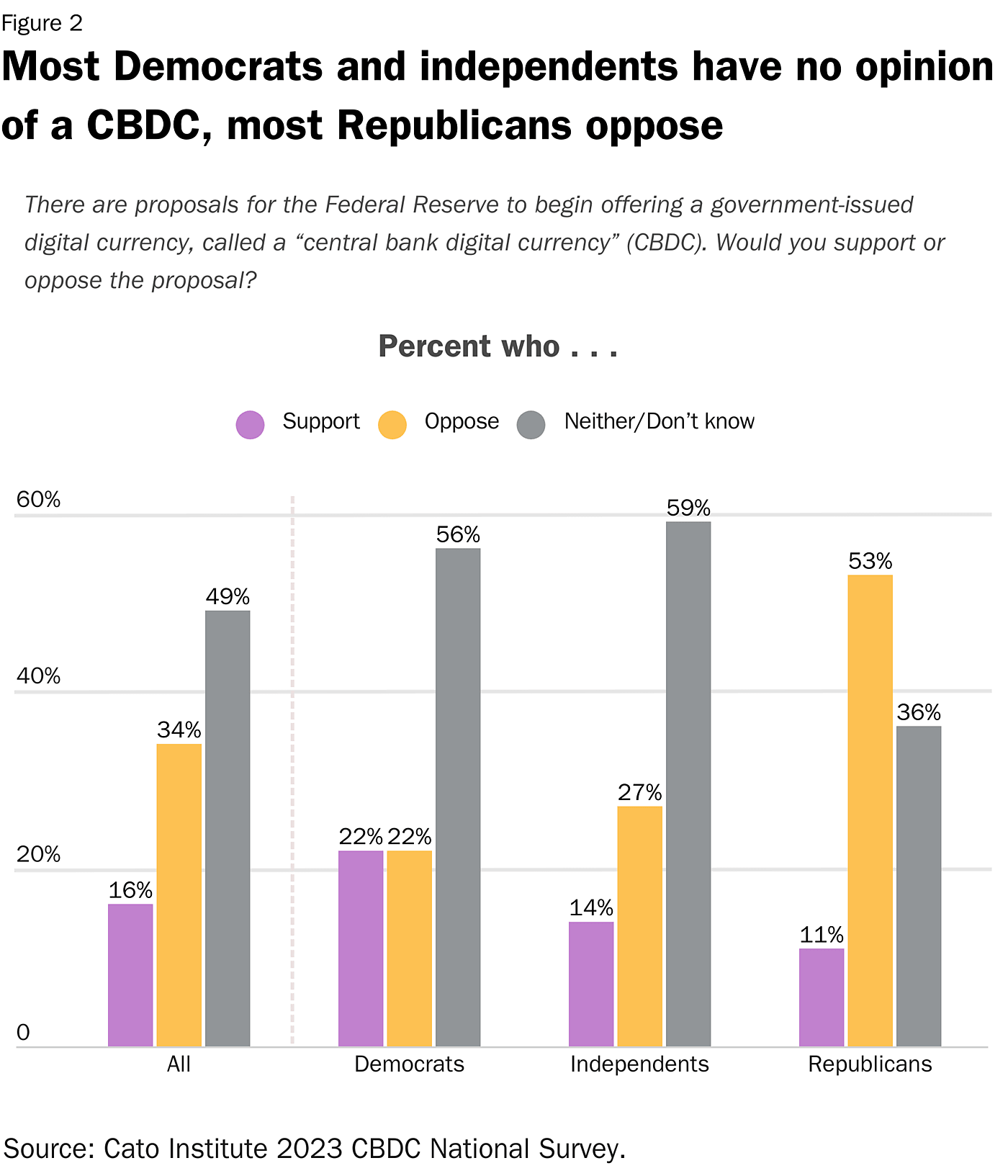

Republicans Oppose a CBDC; Democrats Approach with Caution

While strong majorities of both Democrats and Republicans are unfamiliar with CBDCs, Republicans are slightly more familiar (34%) than Democrats (25%) and independents (25%). However, Democrats are about twice as inclined (22%) to support adopting a CBDC than are Republicans (11%). Interestingly, a majority (53%) of Republicans oppose a CBDC, while most Democrats (56%) don’t have an opinion and 22% are opposed. However, once benefits and risks are considered, both Democrats and Republicans are wary of a CBDC.

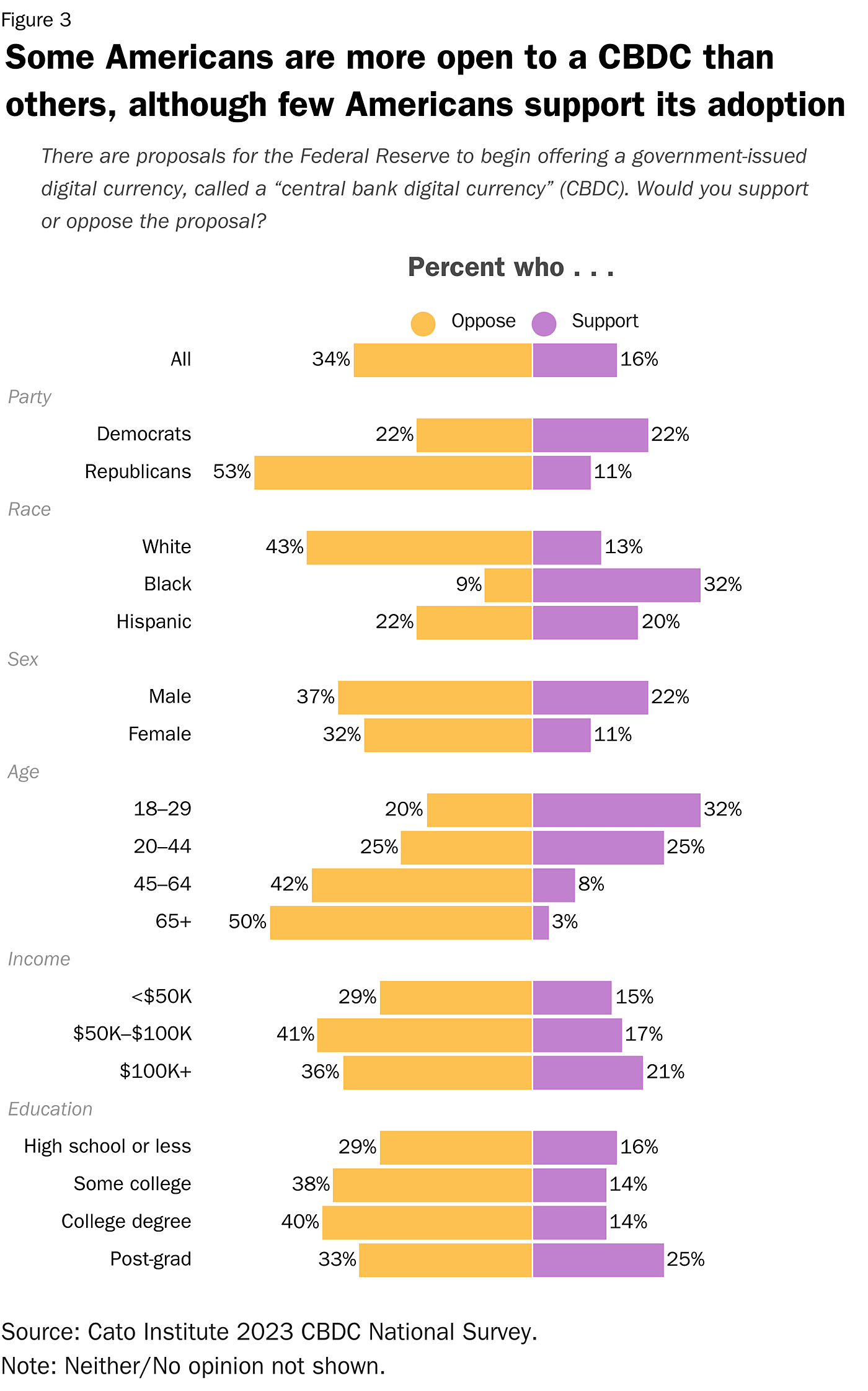

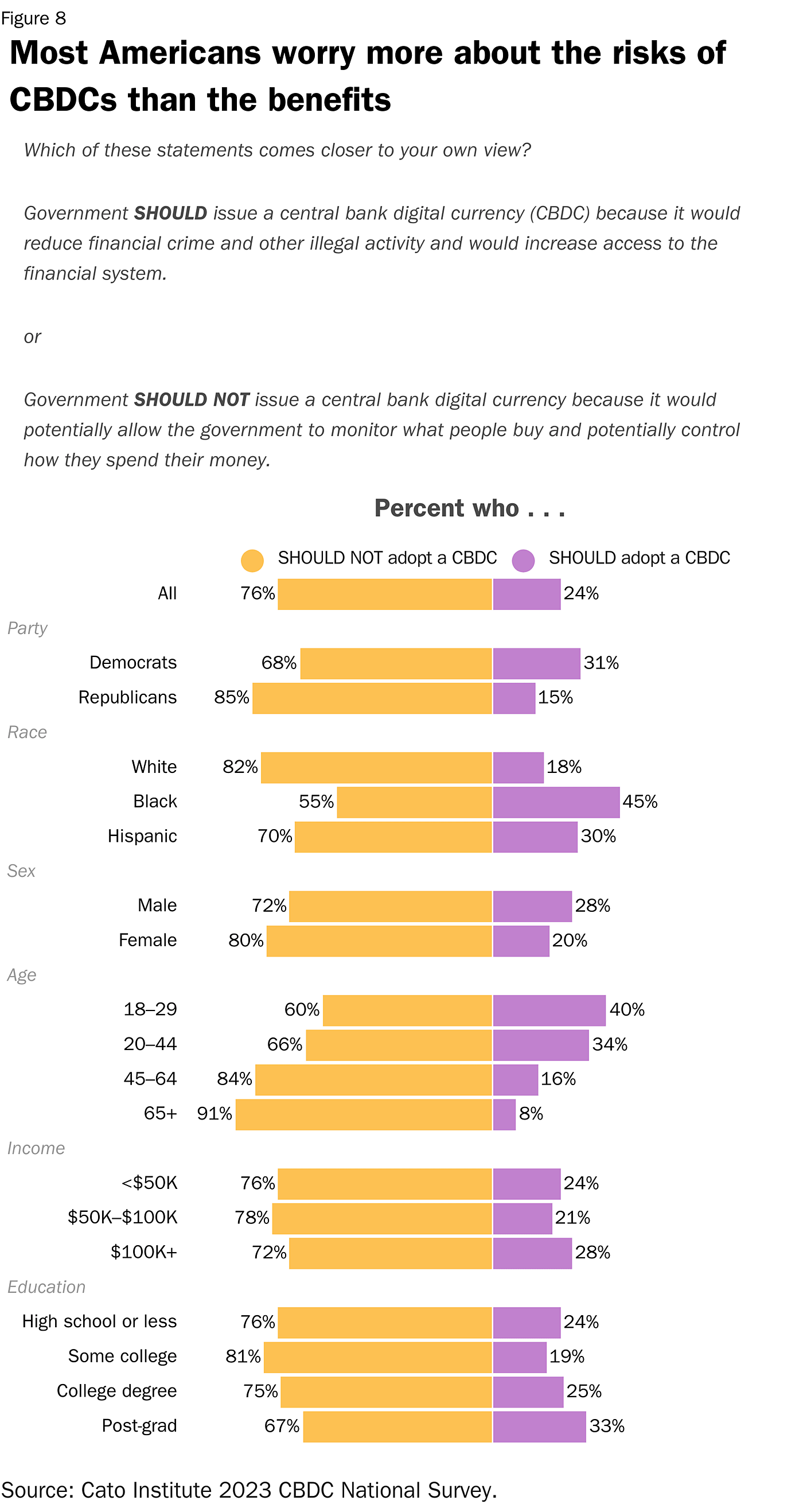

Men are about twice as likely (22%) as women (11%) to support a CBDC. Black Americans are nearly three times as likely (32%) as white Americans (13%) to support a CBDC and are more likely than Hispanic Americans (20%) to support one. Young Americans are about 10 times more supportive of a CBDC than seniors. Nearly a third (32%) of people under age 30 support a CBDC compared to 25% of 30–44-year-olds, 8% of 45–64-year-olds, and 3% of Americans over 65. While about half of all age groups don’t have enough information to support or oppose the United States adopting a CBDC, about half of Americans over age 55 oppose it.

Although CBDCs are advertised as enhancing financial inclusion in the economy, lower income groups do not support a CBDC more than higher income groups. Among those earning less than $20,000 a year, 19% support a CBDC, and among those earning more than $100,000 a year, 21% support one.

CBDCs and Government

68% of Americans Would Oppose a CBDC If the Government Could Monitor What People Buy

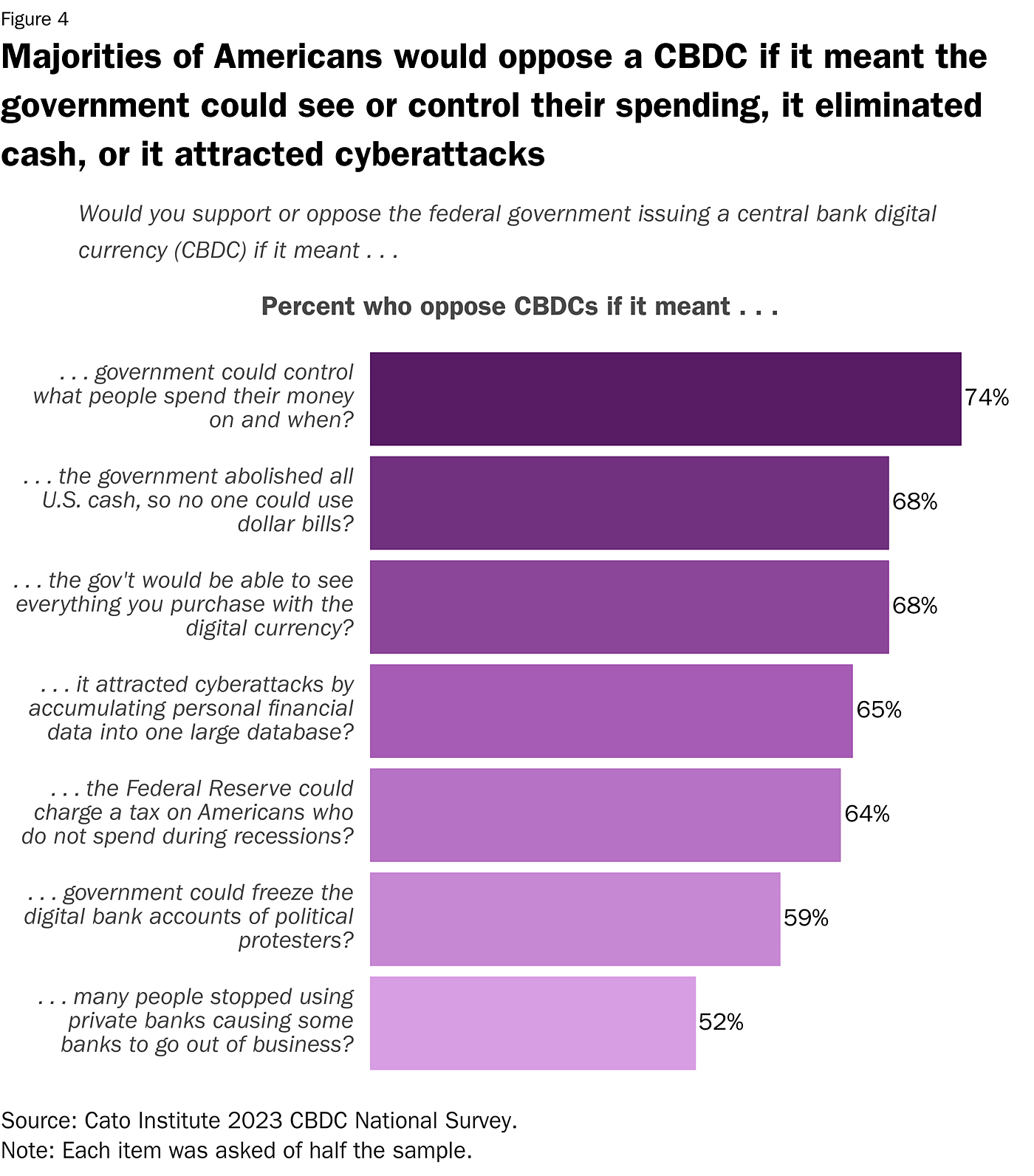

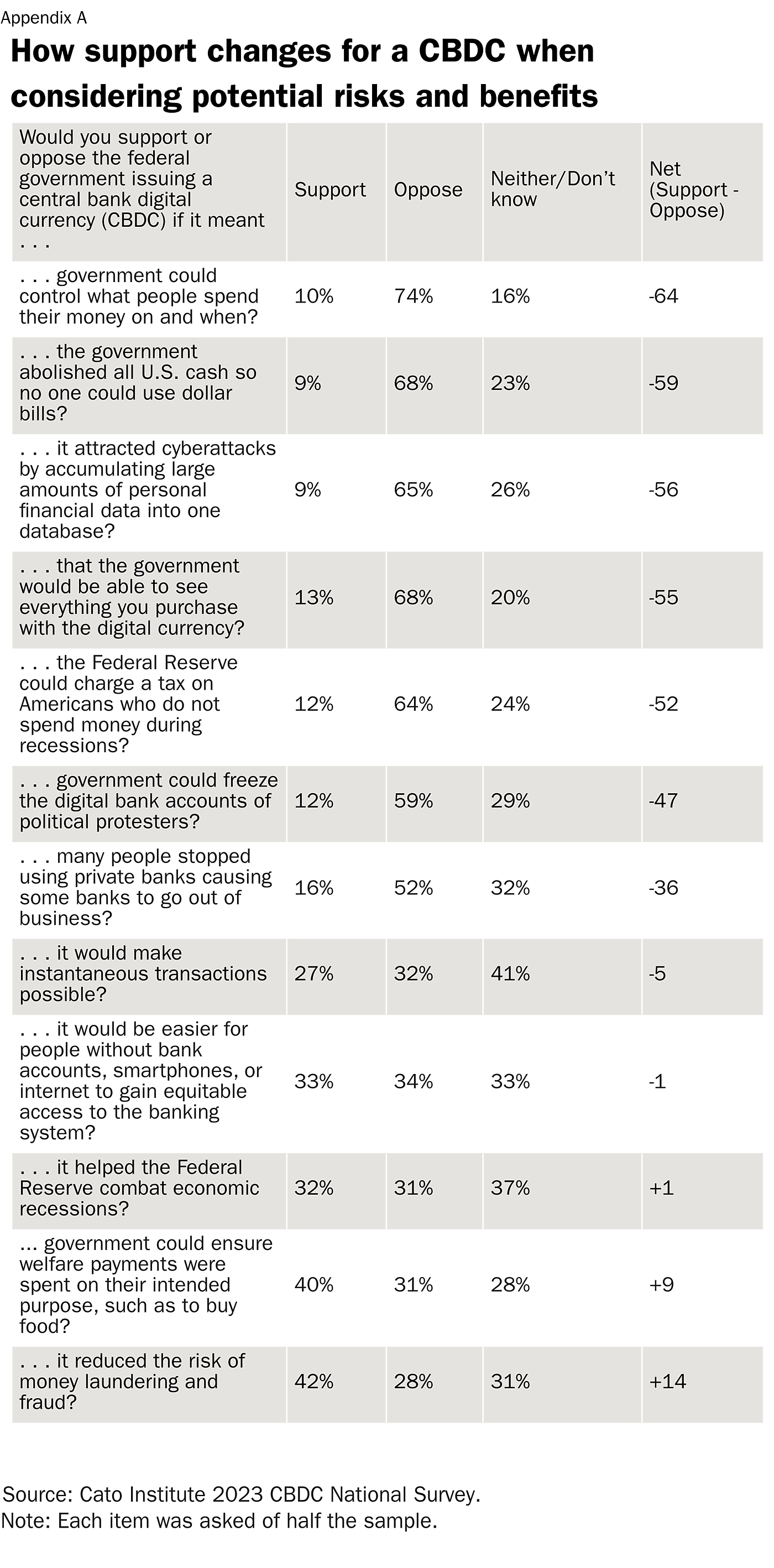

The survey investigated how Americans navigate potential costs and benefits associated with the United States adopting a central bank digital currency. Overwhelming majorities would oppose the adoption of a CBDC if it meant that the government could control what people spend their money on (74%), that the government could monitor their spending (68%), that a CBDC would abolish all U.S. cash (68%), that a CBDC would attract cyberattacks (65%), that the government could charge a tax on those who don’t spend money during recessions (64%), or that the government could freeze the digital bank accounts of political protesters (59%). Americans were marginally opposed (52%) if a CBDC could cause some people to stop using private banks, resulting in some banks going out of business.

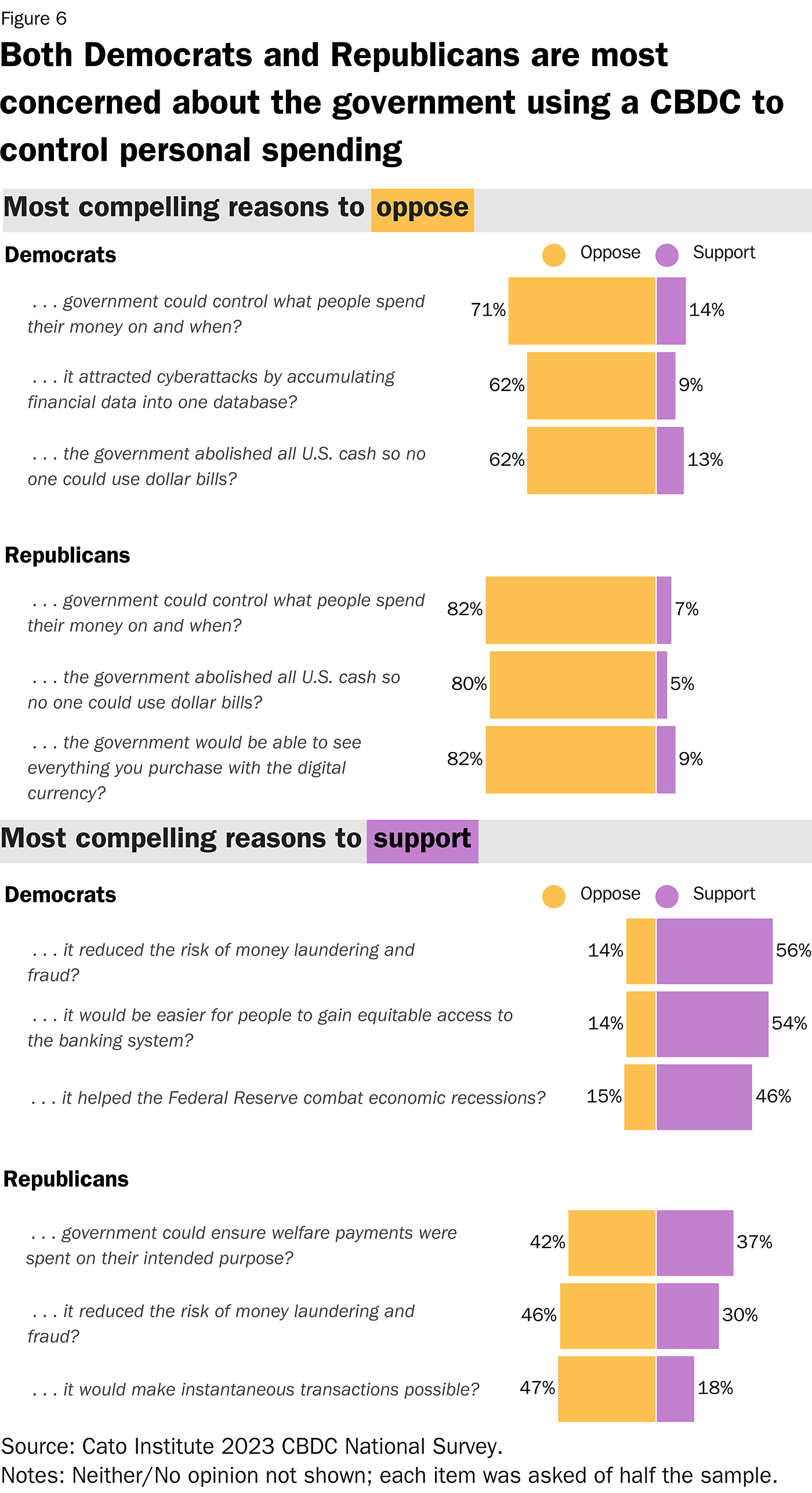

Both Democrats and Republicans Fear Government Turning Off Their Money

Strong majorities of Democrats (71%) and Republicans (82%) would oppose a CBDC if the government could control what people spend their money on and when. Majorities of Democrats (61%) and Republicans (82%) would also oppose a CBDC if the government could see what people buy with the digital currency. Notably, however, Democrats make a stronger distinction between the government monitoring what people buy (61% opposed) and the government having the ability to control it (71% opposed).

Other top concerns for Democrats include if a CBDC led to the elimination of cash or attracted cyberattacks. Nearly two‐thirds of Democrats would oppose a CBDC if it meant abolishing cash (62%) or if it attracted cyberattacks by accumulating large amounts of data in one database (62%).

Republicans’ most cited concerns include the government controlling people’s spending (82%), monitoring people’s spending (82%), or abolishing cash (80%). Nevertheless, they were more likely than Democrats to express concern about cyberattacks (75% versus 62%) and abolishing cash (80% versus 62%) even though those concerns were not in their top three.

Notably, Democrats are far less concerned than Republicans of a CBDC causing private banks to go out of business. Only 40% of Democrats would oppose a CBDC in this case, compared to 74% of Republicans—a 34 percentage point difference.

CBDCs’ Most Broadly Appealing Feature Is Reducing Financial Crime

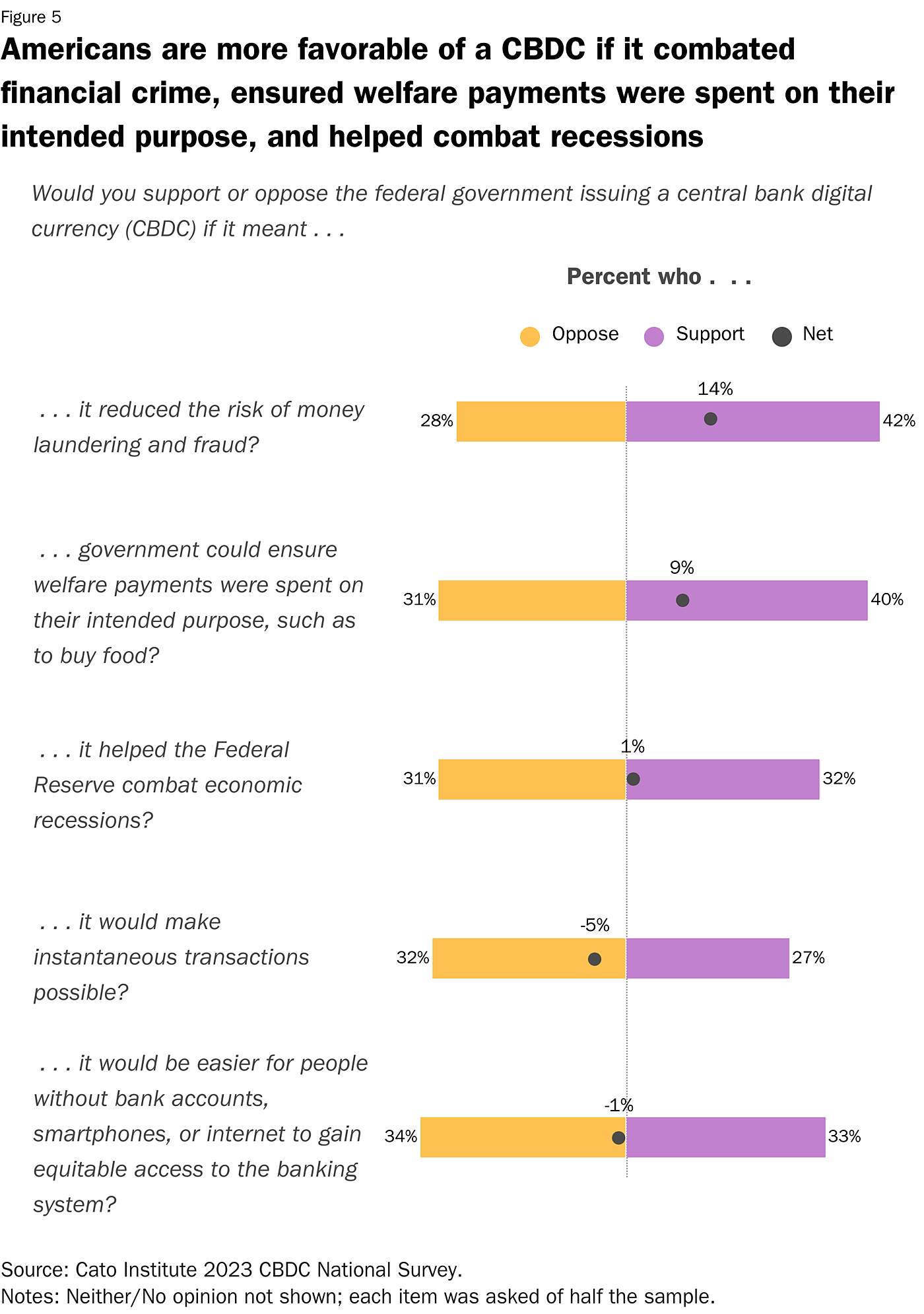

Some potential advantages of a CBDC garnered greater support than opposition. Pluralities would support a CBDC if it reduced the risk of money laundering and fraud (42%) or if it meant that the government could ensure welfare payments were spent on their intended purpose (40%).

Americans are about evenly supportive or opposed if a CBDC made instantaneous financial transactions possible (27% favor), made it easier for people without bank accounts to gain equitable access to the banking system (33% favor), or helped the Federal Reserve combat economic recessions (32% favor). In nearly each of these scenarios, about a quarter to a third of Americans still don’t have an opinion about a CBDC.

The three most persuasive reasons to support a CBDC among Democrats include if one reduced the risk of money laundering and fraud (56%), made it “easier for people without bank accounts, smart phones, or iInternet to gain equitable access to the banking system” (54%), and helped the Federal Reserve combat economic recessions (46%).

None of the benefits asked about in the survey garnered a majority of Republican support. However, the most persuasive reasons to support a CBDC among Republicans include if the government could ensure welfare payments were spent on their intended purpose, such as food (37%), if a CBDC would reduce the risk of money laundering and fraud (30%), and if it made instantaneous transactions possible (18%). Notably, combating financial crime was the potential attribute that most appealed to both Democrats and Republicans.

The appeal of increased access to the banking system among Democrats likely stems, in part, from their concern over unbanked Americans. A majority of Democrats (55%) express concern that some Americans don’t have bank accounts, while only 31% of Republicans feel the same.

CBDC Risks and Benefits

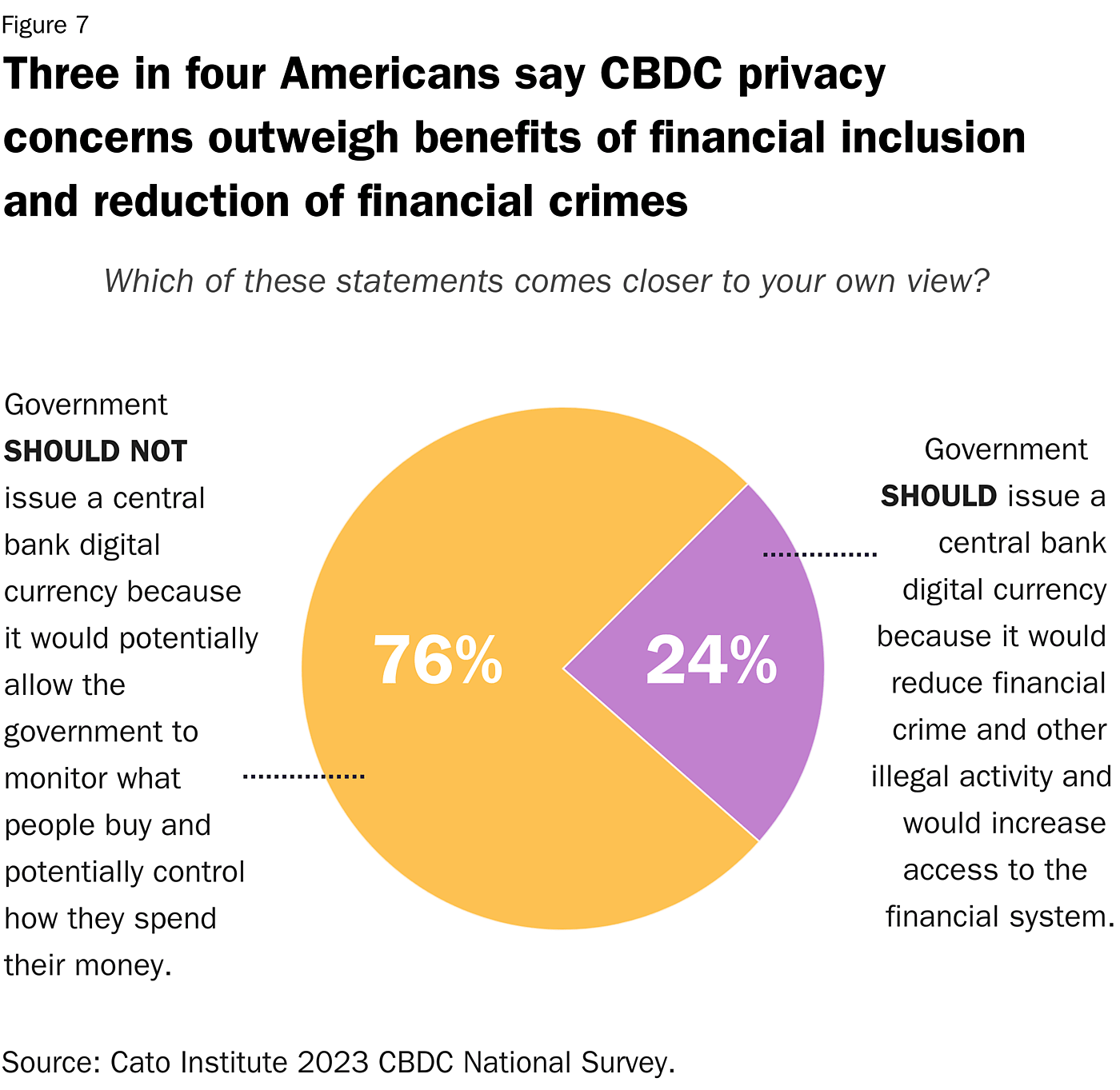

76% of Americans Are More Concerned about CBDCs’ Potential Risks than Potential Benefits

When considering the potential benefits and risks together, 76% of Americans say the “government should not issue a central bank digital currency because it would potentially allow the government to monitor what people buy and potentially control how they spend their money.” About a quarter (24%) say that the “government should issue a central bank digital currency because it would reduce financial crime and other illegal activity and would increase access to the financial system.”

It is possible that Americans might be more supportive of a CBDC with a different combination of benefits and risks. However, when asked about several benefits and risks, Americans were more concerned about the risks than enthusiastic about the benefits.

Strong majorities of both Democrats (68%) and Republicans (85%) are more concerned about the potential for a CBDC to allow the government to monitor and control what people buy than they are about a CBDC reducing illegal activity or increasing financial inclusion.

CBDC Attributes Americans Prioritize Most

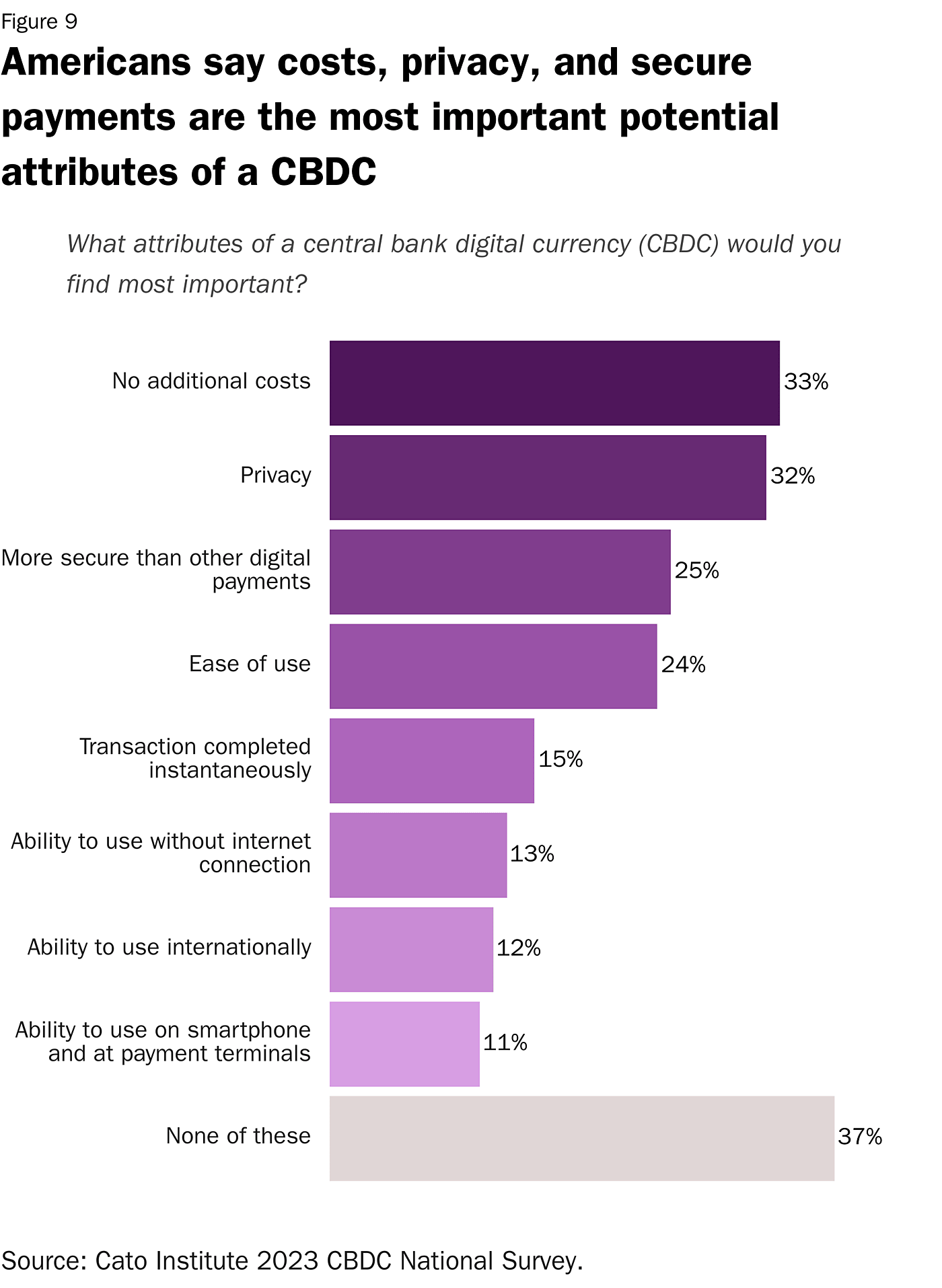

Americans say avoiding additional costs (33%) and securing privacy (32%) are their priorities for a CBDC if one were implemented. More secure digital payments (25%) and ease of use (24%) are the next highest priorities. Other possible attributes of a CBDC are less important to people, including instantaneous transactions (15%), the ability to use a CBDC without an internet connection (13%), the ability to use one internationally (12%), and the ability to use one on a smartphone (11%). A plurality (37%) say none of these potential attributes of a CBDC are important.

Democrats and Republicans rank the same top three priorities for a CBDC but in a different order. Democrats rank no additional costs (41%), privacy (38%), and secure digital payments (33%) as their top possible attributes of a CBDC. Republicans rank privacy first (27%), and then no additional costs (23%), and then secure digital payments (19%). Notably, most Republicans (52%) said none of these potential attributes were important. While some Republicans may not value these possible features, it may be more likely that they don’t believe these attributes, such as privacy, are possible to secure.

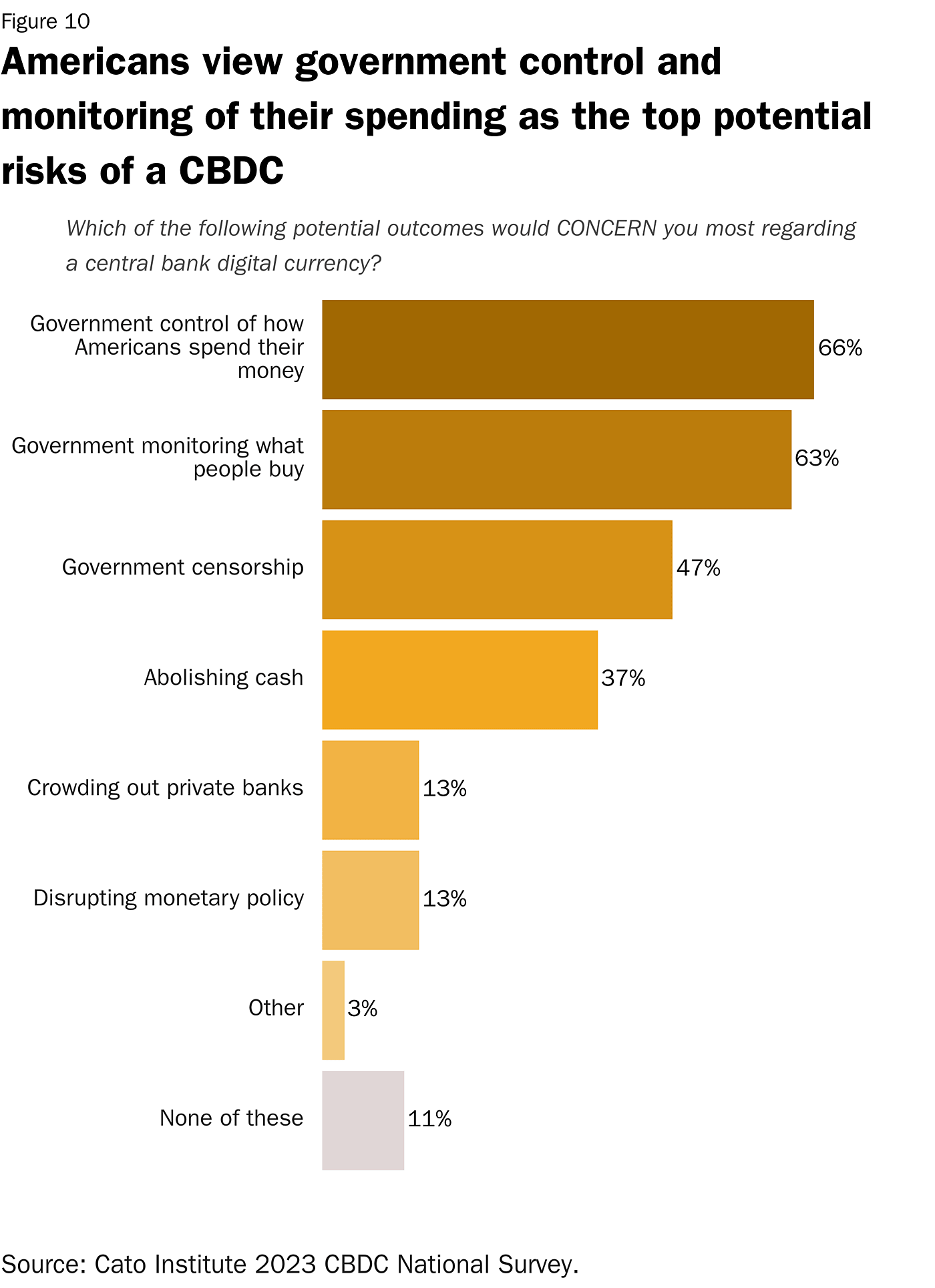

Priority of Potential Risks

Potential risks Americans are most concerned about include the capacity for the government both to control how Americans spend their money (66%) and to monitor what people spend their money on (63%). Medium priority concerns include a CBDC potentially leading to government censorship (47%) or abolishing cash (37%). Lowest priority concerns include a CBDC crowding out private banks (13%) and disrupting monetary policy (13%). Democrats and Republicans share these top three concerns.

Trust Levels

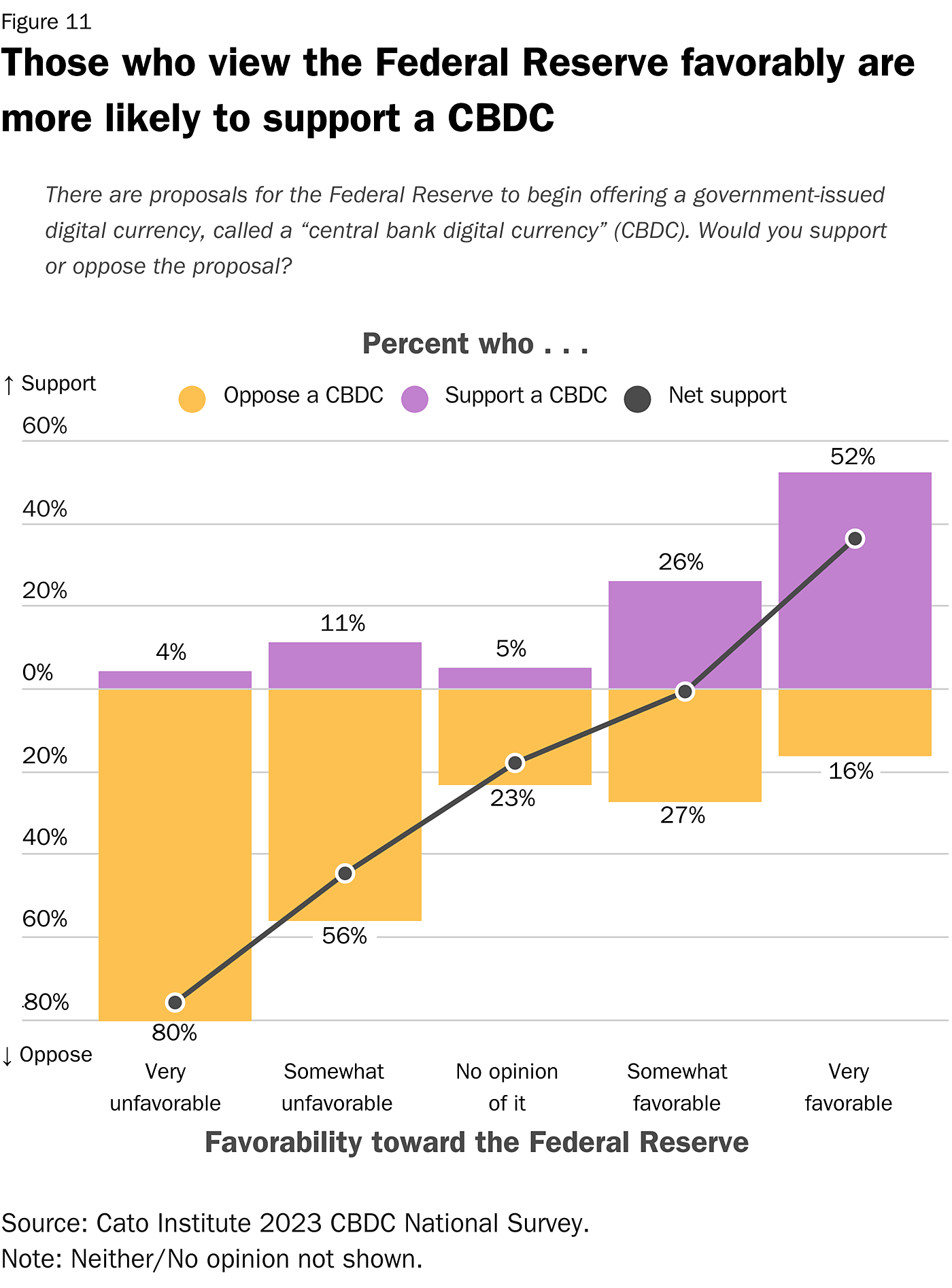

Trust in the Fed Correlates with Support for a CBDC

Americans who trust the Federal Reserve more are more likely to support a CBDC. In fact, those who are “very favorable” toward the Fed are one of the few groups with a majority (52%) who outright support the United States adopting a CBDC. Support drops to 26% among those who are somewhat favorable of the Federal Reserve, to 11% among those mildly unfavorable, and to only 4% among those who are very unfavorable toward the Fed. Indeed, trust in the Federal Reserve may determine if Americans will trust a CBDC.

Americans Familiar with CBDCs Today Support the United States Adopting One

Americans most familiar with CBDCs today are also most supportive of the United States adopting one. A majority (58%) of Americans who are “very” or “extremely familiar” with CBDCs support the United States adopting a CBDC. In contrast, among those “somewhat familiar,” 24% support it and 52% oppose it. Among those “not very familiar,” 10% support and 40% oppose. Among those who have never heard of CBDCs, 5% support it, 28% oppose, and 67% don’t have an opinion.

One should not assume these data represent how the average American’s opinion changes as they learn about CBDCs. Indeed, the types of people who already know about CBDCs systematically differ from those who don’t know much about them. People who have heard a lot about them are more likely to be male (68%), younger (42% are under 30), and have annual incomes above $100,000 (27%). In contrast, people who haven’t heard about CBDCs are more likely to be female (60%), older (83% are over 30), and about half as likely to earn above $100,000 annually (16%).

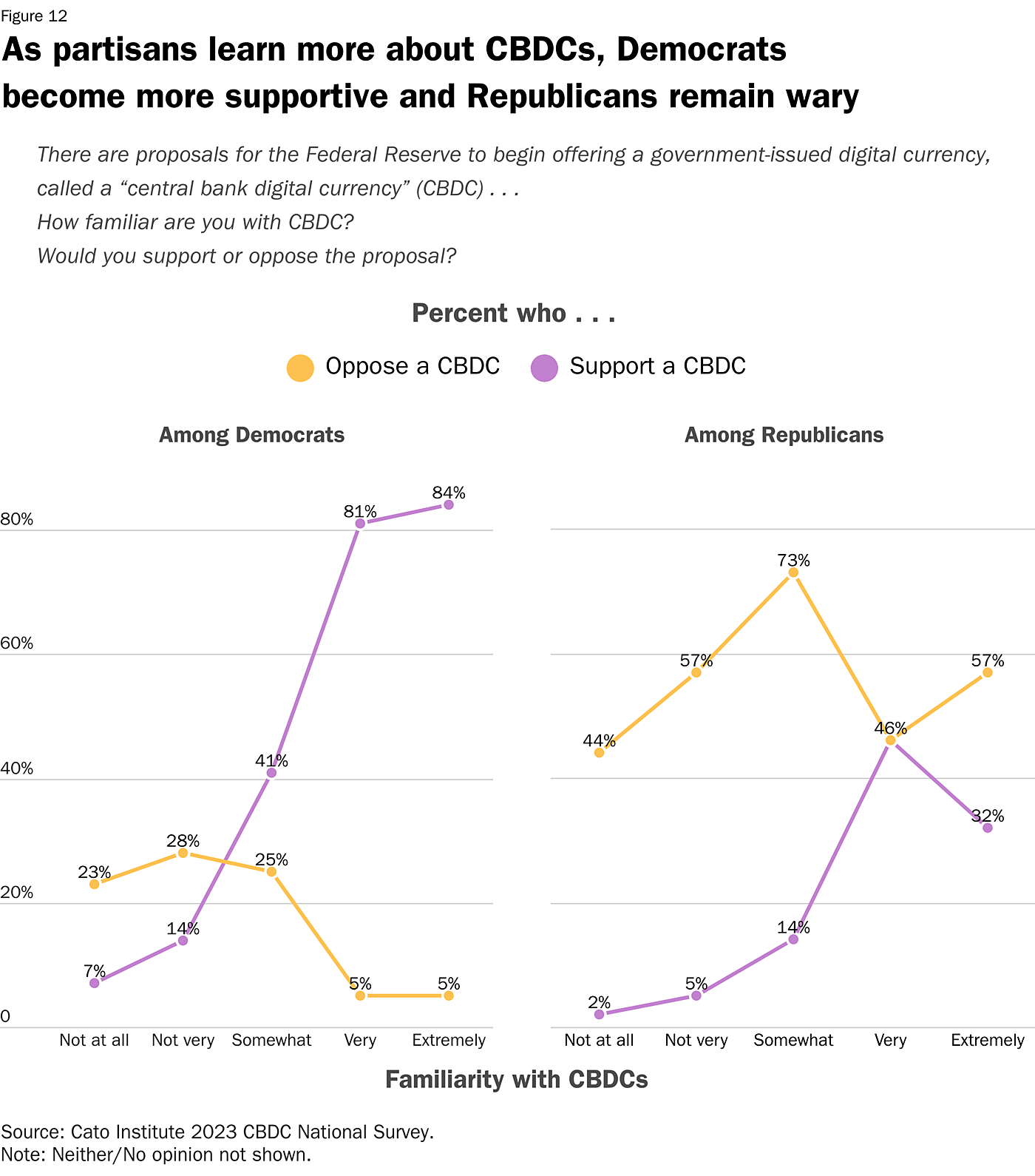

Partisans diverge considerably in their support for a CBDC among those who know more about them. Democrats who know the most about CBDCs are dramatically more supportive of them than those who know little (84% versus 14%). However, Republicans who know more about CBDCs tend to be more opposed to them than those who know less. Among Republicans who previously hadn’t known about them, 44% opposed a CBDC. Opposition rises to 57% among those who are slightly familiar and 73% among those somewhat familiar; it drops to 46% among those very familiar and rises to 57% among those extremely familiar. Taken together, among those who say they are most familiar with CBDCs, 84% of Democrats support the United States adopting one compared to 32% of Republicans.

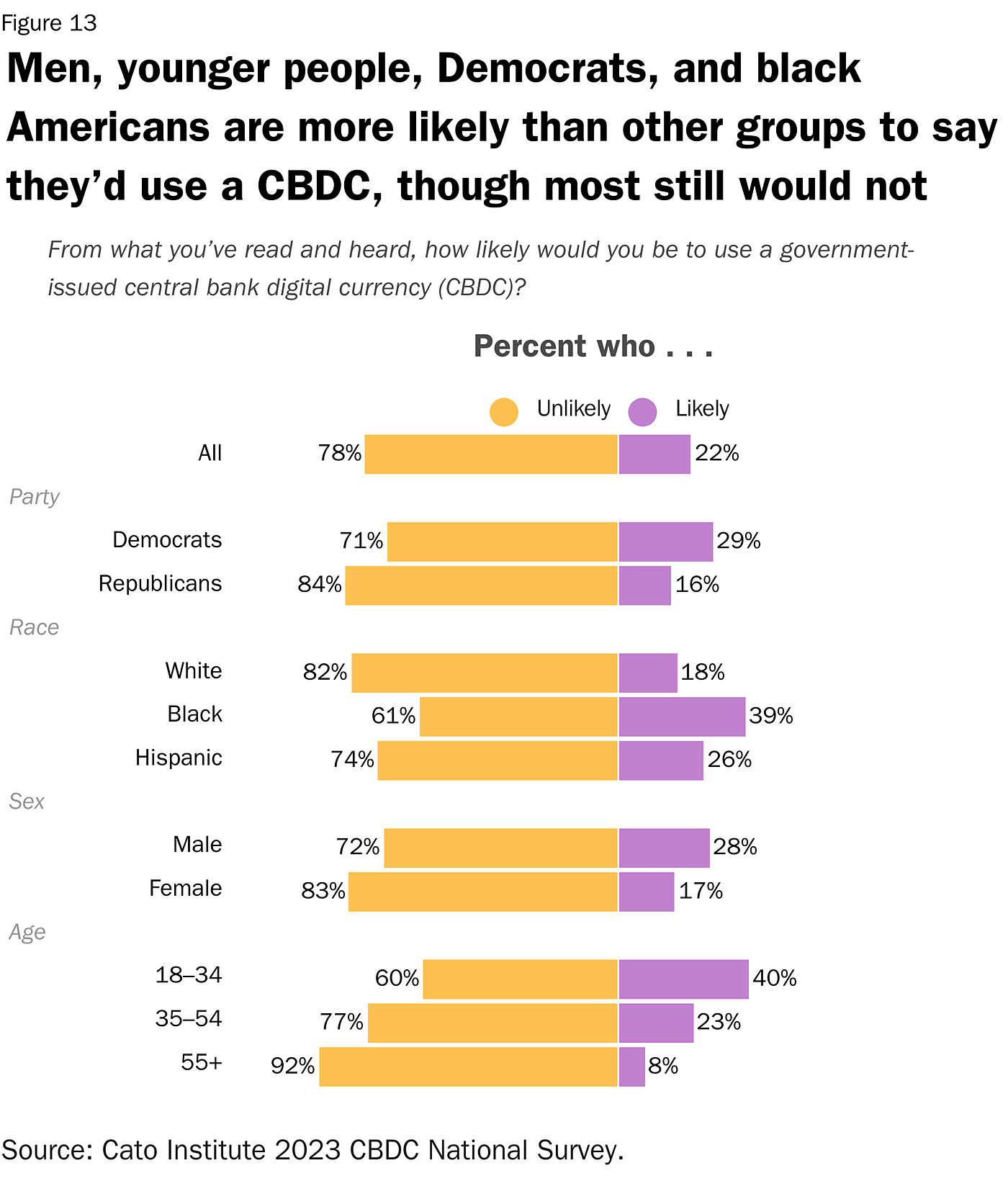

78% of Americans Say They Are Unlikely to Use a CBDC

Less than a quarter of Americans (22%) say they would likely use a CBDC if one were offered. Far more (78%) say they would be unlikely to use a CBDC. Further, 55% say they would be “very unlikely” to use one.

Although majorities across demographic groups don’t plan to use a CBDC if one were offered, some are more likely than others to say they’d use one. Men are about twice as likely as women (28% versus 17%). Black Americans (39%) and Asian Americans (34%) are more likely than Hispanic Americans (26%) and white Americans (18%). Young people under 35 are nearly five times more likely (40%) than seniors over 55 (8%) to say they’d use a CBDC. Democrats are also more likely (29%) than Republicans (16%) to say they’d use one. Nevertheless, majorities of all major demographic groups say they would not use a CBDC if one were offered.

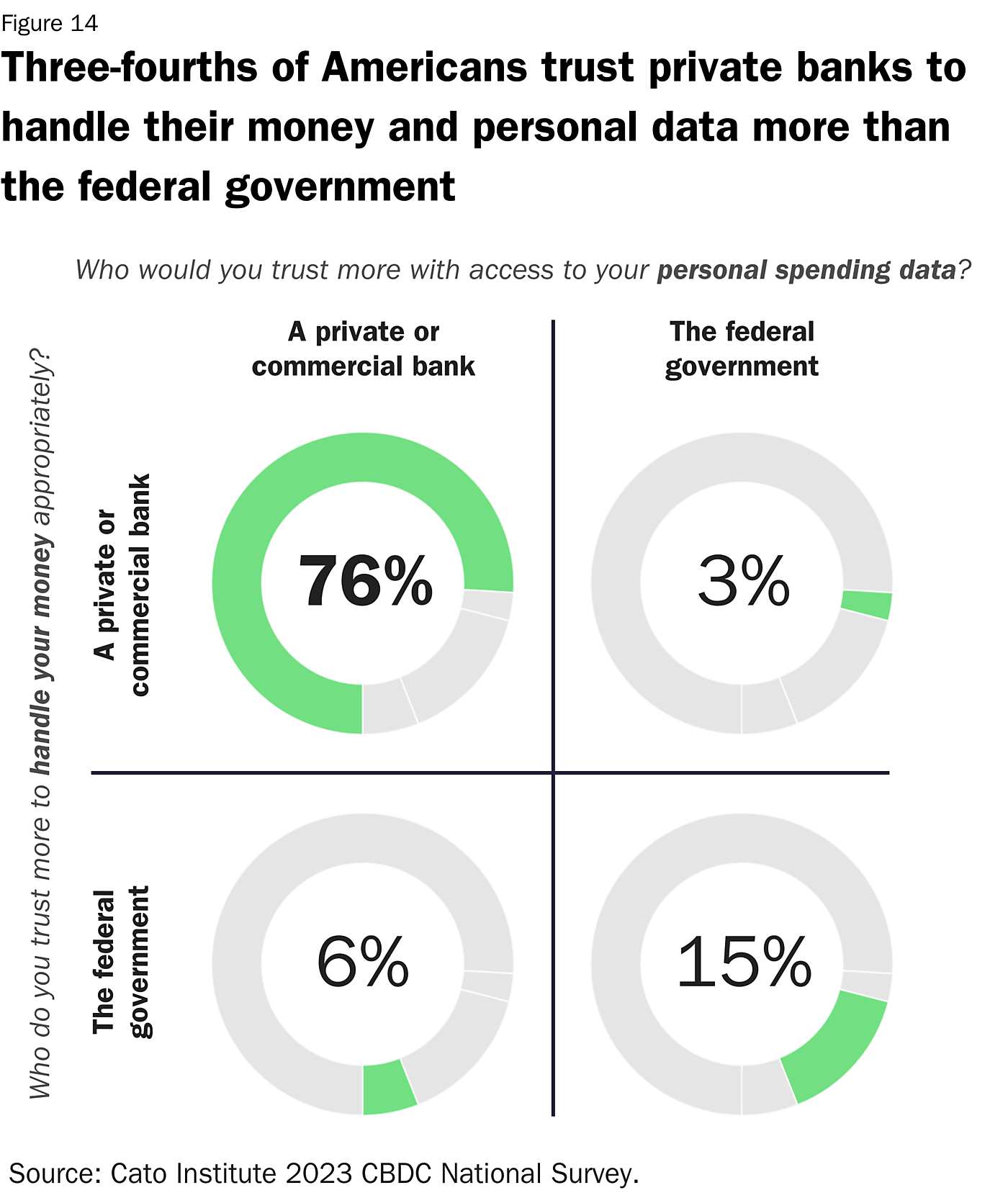

8 in 10 Americans Trust Private Banks More than the Government

Distrust in the “banking industry” is a long‐standing feature of American public opinion. Nevertheless, 89% of Americans are satisfied with the bank they personally use. This may help explain why 8 in 10 Americans say they trust a private bank more than the government “with access to [their] personal spending data” (81% versus 19%) and to “handle [their] money appropriately” (79% versus 21%). Further, 85% of Americans would prefer to keep their money with a private bank rather than in an account operated by the Federal Reserve (15%).

7 in 10 Democrats Trust a Private Bank More than Government with Their Personal Spending Data

Importantly, trust in private banks over government is nonpartisan. Strong majorities of Democrats (78%) and Republicans (93%) prefer to keep their money with a private bank over a government account. Further, both Democrats (72%) and Republicans (90%) trust private banks more than the government with access to their personal spending data.

CBDCs Are About as Popular as In‐Home Government Surveillance Cameras

The survey also investigated Americans’ comfort with the government installing surveillance cameras in every household “to reduce domestic violence, abuse, and other illegal activity.” Perhaps not surprisingly, only 14% of Americans support the idea whereas 75% oppose it.

Notably, Americans who support a CBDC stood out in how they think about in‐home government surveillance cameras. A majority (53%) of Americans who support a CBDC support the government installing in‐home surveillance cameras to reduce abuse and other illegal activity. This suggests that some of the psychology behind support for a CBDC springs from an above average comfort level with trading some personal autonomy and privacy for societal order and security.

Conclusion

The potential use of a CBDC in the United States is a relatively new issue, and many Americans are undecided. After learning about some of the potential costs and benefits of a CBDC, Americans appear wary. They are concerned about the potential for government surveillance and control of how they spend their money as well as the impact a CBDC could have on cash. Some potential benefits, such as a reduction in money laundering and fraud as well as giving the government the ability to ensure welfare benefits are used for their intended purpose, manage to garner a plurality of support. However, after hearing arguments for and against, most Americans say that the United States should not issue a CBDC. Americans are also generally satisfied with their private banks and trust them to handle their money more than the federal government. Taken together, it is not surprising that almost 8 in 10 Americans say they are unlikely to use a CBDC even if the United States issued one. While some groups (Democrats, black Americans, younger people) are more likely to be supportive of a CBDC than others, majorities still oppose adopting a CBDC. In sum, it is clear the idea does not have the majority support that government officials should seek before adopting a CBDC.

Appendix

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.