On October 1st the maximum loan limit for Fannie Mae and Freddie Mac declined from around $729,000 to just over $625,000. Not surprisingly the real estate industry and Fannie apologists are claiming that this would cause the housing market to crater. It would seem to me that this claim would greatly depend upon just how much of the market will be impacted.

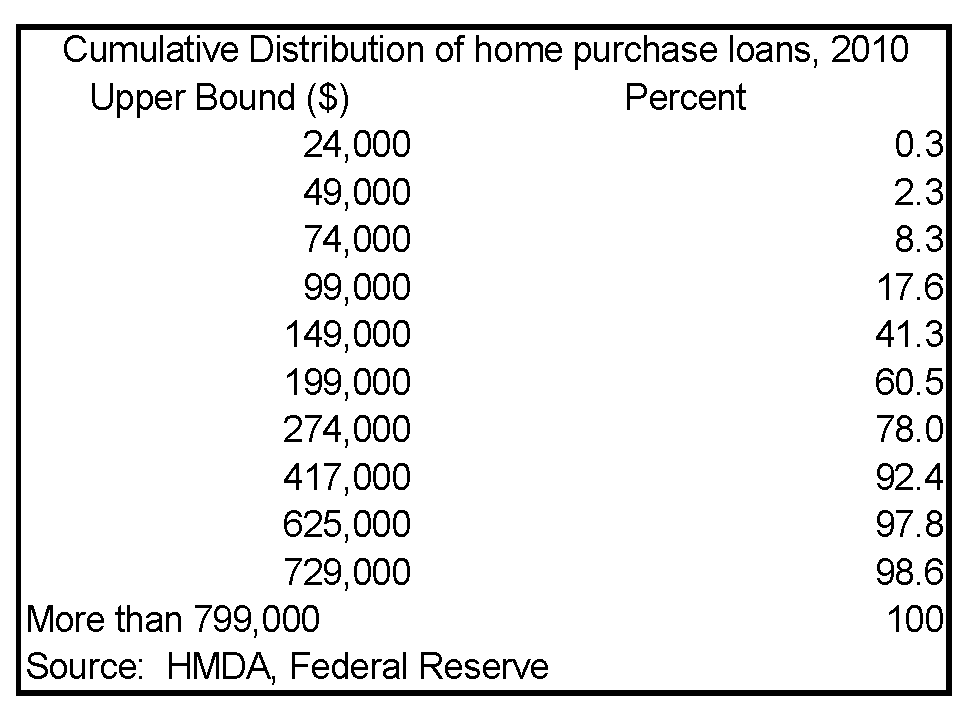

Fortunately one can try to answer that question. According to Federal Reserve data, collected under the Home Mortgage Disclosure Act (HMDA), the percent of home purchase mortgages between $729,000 and $625,000 is less than 1% of the market. So we are arguing over increasing mortgage rates for only 1% of the market? I fail to see how such is going to have much of an adverse impact on the mortgage market.

If we were to go back to the pre-crisis loan limits of $417,000, we’d only have about 8% of the mortgage market not under the conforming loan limit. So instead of talking about a decrease to $625.000 we should be at least talking about a decrease to $417,000. Going even further to just over $200,000 would still leave Fannie and Freddie with a majority of the market.

For those that believe that declining loan limits unfairly hit “high cost” areas, then the solution to me would be to abandon any loan limits altogether and base eligibility on income, as we do in the Rural Housing Programs (which I believe have a limit of 115% of state median income). Of course this sets aside the fact that many “high cost” areas are expensive because of their harmful and misguided land use policies.