The federal government is running massive deficits, which are becoming more unsustainable as interest rates rise. Congress should dig through the budget looking for low‐value programs to cut. Any new spending for foreign crises or other priorities should be offset, and I propose some spending and revenue options below.

Some policymakers favor spending more on Internal Revenue Service (IRS) enforcement to raise added revenues. But that approach would create collateral damage on taxpayers and the economy. Tax compliance is important, but the Biden administration’s plan to more than triple IRS enforcement spending over the next decade is overkill.1

A better way to boost tax compliance is to improve IRS customer service and technologies. More importantly, Congress should simplify the code and pare back the growing thicket of tax subsidies, which encourage abuse and make IRS administration more difficult. Repealing tax subsidies can raise federal revenue while supporting economic growth.

Lopsided IRS Funding Increase

The Inflation Reduction Act (IRA) included $79 billion in mandatory spending for the IRS over the coming decade. With this funding, the IRS budget is projected to double in nominal dollars over 10 years.2 The Fiscal Responsibility Act rescinded $1 billion of the spending and promised to repurpose some additional funding going forward.3

The IRA allocated $45.6 billion for enforcement, $25.3 billion for operations support, $4.8 billion for business systems modernization (technology), and $3.2 billion for taxpayer services. With these increases, President Biden’s budget projected enforcement spending will grow from 38 percent of the total IRS budget in 2023 to 61 percent by 2033.4

These funding priorities are off kilter. The IRS issued a Strategic Operating Plan earlier this year that mainly stressed better technology and customer service.5 Congress should rebalance IRS funding toward these areas.

Collateral Damage of Enforcement

The Congressional Budget Office (CBO) expects the $79 billion boost to IRS funding to raise $180 billion over 10 years.6 Supporters say this shows a high “return on investment” from the funding, but that does not account for the broader costs to society of increased enforcement.

Aside from the IRS funding costs, increased enforcement raises private‐sector compliance costs, costs of audit defense and litigation, and extra taxpayer time and energies. Further costs include deadweight losses from taxpayers changing their behavior in ways that undermine output. One statistical study in 2022 found that small corporations subject to IRS audits are more likely to go out of business than other firms.7 Increased enforcement can also generate hard‐to‐quantify costs such as taxpayer anguish, financial uncertainty, and losses of civil liberties.

More aggressive IRS enforcement would create collateral damage on individuals and businesses because the IRS makes many mistakes, which is not surprising given the complexity of the code. Litigation statistics show that the IRS wins only about half the time in court. For Tax Court and refund cases closed in the past five years, the IRS on decision gained just 48 percent of the dollars in dispute.8

Auditing taxpayers who have already paid the correct amount is collateral damage. Between 40 to 50 percent of partnership audits result in no recommended changes.9 For individuals earning more than $5 million, the audit no‐change rate is just under 40 percent.10 Given that audits are usually targeted by discrepancies and IRS algorithms, these percentages seem high.

For returns where auditors do recommend changes, the Government Accountability Office (GAO) notes that the “IRS collected about 47 percent of all recommended additional taxes from individual taxpayer audits closed in fiscal years 2011 to 2020.”11 For higher‐income returns, the IRS only collects about 40 percent. Enforcement is a leaky bucket.

Additional taxes recommended on IRS audits are relatively higher for middle‐income returns than for high‐income returns. Recommended tax changes on audit average roughly 5 to 8 percent of income for middle‐income taxpayers but just 1 to 3 percent for high‐income taxpayer.12 High‐income taxpayers are more likely to receive expert tax help, and thus less likely to make errors.

Of course, the IRS needs to enforce the tax laws. But as enforcement increases, compliance costs rise, deadweight losses rise, and families and businesses face added stress and uncertainty. Also, because the IRS is such a powerful agency, aggressive tax enforcement can put civil liberties at risk.13

Tax Gap Is Stable

In October, the IRS released a new estimate of the “tax gap,” which is the amount of federal taxes owed but not paid.14 The estimated gross tax gap for 2021 was $688 billion. After late payments and enforcement, the net gap was $625 billion—$475 billion from individual income taxes, $37 billion from corporate income taxes, $112 billion from employment taxes, and $1 billion from estate taxes.

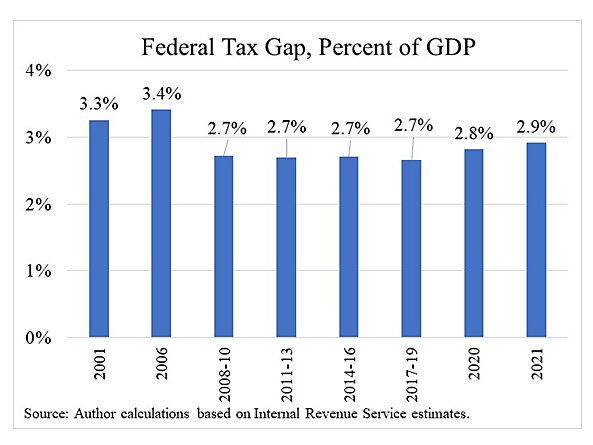

The dollar value of the tax gap has increased over time, but the new gap estimate is similar to previous IRS estimates when compared to U.S. gross domestic product (GDP), as shown in the figure below.15

The flip side of the gross tax gap is the “voluntary compliance rate,” which is the tax paid on time divided by the estimated full amount owed. The IRS report shows that the voluntary compliance rate has hovered between 82 and 85 percent since 2001. It was 84.9 percent in 2021. The degree to which Americans are law‐abiding on federal taxes does not appear to have changed much over the past two decades.

Note that these tax gap measures overstate revenues that might be gained from enforcement because they do not account for behavioral responses. If the IRS were to squeeze more money from individuals and businesses, some would decrease working, hiring, and investment, which would reduce revenues raised.