President Biden’s infrastructure plan is a mess of contradictions. It promises to increase America’s competitiveness and “create millions of good jobs,” but it would be funded by a corporate tax increase that would do the opposite. The plan would provide large corporate subsidies, even though leading Democrats often complain about corporate subsidies.

Perhaps the most striking contradiction in Biden’s plan is that it is supposed to combat climate change, but the plan’s $2 trillion in taxpayer funding is not green. The green way to fund infrastructure is through user charges that restrain consumer demand. But Biden’s plan relies on income taxes to pay for infrastructure subsidies, and that approach does not moderate consumption or reduce resource use.

If water systems need upgrades, for example, they should be funded by increases in water charges to limit water use and benefit the environment. In the same way, gas taxes are a good way to fund highways because they restrain automobile use and passenger charges are a good way to fund airports because they restrain airline use. Well-structured user charges can also reduce congestion.

Biden would subsidize the upgrades to water systems, highways, airports, and other facilities, rather than relying on green and efficient user charges. In his infrastructure plan, the president mentions climate change 20 times and the environment 14 times, but the plan is entirely funded in a non-green manner.

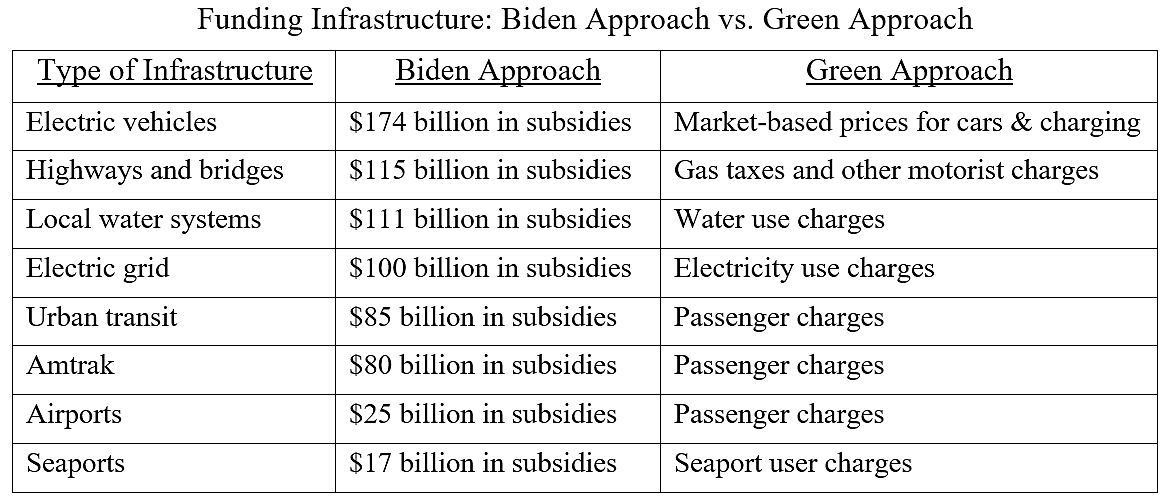

The table shows some of Biden’s proposed non-green infrastructure subsidies and the preferred green funding approach.

Other commentary on Biden’s infrastructure plan here, here, here, here, here, here, and here.