The proposed $2.4 trillion reconciliation bill includes $80 billion for increased Internal Revenue Service (IRS) funding. The Democrats want to beef up the tax agency and expand its powers. The aim is to raise revenues by reducing the tax gap, which is the amount of taxes legally owed but not paid.

The large funding increase would double the IRS workforce, according to the Congressional Budget Office (CBO). About three-quarters of the increased funding would go toward enforcement.

Supporters think that greater enforcement would be good policy because the expected higher tax revenues would outweigh the cost of higher IRS spending. But that ignores the higher costs that would be imposed on the private sector, including tax compliance burdens and a loss of civil liberties. More aggressive IRS enforcement would mean more paperwork, more lawyer fees, more time consumed on tax matters, and more anguish and uncertainty for taxpayers. It could also result in less privacy and personal financial security. These private costs are difficult to measure, and are usually ignored by policymakers.

With IRS enforcement, there is a trade-off between the benefits of a lower tax gap and the costs to society of achieving it. If we wanted a tax gap of zero, we could hire an army of IRS agents to routinely search every home and laptop in the nation and impose root-canal audits on everyone. But people in democracies do not accept that level of government intrusion, and so every tax system has a tax gap.

The U.S. tax gap is fairly low by international standards. The official net federal tax gap of $381 billion is 2.3 percent of gross domestic product (GDP). One pro-enforcement group puts the gap at 2.5 percent of GDP. If we add in an estimated state-local tax gap, then the total U.S. gap would be about 3.9 percent of GDP. By comparison, this study estimated that the average tax gap in the European Union (EU) is 5.6 percent of GDP, while this study found that the average EU tax gap is 10.7 percent of GDP.

Another study estimated that the U.S. tax gap is 3.8 percent of GDP and the average tax gap in the EU is 7.7 percent GDP. Yet another study estimated that among 157 countries the United States had the second smallest shadow economy, meaning the economic activity outside of the government’s tax and regulatory net.

If the U.S. tax gap is already quite low, the marginal costs of reducing it further from enforcement is probably high. That is suggested by the recent Democratic proposal for the IRS to gather total inflow and outflow data from millions of household bank accounts. That would be a major intrusion into personal finances and could impose large compliance costs on financial institutions. But that is the sort of aggressive action that Democrats think they need to reduce the tax gap further through enforcement.

Another example of how civil liberties would shrink with more aggressive enforcement regards IRS penalties for taxpayer underpayments, which can be a steep 20 percent. In response to IRS abuses in the 1990s, Congress enacted a requirement (tax code section 6751) that supervisors must sign off in writing when IRS employees want to impose these heavy penalties. The National Taxpayer Advocate noted that this “provision protects a taxpayer’s right to a fair and just tax system.” Yet the Democratic plan (p. 135) would repeal this important procedural check on the powerful tax bureaucracy.

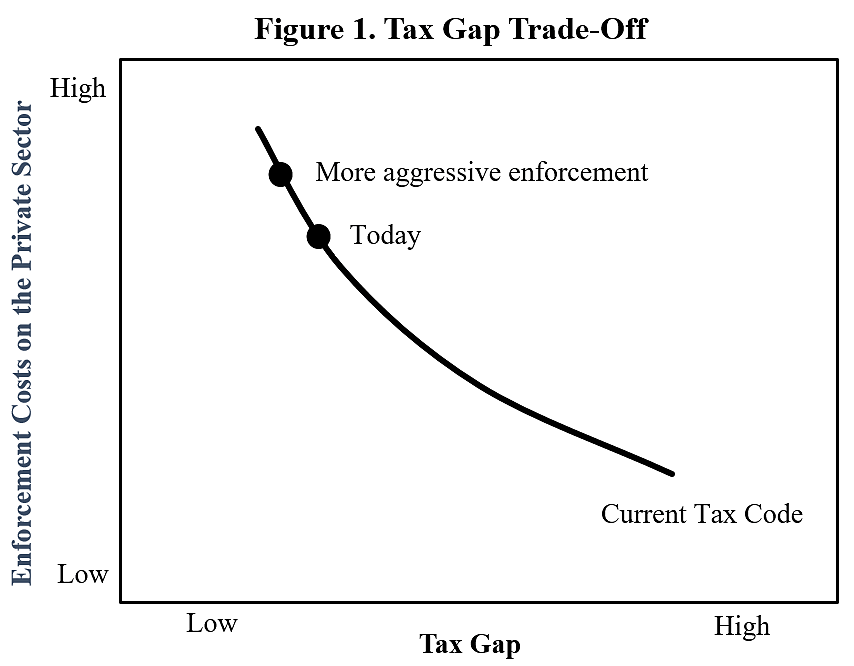

Tax Gap Trade-Off Curve

Figure 1 illustrates the trade-off between the size of the tax gap (horizontal axis) and the private-sector costs imposed by more aggressive enforcement (vertical axis). On the bottom right, the IRS does little enforcement and the tax gap is large (which is bad), but the private-sector costs are low (which is good). On the top left, the IRS enforces aggressively and the tax gap is low but the private-sector costs are high.

The assumed shape of the curve suggests that starting from the right, initial enforcement efforts impose moderate private-sector costs and generate substantial revenue. As the government moves to the left to close the tax gap, extra enforcement brings in less marginal revenue but imposes higher costs on the private sector. On the figure, “Today” and “More aggressive enforcement” are where I think enforcement is now and where Democrats want to move us.

The Foreign Account Tax Compliance Act (FATCA) passed in 2010 indicates that we are on the top left of Figure 1 because it appears to have generated relatively little revenue but imposed large costs on the private sector. FATCA imposes complex rules on thousands of foreign financial institutions forcing them to find out which of their customers are American and to report the transactions of those customers to the U.S. Treasury. It also imposes compliance burdens on millions of Americans who live abroad, do business abroad, or who own foreign assets. The rules were layered on top of other foreign reporting rules that were already in place.

The FATCA rules may only raise about $200 million a year but have imposed tens of billions of dollars in compliance costs on financial institutions and their customers. FATCA creates major headaches and injustices for the nine million Americans who live abroad and for Americans pursuing foreign business opportunities. Financial institutions all over the world have decided not to provide services to Americans because of the extra compliance burdens involved. FATCA rules were overkill and should be repealed.

Another example of overkill on tax enforcement regards IRS Form 3520. People who receive substantial foreign gifts and mistakenly do not notify the IRS have been getting hit without warning with enormous 25 percent penalties on the gross value of the gifts, and the IRS has not been flexible in abating them. The heavy penalties are essentially theft because foreign gifts are not taxable under the federal income tax.

As with FATCA, tax experts know that Form 3520 enforcement is harmful and unfair, but it is very difficult to restrain the IRS once it is unleashed. A big problem with giving the IRS new enforcement powers, as the Democrats are proposing, is that the damage to citizens and the economy may be much larger than expected yet politicians almost never admit mistakes and backtrack to fix bad provisions.

Other problems with increasing IRS enforcement powers include:

- Compliance Costs. The income tax already imposes compliance costs on individuals and businesses of more than $400 billion a year. That is overhead for the economy and subtracts from our standard of living. More aggressive enforcement would impose higher compliance costs on millions of law-abiding taxpayers.

- False Positives. The IRS makes many mistakes, and it can be difficult for taxpayers to get the agency to admit error and back off. Tax litigation specialist Dan Pilla says that the “IRS’s audit results are incorrect between 60 and 90 percent of the time,” which the agency gets away with because many taxpayers don’t challenge them. More IRS enforcement means more targeting of people who end up being innocent. Individuals and businesses will have to invest more time and money in lawyer fees to defend against false IRS claims. With regard to the Democrat’s bank reporting proposal, Steven Rosenthal of the Tax Policy Center noted that it would “bury the agency in a sea of unproductive information.”

- Financial Privacy. Americans do not want giant computer systems amassing even more of their personal data, but that is what a more powerful IRS would do. With its treasure trove of information on every household, the IRS is an ideal hacking target for criminals and foreign governments. Earlier this year, ProPublica published private information on high-income taxpayers gained from thousands of stolen returns it had obtained. ProPublica’s irresponsible action could inspire criminals to steal tax returns of other well-known people to make a media splash, to sell information, or to extort payoffs. The IRS experiences “1.4 billion cyberattacks annually” and has a “track record of data breaches,” including data from 724,000 returns leaked in 2016. A study by Michael Hatfield of the University of Washington argues that the IRS’s vast pool of data is highly vulnerable to ransomware attacks, Chinese government hacking, and other criminal activity.

Democrat Plan Would Shift the Curve Upward

The Democrats want to increase IRS enforcement to reduce the tax gap, but their tax plan would increase tax-code complexity resulting in the opposite. Tax-code complexity increases tax avoidance and evasion by making IRS administration more difficult and by prompting taxpayers to combine disparate provisions in unexpected ways. In a recent report on tax enforcement, the CBO noted:

“The complexity of the tax code makes compliance more challenging and increases areas of potential dispute with the IRS. Eligibility requirements for certain tax benefits can be confusing and make it more difficult for taxpayers to determine their tax liability. Such eligibility may also be difficult for the IRS to verify.”

Unfortunately, the Democratic tax plan would increase disputes and confusion by adding dozens of tax breaks for energy, housing, manufacturing, education, and other items. The more such special-interest breaks there are in the tax code, the more information the IRS needs to collect on our finances, investments, purchases, lifestyles, and other personal details.

The IRS cannot properly administer the tax breaks it already has, let alone a raft of new ones. The earned income tax credit (EITC), for example, suffers from a 24 percent improper payment rate, despite many efforts to tackle the problem. Meanwhile, the Low-Income Housing Tax Credit is riddled with fraud by housing developers. The Government Accountability Office found that IRS oversight of the LIHTC is minimal and disorganized. The IRS auditing guide for the LIHTC is a massive 344 pages long, and that intense complexity is probably why the IRS does little policing of the credit.

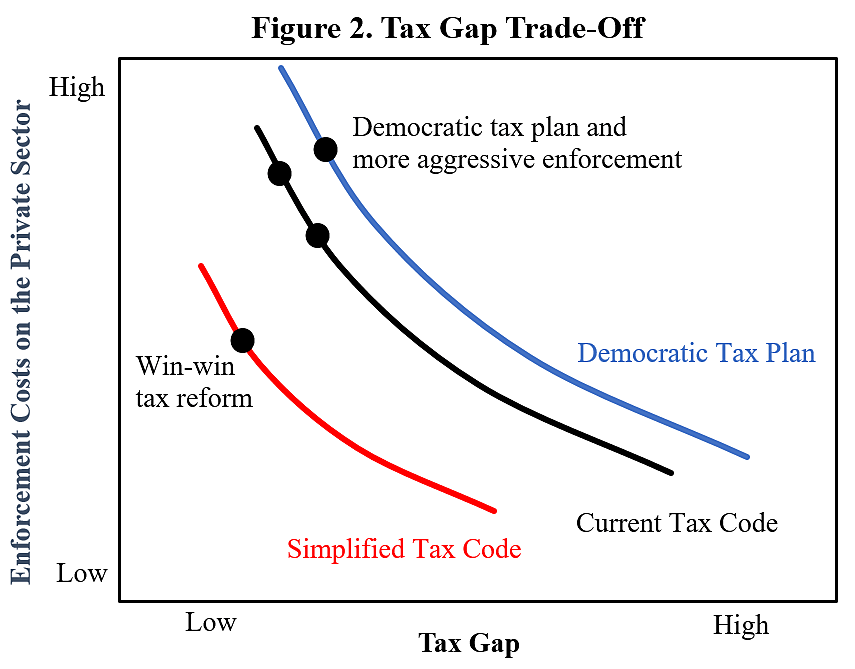

Figure 2 shows that the Democratic tax plan would shift the tax gap trade-off curve upward to the right. While the Democrats want to beef up the IRS to reduce the tax gap, their plan would increase tax-code complexity, which would expand the tax gap.

Tax Reform Would Shift the Curve Downward

Movements along the tax gap trade-off curve illustrate IRS enforcement as a win-lose proposition—gains to the government through aggressive enforcement are losses to the private sector. But there is a way to generate a win-win. Reforms to simplify the tax code would shift the curve down to the left, which would reduce both the tax gap and private-sector costs.

There are two main reasons why the federal income tax is so complicated. The first is that politicians try to micromanage the economy through credits, exemptions, and other narrow breaks. Tax partner Chris Hesse noted to me, “Frequent changes to many of these special-interest provisions magnify the difficulty of IRS tax administration and financial planning for individuals and businesses.” Virtually all such breaks should be repealed, which would make IRS administration and taxpayer compliance much easier.

The second is that the income tax is based on an inconsistent and ad hoc definition of “income.” Many tax experts think that consumption would be a better base for the tax code and would greatly simplify the system. The Tax Foundation estimated that a consumption-based flat tax would slash tax compliance costs by about 90 percent.

Figure 2 shows that such a tax reform would shift the tax gap trade-off curve downward. Taxpayers would enjoy lower compliance costs and fewer civil liberties intrusions, and the IRS would benefit from easier administration and a lower tax gap.

In sum, it makes sense to improve IRS computer systems, employee training, and phone service to reduce taxpayer errors and shrink the tax gap. But it would be unfair and irresponsible for Congress to increase the agency’s enforcement powers when there is so much wrong with the current tax code and its administration. Congress should repeal enforcement structures such as FATCA that have higher costs than benefits, and it should repeal fraud-ridden provisions such as the LIHTC rather than adding new special-interest breaks.

Data Notes: The official net tax gap of $381 billion (for 2011 to 2013) divided by 2012 GDP is 2.3 percent. The tax gap estimate from www.shrinkthegap.com of $574 billion is 2.5 percent of 2021 GDP. I assumed that the state-local tax gap is the same size relative to tax revenues as is the federal tax gap. These tax gap figures include all types of taxes.

Ilana Blumsack created the charts for this post.