President Joe Biden said that the richest Americans should “start paying their fair share” of taxes and that his proposed tax increases would ensure that the “wealthiest 1% … just pay their fair share.”

Senator Elizabeth Warren wants to make “changes to our rigged tax code so that the wealthy pay their fair share.”

Senator Bernie Sanders wants to make sure that the “wealthiest people … begin to pay their fair share of taxes.”

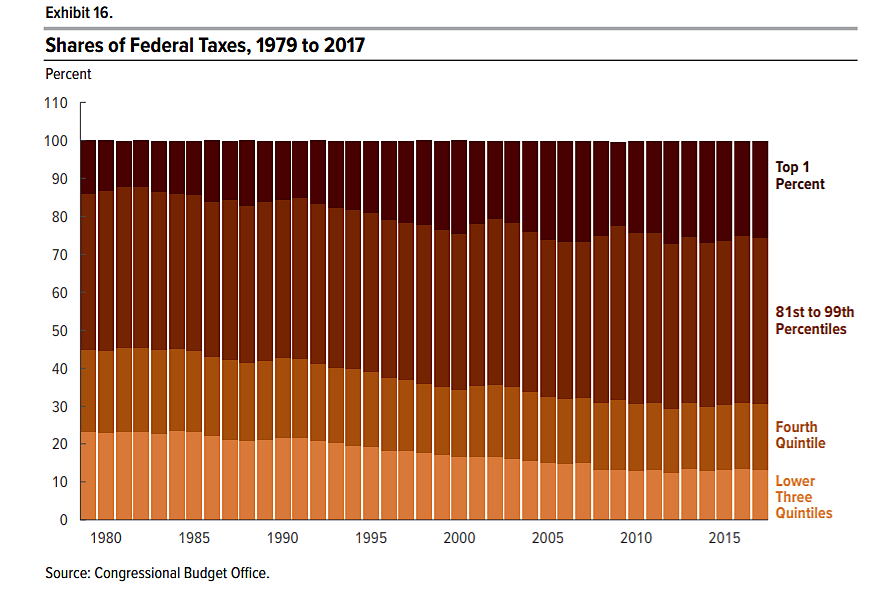

To shed light on these statements, we can look at Congressional Budget Office data on federal tax shares by income group. The CBO chart below includes individual income taxes, corporate income taxes, payroll taxes, and excise taxes. The lowest-income three quintiles, or three-fifths of households, are grouped together. The top 1 percent has been split out of the top quintile.

The share of federal taxes paid by the top 1 percent increased from 14.1 percent in 1979 to 25.3 percent in 2017. The share paid by the overall top quintile (the 1 percent group plus the 81st to 99th percentile group) increased from 55.1 percent in 1979 to 69.2 percent in 2017. The share paid by the other four-fifths of households has fallen substantially.

For reporters, an obvious follow-up question when politicians say that high earners are not paying their fair share is: “How high do the top shares need to rise before they are fair?”

Data for the CBO chart is available here.

Average tax rates by income group are discussed here.