The release of Mitt Romney’s tax returns is generating debate about the federal tax rates on capital gains and dividends of 15 percent. Great, let’s have a debate about why it’s both fair and good policy that these rates were cut in 2003.

Romney’s effective income tax rate in 2010 was 14 percent because most of his income was in the form of capital gains and dividends. Let’s focus on dividends, which were $4.9 million of his 2010 income of $21.7 million.

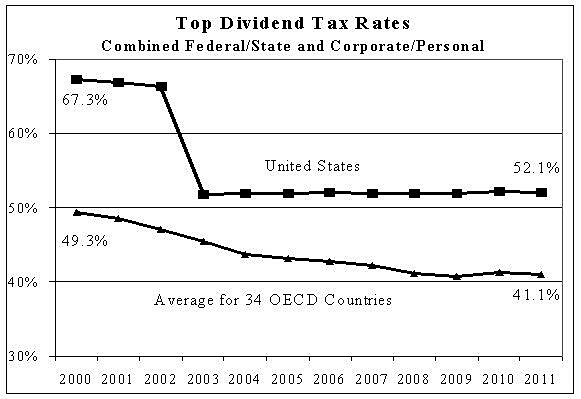

While Romney paid a 15 percent federal personal rate on his dividend income, the total tax rate on the stream of corporate profits that ended up in Mitt’s pocket was a huge 52 percent. That figure is from the OECD, and it includes the corporate-level burden on the underlying profits and the state-level corporate and personal taxes on dividends. So the total tax burden on Romney’s dividends is high not low, despite the dividend tax cut in 2003.

Just about every industrial country provides relief for the double taxation of corporate equity, either by having a lower personal rate on dividends, a personal tax credit for dividends, or a lower corporate-level tax. Despite the 2003 dividend tax cut, the overall U.S. rate on dividends at 52 percent is still the fourth-highest among the 34 high-income nations of the OECD.

Many people don’t seem to understand is that globalization has vastly changed the reality for capital income. Every major nation has cut tax rates on capital income in recent decades. The chart shows the average top dividend tax rate in the 34 OECD countries since 2000. The U.S. cut its rate, but so did other countries. Liberals say they want to bring back Clinton’s higher tax rates, but the world has changed since then. And we’ve got more cutting to do: Our dividend rate is still 11 points higher than the average of the 34 high-income nations.