Dear Capitolisters,

Well, you can’t say you weren’t warned. For the last several years, my fellow “free market fundamentalists” (LOL) and I patiently tried to explain how politics can distort U.S. industrial policy and create a large and potentially insurmountable chasm between technocratic rhetoric and implementation reality. Even the most well-intentioned and theoretically sound plan, we cautioned, can fall victim to legislative sausage-making, K‑Street meddling, bureaucratic capture, and other facets of public choice economics. I thought that recent U.S. electric vehicles subsidies might be the best real world lesson we’d get in this regard, but the just-released Department of Commerce guidelines for federal semiconductor subsidies, as authorized under last year’s CHIPS and Science Act, compel me to reopen the textbook once again.

Steelmanning the CHIPS Subsidies

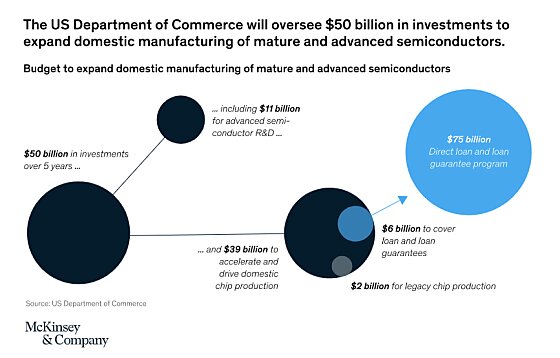

Before we get to that, however, let’s recall how we got here. Signed into law last summer, the CHIPS Act provided a suite of financial assistance to semiconductor and semiconductor-related companies operating in the United States. Most prominent among these subsidies, though certainly not the only ones, was $39 billion in grants, loans, or loan guarantees—administered by Commerce—for domestic semiconductor and semiconductor-related manufacturing facilities. Companies can apply for up to $3 billion in grants per project, but the president can authorize even more (and Commerce says there’s “no set maximum”).

Arguments for these subsidies centered on the cost of building commercial semiconductor facilities—known as fabs—and these plants’ importance for the U.S. economy and national security. In particular, we were told repeatedly that the United States’ share of global semiconductor production had fallen from 37 percent in 1990 to 10 percent today, with almost all leading-edge chips made in Asia. This shift, moreover, raised major U.S. economic and national security risks and has been driven in large part (again, allegedly) by foreign government subsidies, which have helped make it much cheaper to build and operate fabs in Korea, Taiwan, and China than in the United States. Given these subsidies and modern fabs’ extremely high cost, only the U.S. government can provide the capital (tens of billions of dollars) needed to narrow this cost differential and to attract the private investment needed to build, expand, and operate fabs in the United States.

This script has become gospel among subsidy supporters in the U.S. government, think tanks, and the semiconductor industry—so much so that I can (sadly) recite it from memory. Here’s how the Semiconductor Industry Association put it a few months ago: “Taken as a whole, these incentives are expected to generate significant investment in the semiconductor ecosystem in the U.S., and both are sorely needed to close the significant cost gap between the U.S. and global competitors.” Both Micron’s and Intel’s CEOs made similar claims earlier in the year, as did the White House and many other supporters on the left and right. And they’re doing it again right now.

As Capitolism readers surely know by now, I’ve poked some rather large holes in these arguments, but there’s surely some merit to concerns from subsidy proponents about the time and expense needed to build and run fabs in the United States. Yet if encouraging domestic construction, private investment, and U.S. semiconductor output is really as important for U.S. economic and national security as CHIPS Act supporters’ claim, the Biden administration sure has a funny way of showing it.

Strings. So Many Strings.

Indeed, the Commerce Department notices announcing the first round of funds—for fab construction and expansion—are chock-full of terms that will inevitably increase the time and expense of producing semiconductors in the United States and could actually discourage private investment in these and other projects—precisely the opposite of the subsidies’ stated objectives.

Admittedly, the department states up front that it will consider and prioritize both an applicant’s fulfillment of U.S. economic and national security objectives and proposed projects’ commercial and financial viability. Right after that, however, come a lot of costly strings.

First, there are the financial restrictions. For example, subsidy applicants must detail whether they intend to refrain from or limit “share buybacks, dividend payments, dividend payment increases, or special dividends” over the next five years, and the department “will evaluate applications based on the extent of the applicant’s commitments to refrain from stock buybacks.” Under the law, subsidy recipients are generally barred from using subsidy funds to engage in buybacks or to issue dividends, but the department’s terms are broader. And Commerce Secretary Raimondo subsequently confirmed that the agency will give “preferential treatment” to companies that forgo all buybacks for five years.

There’s also a new cap on applicants’ profits, called “upside sharing” (ha), under which the department “will require recipients of more than $150 million in direct funding to share with the U.S. government a portion of any cash flows or returns that exceed the applicant’s projections above an established threshold.” Applicants must also refrain from significantly expanding in, or transferring certain technology to, a “foreign entity of concern” (e.g., China). The expansion moratorium lasts for 10 years and was in the law itself, but the department’s restrictions here are also broader.

Second, the Commerce notice includes numerous workforce-related terms and conditions. Most notably, applicants requesting funding of more than $150 million must detail how they will provide “access to affordable, accessible, reliable, and high-quality child care for facility and construction workers.” This can include onsite childcare facilities or just additional cash to workers.

Applicants also must submit detailed “facility workforce plans,” explaining how they plan to hire, train, and retain workers and meet various workforce-related conditions or priorities. This includes providing “wraparound services” (e.g., adult care, transportation assistance, housing assistance, emergency, cash assistance, language support, tools, uniforms, equipment, application fees, mentorships, etc.), and adhering to the Department of Labor’s “Good Jobs Principles” on pay, benefits, unionization, and so on. In drafting these plans, applicants must “consult, engage, and coordinate with workforce partners—including educational institutions, training providers, community-based organizations, labor unions, career and technical education organizations, and public-sector organizations.”

Applicants must also provide a “construction workforce plan” that adheres to the facility-related workforce requirements and adds two more important ones. First, construction or repair workers (whether contractors or subcontractors) must be paid local “prevailing wages,” as defined under the Davis-Bacon Act, and must agree to “Davis-Bacon Act compliance training” and applicants must maintain “competency in Davis-Bacon Act compliance.” Applicants are also “strongly encouraged” to use Project Labor Agreements (PLAs) or else to submit a detailed “workforce continuity plan” and then be subject to a laundry list of additional compliance and monitoring requirements.

To ensure compliance with these terms, the department requires applicants to collect and submit “real-time, granular data that will inform the evaluation of their workforce efforts” and to make this data (redacted as necessary) publicly available too.

Third, there’s a random assortment of social policy baked into the subsidy application. For example, applicants must provide an “equity strategy” discussing the specific steps they’ll take “to attract economically disadvantaged individuals and promote diversity, equity, inclusion, and accessibility” (DEIA). (This DEIA factor is also one of the aforementioned “Good Jobs Principles” that applicants are encouraged to adopt.) Applicants should also identify their “community investments” to “unlock barriers to economic participation and benefit disadvantaged communities” including through things like building “affordable housing” or providing housing vouchers. And they must present (1) a “Supplier Diversity Plan” detailing how they “will coordinate with small, minority-owned, veteran-owned, and women-owned businesses, as well as describe their supplier diversity programs and/or office and any internal staff dedicated to overseeing outreach to such businesses”; and (2) a “Climate and Environmental Responsibility Plan,” including a commitment to use renewable energy to the “maximum extent possible” and a “description of the applicant’s strategies for minimizing the potential for adverse impacts to the local community, including communities with environmental justice concerns.”

Finally, applicants are strongly encouraged to buy American and must “include a description of whether and how they intend to utilize domestically produced iron, steel, and construction materials. Applicants should also identify whether they will include domestic content specifications in their contracting terms.”

Not all of these conditions are mandatory, but the Biden administration has repeatedly made clear that they are a White House priority and will be considered when the department evaluates subsidy applications. Companies, moreover, appear to be taking the non-binding stuff seriously: Several analysts, for example, noted that Intel’s recent dividend cut “was partly aimed at grooming the company for subsidies from the U.S. government.” And, per Commerce, enforcement of any application promises will be rigorous:

Commitments will be codified in the terms of an award. The CHIPS Program Office will require regular reporting from award recipients and intends to establish a rigorous compliance and audit program to ensure that these commitments are being upheld. Failure to adhere to the terms of the award may result in one or more of the following actions, as appropriate in the circumstances: the temporary withholding or suspending of payments, the suspension or termination of the award, the return of funds made available under the award, the initiation of suspension or debarment proceedings in accordance with law, or other remedies that may be available.

It’s thus safe to assume that a lot of this stuff, whether mandatory or not, will find its way into U.S.-based semiconductor companies’ business plans, and that they’ll stick to those plans for fear of getting dinged by the feds.

How Does Any of This Boost Semiconductor Output or Investment?

The terms and conditions now tied to CHIPS Act funding are not just bureaucratic mumbo-jumbo; they could actually undermine the subsidies’ stated objectives. Most obviously, they’ll impose additional costs on subsidy recipients, potentially diverting finite resources—money, time, labor, etc.—away from producing more chips onshore and toward these other requirements.

As we’ve discussed (repeatedly), “Buy American” mandates are expensive and can add years to federal projects; Davis-Bacon rules inflate construction costs (especially following Biden administration changes); and restrictions on buybacks or dividends can prevent firms from optimizing their capital structure in the most cost-effective way (e.g., by switching from equity to potentially-cheaper debt). PLAs also can raise construction costs by mandating, among other things, the use of union labor, resources, and benefit/pension plans. Childcare and “wraparound” services, DEIA and other “equity” initiatives, “environmental justice” plans, and other strings surely cost money too, as do the armies of employees that’ll be needed to demonstrate compliance with the subsidy award terms.

To the extent that semiconductor firms weren’t already doing this stuff (and if they were, then why mandate it?), requiring them to do so now will mean fewer corporate resources available for producing chips or engaging in new research and development. That’s particularly a concern right now, as the global semiconductor market’s recent collapse has already left major chipmakers more capital constrained (and cutting staff and investments) than they were just a year ago. Furthermore, even the companies that were already doing some or most of this stuff will face higher costs (monitoring, compliance, etc.) and will be locked in to maintaining it even if market or other conditions change. The Commerce Department’s watchful eye—aided, I’m sure, by non-government beneficiaries of all this largesse—will make sure of it.

Of course, subsidy recipients might simply ask the government for more money to cover these and other expenses, but this approach raises problems too. Most obviously, because Congress set a hard cap on these grants (one that inflation has already eroded), further inflating project totals will mean fewer projects get funded. More money also can’t solve the problem of other resource constraints. For example, those PLAs and Davis-Bacon rules all but ensure the use of union labor—something Secretary Raimondo and the White House openly admit and applaud—but this would mean excluding the 88 percent of the U.S. construction workforce that was non-union in 2022 (a small increase from 2021, by the way). That’s not exactly a smart move when there’s already “a shortage of skilled construction workers to build complex semiconductor factories.”

Finding or training qualified workers and filling out paperwork also takes time, which you’d think was of the essence given the subsidies’ supposed national security imperative. Indeed, if these subsidies are—as many contend—a hedge against an imminent Chinese invasion of Taiwan, then the feds probably shouldn’t be larding them up with conditions that could take months or years for semiconductor projects to meet. Finally, there’s the fact that much of Congress voted for a bill to boost domestic semiconductor production, not to ban buybacks (they actually voted against that) or to fund labor unions, childcare, corporate DEI offices, and “environmental justice.” Cost incidence aside, this intent should matter—especially for the “conservative” Republicans who are supposedly fighting an existential culture war against the Woke Left (or whatever) yet woke up last week to discover they voted to subsidize DEI and environmental justice initiatives at some of the largest companies on the planet.

Oops?

Anyway, the subsidy strings could also raise several other unintended consequences. The financial restrictions, for example, might discourage private investment in these companies, making it harder for them to raise already-scarce private capital and thus potentially more reliant on government help. I mean, would you want to invest in a company that may be forced to give the government its “excess profits,” that was barred from doing most future business in a mammoth and still-growing market like China (or other unnamed countries), and that can’t offer shareholders buybacks or (maybe) dividends?

Yes, limiting highly advanced or sensitive technology in China might make some sense, but these restrictions go well beyond that—and have Korean semiconductor firms already worried about them, because they still have a lot of business in China. The other financial restrictions, meanwhile, have no plausible security justification. And the profit caps are particularly problematic in a highly cyclical global industry like semiconductors where companies routinely use massive profits to offset massive losses and prepare for the next boom-bust cycle. No wonder, then, that Korea’s Samsung—one of the “Big 3” chipmakers, along with Intel and TSMC—just expressed “alarm” over this provision, its ambiguity (which would grant the Commerce Department “huge discretionary power”), and how it could set a troubling precedent for other governments that are also playing the global subsidy game.

None of this stuff screams “BUY” to major institutional investors. (For what it’s worth, the stocks of big U.S. chipmakers Intel and Micron are down big over the last year, as compared to the broader semiconductor index.)

The childcare mandates, meanwhile, could perversely make childcare more expensive for most American workers in the affected areas. This is because, as I explained in a recent column, government policies—on zoning, immigration, occupational licensing, regulation—dramatically restrict the available supply of local childcare services (businesses and workers). Thus, as my Cato colleagues just explained, artificially boosting demand for these services, without doing anything to liberalize the supply side, will likely mean higher prices, especially for those parents who aren’t lucky enough to eligible for the new benefits (i.e., locals who don’t work for semiconductor companies).

It’s not just libertarians noticing these problems, by the way. The Washington Post’s (sensible center-lefty) Catherine Rampell, for example, also expressed concerns that “piggybacking rushed child-care initiatives onto unrelated semiconductor manufacturing objectives is likely to diminish our ability to do either thing well.” Not only would it likely raise firms’ costs (because “if spending an additional dollar on child care rather than salary attracted hires, they’d provide it” already), but it could also “lock workers to a specific employer to maintain access to care.” Obama White House economist Jason Furman agrees, as do the Financial Times editors who balked at the “Chips Act Christmas Tree” that risks doing too little by trying to do too much.

Summing It All Up

The fact that $39 billion in federal semiconductor funds is today bogged down by politics will come as no surprise to the ivory tower “fundamentalists” who’ve, you know, actually studied America’s long history of problematic industrial subsidies. As R Street’s Adam Thierer just noted about the Biden administration’s new chip subsidy rules, “one timeless truth about industrial policy … is that handouts always come with handcuffs,” and “ it is almost impossible to pass a massive industrial policy bill without extensive political meddling coming into play.” Just how much this meddling undermines the CHIPS Act’s objectives remains to be seen—there are other subsidies buried in the law, and this is a lot of government money. But it surely isn’t helping, and the risk of project failures, capital misallocation, and other economic distortions is surely higher today than it was ten days ago. (And, by the way, it was already high.)

Even if these subsidies were deployed perfectly, global market and domestic policy realities were going to prevent them from being the gamechanger many proponents made them out to be: Goldman-Sachs, for example, estimated that the CHIPS Act might boost the U.S. market share of global chip capacity—i.e., the subsidies’ raison d’etre—by less than 1 percent because it “costs 44% more to build and run a new fab in the U.S. than in Taiwan.” (Taiwan’s TSMC is, alas, finding this out the hard way.) And even the U.S. semiconductor industry’s own, and surely overly optimistic, projections saw the subsidies driving a modest, 2 percentage point gain in U.S. market share.

But now, even this return on taxpayers’ (forced) investment could prove too ambitious, as the subsidies’ political goals undermine their stated economic and national security ones. Maybe that result is a perfectly fine tradeoff for a Democratic president seeking reelection, a Democratic Senate majority leader building an in-state legacy, or their friends in organized labor or on the progressive left.

But what are the Republican CHIPS Act supporters getting out of the deal?

Chart(s) of the Week