The health crisis and office shutdowns in New York, San Francisco, and other cities have prompted companies to liberalize their policies on remote working. That has led to some office workers rethinking where they live and moving to locations with nice weather, natural beauty, and lower taxes.

The Wall Street Journal examined the new moving trends the other day:

Drew Erra, a 52-year-old insurance broker and moving-company co-owner, and wife Melissa Erra, lived in Minneapolis for 24 years. But in July—when many Americans were realizing that working from home, remote learning and social distancing would be the new reality for a long time—they picked up and moved to Las Vegas. Their new home, a $3.2 million, arts-and-crafts home with a pool and golf-course views, cost over $2 million more than the one they sold in Minneapolis. “I was paying 10.5% state income tax in Minnesota,” a rate which has now dropped to zero in tax-free Nevada, Mr. Erra said. “Just the tax savings alone covered the cost of the house.”

This study showed that Americans are moving from high-tax to low-tax states in substantial numbers. This year’s crisis may have strengthened the trend, and it appears that the election results will not upset the pattern. Republicans have the edge to retain the U.S. Senate majority, which means that the cap on deducting state and local taxes on federal returns will likely stay in place for now. The cap increases the tax savings for middle- and higher-income households when they move from high-tax to low-tax states.

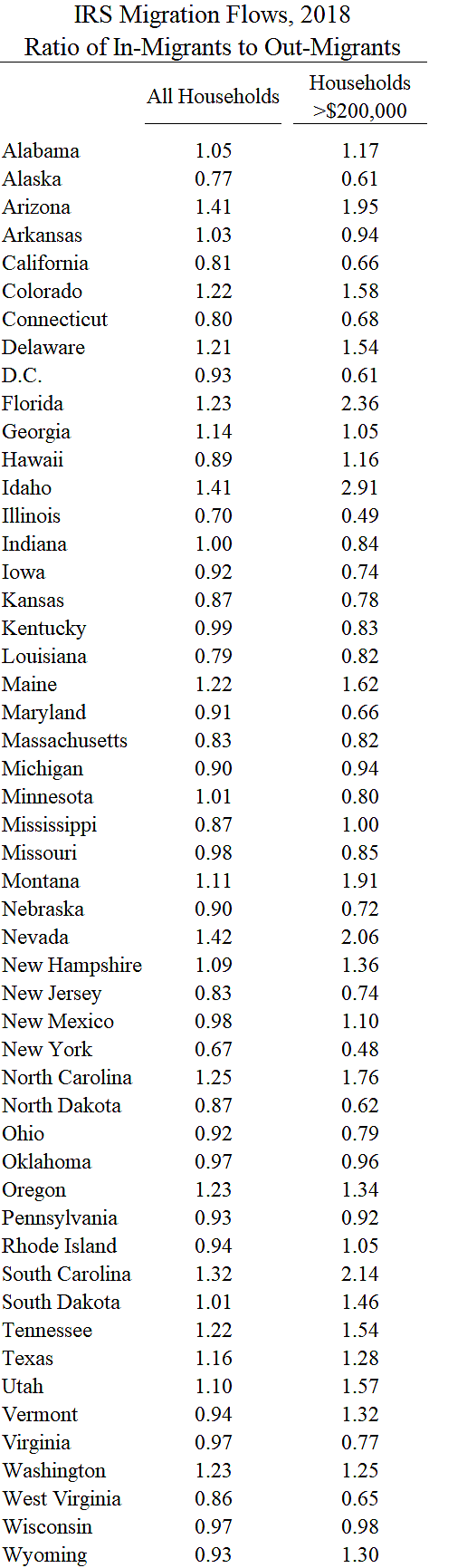

The table summarizes IRS data on interstate migration for 2018. The column on the left shows the ratio of in-migration to out-migration for all households, while the column on the right shows the ratio for households earning more than $200,000 per year.

Florida, for example, has 1.23 households arriving for each one leaving but has 2.36 high-earning households arriving for each one leaving. By contrast, New York has 0.67 households arriving for each one leaving, and it has just 0.48 high-earning households arriving for each one leaving. In other words, low-tax states such as Florida attract people overall but particularly high earners, whereas high-tax states such as New York repel people overall but particularly high earners.

The Wall Street Journal article continued:

Searches by out-of-towners for homes over $1 million in the Las Vegas metro area surged by 155% from last year, according to Zillow’s analysis. Ten agents and brokers in the area said they have never seen more relocation interest. “More are driven to come here by high taxes in their states,” said Heidi Kasama, the listing agent at Berkshire Hathaway Home Services Nevada Properties for the home the Erras purchased. Weather is also a draw.

Last week, CNBC discussed the finance industry leaving New York City.

By forcing the mass adoption of remote work and crimping many of the advantages of urban life, the pandemic has turbocharged migration from high cost, high-density places to lower-cost states including Texas, Florida and Nevada.

… Data from the U.S. Postal Service, national moving companies and tech start-ups tracking smartphones all show an elevated outflow from New York City this year. More than 246,000 New Yorkers filed a change-of-address request to zip codes outside the city since March, almost double the year-earlier period, for instance.

… For those in finance, the simple math of lower tax regimes is hard to ignore. New York state levies 8.8% on wages for high earners, and New York City takes another 3.9%, or nearly 13% combined. Meanwhile, states including Florida, Texas and Nevada don’t tax wages. The more people make, the greater the incentive there is to leave, and the difference could easily mean hundreds of thousands more dollars in after-tax pay.

That’s a trade that some Wall Street titans have already made. Hedge fund billionaire Paul Singer is moving the headquarters of Elliott Management to Florida from midtown Manhattan, Bloomberg reported this month. His move follows that of another billionaire, famed corporate raider Carl Icahn, who made the switch last year to avoid New York taxes.

As this study discussed, high earners are often business owners who bring their businesses and related jobs with them when they move. The CNBC story continues:

“My concern isn’t that they’re leaving, it’s that they’re taking their businesses with them,” said Mark Klein, a New York-based tax attorney and chairman of Hodgson Russ. The flight of business owners is worrying for those remaining in the city, he said … “I’ve never been as inundated with people leaving New York and Connecticut, any of these high-tax states, in my 40 years of doing this,” he said. “Once Covid hit, with the recognition that people can work from any location, the floodgates opened.”

… When fintech CEO Paraag Sarva bought a weekend home in Bucks County, Pennsylvania last year, he figured he’d probably rent it out most of the time. But months into the pandemic, after it became clear that full-time, in-person schooling in New York was unlikely for his small children, he made it his permanent residence …. His taxes are 10% lower in Pennsylvania, he figures.

What should high-tax states such as New York do?

New York’s government is twice as large as Florida’s for no good reason, and New Yorkers endure the least freedom in the nation. New York and other people-losing states should downsize their governments by slashing taxes, spending, and regulations which reduce economic and personal freedoms. Policymakers in these states need to wake up to the new realities of mobile businesses and lifestyles.