I know you liked last week’s column on The Bear, but we need to talk about tariffs. Again. I swear, however, that there’s a good reason: The federal government is now considering one of the largest “trade remedy” (anti-dumping and countervailing duty) cases in recent years—one requested by the United Steelworkers union and Ohio-based steelmaker Cleveland Cliffs and targeting almost all imports (billions of dollars in total) of “tinplate” steel, which American companies use to make cans for food and other consumer staples. The Wall Street Journal deserves credit for covering and opining on the case, which is currently pending before the relevant government agencies, but misses some important details and context—points that turn the investigation and any resulting import duties into not merely another case of American protectionism but also a real case study of the absurdity of U.S. tariff policy today.

The U.S. Still Imposes a Lot of Tariffs

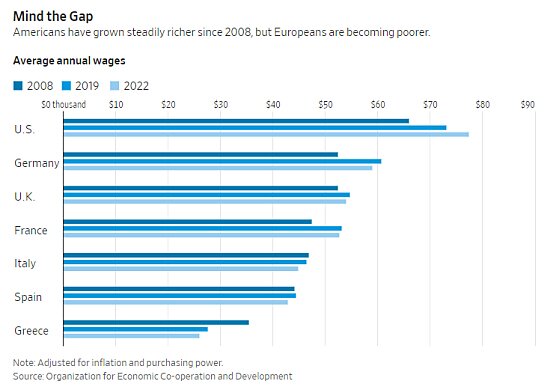

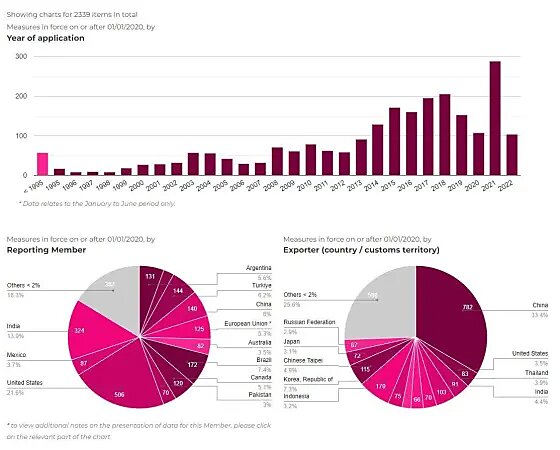

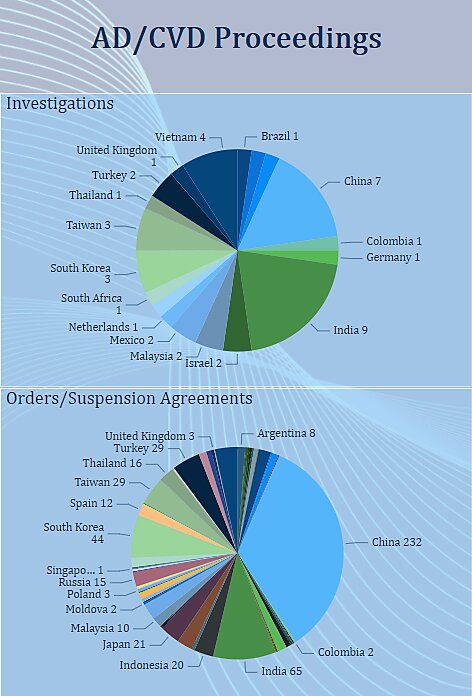

For starters, the case underscores the emptiness of trendy claims that the U.S. is some sort of tariff-free “neoliberal” paradise (or whatever). As new data from the World Trade Organization show, in fact, the United States is—by far—the world leader in the use of trade remedy protection, imposing by mid-2022 almost 22 percent of the world’s anti-dumping duty measures (506 total) …

… and a whopping 61.4 percent (178) of all global anti-subsidy (countervailing duty) measures:

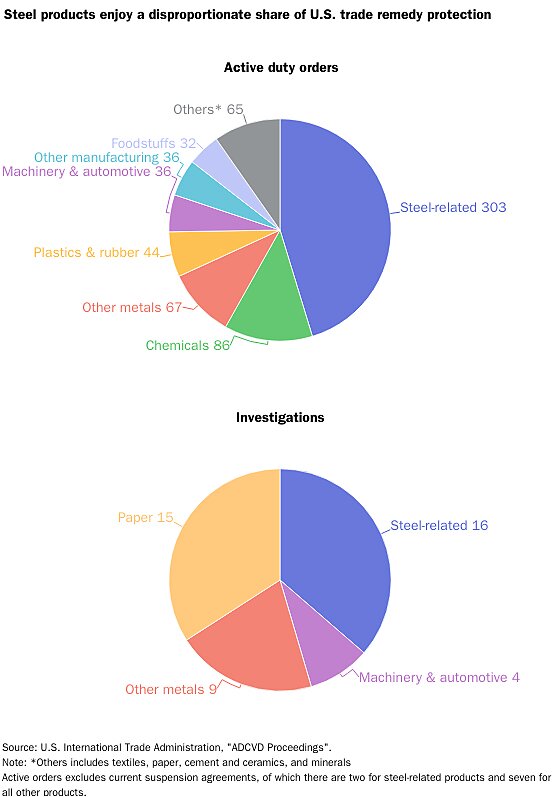

According to the Commerce Department, moreover, almost half of these duties (305) are on steel products like tinplate. In fact, we already have anti-dumping duties on tinplate from Japan, and those have been in place for more than 20 years—a true testament to the persistence (and absurdity) of this kind of protectionism. And there’s more in the works: Another 44 trade remedy investigations are now underway, 16 of which are also on steel products (nine on tinplate and seven on other stuff):

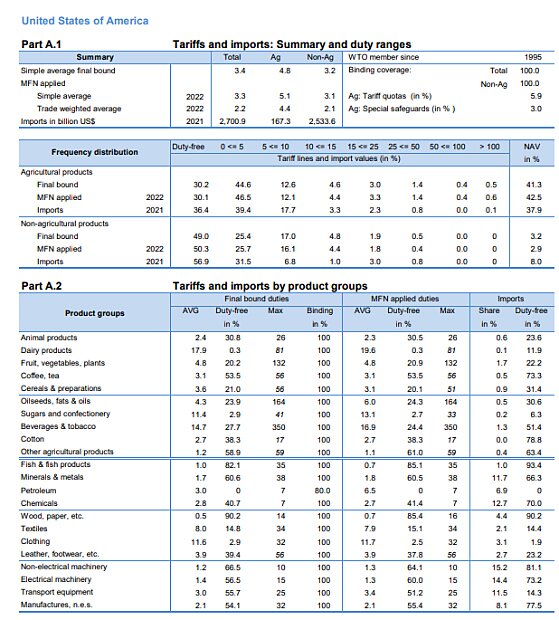

It’s also worth noting that, while average rates for “normal” U.S. tariffs are indeed relatively low, we still have (and had before Trump) these taxes on plenty of imports, especially food, clothing, and footwear. According to the latest WTO tariff profile of the United States, in fact, we apply tariffs to about 70 percent of all agricultural imports and about half of all non-agricultural imports. Most of these tariffs are low (below 5 percent), but a lot of them are much higher—especially for certain “politically sensitive” things like food, clothing, and footwear (click the link for more details).

Thus, even leaving aside all the other U.S. protectionism—the Jones Act, Buy American, regulatory barriers (like on baby formula)—even U.S. tariff policy isn’t the “free market fundamentalism” some would have you believe.

Tariffs Aren’t ‘Pro-Worker’ (or Pro-Manufacturing, Either)

The tinplate case also reveals the silliness of describing American protectionism as “pro-worker.” All American workers are also consumers, and research shows that they (we) pay the lion’s share of a tariff’s cost—whether in taxes paid to the Treasury or higher prices in the U.S. market. We’ve discussed this rather obvious conclusion several times now, but it was recently confirmed again in a March 2023 U.S. International Trade Commission (ITC) report on the Trump-era tariffs (steel/aluminum and China), as well as a new academic study on the China tariffs alone. In both cases, Americans—not foreign producers or governments—paid almost all the tariffs’ costs.

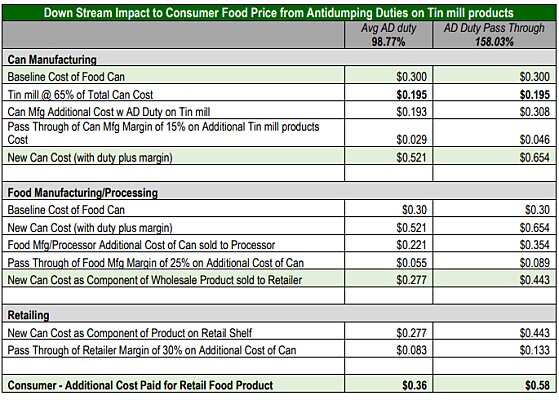

In the case of tinplate, some portion of new tariffs would inevitably be passed on to consumers via higher prices for canned goods—food, aerosol sprays, etc. According to one recent study, about 34 percent of the cost of a typical can of corn is the can itself, and tinplate accounts for most of the can’s cost. Thus, tariffs at the high rates requested by petitioners in the new tinplate investigations could increase the price of a can of food by 36 to 58 cents per can, or 19 to 30 percent.

This is, of course, a speculative exercise that depends on a lot of factors, including final tariff rates and domestic demand, but ample research and recent experience show that tariff-related price hikes are all but certain.

Consumer harms, however, aren’t limited to end users because most American businesses—and their workers—are consumers too. When tariffs raise their input costs, these companies typically respond by cutting other costs (jobs, investments, etc.) and/or by raising their prices. Sometimes, they openly admit it. Higher prices, in turn, can reduce the companies’ output (because consumers will buy less from them at the new, higher price). Thus, for example, that new U.S. ITC study found that each year between 2018 and 2021, Trump’s steel and aluminum tariffs caused approximately $3.4 billion in output losses for downstream U.S. manufacturers—$13.6 billion total over the period. Automotive, machinery, and cutlery companies were especially harmed. Even factoring in tariff-related gains for protected U.S. metals producers, we still ended up around $5 billion poorer on net through 2021. That damage continues today.

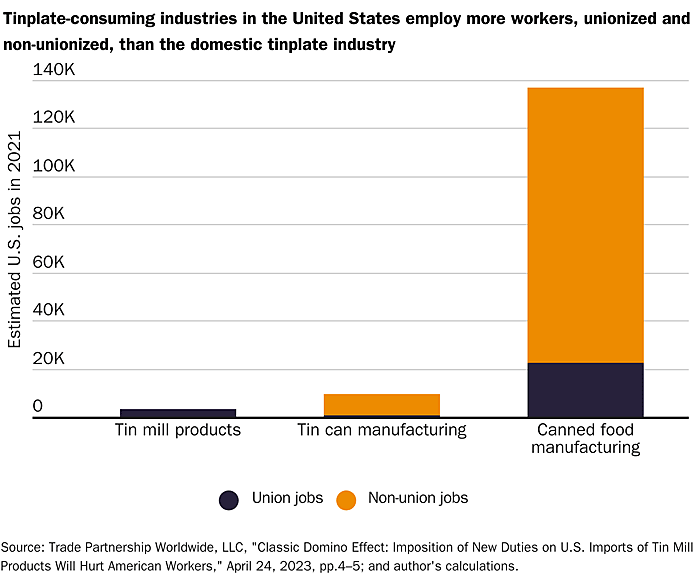

The same dynamics would be in play for new tinplate tariffs, threatening downstream U.S. manufacturers and their workers—workers who, by the way, outnumber upstream tinplate workers by an almost 45-to‑1 margin (approximately 147,000 to 3,300). The consumer companies even employ more than seven times as many unionized workers—about 23,350—as do tinplate producers (3,000), if you’re into that sort of thing.

Given these facts, it’s no surprise that a new Trade Partnership study estimates that high tariffs on tinplate and the resulting higher U.S. prices would hurt production at American tin can and processed food manufacturers, via reduced domestic demand and/or new competition from imports that aren’t hamstrung by similar tariffs. This lower output would, they estimate, also threaten the jobs of almost 40,000 U.S. workers, thousands of whom are themselves unionized. By contrast, the study estimates that the tariffs might create just a handful (66!) of upstream jobs at U.S. tinplate makers—in large part because these companies have expressly stated they have little interest in expanding domestic production capacity, and because certain types of tinplate are available only abroad (hence, all the imports). To put a human face on all of this number crunching, Virginia Sens. Mark Warner and Tim Kaine just wrote to Commerce Secretary Gina Raimondo warning that new tariffs could not only increase food prices but threaten a can facility in Roanoke, Virginia, which employs 130 of their constituents.

As always, protectionism isn’t “pro-worker”; it’s pro-some workers—at most other workers’ expense.

Tariffs Beget More Tariffs—and Requests for Special Exceptions

The Warner/Kaine letter and the tinplate cases more broadly also show how tariffs on manufacturing inputs not only harm other U.S. manufacturers but also lead to demands for even more protectionism or special exceptions from the pain. Here, U.S. “national security” (Section 232) tariffs on the stuff used to make tinplate (hot-rolled steel and “blackplate”) increased tinplate manufacturers’ costs and caused serious harm to the industry—harm that’s now being blamed on imports under investigation. The aforementioned ITC report, in fact, summarizes direct testimony from one tinplate company—Ohio Coatings—detailing the damage:

The imposition of [Section 232] trade remedies to restrict the import of tin mill blackplate—when domestic tin mill blackplate is undeniably in short supply—… has had the unintended consequence of actually reducing the American steel industry’s tin plate market share. During 2017, the year prior to imposition of Section 232 trade protection, the three domestic tinplate producers (U. S. Steel, ArcelorMittal, USA and OCC) supplied 60% of the America’s tinplate needs. The remaining 40% of the domestic tinplate market was split between several foreign producers. In 2022, U. S. Steel, Cleveland Cliffs and OCC will account for less than 40% of the American tin plate market. That precipitous loss of domestic market share is attributable in significant measure to the impact of the misapplication of Section 232 tariffs and quotas to imported blackplate, and the consequent reduction in OCC’s ability to fully participate in domestic tinplate production.

Instead of lobbying to repeal those tariffs, tinplate-maker Cleveland Cliffs and the steelworkers union just want more tariffs—“cascading protectionism” that we’ve seen repeatedly (for kegs and nails and oil pipe, for example) as a result of Trump’s (now Biden’s) metals tariffs. Other tinplate producers, meanwhile, have lined up to lobby the Commerce Department for exclusions from the Section 232 tariffs—3,364 times, in fact. That process, as you may recall, was found by the Commerce Department’s own inspector general to be “neither transparent nor objective” and giving off “the appearance of improper influence in decision‐making for tariff exclusion requests.” (Shocking, I know.)

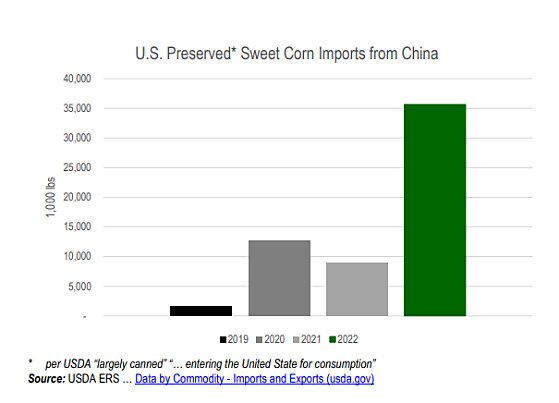

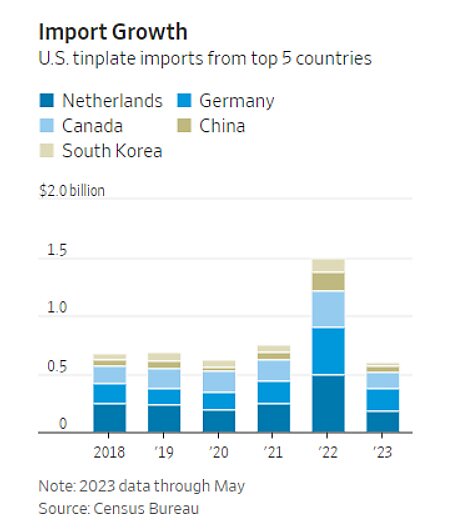

New duties on tinplate could cause the cascade to continue, as U.S. producers of cans and canned goods struggle to compete with overseas companies who aren’t hamstrung by high taxes on their main input. In fact, we’ve already seen some of this happening with the 232s, as U.S. producers report higher tin can imports and imports of canned foods—including from China—since metals tariffs started biting in 2018.

Tariffs Don’t Revive Industry—And Protected Companies Often Don’t Even Try

As the long and illustrious history of U.S. steel tariffs demonstrates, protectionism rarely produces a thriving domestic industry because protected companies have little incentive to invest in things (e.g., cost‐saving technologies) that would actually improve their productivity and long‐term competitiveness. In case after case, companies enjoying tariff-fueled price increases don’t plow their windfall profits back into the company and instead choose to pay out managers, debtors, and shareholders – and to lobby for more protection (or subsidies).

According to the Journal, the petitioners in the current tinplate investigations, Cleveland Cliffs and the United Steelworkers Union, say that tariffs will improve profitability and let companies expand capacity. But the company’s own words and actions show they’ll do nothing of the sort. In fact, they doubled tinplate prices despite steady costs in late 2021 and bragged to investors about a “meaningful, bigger [earnings] contribution from tinplate.” Then a year later, they explained that they’d used these profits not to expand capacity but to just pay off their 2020 acquisition of another tinplate producer.

As U.S. Steel, a tinplate producer that doesn’t support the new tariffs, told the Journal, and as a separate editorial reinforced, nobody is interested in expanding domestic tinplate capacity because of weak U.S. demand for the product and the possibility of earning fatter profits on other, higher-margin steel products. As a result, “domestic tin-mill production capacity is expected to be about 45% lower by the end of this year than in 2017,” and—far from causing those capacity closures—imports have helped fill the gap that such closures left in the U.S. market. New tariffs are thus quite plainly just a way for Cleveland Cliffs to goose tinplate prices and profits even more—at American consumers’ great expense.

Same as it ever was.

U.S. Tariff Policy Isn’t (Just) China Policy

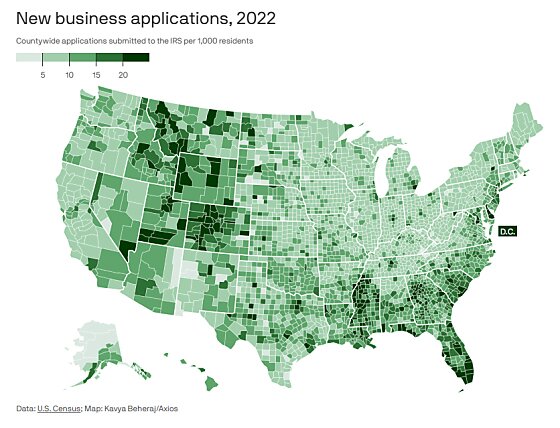

Finally, the tinplate case is yet another reminder that much of American protectionism has little to do with China, despite what its advocates would have you believe. Commerce Department data on trade remedy investigations and duties demonstrate this point, with China getting a lot of attention but other countries collectively getting even more:

For tinplate, in fact, China has been a relatively minor player in the U.S. market and continues to be so this year:

Yet the United Steelworkers’ press release cheering the continuation of the investigation coincidentally mentions only China by name—three times, in fact, in a seven-sentence statement. Such blame shifting is par for the protectionist course: Section 232, for example, was repeatedly touted as countering China, even though—thanks in large part to all those trade remedy duties—the country wasn’t even a top 10 supplier of steel to the United States before the tariffs were imposed. Much like with any tinplate tariffs, the 232 tariffs hurt mainly U.S. allies in Canada, Europe, and Asia (Japan and South Korea) instead.

Other U.S. tariffs are similarly misguided. For example:

Your Dumb US Trade Policy Fact of the Day™, via @EBGresser: the average rate of US tariffs paid in 2022 was higher for Bangladesh & Sri Lanka than for China (bc we tax the crud out of cheap clothes & shoes): https://t.co/4WhA8eAyFv pic.twitter.com/9XaDgzNtMc

— Scott Lincicome (@scottlincicome) July 12, 2023

As frustrating as this all is, it’s also a good reminder that the U.S. government could pursue plenty of meaningful tariff reforms without ever touching the China issue. (Spoiler: It won’t.)

Will Any of This Matter? (Maybe Not.)

While I applaud the Journal’s attention to the tinplate case, they misfire by framing the ultimate decision as one in President Biden’s hands. That’s because, as I’ve explained repeatedly, U.S. trade remedies law puts these cases on procedural autopilot and makes new duties extremely likely. Sure, there’s some methodological wiggle room here and there (e.g., on document production or final duty rates), but—as we saw recently with solar panels—simply terminating or even pausing these cases, even really dumb or damaging ones, takes extraordinary (and legally dubious) action from the president.

In fact, decades of congressional meddling and regulatory interpretation have ensured that much of what I’ve mentioned above can’t factor into the final agency decision to apply duties on these imports. The Commerce Department’s dumping calculations, for example, generate “dumping” in almost all cases, regardless of whether foreign producers are pricing below cost or have any predatory intent. The ITC’s “injury” determinations are a bit more intellectually honest, but even there the law generates an affirmative determination (and thus duties) where imports are increasing and simply a cause, not the principal cause, of injury to the domestic industry. The ITC is also barred by law from considering consumer harms, emergency situations, or the broader public interest. As an independent agency, moreover, the commission isn’t under the president’s thumb.

Given these realities, betting against new trade remedies duties is a surefire way to go broke. It can happen, but it’s rare, as the U.S. steel industry knows all too well. The facts here—increasing U.S. prices, insufficient domestic capacity, tinplate producers’ own statements and actions, pandemic-related disruptions, etc.—are so egregious that they might very well generate a negative ITC determination in a few months. If they don’t, however, the results will be a sad but unsurprising addition to the annals of American protectionism.

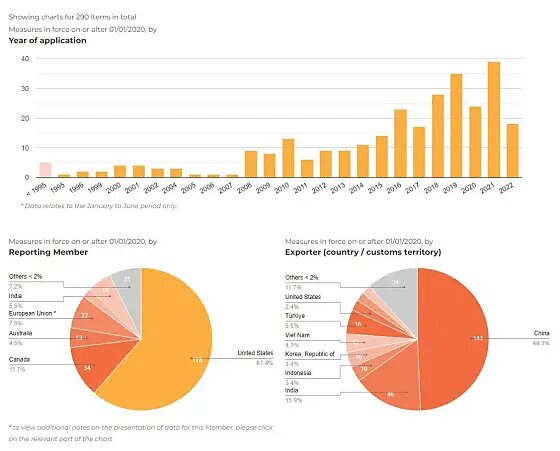

Chart of the Week