During the last few years an apparently new and revolutionary idea has emerged in economic policy circles in the United States: “Modern Monetary Theory” (MMT). The central tenet of this view is that it is possible to use expansive monetary policy — money creation by the central bank (i.e., the Federal Reserve) — to finance large fiscal deficits, and create a “jobs guarantee” program that will ensure full employment and good jobs for everyone.1 This view is related to Abba Lerner’s (1943) “functional finance” idea, and has become very popular in progressive spheres. According to MMT supporters, this policy would not result in crowding out of private investment, nor would it generate a public debt crisis or inflation outbursts.2

MMT runs against received wisdom among economists, and has been resisted by Keynesians and monetarists alike. Respected and influential academics such as Paul Krugman, Kenneth Rogoff, and Larry Summers, among others, have stated that MMT makes little sense. Krugman (2019b) has written that the principles behind MMT are “indefensible,” and that the arguments made by its supporters are “sophistry.” According to Rogoff (2019), MMT is “nonsense” based “on some fundamental misconceptions.” And Summers (2019) has contended that embracing “modern monetary theory is a recipe for disaster.”

MMT supporters have responded by saying that their critics don’t truly understand how modern monetary economies work. According to them, in countries with a currency of their own, governments don’t face a hard budget constraint; the government can always print additional money to pay for higher expenditures.3 According to Stephanie Kelton (2019), “The government budget is not like a household budget because the government prints its own money.” Along similar lines, Forstater and Mosler (2005) have argued that in a “fiat money” system the natural rate of interest is zero; the role of the monetary authority is to push the actual rate to zero, through the purchase of government securities. If long-term equilibrium interest rates are equal to zero, then r < g in growing economies — that is, the rate of interest is lower than the rate of growth of GDP — and there would be no explosion of government debt.4

MMT supporters have argued that, in order for these policies to work, the country in question does not need to have a “convertible currency”; all is needed is sovereign fiat money that economic agents have to use to pay taxes. Thus, MMT would still work in emerging countries with a currency of their own, including in many of the nations of Asia and Latin America. Wray (2015: 127–28) makes this point explicitly, when he writes:

The United States (and other developed nations to varying degrees) is special but all is not hopeless for the nations that are “less special.” To the extent that the domestic population must pay taxes and other obligations in the government’s currency, the government will be able to spend its own currency into circulation. And where the foreign demand for domestic currency assets is limited, there still is the possibility of nongovernment borrowing in foreign currency to promote economic development that will increase the ability to export.

MMT supporters have also posited that their policies would work best in countries that do not have a fixed exchange rate (Wray 2015: 124–29).

Efforts to evaluate the merits of MMT have run into two types of difficulties. First, there is no unified and generally accepted description of how the MMT model is supposed to work in detail. This is not due to a lack of publications. In fact, MMTers are prolific authors, and have published a large number of papers, pamphlets, and books, including some primers. However, these works contain very few (if any) equations or diagrams; MMT authors have generally avoided the language that, for better or for worse, has become dominant in scholarly conversations among professional economists.5 By doing this, MMTers have left themselves open to the criticism that their views and models lack clarity. According to Paul Krugman (2019a) MMT supporters “tend to be unclear about what exactly their differences with conventional views are, and also have a strong habit of dismissing out of hand any attempt to make sense of what they’re saying.”

A second difficulty in evaluating MMT is that its supporters have offered very little empirical evidence on how the policy would function, especially in the medium and longer run.6 Although some authors have argued that Japan during the last decade or so provides evidence that the approach works, most critics — including the governor of the Bank of Japan, Haruhiko Kuroda — disagree with that contention (Reynolds and Nobuhiro 2019). When discussing the applicability of MMT to the United States, Irwin (2019) has argued that it is important to have the policies first implemented in a small country, as an experiment. He wrote:

It would be nice to have some proof of concept before it is put in place in the largest economy in the world — also home to the world’s reserve currency… . It would be genuinely fascinating to watch a small country — with its own currency — govern itself according to the [MMT] theory’s principles… . If those smaller countries can work out the kinks of economic governance in an MMT world, and achieve a higher standard of living, maybe then scale it up to a midsize country?

It turns out that MMT — or some version of it — has been tried in a number of emerging countries. Although most cases have taken place in Latin America, there have also been episodes in other parts of the world, including in Turkey and Israel. MMT-type policies were also attempted in France during the Mitterrand presidency. Almost every one of the Latin American experiments with major central bank–financed fiscal expansions took place under populist regimes, and all of them ended up badly, with runaway inflation, huge currency devaluations, and precipitous real wage declines. In most of these episodes — Argentina, Bolivia, Brazil, Chile, Ecuador, Nicaragua, Peru, and Venezuela — policymakers used arguments similar to those made by MMTers to justify extensive use of money creation to finance very large increases in public expenditures.7

In this article, I analyze some of Latin America’s episodes with MMT-related policies and show that all these cases ended up in major macroeconomic disasters. The analysis uses the framework developed by Dornbusch and Edwards (1990, 1991) for studying macroeconomic populism. The rest of the article is organized as follows: First, I present the basic principles of Latin American populism and compare them to MMT. Next, I analyze three specific Latin American episodes with major central bank–financed fiscal expansions: Chile during President Salvador Allende’s socialist experiment (1970–73), Peru during the first Alan García presidency (1985–90), and Venezuela under Hugo Chávez and Nicolás Maduro (1998–present). These are the “cautionary tales” referred to in the title of this article. Finally, I provide some concluding remarks, including a brief discussion of MMTs weakest points.

Latin American Populism

Macroeconomic populism is usually defined as a set of policies aimed at redistributing income by running high fiscal deficits, financed through an expansive monetary policy.8

The Mechanics of Latin American Populism and MMT

In the language of textbook macroeconomics, these are policies where the government shifts simultaneously, and significantly, the IS and the LM curves.9 In every Latin American experience with populist policies the government granted wage increases — both public-sector and minimum wages — that exceeded significantly what was justified by improvements in productivity. Just as MMTers, populist politicians present heterodoxy as the solution to the nation’s ills, and in particular to the suffering of the middle and lower classes.10

For populists, one of the features of capitalist economies is the existence of substantial idle capacity. Thus, in their view, large and persistent fiscal deficits financed through money creation do not result in serious imbalances, high inflation, and, eventually, crises. For populists the contrary is true: large fiscal deficits expand demand and encourage output, allowing firms to exploit economies of scale and to use resources fully. For them the combination of large deficits with redistributive policies results in a decline in inflation. Populists tend to dismiss possible collapses in the demand for domestic money, and increases in the velocity of circulation; in this, their perspective is, again, very similar to that of MMT supporters.11

These views are clearly captured by the following quote from Daniel Carbonetto (1987: 82), the economist behind Alan García’s populist policies in Peru in the second half of the 1980s: “If it were necessary to summarize the strategy adopted by the government since August 1985 with two words, they are control (meaning control of prices and costs) and spend, transferring resources to the poor so that they increase consumption.” Carbonetto (1987: 83) then added that budget constraints had to be ignored: “It is necessary to spend, even at the cost of a large fiscal deficit, because, when this deficit transfers public resources to increase consumption of the poorest, they demand more goods and this will bring about a reduction in unit costs. Thus the deficit is not inflationary.”

This statement is very similar to what Stephanie Kelton, one of the most prominent supporters of MMT, stated: “The government budget is not like a household budget because the government prints its own money” (Walsh 2018). It is also similar to what Wray (2015: 104) writes in his primer on MMT: “The following statements do not apply to a sovereign currency issuing government… . Governments have a budget constraint … Government deficits drive interest rates up, crowd out the private sector, and lead to inflation.”

In addition to rejecting fiscal balance and sound monetary policy, Latin American populists reject markets, competition, and globalization. They believe in price and exchange controls, high minimum wages, high import tariffs, and large subsidies, mostly for food and public transportation. They support state-owned enterprises and favor nationalizing large multinationals (often associated with natural resources, such as oil and mining). In some instances, Latin American populists have borrowed from Marxist ideology, as was the case with Hugo Chávez’s “socialism of the 21st century” program.12

It would be a mistake, however, to believe that populists “like” or “favor” inflation. They don’t. In fact, before taking power, populist politicians usually declare that one of their fundamental objectives is to reduce or eliminate inflation. They state that price increases benefit large monopolistic firms and hurt the working class. For instance, in Chile, the Unidad Popular electoral platform of 1970 stated that a main goal of the “popular government” was to achieve “price stability.“13 In speech after speech President Salvador Allende pointed out that price controls would play a key role in defeating inflation.14 Even though the quantity of money increased by 124 percent during his first year in office, he did not see that as a problem. On the contrary, for him monetary expansion played a key role in helping finance Chile’s move toward Socialism.15 MMT supporters also assert that one of their main goals is to achieve price stability. According to Wray (2015: 244), “MMTers fear inflation… . Indeed, price stability has always been one of the two key missions of [the MMT approach].”

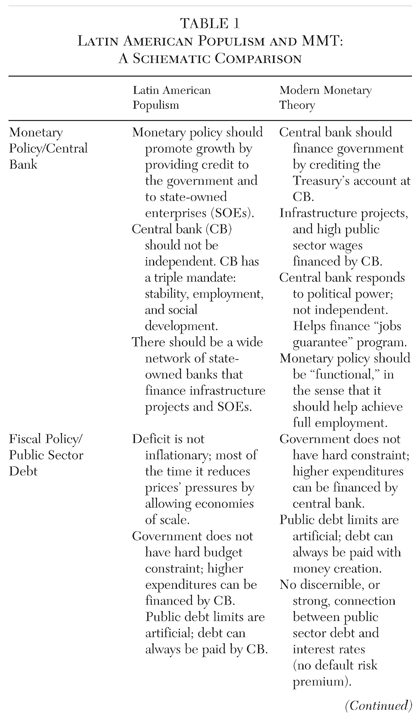

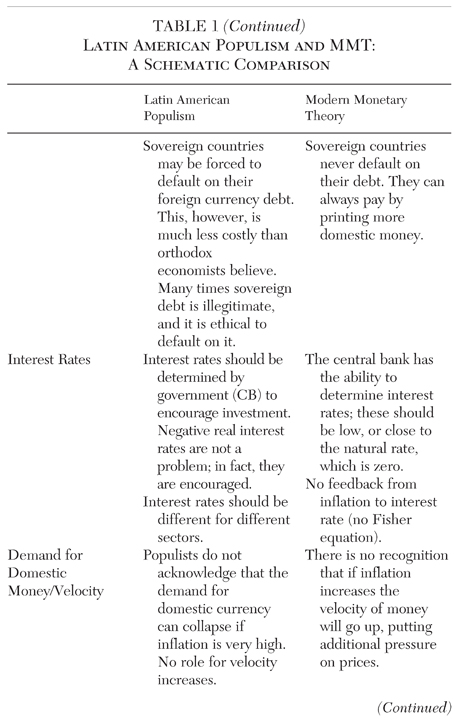

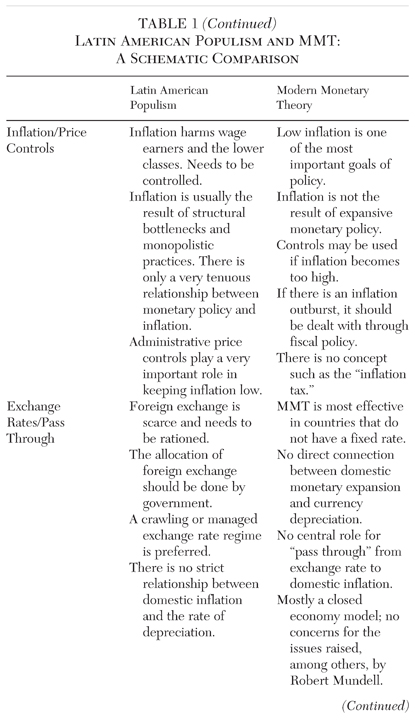

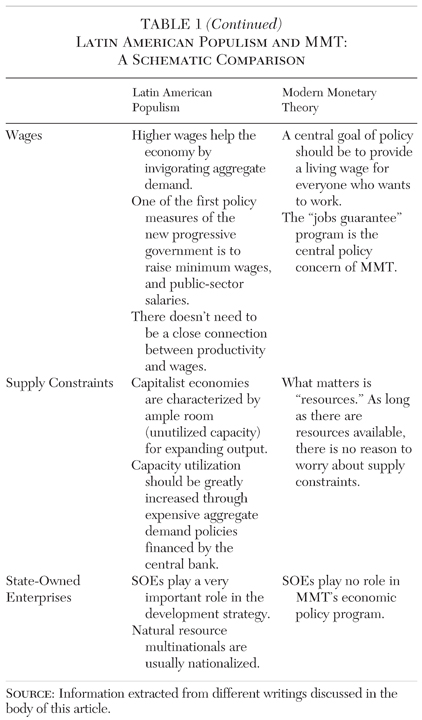

In sum, there are a number of coincidences between the policy recommendations (and actions) of Latin American populists and MMT supporters. In order to further organize the discussion, Table 1 presents a systematic comparison of both perspectives on a number of key policies.

The Four Phases of Latin American Populism

Most macroeconomic populist experiments go through four distinct phases that span from euphoria to collapse. The length of the cycle depends on a number of factors, including the evolution of the terms of trade, political institutions, the availability of foreign financing by friendly nations, and the degree of political repression.16 In the vast majority of Latin American populist episodes, the leader comes to power after a major crisis. In many cases, the IMF has been called to bring order into the economy. In every case, the IMF imposed an “austerity-based” adjustment program, which exacerbated the sense of frustration among the country’s citizens, and in particular among the middle and lower classes. Although a structurally unequal distribution of income is not a requirement for the emergence of populism, populist rhetoric is more attractive in countries with significant income disparities, or in countries where inequality has increased during the immediate past (Edwards 2010: chap. 1).

Dornbusch and Edwards (1991) identify the following four phases of populism.

Phase 1. Policies very similar to those espoused by MMT are first put in place. Government expenditures increase rapidly, and massive income transfers are implemented. Public-sector wages and minimum wages are raised, and large public-sector investment projects enacted. These policies are financed by a combination of easy money that flows from the central bank, and foreign resources that come from the country’s international reserves. During this early phase growth and wages increase, and the populist views appear to be vindicated. The populist leader repeatedly makes the point that orthodox economics and its supporters are wrong.

Phase 2. The consequences of the overly expansive heterodox policies begin to show up, and bottlenecks and imbalances emerge. Foreign exchange becomes scarce and there is significant pressure for the currency to depreciate rapidly. Exchange controls are introduced — France under Mitterrand, in 1984, is a good example of this development from outside of Latin America. In some cases, traditional exports are taxed. In spite of these measures, prices continue to rise. The populist response is to decree generalized price controls. Unions ask for higher salaries, and indexation practices are adopted. The central bank continues to lend vast amounts to the public sector, helping maintain the experiment. The economy enters into an inflationary spiral. A black market for necessities, and a parallel market for foreign exchange, usually appears.

Phase 3. There is a deepening of imbalances and inflation accelerates, generally moving to the three- or four-digit terrain. “Fiscal dominance” becomes more acute, as the central bank continues to finance the government. The frequency of price adjustments, through indexation, increases — first to quarterly and then to monthly intervals. Pervasive indexation tends to worsen the fiscal accounts through the so-called Olivera-Tanzi effect. Government expenditures increase according to the indexation formula, while tax revenues are collected based on lagged income figures. Consumers ditch domestic money, and foreign exchange becomes the medium of exchange. However, since the government requires that taxes be paid in domestic currency, the local monies (pesos, soles, escudos, bolívares, and córdobas) do not disappear completely. Demand for domestic money, however, falls very rapidly, with velocity of circulation increasing significantly. The disparity between inflation (very high) and exchange rates (depreciating more slowly) intensifies the extent of real exchange rate overvaluation.17

Phase 4. The populist regime is finally replaced. The new post-populism government faces a very fragile economy and frequently a mess. Inflation is usually (very) high, international reserves are non-existent, exports are at an all-time low, the government debt is in default, and the real economy is replete with distortions. When the new government comes into power, real incomes and wages are often below what they were at the beginning of the experiment.

Three Populist Episodes in Latin America: Lessons for MMT Supporters

In this section I analyze three of Latin America’s best known populist episodes: Chile during Salvador Allende’s socialist experiment from 1970 through 1973, Peru during the first Alan García administration (1985–90), and Venezuela during the Hugo Chávez and Nicolás Maduro governments (1998–present). Although each of these cases is unique, the three of them share the populist pattern discussed above, and followed policies similar to those espoused by MMT. Also, the three of them ended up in major crises. The case of Chile is possibly the most dramatic one, as the experiment with populist-socialist policies of President Salvador Allende ended up in a violent coup that was followed by a 17-year dictatorship. In Chile, inflation exceeded 500 percent in 1973. In both Peru and Venezuela, the central bank–financed fiscal expansions ended up in hyperinflation. In Peru the rate of inflation peaked at almost 8,000 percent, and the International Monetary Fund has forecasted that inflation in Venezuela will be almost 1 million percent by the end of 2019.18

The three countries studied in this section had a sovereign currency, and thus could (and did) follow the type of policies recommended by MMT economists. In addition, in all cases the exchange rate was not strictly fixed; the price of foreign currency was adjusted frequently (in some cases daily) through a crawling rate regime or a “dirty float” system.19 In every one of the episodes, exchange controls of one type or another were eventually put in place in an effort to slow down currency depreciation (Edwards 2010).

I begin the discussion by presenting data on economic growth. I then discuss the expansion of public sector expenditures financed by central bank money creation, and the resulting inflation outbursts. The section ends with an analysis of the evolution of social conditions. I show that in the three cases, when the populist regime was replaced, real wages were lower than when the populist leader took over.

Growth and Populism Phases

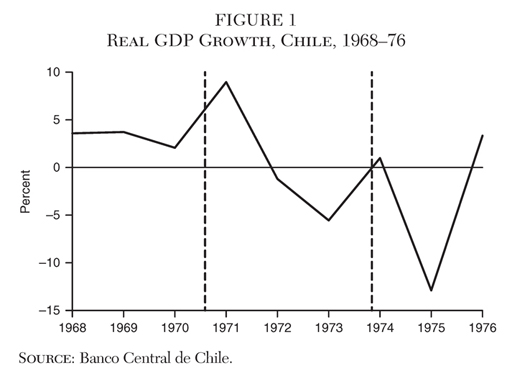

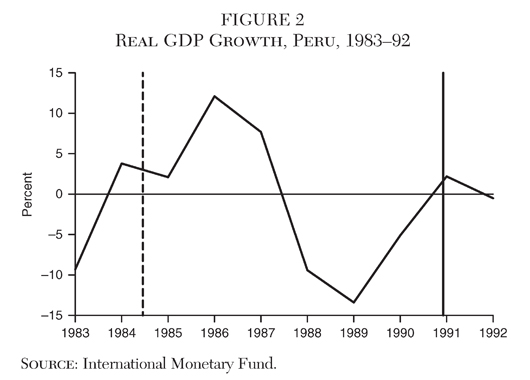

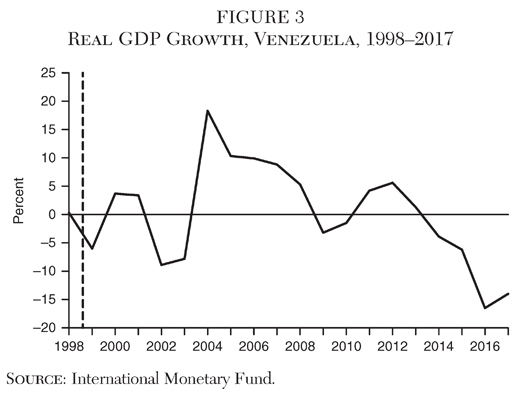

In Figures 1–3, I present data on GDP growth for the three episodes. There are two dashed vertical lines in these graphs. The first one corresponds to the initial year of the populist episode; the second one refers to the first year of the post-populist regime. The similarities across cases are quite remarkable; the different phases of populist experiments are easy to detect in each one of these figures.

• In the three episodes it is possible to see that the initial conditions are characterized by either very low or negative growth. As noted, these depressed circumstances give the populist leader the opportunity to present his/her nationalistic, anti-globalization and anti-elite program, and to get to power. In Chile, growth in 1970 was 2 percent, which meant that per capita growth was slightly negative.20 In Peru, there was an IMF program at the time Alan García was inaugurated. Economic conditions were also negatively affected by the El Niño climatic phenomenon, which resulted in some of the worst flooding in the country’s history.21 In Venezuela, growth was negative the year Chávez won the elections. Depressed initial conditions in Venezuela were the result of a succession of failed adjustment programs — some supported by the IMF — and a decline in the price of oil. Memories of the repression and deaths during the Caracazo demonstrations and riots also contributed to the support of Hugo Chávez and his program (Edwards 2010).

• As may be seen from these figures, Phase 1, with its booming growth, follows the launching of the populist programs. In Chile the economy grew at an impressive 9 percent during the first year of President Salvador Allende’s Unidad Popular government. Peru saw its GDP growth jump to 12 percent in 1986, one year after Alan García’s election. In Venezuela there was also important GDP recovery after the accession to power of the new leader. In Venezuela it is possible to detect the negative effect of the global financial crisis of 2008-09. However, there is a recovery, and the good times continued for a few additional years. In Venezuela, the positive-growth phase (Phase 1) was rather longer than usual. This was thanks to very positive terms of trade; the prices of oil and soybeans were very high during the early years of this episode (Edwards 2019).

• Eventually, in every one of the three countries, the day of reckoning arrives, and Phase 3, with the collapse in growth, becomes a reality. As may be seen, in Chile there was negative growth in 1972, the second year of the Allende administration. In Peru growth was negative 9 percent in 1989, toward the end of the Alan García presidency. In Venezuela the economy collapsed in 2014. During Phase 4 the new postpopulist government had to put in place policies aimed at reducing inflation and reigniting growth.

Monetary Policy, Fiscal Imbalances, and Inflation

As noted, in all of these episodes there were massive fiscal expansions financed by money creation by the central bank. In Chile, the Unidad Popular government also nationalized the banking sector, as a way to facilitate the flow of credit to newly nationalized companies and major public infrastructure projects. In Peru, President Alan García tried to follow Allende’s footsteps and nationalize the banking and financial sectors. However, there was a massive popular opposition, and, after weeks of protests led by novelist and future Nobel Prize winner Mario Vargas Llosa, the government gave up on the attempt (Larraín and Meller 1991; Edwards and Edwards 1991). In Venezuela, the central bank came under significant political pressure, and in the early years of the Chávez administration its degree of independence was greatly reduced. During the populist experiment, the central bank’s main goal was to help the government achieve its political and social development goals (Carrière-Swallow et. al. 2016).

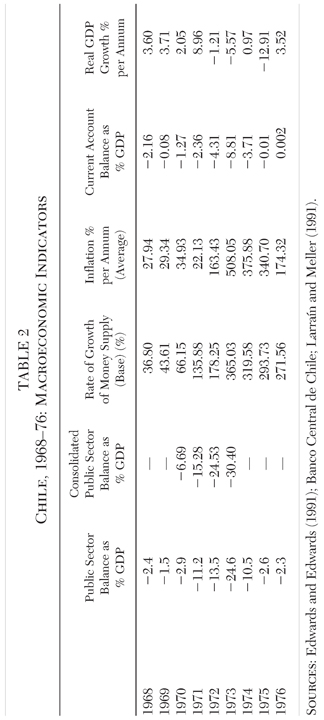

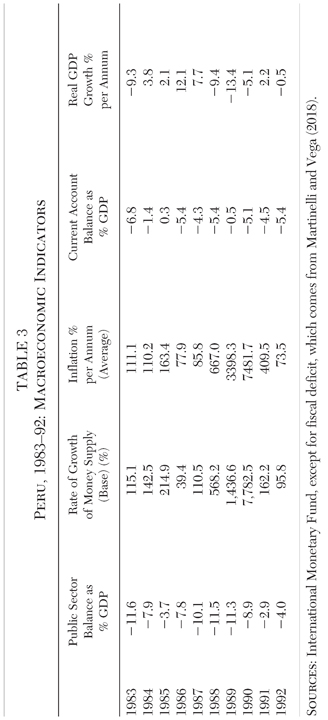

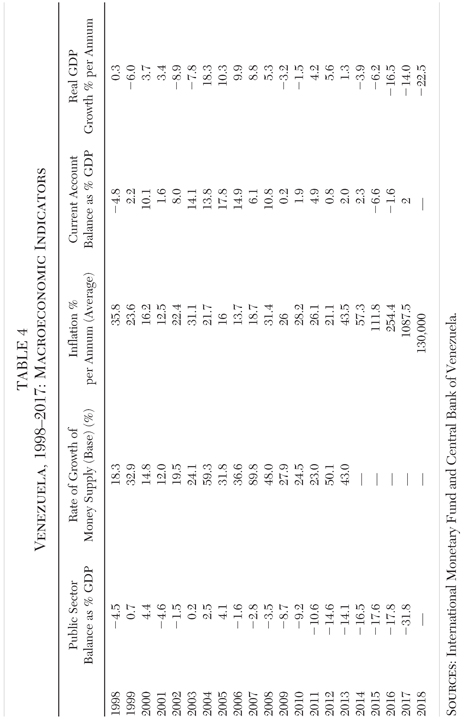

In Tables 2 through 4, I present data on a number of key macroeconomic variables: public sector balance as percentage of GDP, rate of growth of the monetary base, annual inflation rate, current account balance over GDP, and real GDP growth. In addition to the boom and bust dynamics of growth already discussed, several results stand out from these tables.

Fiscal Expansion. In all cases the fiscal deficit becomes very large during the episode. In two of the cases (Chile and Peru), a large imbalance develops immediately after the populist leader takes over. In Venezuela, it takes some time for the deficits to explode, but eventually it does happen. This delay is due to the extraordinarily high export prices during the early years of this experiment (Edwards 2019).

In the case of Chile, I present two series for fiscal balance. The first one refers to the central government accounts, and shows that in 1973, the last year of the Allende administration, the deficit was almost 25 percent of GDP. The next column presents data for the “consolidated public sector” for 1970–73, and includes state-owned enterprises. As may be seen, in 1973 this measure of the deficit reached an astonishing 30 percent of GDP.

In Peru, in 1983, two years before Alan García got to power, there was a huge deficit: 11.6 percent of GDP (Table 3). In 1984, President Fernando Belaúnde decided to call in the IMF, and an orthodox stabilization program was put in place. The data in Table 3 show that between 1983 and 1985 there was a draconian fiscal adjustment that amounted to 8 percent of GDP. This drastic fiscal correction generated a substantial jump in unemployment and a precipitous decline in real wages — 39 percent between 1982 and 1985 — and paved the way to Alan García’s electoral success in 1985. One of the first measures taken by García was to suspend the IMF program and to go back to very expansive fiscal policies. As may be seen in Table 3, in Peru the deficit exceeded 10 percent of GDP in 1987, 1988, and 1989. In 1990 it was slightly down to 8 percent of GDP. Throughout these years it was mostly financed by money creation by the central bank (Martinelli and Vega 2018).

The picture for Venezuela, in Table 4, shows that during the early years of the Chávez administration the public sector ran a surplus. With the exceptions of 1998 and 2001, and thanks to a very high international price of oil, the early years of the Bolivarian Revolution were characterized by (relatively) balanced public-sector finances. However, the fiscal deficit surpassed the 3 percent of GDP mark in 2008, and from that point onward increased markedly every year, reaching a remarkable 31 percent of GDP in 2017. The initial fiscal imbalance in 2008-10 coincided with a sharp decline in oil prices in the global marketplace. However, when oil prices recovered in 2011, Venezuela made no attempt to adjust public finances. The decision was made to finance the deficit with money created by the central bank. In 2017 the deficit reached almost 32 percent of GDP, even higher than the consolidated fiscal deficits for Chile in the last year of the Allende administration.

Money Supply Growth. The data in these tables show a clear connection between the eruption of very large fiscal deficits and a jump in the rate of growth of the money supply. This, of course, reflects the fact that in every one of these cases the central bank financed the expansion of public expenditures through the purchase of government debt. This was a deliberate component of these populist economic programs. This is illustrated by the following quote from García (1972: 102, 104), one of the economists behind President Salvador Allende’s economic program in Chile: “[The policy] was based on the simultaneous control of prices, wage increases, and increase in the public sector deficit… . [M]onetary and credit policy provided the financing for fiscal expansion and the deficit.“22 In Venezuela, the chairman of the Finance Committee of the National Assembly declared in 2010 that the central bank’s role was to finance the government. “It should support the development and social program approved [by the government]” (America Economía 2010). It is precisely this close relationship between fiscal deficits and money creation that makes these episodes particularly germane to the debate on the merits and prospects of MMT.

Inflation. The data in these tables show that inflation was, eventually, extremely high in the four episodes. In Chile it surpassed 500 percent in 1973; in Peru, it reached hyperinflation levels — it exceeded 7,000 percent in 1990 — and in Venezuela it surpassed 130,000 percent in 2018. The IMF expects inflation in Venezuela to reach the 1,000,000 percent annual mark in 2019. As noted earlier, very high inflation feeds back into the fiscal deficit through the Tanzi-Olivera effect. When inflation is very high, indexation tends to become generalized, and wages are adjusted at increasingly shorter intervals. This means that the government wage bill — which in all of these countries was very substantial — increased rapidly, while taxes were assessed and paid based on lagged (and much lower) prices. In all of these cases a collapse in the demand for domestic money (or an increase in velocity) contributed significantly to the explosion of inflation. In Chile, for example, velocity in 1973, at the end of the Allende government, was 24 “times” per year, which was two times higher than the historical pre-Allende average of 12 times.23 Interestingly, during the last decade, velocity in Chile has been around 3 times.

One of the most serious weaknesses of MMT is that it ignores the role played by the demand for money in macroeconomic outcomes. Economists have known for a long time that, as Patinkin (1965) masterfully emphasized, what matters is the excess supply (demand) in different markets. In his MMT Primer, Wray (2015: 254) declares that he is surprised by the notion that during a hyperinflation economic agents reduce their holdings of domestic money to a minimum. The absence of a prominent role for the demand for money (and changes in velocity) in the theoretical construct of MMT is, indeed, surprising. In Chapter 13 of the General Theory, Keynes explains that people hold money for three motives: transactions-motive, precautionary-motive, and speculative-motives (Keynes 1936: 168). He further argues that the demand for money (or liquidity preference) is a function of the rate of interest. He explicitly writes M = L(r). Economists have known, since at least Irving Fisher, that higher inflation results in higher r. Thus, a rapid increase in inflation will generate a greater excess supply for money, which will be mirrored by an excess demand for goods and bonds (here I am following Patinkin’s analysis); the excess demand for goods, in turn, will put pressure on prices. MMTers believe that because taxes have to be paid in domestic currency the demand for local money cannot decline precipitously. The experiences of the three countries discussed here show that this is not the case. Indeed, and as a large number of economists have pointed out throughout history, when the value of the local currency erodes quickly, holdings of it are reduced to a minimum and velocity increases rapidly.

External Balance. The data in these tables show that current account deficits were not very large. In fact, in Venezuela there are surpluses until 2014. This absence of major external imbalances was due to a combination of factors, including the high price of exports in Venezuela during most of the episodes, and the difficulty, in the three cases, of finding international sources of financing. One of the realities of most populist regimes is that capital flows reverse soon after investors realize that the policy stance is inconsistent.24 Once the country runs out of international reserves its currency depreciates at an increasingly rapid pace. Depreciation is passed through to prices, making the inflationary problem more acute. This external constraint, which is particularly important for countries with nonconvertible currencies — the type of country that Wray (2015: 127) calls “less special” — is either ignored or minimized by MMT supporters. Wray (2015: 286), for example, writes that a country with its own nonconvertible currency “cannot be forced into involuntary default on its obligations denominated in its own currency. It can ‘afford’ to buy anything for sale that is priced in its own currency. It might be able to buy things for sale in foreign currency by offering up its own currency in exchange — but that is not certain.”

The data presented above show that the duration of the three episodes is different. Chile’s Unidad Popular government lasted only three years. On September 11, 1973, president Salvador Allende was overthrown by a violent coup led by General Augusto Pinochet. The Peruvian experiment lasted five years; and in Venezuela it is still going on after two decades. There are political and economic reasons for these disparities. The most important economic factors are the external environment and export prices. The Allende government was affected by a sharp decline in the price of copper. During the Peruvian experiment, the international price of fishmeal, Peru’s main export, fell from USD 1,024 per metric ton in the third quarter of 1983, to USD 614 per metric ton in the first quarter in 1989, a decline of 40 percent. Chile and Peru contrast markedly with the case of Venezuela. The price of crude oil, Venezuela’s main export, jumped from USD 20 per barrel in 2002 to USD 130 in 2008.From a political point of view there are two main reasons behind the longer duration of more recent episodes. First, since the 1990s, new constitutions approved in a number of Latin American countries — Colombia, Venezuela, Ecuador, Bolivia, and Nicaragua — have made it is easier for the head of state to be reelected for multiple periods in office.25 Second, in some of these experiments — most notably in Venezuela and Nicaragua — the political regime became increasingly authoritarian and resorted to repressive tactics in order to suppress political dissent. Human rights organizations, such as Amnesty International, decried these practices.26

Real Wages and Exchange Rates

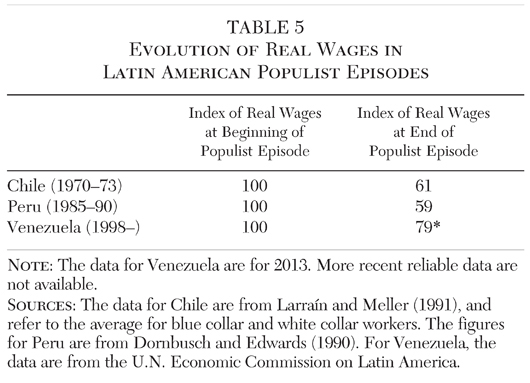

An important question is what happened to real wages during these episodes. The answer is summarized in Table 5. As may be seen, in the three cases there were steep declines. In Chile, average real wages fell by 39 percent between 1970 and 1973. In Peru real wages went down by 41 percent between 1985 and 1989. In Venezuela real wages declined 21 percent between 1999 and 2013; more recent reliable data are not available, but given the hyperinflation and generalized black markets for almost every item, including food and medicines, most experts have argued that there has been further precipitous deterioration.

In all of these cases there were also very severe currency devaluations. In Chile, for example, the peso lost 93 percent of its value in 1973 alone, and the price of the foreign exchange increased at a three-digit pace until 1977. In Peru the price of foreign currency jumped by more than 8,000 percent in 1989–90. In 1991, there was a need to introduce a new currency, with fewer zeros. In Venezuela the loss of value of the Bolivar has been absolute, and the government has tried to introduce a new cryptocurrency that would replace it. In all cases currency depreciation helped fuel inflation by putting upward pressure on the price of tradables. Interestingly, this regularity of Latin American experiments is not considered a serious problem by MMTers. In their writings MMT theorists mostly ignore issues related to exchange rate “pass through,” a question that has been at the forefront of studies on macroeconomic policy and inflation in open economies for many decades.

Conclusion

A full assessment of the weaknesses of MMT is beyond the scope of this article. However, the fact that, as documented in Table 1, most of its policy recommendations are similar to those of Latin American populists should be a cause for concern to observers of the global economy. As pointed out, the easiest way to think conceptually about MMT is that it suggests policies that simultaneously shift the IS and LM curves to the right. Of course, that is a possibility that all undergraduate students of macroeconomics, at one point or another, contemplate as a theoretical possibility. Although that policy mix — expansive fiscal and monetary policies — may seem attractive to the novice, it is full of dangers that have been identified through the years by successive scholars. Such policies are not only likely to generate inflationary pressures once aggregate demand exceeds supply constraints, but they are also expected to generate higher interest rates. In addition, it is highly probable that they will result in a higher risk premium and in currency depreciation. The latter will be passed through to prices, further fueling inflation.

The fact that, by law, taxes have to be paid with local currency — a point emphasized time and again by MMT supporters, on the basis of work done by German economist G. F. Knapp in 1904 — does not mean that the demand for local currency is insensitive to rapid losses in value. Indeed, as the histories of the countries analyzed in this article show, once inflation reaches a certain threshold there is usually a rapid collapse in the demand for cash and bank deposits, or what economists know as M1.

Some may argue that I deliberately picked the worst possible cases in Latin America to illustrate the shortcomings of MMT, episodes where macroeconomic excesses were the order of the day. However, this is not so. As is documented in the volume by Dornbusch and Edwards (1991), similar experiments in Argentina, Bolivia, Ecuador, Mexico, Nicaragua, and Uruguay led to very similar results — namely, runaway inflation, currency depreciation, income collapse, and lower wages. More recently, similar policies have been tried in Argentina (again) and in Ecuador; the pattern discussed in this article was, not surprisingly, present in those cases (Edwards 2019). Experience with these types of policies outside of Latin America, in places such as Turkey, Israel, and France during the Mitterrand administration, also ended up badly.

A short and partial list of limitations of MMT would include the following:

• There is no serious attempt to integrate different markets and sectors into a general equilibrium macroeconomic perspective, in the tradition of Patinkin (1965). More specifically, MMT fails to recognize that what really matters are excess demands or excess supplies in specific markets, which spill over (with the opposite sign) to the rest of the economy. Indeed, it is important to realize that situations of sizable excess supplies of money, which are translated into excess demands for bonds and goods, may arise because of the collapse of the demand for domestic money.

• MMT ignores (or minimizes) the role of expectations on interest rates. As is well established by empirical research, expected inflation is translated into higher interest rates through the so-called Fisher effect. In addition, MMT ignores the role of expectations of currency depreciation and of credit events. MMT supporters repeatedly make the point that countries with a currency of their own don’t ever have to default on their debts, as long as they are denominated in local currency. What this perspective ignores is that hyperinflation — the outcome of many MMT-type policies — is a form of default. In Argentina, for example, there is even a term used for this mechanism for not paying the sovereign debt as initially contracted — “liquefying the debt” (Edwards 2010).

• MMT, essentially, offers a closed economy view of the world. This is the case even though a number of MMT authors have written about exchange rate regimes. As noted, a straightforward way of interpreting MMT is as a policy mix that simultaneously shifts to the right the IS and LM curves. Of course, open economy models of that vintage include, since at least the work of Robert Mundell, a third schedule, often called the FF curve, which captures the combination of interest rates and income compatible with external balance. Every time a domestic policy moves the economy away from the FF curve there will be a currency depreciation or appreciation to reestablish external equilibrium. A well-established empirical fact in international economics is that currency depreciation tends to be passed onto prices. The extent of this transmission is an empirical question and varies from country to country. MMTers, however, minimize (or ignore) this mechanism.

• MMT does not delve into the intricacies of modern financial markets. Among other things there is no inkling of portfolio decisions by investors and households, or how those tend to affect the way in which policies interact with the key economic variables. More specifically, there is no role for risk premium in these models. In MMT conceptual models interest rates are determined in the simplest possible way by the central bank. There is no theory of the term structure of interest rates or of the transmission mechanism of monetary policy. There is no consideration for the fact that the demand for sovereign debt may shift as a result of changes in expectations.

• MMT ignores the strategic interaction of different economic agents and institutions in a modern economy. No game theory considerations are included in these models. There is no discussion about credibility or lack thereof. In MMT models there is no reason why a central bank may want to be independent of political forces. However, the evidence stemming from Latin America indicates that as soon as central bank independence is weakened, and the central bank begins to work for the government, inflation expectations take off, as does inflation proper.

• MMT supporters believe that supply constraints are soft. Increases in aggregate demand will usually be accommodated by increases in output. In addition, MMT believes that large current account deficits are beneficial, because the rest of the world is willing to provide real resources in exchange for IOUs. At the core of these beliefs is the notion that economic authorities can fine-tune macroeconomic policy — that is, it is possible for the central bank to finance large increases in government expenditure and still keep things under control. If there is a threshold beyond which it is advisable to increase aggregate demand, policymakers will recognize it. They will stop just short of it, and, if necessary, will implement a restrictive fiscal policy. The experiences of the Latin American countries discussed in this article (and of other cases) indicate that that type of fine-tuning is extremely difficult, and that, once politicians capture the central bank, they will continue to use its money creation authority well past that threshold.

The historical episodes presented in this article provide a clear cautionary tale for MMT enthusiasts. New York Times reporter Neil Irwin asked to see some evidence on how MMT-type policies worked in small countries. The stories presented here show that, in a variety of Latin American countries over the period 1970–2019, things did not turnout as policymakers who followed MMT-type policies had promised. It is true that these countries are not like the United States, the United Kingdom, or Australia. Their currencies were not fully convertible; they were what MMTers call “less special” countries. But according to their own writings, these countries still could benefit from money-financed fiscal expansions. The historical record shows that they did not.

References

Acemoglu, D.; Egorov, G.; and Sonin, K. (2013) “A Political Theory of Populism.” Quarterly Journal of Economics 128 (2): 771–805.

Allende, S. (1989) “Obras escogidas: 1970–1973.” Editorial Crítica 205.

America Economía (2010) “The Central Bank of Venezuela Can Finance the Government” (March 25). Available at www.americaeconomia.com/politica-sociedad/politica/banco-central-de-venezuela-podria-financiar-al-gobierno.

Amnesty International (2018) Amnesty International Report 2017/18: The State of the World’s Human Rights. London: Amnesty International.

Carbonetto, D. (1987) “Marco teórico de un modelo de consistencia macroeconómica de corto plazo.” In D. Carbonetto (ed.), Un modelo económico heterodoxo: El caso peruano. Lima, Peru: Instituto Nacional de Planificación.

Carrière-Swallow, Y.; Jacome, L.; Magud, N. E.; and Werner, A. M. (2016) Central Banking in Latin America: The Way Forward. Washington: International Monetary Fund.

Conniff, M. L. (1982) Latin American Populism in Comparative Perspective. Albuquerque: University of New Mexico Press.

Cowan, K.; De Gregorio, J.; Micco, A.; and Neilson, C. (2008) “Financial Diversification, Sudden Stops, and Sudden Starts.” In K. Cowan, S. Edwards, and R. O. Valdés (eds.), Current Account and External Financing, 159–94. Santiago, Chile: Central Bank of Chile.

Díaz, J.; Lüders, R.; and Wagner, G. (2010). “La república en cifras.” EH Clio Lab-Iniciativa Científica Milenio. Available at www.economia.puc.cl/cliolab.

Dornbusch, R., and Edwards, S. (1990) “The Macroeconomics of Populism in Latin America.” Journal of Development Economics 32 (2): 247–77.

__________ (1991) The Macroeconomics of Populism in Latin America. Chicago: University of Chicago Press.

Edwards, S. (2004) “Financial Openness, Sudden Stops, and Current-Account Reversals.” American Economic Review 94 (2): 59–64.

__________ (2010) Left Behind: Latin America and the False Promise of Populism. Chicago: University of Chicago Press.

__________ (2019) “On Populism, Old and New: Lessons from Latin America.” Working Paper, UCLA.

Edwards, S., and Edwards, A. C. (1991) Monetarism and Liberalization: The Chilean Experiment. Chicago: University of Chicago Press.

Eichengreen, B. (2018) The Populist Temptation: Economic Grievance and Political Reaction in the Modern Era. New York: Oxford University Press.

Forstater, M., and Mosler, W. (2005) “The Natural Rate of Interest Is Zero.” Journal of Economic Issues 39 (2): 535–42.

Frenkel, R. (2006) “An Alternative to Inflation Targeting in Latin America: Macroeconomic Policies Focused on Employment.” Journal of Post Keynesian Economics 28 (4): 573–91.

García, N. (1972) “La coyuntura económica en 1971.” In La economía chilena en 1971. Santiago: Instituto de Economía, Universidad de Chile.

Irwin, N. (2019) “How About We Try Modern Monetary Theory in a Small Country First?” New York Times (March 7).

Kelton, S. (2019) “Modern Monetary Theory Is Not a Recipe for Doom.” Bloomberg (February 21).

Keynes, J. M. (1930) A Treatise on Money in Two Volumes. 1.: The Pure Theory of Money. 2.: The Applied Theory of Money. London: Macmillan.

__________ (1936) The General Theory of Employment, Interest, and Money. London: Macmillan.

Knapp, G. F. ([1904] 1924) The State Theory of Money. London: Macmillan.

Krugman, P. (2019a) “What’s Wrong with Functional Finance (Wonkish).” New York Times (February 12).

__________ (2019b) “Running on MMT (Wonkish).” New York Times (February 25).

Lago, R. (1991) “The Illusion of Pursuing Redistribution through Macropolicy: Peru’s Heterodox Experience, 1985–1990.” In R. Dornbusch and S. Edwards (eds.), The Macroeconomics of Populism in Latin America, 263–330. Chicago: University of Chicago Press for the NBER.

Larraín, F., and Meller, P. (1991) “The Socialist-Populist Chilean Experience, 1970–1973.” In R. Dornbusch and S. Edwards (eds.), The Macroeconomics of Populism in Latin America, 175–221. Chicago: University of Chicago Press for the NBER.

Lerner, A. P. (1943) “Functional Finance and the Federal Debt.” Social Research 10 (1): 38–51.

López, M. (2003) “The Venezuelan Caracazo of 1989: Popular Protest and Institutional Weakness.” Journal of Latin American Studies 35: 117–37.

Martinelli, C., and Vega, M. (2018) “Monetary and Fiscal History of Peru 1960–2010: Radical Policy Experiments, Inflation, and Stabilization.” Working Paper, Becker Friedman Institute, University of Chicago.

Patinkin, D. (1965) Money, Interest, and Prices: An Integration of Monetary and Value Theory. 2nd ed. New York: Harper and Row.

Reynolds, I., and Nobuhiro, E. (2019) “Kuroda Foe Says Japan to Prove Modern Monetary Theory a Mistake.” Bloomberg (April 10).

Rodríguez, F. R. (2008) “An Empty Revolution: The Unfulfilled Promises of Hugo Chávez.” Foreign Affairs 87 (2): 49–58, 60–62.

Rogoff, K. (2019) “Modern Monetary Nonsense.” Project Syndicate (March 4).

Schumpeter, J. A. (1954) History of Economic Analysis. New York: Oxford University Press.

Summers, L. (2019) “The Left’s Embrace of Modern Monetary Theory Is a Recipe for Disaster.” Washington Post (March 4).

Sumner, S., and Horan, P. (2019) “How Reliable Is Modern Monetary Theory as a Guide to Policy?” Arlington, Va.: Mercatus Center, George Mason University (March 11).

Tymoigne, É., and Wray, L. R. (2013) “Modern Money Theory 101: A Reply to Critics.” Levy Economics Institute, Working Paper No. 778.

__________ (2015) “Modern Monetary Theory: A Reply to Palley.” Review of Political Economy 27 (1): 24–44.

Walsh, B. (2018) “Stephanie Kelton Wants You to Rethink the Deficit.” Barron’s (September 13).

Williamson, E. (1992) The Penguin History of Latin America. London: Penguin.

Wray, L. R. (2015) Modern Money Theory: A Primer on Macroeconomics for Sovereign Monetary Systems. 2nd ed. London: Palgrave Macmillan.

__________ (2018) “How I Came to MMT and What Do I Include in MMT.” Remarks at the 2018 MMT Conference, September 28–30, New York City. Available at http://multiplier-effect.org/modern-money-theory-how-i-came-to-mmt-and-what-i-include-in-mmt.

1 See Wray (2015) for details. The term “modern” is supposed to be an inside joke, and refers to a statement made by Keynes in A Treatise on Money (1930: 4), where he says that, for at least 4,000 years, money has been the creation of the state. Money is whatever the state accepts in payment of taxes (see Knapp [1904] 1924).

2 See, for example, Forstater and Mosler (2005), Tymoigne and Wray (2013, 2015), and Wray (2015) and the literature cited therein. Scott Sumner has discussed MMT in depth in his blog. See Sumner and Horan (2019).

3 MMT has also been called “Neo-Chartalism.” The term “Chartalism” was introduced by German economist G. F. Knapp in 1905 to refer to a theory where the value of money is not tied to the value of a commodity, such as gold. It is interesting to notice that Schumpeter (1954: 288) spelled the term as “Cartalism.”

4 For a skeptical view see, for instance, Sumner and Horan (2019).

5 See, for example, Forstater and Mosler (2005), Tymoigne and Wray (2013), and Wray (2015, 2018) and the literature cited therein.

6 There seems to be agreement that in the short run, and under special circumstances, such as a severe crisis similar to the one triggered by the subprime mortgages collapse, a short-run policy based on massive purchases of government paper by the central bank would make sense.

7 For analyses of populist experiences in Latin America, see, for example, Dornbusch and Edwards (1991) and Edwards (2010).

8 Edwin Williamson (1992: 347), defined populism as “the phenomenon where a politician tries to win power by courting mass popularity with sweeping promises of benefit and concessions to the lower classes.” Political scientist Michael L. Conniff (1982: 82) pointed out that “populist programs frequently overlapped with those of socialism.” More recently, Acemoglu, Egorov, and Sonin (2013: 771) stated that populist “politicians use a rhetoric that aggressively defends the interests of the common man against the privileged elite.” Eichengreen (2018: 1) wrote that populism is a “political movement with anti-elite, authoritarian, and nativist tendencies.” Parts of this section draw on Edwards (2019).

9 Frenkel (2006) discusses a heterodox monetary policy geared at maximizing employment. He presents his proposal as an alternative to orthodox inflation targeting policies.

10 In Dornbusch and Edwards (1991), case studies for Argentina, Chile, Peru, Colombia, Brazil, and Nicaragua are presented.

11 See Chapter 8 in Edwards (2010).

12 Many of their views are associated with the traditional “structuralism approach” to economic development, espoused by thinkers such as Raul Prebisch.

13 See www.abacq.net/imagineria/frame5b.htm#05.

14 Abba Lerner, an inspiration for MMTers, argued that the most efficient way to deal with inflationary pressures was the use of price controls.

15 See the various speeches on the economy in Allende (1989).

16 A formal model that captures these cycles is presented in Dornbusch and Edwards (1990). Acemoglu, Egorov, and Sonin (2013) develop a more general model that generates this type of populist dynamics.

17 In some cases, such as Venezuela under Nicolás Maduro, economic conditions become so bleak that the population becomes undernourished and outmigration increases significantly. Rodríguez (2008).

18 In Edwards (2010), I discuss Chile, Argentina, and Venezuela. For Peru, see Dornbusch and Edwards (1990) and Lago (1991). For Chile, see also Edwards and Edwards (1991).

19 Wray (2015) has stated that MMT policies work better if the central bank does not make a firm commitment to exchanging the sovereign money into a commodity (gold) or another currency.

20 As will be seen below, in 1970 inflation in Chile was a very high 35 percent. This was an important component of the sense of crisis in the country. In fact, as mentioned earlier, achieving price stability was one of President Allende’s more important goals. See Edwards and Edwards (1991).

21 Alan García became President in July 1985. A year earlier Peru signed an IMF program, for 104 million SDRs. Peru stopped making payments to the IMF in 1987. Venezuela obtained IMF support in 1996 (300 million SDR), under the presidency of Rafael Caldera, Hugo Chávez’s predecessor.

22 The original is in Spanish. This is my own translation.

23 These numbers refer to the number of times the stock of money turns over every year. An alternative way of looking at this problem is to calculate what fraction of nominal GDP is held in the form of domestic money. This, of course, corresponds to “Cambridge’s k.” When inflation is very high, this ratio collapses. For the data on Chile, see, Díaz, Lüders, and Wagner (2010).

24 On reversals of capital flows and crises (including populist crises) and the imposition of controls, see, for example, Cowan et al. (2005), and Edwards (2004). MMTers believe that this is unlikely. Wray (2015: 127) acknowledges that interest rates paid by the government of a “less special” country in the international market may go up, but doesn’t acknowledge that the country in question may be completely cut off from foreign finance sources.

25 On neopopulist constitutions in Venezuela, Ecuador, and Bolivia, see Edwards (2010).

26 In its 2017/2018 report of human rights Amnesty International states: “In Venezuela, hundreds of people were arbitrarily detained and many more suffered the consequences of excessive and abusive force used by security forces in response to widespread public protests against rising inflation and shortages of food and medical supplies.” Repressive policies were also implemented by Nicaragua’s Daniel Ortega after 2017.

About the Author

Sebastian Edwards is Henry Ford II Distinguished Professor at the Anderson Graduate School of Management, UCLA. This article is a revised version of his Hoover Institution Working Paper (www.hoover.org/sites/default/files/research/docs/19106_edwards.pdf). The author thanks Michael Bordo, Edward Leamer, José De Gregorio, Scott Sumner, and Alejandra Cox for beneficial discussions of earlier versions of this article, and Doug Irwin and John Taylor for their support.

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.