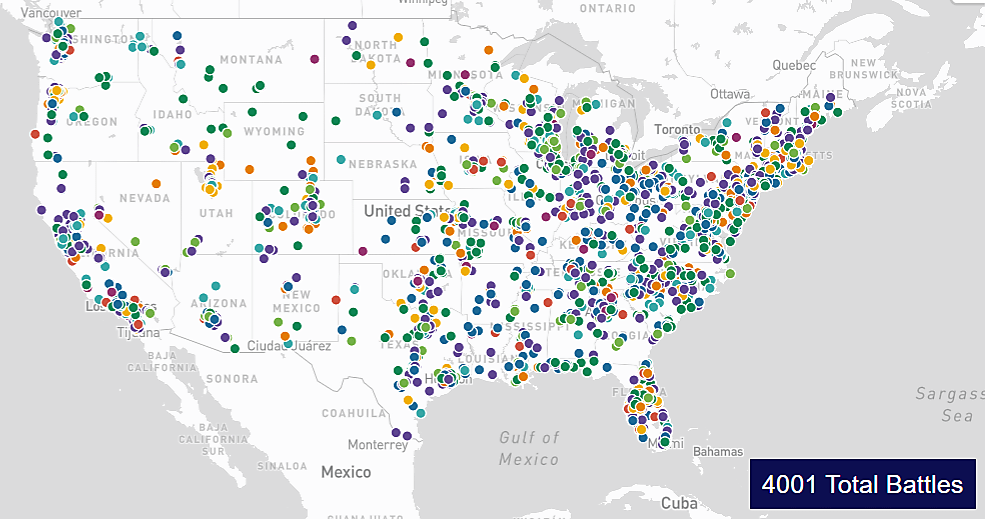

Charter schools receive public funding but escape many regulations that apply to traditional public schools (TPSs). Thus, many charters offer more varied curricula and teaching approaches than TPSs. Around 7,800 charters now operate in the United States, enrolling about 3.7 million students.

The value of charters depends partially on two issues: their impact on students who enroll in them, and the impact on students “left behind” in TPSs.

Research on the first question finds that charters increase math and reading scores in some cases but decrease them in others.

Research on the second question also obtains mixed results, with some papers suggesting that charters improve TPS students’ math and reading scores and other papers suggesting the opposite.

A new paper on the second question (Cato Research Brief No. 379) again finds provocative but mixed results:

[I]ncreased charter school competition improves reading test scores and reduces absenteeism of students remaining in TPSs … [but does not improve] math outcomes. … The null finding on math scores is particularly notable because education research tends to find that school policies affect math scores but not reading scores.

These mixed results might imply that advocates of school choice are overselling: charters (and private school vouchers) have positive effects in some cases, but they are far from a panacea.

That perspective, however, implicitly takes TPSs as the default and ignores a crucial consideration: many parents and students seem to value the choice that charters and vouchers provide, even when outcomes like test scores do not show obvious improvement.

So absent strong evidence that school choice has non-trivial negatives, shouldn’t more choice be the default?