In their haste to pass massive spending bills and clobber the rich, the Democrats are floating some radical tax schemes. The latest far-out idea is to tax capital gains even before gains are realized. No other country in the OECD taxes capital gains in such an aggressive manner.

The Democrats are obsessed with raising taxes on capital. They’ve proposed raising the top capital gains tax rate, even though our federal-state rate of 29 percent is already higher than the 19.5 percent average in Europe. They’ve proposed raising the corporate tax rate, even though our federal-state rate of 27 percent is already higher than the 19 percent average in Europe. And some Democrats want to impose an annual wealth tax, even though nearly all European countries have eliminated those harmful levies.

Many high-income countries in Europe and elsewhere have heavier overall tax burdens than we do, but they make up the difference with high taxes on consumption, not capital. These countries recognize that taxes on consumption, such as value-added taxes (VATs), are less damaging than taxes on capital.

The Democrats are steering America to a worse place than Europe—a place where the private sector is undermined by expansive welfare programs, and where the programs are funded by taxes on capital rather than VATs. I am against a VAT for the United States because I favor smaller government, but I worry that the Democrats want to impose bigger government funded in an even more damaging manner than big European governments.

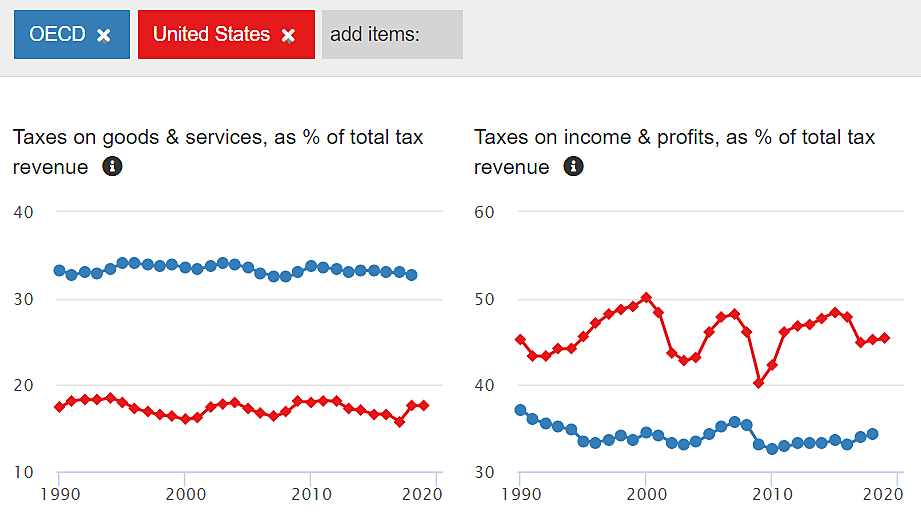

Let’s compare taxation in the United States and other high-income nations. In 2019, overall tax revenues were 24.5 percent of GDP in the United States and 33.8 percent in 35 OECD countries, on average. The charts below show the shares of overall tax revenues raised by taxes on goods and services or consumption (e.g. VATs and sales taxes) and taxes on income and profits (e.g. individual income taxes, corporate income taxes, and capital gains taxes). The charts are from here.

The United States raises a larger share of revenues from (more damaging) income and profits taxes and a smaller share from (less damaging) consumption taxes. Democratic proposals would worsen our reliance on the more damaging taxes. Instead, we should devolve government programs to the states and rely on state sales taxes to fund the needed activities.

Notes: The OECD tax shares appear to be based on 35 countries in 2019, but would include fewer countries in prior years. I calculate that U.S. taxes in 2019 were somewhat higher than the 24.5 percent reported by the OECD. I discuss unrealized capital gains here and here, and I examine taxes on capital income here and consumption taxes here.