Finding myself in New York before a group of community bankers, I cannot help but think of George Bailey, the lead character in the 1946 movie It’s A Wonderful Life.

Bailey is of course the manager of Bailey Bros.' Building and Loan, the local bank in Bedford Falls, New York. He's also the very picture of the upstanding community banker: generous, altruistic, and always ready to sacrifice himself for his family and neighbors. When Bailey falls on hard times and is contemplating suicide, his guardian angel can show him multiple examples of how the world would be a worse place without him.

For decades, that movie shaped popular perceptions of the good that banking can do. It offered a welcome contrast to the all-too-common stereotype of banking as a business of questionable social value, altogether separate from "the real economy." The people in this room scarcely need reminding that, were it not for all the services that banks provide at a comparatively low cost — diversification, payments, safekeeping, the transfer of funds across time and place, and more — life would be harder, less secure, and less comfortable.

Structural Changes in the U.S. Banking Landscape

Yet, watching It's A Wonderful Life in 2019, one also wonders whether George Bailey could run his little local thrift today. In some ways, of course, his life might be less difficult: deposit insurance means most bank customers don't rush to bank offices in times of stress — although some did, in America, Britain, and elsewhere, at the height of the last financial crisis.

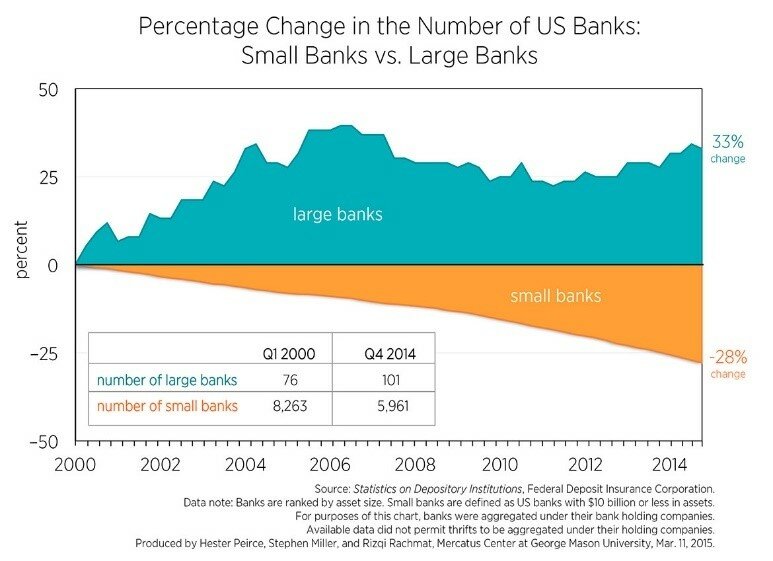

But a number of long-term changes in the U.S. banking landscape make me skeptical that the Bailey Bros.' Building and Loan could remain a thriving, independent institution in 2019.1 Some of these changes are benign: Economies of scale, technological innovation, and the removal of branching restrictions since the late 1970s have ushered in major bank consolidation.

Where there existed more than 14,000 FDIC-insured commercial banks in the mid-1980s, there are now just under 5,000.

That doesn't mean access to banking services has declined; in fact, for most people it has increased, with the number of bank offices more than double what it was in the 1960s. Were Bailey around today, he would probably find himself vying for his neighbors' custom with the Bedford Falls branches of Chase, Citibank, and Bank of America.

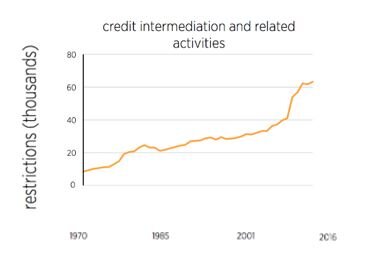

But it would be naïve to suggest that the consolidation of the last four decades is just the consequence of increased competition and other market phenomena. On the contrary, along with the spread of branching and information technology, one of the strongest secular trends in banking since 1970 is the steady increase in government regulation. According to the Mercatus Center, the number of regulatory restrictions and mandates related to credit intermediation quadrupled between 1970 and 2010, from around 10,000 to just over 40,000.

Source: Mercatus Center

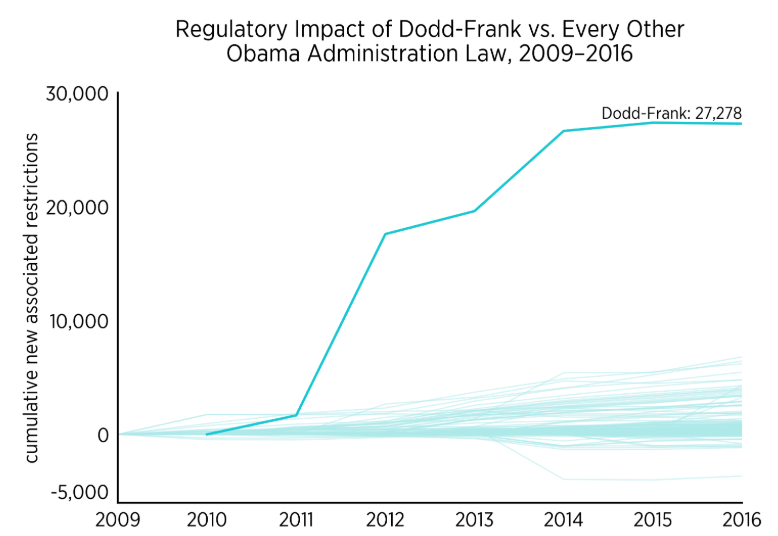

That, of course, was before the passage of Dodd-Frank. Mercatus researchers estimate that the post-crisis legislation on its own added more than 27,000 new restrictions to the rulebook, calling it "one of the biggest regulatory events ever."

Source: Mercatus Center

George Bailey would struggle to recognize the 21st-century banking landscape. And he might also struggle to hold on to his bank. Below are the FDIC's 2018 data on the return on assets and shareholder equity among different-sized banks. As the table shows, banks with less than $100 million in assets — of which the FDIC alone regulates 1,278 — have rates of return 20 to 40 percent below those of larger institutions. Their return on equity, at an average of 7.59 percent, is also considerably lower than the 10 percent figure that equity analysts consider healthy.

As it turns out, being a small bank in 2019 is sometimes not such a wonderful life.

With regulation as with so much else, there is a strong status quo bias: we assume that whatever is today will remain forever. One of the most entertaining parts of my research at Cato is going through the archives to see what regulators, industry players, and policymakers in the past thought would be the future of banking. Invariably, all overstated the permanency of the status quo and discounted the possibility of radical transformation.

We assume the regulation that exists today will be there tomorrow. Many among us also assume that all financial regulation is there for a good reason: after all, new rules typically follow bad experiences during times of stress. Experts identify the policies and behaviors that they believe caused these problems, come up with what they deem to be appropriate fixes, and enact them for what they consider to be the good of the public. Problem solved. That, at least, is the conventional account of financial regulation.

But is it true? Consider Dodd-Frank, or, to use the legislation's formal name, the Wall Street Reform and Consumer Protection Act. Most people would agree that the overwhelming policy issue that the financial crisis uncovered was the "too-big-to-fail" problem — the existence of an implicit government bailout guarantee for the largest financial institutions. Indeed, many sections of Dodd-Frank mandate new regulations for the industries and products at the epicenter of the crisis: insurance, credit default swaps, orderly liquidation, and SIFI capital buffers, for instance. But more than a few people would doubt the contention that post-crisis regulation has successfully removed that implicit bailout guarantee. Even before 2008, the U.S. financial system, weighed down by 40,000 separate regulations, was anything but a "Wild West." That fact alone warrants further skepticism that more rules are the necessary and sufficient fix.

Another reason to doubt the conventional narrative around financial regulation is that the process of regulatory design is much messier than what that narrative suggests. Financial regulation, especially in the high-stakes political environment of 21st-century America, where government accounts for roughly 38 percent of GDP, is hardly the exclusive province of academics and public-spirited technocrats. It's a tug-of-war involving interest-group pressures, reciprocal favors between politicians, rent-seeking, and political grandstanding — along with some well-intentioned advocacy, to be sure. Yet even then, good intentions are no guarantee of satisfactory outcomes.

Intentions vs. Consequences in Financial Regulation

Broadly, there are four motivations for most financial regulation:

- prudential regulation, or what has misleadingly come to be called "financial stability";2

- consumer protection from fraud and abuse;

- national security and the prosecution of crime;

- industrial interventions, whether to promote competition or to restrict it.3

Most financial legislation throughout America's history can be attributed to one or more of those four motivations. The National Banking Acts of 1863 and 1864, for instance, mainly belong in category 4, although its proponents might also have cited 1 as another reason to enact them. The 1913 Federal Reserve Act is associated primarily with category 1, because many people attribute the frequency and severity of financial crises to the absence of a lender of last resort.4 The 1970 Bank Secrecy Act falls under category 3, while the Dodd-Frank package passed in 2010 includes measures related to 1, 2, and 4.

Those are the motivations behind financial regulation, but that doesn't ensure that regulation ends up achieving its desired aims. The National Banking Acts and subsequent Civil War legislation made it increasingly difficult for state-chartered banks to compete with nationally chartered banks. The Federal Reserve Act gradually removed the right of note issue from all U.S. banks. But the presence of a lender of last resort did not mitigate the widespread panics and bank failures of the Great Depression. Deposit insurance, enacted in 1934 to prevent bank runs, has had the unintended effect of providing banks with a cheap funding source, and international evidencesuggests that the more generous the deposit insurance system, the more risk banks are willing to take on.

That past financial regulation has had effects different from, and sometimes even contrary to, the ones its authors intended gives additional reason to doubt that "this time will be different." Nor is it likely, unfortunately, that the process of regulating will become any "cleaner" or less vulnerable to interest-group abuse. If anything, the proliferation of regulation leads to a growth in the number of vested interests, who have much to lose from removing regulation. I'd like to discuss three examples of such regulatory entrenchment from my own research, which will hopefully resonate with you: the Community Reinvestment Act (CRA), the Bank Secrecy Act (BSA), and the use of prudential capital buffers.

Community Reinvestment Act

Passed in 1977, the CRA required depository institutions — except for credit unions — to lend in the areas where they collected deposits. At the time, anti-competitive restrictions on branching, along with statutory ceilings on the rates that banks could pay on customer deposits, meant that banks had little incentive to satisfy all the profitable credit demand in their communities. A 40-year legacy of redlining had also caused a paucity of data on the value of collateral in certain (typically minority) neighborhoods, making credit underwriting more difficult. In that context, a regulatory mandate for lending may have been defensible, although even at the time, the relevant regulators found the CRA to be an imperfect means of addressing redlining.

Four decades later, the American banking system has changed dramatically, and mostly for the better. Greater local competition has made credit rationing unattractive. Interest-rate ceilings are long gone, meaning new banks can lure customers away from incumbents by offering more competitive terms. Finally, despite the regrettable persistence of residential segregation — now driven by socioeconomic rather than institutional factors — a diversity of providers, both banks and nonbanks, has emerged to cater to the needs of historically marginalized groups.

These auspicious trends are rendering the CRA increasingly obsolete. You would think that this would provide an impetus for reforming and even repealing this legislation. After all, there are other rules in place — such as the Equal Credit Opportunity Act (ECOA) and the Home Mortgage Disclosure Act (HMDA) — to prevent and punish individual instances of discrimination in credit provision.

To its credit, the OCC last year launched a review of CRA enforcement, and the FDIC and Fed have recently joined these efforts. But all available evidence suggests that any changes in regulatory supervision will be modest — possibly involving the replacement of the CRA's current system of vague qualitative assessments with a more predictable quantitative score. Any consideration of repeal, however, seems out of the question, despite accumulating evidence that the CRA has, in some cases, harmed banks' safety and soundness. In other cases, research shows that the CRA has caused credit to flow not to those most in need (low-income and minority borrowers) but to the best credits in CRA-eligible assessment areas (people like me, who have average or above-average incomes but live in gentrifying neighborhoods).

With $4.5 trillion worth of CRA lending commitments between 1992 and 2007, and with an explicit requirement that regulators consider CRA ratings when banks apply to merge or expand, the CRA has become a big business for activist groups. They lobby banks and regulators for promises of "community development" funding, and they protest vociferously when their requests go unheeded. Not surprisingly, these groups are the ones most bitterly opposed to any CRA reform.

Bank Secrecy Act

The BSA aims to combat illicit finance. Its anti-money-laundering/know-your-customer (AML/ KYC) provisions have gradually grown in depth and scope, notably with the passage of the USA PATRIOT Act in the wake of 9/11. Being concerned with law enforcement and national security, the BSA is a set of financial regulations to which policymakers across the political spectrum are particularly sensitive.

However, as BSA-related rules have increased in number, they seem to be yielding diminishing returns, even as their costs mount. A 2018 survey of community banks by the St. Louis Fed found the BSA to be the most onerous financial regulation, accounting for nearly a quarter of bank compliance costs. A study by the Heritage Foundation estimated aggregate BSA-related compliance costs at somewhere between $4.8 billion and $8 billion.

Last year, financial institutions filed more than 5 million reports of suspicious financial activity — but only about a million of those seem to have been prompted by major security concerns, such as money-laundering, cybersecurity risks, and terrorism. Nearly two million have vague tags, such as "other suspicious financial activity." The relationship between BSA reporting and criminal prosecutions is also somewhat tenuous: the number of money-laundering investigations by the IRSand FBI has declined as BSA reports have escalated. In fact, candid off-the-record conversations with law enforcement veterans often reveal that BSA reports typically played a marginal role in their investigations.

Yet the BSA remains in place. Not only that, but as the nominal dollar thresholds for reporting transactions haven't changed since 1970, many more routine financial operations are caught in the BSA's net than legislators had originally intended.

The status quo has some obvious and powerful beneficiaries: law enforcement authorities, understandably, are eager to get their hands on as much transaction data as possible. After all, it might conceivably be useful in the future, and the cost of reporting isn't borne by law enforcement, but by the private sector. Politicians also benefit from supporting the Act, as it allows them to appear tough on crime without committing taxpayer dollars to those efforts.

The losers are banks and their customers, some of whom may have their transactions flagged even though they are guilty of no wrongdoing. The BSA also carries with it the major yet often ignored cost of financial privacy. Competition and financial innovation suffer as well, since the Act's heavy compliance costs make entry into banking less attractive, and banking innovation potentially riskier: consider an innovative new product — say, a blockchain-based payment services provider — that might potentially be used by wrongdoers. The costs of developing and marketing this product, and other technologies like it, would hardly seem worth the likely outcome of regulatory rejection.

Capital requirements

Capital buffers are an essential form of prudential risk management by banks. There is reason to believe that, even in a free market where regulatory capital requirements didn't exist, banks would still have a strong incentive to hold significant amounts of capital. Capital reserves are the collateral that creditors require to lend to the bank at reasonable rates.

But so long as we're far from that hypothetical free market, decisions on capital buffers are likely to come from regulators. That doesn't mean capital planning has to be a complicated exercise, involving two dozen different measures, calibrated by internal models, verified by public authorities, and subject to periodic tinkering by the Basel Committee and the Federal Reserve. In fact, post-crisis studies strongly indicate that simple leverage ratios without any risk weights were better predictors of impending failure before 2008 than the supposedly more scientific models prescribed by Basel. That research, by the way, comes not from free-market think tanks but from the venerable Bank of England, among others.

Small community banks tend to prefer simple leverage ratios. The unsuccessful Financial CHOICE Act, along with the less ambitious but successful Economic Growth, Regulatory Relief, and Consumer Protection Act (EGRRCPA), which passed last year, both included an off-ramp from complicated capital rules in the form of a single leverage ratio. The one passed by Congress in the EGRRCPA is limited to institutions with $10 billion or less in assets, and the level of the ratio is yet to be set by regulators. But it's a promising start.

However, larger banks are skeptical of a simple leverage rule. Part of their wariness is understandable: having spent considerable resources complying with the complicated set of existing requirements, they fear the disruption of moving to a new system of assessment. Furthermore, who can assure them that the single leverage measure won't gradually creep upward over time? Yet another part of their skepticism is also due to their understanding that complicated capital measures can be tinkered with, lobbied for and against, and ultimately gamed. For large and complex institutions with a great deal of political influence, such a playing field can be exceedingly attractive.

The Road to Financial Regulatory Reform

These examples — the CRA, the BSA, and the prudential capital regime — illustrate that attempts for meaningful change in financial regulation almost always meet with fierce resistance. But regulation needs to change, because the way we save, borrow, insure, and invest today is much different from the way we used financial services in the past.

The pressure to remove and change outdated regulation often comes from outside. Consider the rise of Uber, which has made a stronger case for the abolition of taxi medallions and regulated pricing than a thousand public policy economists could have mustered before its advent. Similarly, the effort to reconsider the enormous burden of banking mandates and restrictions has become more urgent with the rapid rise of nonbanks and fintech companies. These challengers are competing with banks while eschewing some of the more highly regulated aspects of the banking business. In addition, they're showing that innovation in areas such as credit-scoring, underwriting, and marketing can achieve the goals of regulation — consumer protection, adequate risk management, and effective competition — without the need for rigid regulatory mandates.

The growing number of partnerships between fintechs and banks is likely to further hasten the review of existing regulations for their fitness. I'd like to aim for a model of activity-based regulation — that is, one where similar regulations apply to institutions performing similar functions — and where policymakers recognize the efficiency of competitive markets in addressing customer needs and preferences. To paraphrase Adam Smith, the founder of the science of economics, "It is not from the benevolence of the butcher, the brewer, or the baker that we expect our dinner, but from their regard to their own interest [TripAdvisor rating]."

The portrait of the community banker depicted in It's A Wonderful Life emphasized the close relationship between George Bailey and his customers. The regulator is a distant presence — and a nagging one at that, as demonstrated when the carelessness of George's uncle almost drives Bailey Bros.' Building and Loan into bankruptcy and an OCC inspector arrives. Yet policymakers have long since forgotten that the George Baileys of the world, if given appropriate incentives, can serve the public much more effectively than distant regulators can. Contrary to popular perception — and again paraphrasing Adam Smith — creative and competent individuals can often better promote the public interest from the private sector than from within government. Indeed, I'd wager that, if the generous and public-spirited George Bailey were around today, he'd be running a small innovative bank or a fintech company.

Thank you.

Notes

1 Cato colleagues have rightly pointed out that thrifts such as Bailey Bros. largely disappeared after the savings and loan crisis in the 1980s. For our purposes, however, it's the size of Bailey's institution — not its status as a thrift rather than a community bank — that matters.

2 I write "misleadingly," because the term "financial stability" suggests that any change in the current structure of banking — further consolidation, integration of different financial services activities, and periodic bank failures — are undesirable. That is emphatically not the case.

3 It is worth noting that much bank regulation historically also had a fiscal motive. For example, the National Banking Acts, by tying note issue to a bank's holdings of U.S. Treasury securities, helped to pay for the Civil War.

4 My CMFA colleague George Selgin, however, argues that the true motivation behind this specific solution, which a U.S. federal central bank devised, was in fact to maintain the privileges of correspondent banks, mainly in New York City, while mitigating the impact of liquidity crunches on unit banks around the country.

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.