Have you heard all the banter about a U.S. manufacturing renaissance? Numerous media reports in recent months have breathlessly described a return of manufacturing investment from foreign shores, mostly attributing the trend to rising wages in China and the natural gas boom in the United States, both of which have rendered manufacturing state-side more competitive. Today’s Washington Post includes a whole feature section titled “U.S. Manufacturing: A Special Report,” devoted entirely to the proposition that the manufacturing sector is back!

The myth of manufacturing decline begets the myth of manufacturing renaissance. This new mantra raises a question: How can there be a manufacturing renaissance if there was never a manufacturing “Dark Ages”?

Contrary to countless tales of its demise, U.S. manufacturing has always been strong relative to its own past and relative to other countries’ manufacturing sectors. With the exception of a handful of post-WWII recession years, U.S. manufacturing has achieved new records, year after year, with respect to output, value-added, revenues, return on investment, exports, imports, profits (usually), and numerous other metrics appropriate for evaluating the performance of the sector. The notion of U.S. manufacturing decline is simply one of the most pervasive economic myths of our time, sold to you by those who might benefit from manufacturing-friendly industrial policies with the abiding assistance of a media that sometimes struggles to distill fact from K Street speak.

The myth of U.S. manufacturing decline has long been advanced by policymakers and interested parties as a predicate for industrial policy or trade barriers. “Because U.S. manufacturing has fallen behind,” the argument goes, “we need to match the efforts of other governments in supporting our factories,” or “because U.S. manufacturing has been hobbled by predatory foreigners we need to erect tariffs to level the playing field,” or “because our industrial base is in ruins, U.S. national security is threatened without subsidies to rebuild manufacturing.”

The assertion that “U.S. manufacturing is in decline” is usually presented as holy writ, without allowance for examination or dissent, before those dubious policy solutions are pitched as our only salvation. Fortunately, the more open-minded and genuinely inquisitive insist upon closely evaluating premises before considering the “therefore-we-musts.”

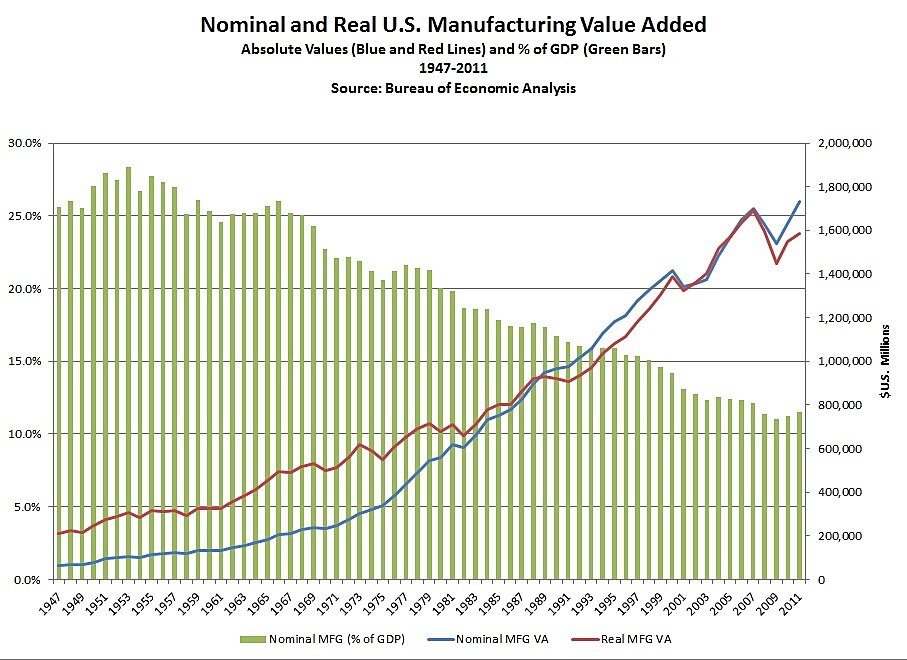

As the nearby chart confirms, U.S. manufacturing value-added (the metric most comparable to GDP, which equals the value of manufactured output minus the cost of intermediate goods), in both nominal and real terms, has been trending upward since the end of the World War II. Nominal manufacturing value-added declined on a year-to-year basis only eight times in the past 64 years. Manufacturing value-added took a hit during the Great Recession, as did the rest of the economy, but it plainly defies the data to suggest that U.S. manufacturing is – or has been at anytime – in decline.

As a share of the U.S. economy (the green bars on the chart), manufacturing has declined from a 1953 peak of 28 percent to 11.5 percent in 2011. But that is testament to the growth of U.S. services sectors, not to a decline in manufacturing, which (as you see) has been growing nearly continuously in absolute terms.

Yet some insist that these particular figures don’t tell the real story, which can be found in the manufacturing employment figures. Ah, well. Manufacturing employment has certainly been on a downward trajectory for three decades, after peaking at 19.4 million workers in 1979. Despite increases of about 500,000 workers over the past couple of years, manufacturing employment stands at about 11.8 million today. But manufacturing employment is not a barometer of the health of the sector. If the objective of economics is to make the best use of scarce resources, U.S. manufacturing – with its historic productivity gains in recent decades – has done an excellent job. It is not a reflection of manufacturing weakness that those scarce resources (apparently not so scarce) have not been redeployed elsewhere in the economy. Nevertheless, most of the “manufacturing-in-decline” narrative is the result of conflating the meanings of manufacturing value-added and manufacturing employment.

What the media are today characterizing as a manufacturing renaissance is better understood as a surge. Things aren’t being turned around; they are accelerating in the same direction.

Plenty of manufacturing and manufacturing-related activities have been occurring and growing in the United States for several years. Rising wages in China and the domestic gas boom change the mix of relatively viable manufacturing activities, but they are just two of dozens of considerations that factor into thousands upon thousands of decisions about where to develop, test, manufacture, assemble, package, sell, and perform every other function in a products supply chain from its conception to its consumption. A confluence of considerations from worker skills, total labor costs, degree of risk aversion, desire to produce within a tariff wall, interest in influencing political decisions, infrastructure quality, proximity to lucrative markets, proximity to supply chain locations, the stability of the political and business climates, corruption, the rule of law, access to capital, taxes, regulations, and dozens more all factor into the ultimate decision about where to perform a specific manufacturing activity.

The implication that the shrinking disparity in U.S. and Chinese wages or the growing disparity between U.S. and world natural gas prices recently have surpassed magic benchmarks that will open the flood gates to foreign and returning domestic investment is an oversimplification that erroneously homogenizes manufacturing. In fact, the sector is diverse in its requirements, and thus in the weighting of factors that affect its location decisions. Every business – even in the same industry – considers different factors and weights them differently.

What matters, though, is that direct investment in the U.S. economy – whether from foreign or domestic companies – is something to celebrate. Attracting investment in manufacturing and in other sectors is essential for economic growth. Unlike previous decades when the United States was easily the destination of choice for direct investment, nowadays there is much greater competition, particularly from emerging economies. In fact, the U.S. share of the world’s foreign direct investment stock has dropped significantly from 41 percent in 1999 to 17 percent in 2011.

So rather than observe the migration of some activities back to the United States and assume that a trend is in the making, a better use of the media’s resources would be to take inventory of the factors that encourage direct investment in the United States and spotlight for the public how U.S. policies can encourage, and not deter, an investment renaissance in United States.