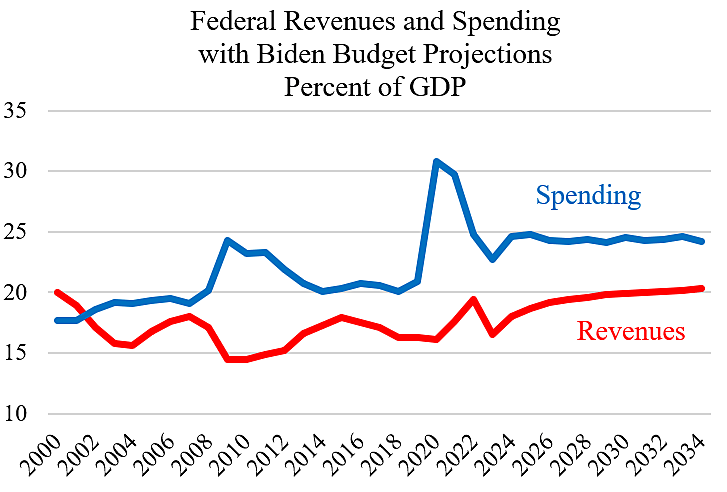

Federal government debt tops $26 trillion, or $200,000 for every household in the nation. Compared to the size of the economy, the rising debt will soon reach levels never seen in our history.

Next year, the government will spend $6.8 trillion, or 36 percent more than it raises in revenues, with the difference made up by vast borrowing. Despite the massive flow of red ink, politicians keep dreaming up new ways to spend money that we don’t have.

This is madness!

Congress should change course and cut spending. But which programs should it cut? Cato has proposed many specific reforms, and Romina Boccia has proposed that a congressional commission tackle the problem.

The public should weigh in, and so Cato is launching a tournament to crowdsource spending cut priorities for Congress—Spending Madness 2024!

www.cato.org/2024-spending-madness

Spending Madness pits 32 bloated, deficit-causing programs against each other across four regions of the federal budget—Social Security and Health Care, Federalism, Subsidies, and Welfare. Which programs should Congress cut first? Help us pick the “winners” by choosing the worst programs in each head-to-head matchup over five tournament rounds.

Our computers will tally the crowdsourced choices in each matchup. After each round, the top vote-getters—the policies that voters think are the more wasteful, harmful, inefficient, and unaffordable—will advance to the next round.

We’ll announce the Spending Madness 2024 champion on April 11, 2024.

Good luck!