Chairman Whitehouse, Ranking Member Grassley, and members of the committee, thank you for inviting me to testify on IRS tax enforcement and the budget deficit.

The federal government is running massive deficits, which are becoming more unsustainable as interest rates rise. Congress should dig through the budget looking for low-value programs to cut. Any new spending for foreign crises or other priorities should be offset, and I propose some spending and revenue options below.

Some policymakers favor spending more on Internal Revenue Service (IRS) enforcement to raise added revenues. But that approach would create collateral damage on taxpayers and the economy. Tax compliance is important, but the Biden administration’s plan to more than triple IRS enforcement spending over the next decade is overkill.1

A better way to boost tax compliance is to improve IRS customer service and technologies. More importantly, Congress should simplify the code and pare back the growing thicket of tax subsidies, which encourage abuse and make IRS administration more difficult. Repealing tax subsidies can raise federal revenue while supporting economic growth.

Lopsided IRS Funding Increase

The Inflation Reduction Act (IRA) included $79 billion in mandatory spending for the IRS over the coming decade. With this funding, the IRS budget is projected to double in nominal dollars over 10 years.2 The Fiscal Responsibility Act rescinded $1 billion of the spending and promised to repurpose some additional funding going forward.3

The IRA allocated $45.6 billion for enforcement, $25.3 billion for operations support, $4.8 billion for business systems modernization (technology), and $3.2 billion for taxpayer services. With these increases, President Biden’s budget projected enforcement spending will grow from 38 percent of the total IRS budget in 2023 to 61 percent by 2033.4

These funding priorities are off kilter. The IRS issued a Strategic Operating Plan earlier this year that mainly stressed better technology and customer service.5 Congress should rebalance IRS funding toward these areas.

Collateral Damage of Enforcement

The Congressional Budget Office (CBO) expects the $79 billion boost to IRS funding to raise $180 billion over 10 years.6 Supporters say this shows a high “return on investment” from the funding, but that does not account for the broader costs to society of increased enforcement.

Aside from the IRS funding costs, increased enforcement raises private-sector compliance costs, costs of audit defense and litigation, and extra taxpayer time and energies. Further costs include deadweight losses from taxpayers changing their behavior in ways that undermine output. One statistical study in 2022 found that small corporations subject to IRS audits are more likely to go out of business than other firms.7 Increased enforcement can also generate hard-to-quantify costs such as taxpayer anguish, financial uncertainty, and losses of civil liberties.

More aggressive IRS enforcement would create collateral damage on individuals and businesses because the IRS makes many mistakes, which is not surprising given the complexity of the code. Litigation statistics show that the IRS wins only about half the time in court. For Tax Court and refund cases closed in the past five years, the IRS on decision gained just 48 percent of the dollars in dispute.8

Auditing taxpayers who have already paid the correct amount is collateral damage. Between 40 to 50 percent of partnership audits result in no recommended changes.9 For individuals earning more than $5 million, the audit no-change rate is just under 40 percent.10 Given that audits are usually targeted by discrepancies and IRS algorithms, these percentages seem high.

For returns where auditors do recommend changes, the Government Accountability Office (GAO) notes that the “IRS collected about 47 percent of all recommended additional taxes from individual taxpayer audits closed in fiscal years 2011 to 2020.”11 For higher-income returns, the IRS only collects about 40 percent. Enforcement is a leaky bucket.

Additional taxes recommended on IRS audits are relatively higher for middle-income returns than for high-income returns. Recommended tax changes on audit average roughly 5 to 8 percent of income for middle-income taxpayers but just 1 to 3 percent for high-income taxpayer.12 High-income taxpayers are more likely to receive expert tax help, and thus less likely to make errors.

Of course, the IRS needs to enforce the tax laws. But as enforcement increases, compliance costs rise, deadweight losses rise, and families and businesses face added stress and uncertainty. Also, because the IRS is such a powerful agency, aggressive tax enforcement can put civil liberties at risk.13

Tax Gap Is Stable

In October, the IRS released a new estimate of the “tax gap,” which is the amount of federal taxes owed but not paid.14 The estimated gross tax gap for 2021 was $688 billion. After late payments and enforcement, the net gap was $625 billion—$475 billion from individual income taxes, $37 billion from corporate income taxes, $112 billion from employment taxes, and $1 billion from estate taxes.

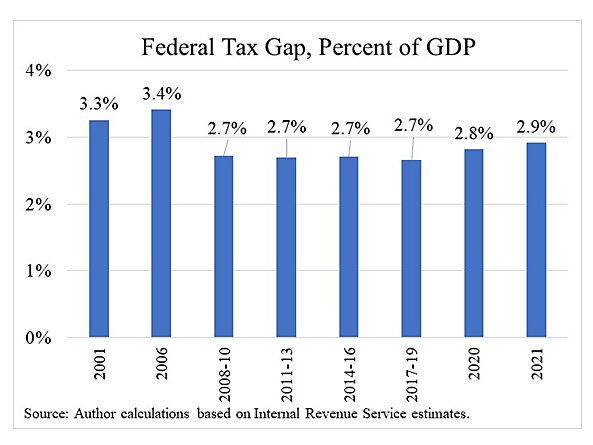

The dollar value of the tax gap has increased over time, but the new gap estimate is similar to previous IRS estimates when compared to U.S. gross domestic product (GDP), as shown in the figure below.15

The flip side of the gross tax gap is the “voluntary compliance rate,” which is the tax paid on time divided by the estimated full amount owed. The IRS report shows that the voluntary compliance rate has hovered between 82 and 85 percent since 2001. It was 84.9 percent in 2021. The degree to which Americans are law-abiding on federal taxes does not appear to have changed much over the past two decades.

Note that these tax gap measures overstate revenues that might be gained from enforcement because they do not account for behavioral responses. If the IRS were to squeeze more money from individuals and businesses, some would decrease working, hiring, and investment, which would reduce revenues raised.

U.S. and Foreign Tax Gaps

International studies show that the U.S. tax gap is not high compared to other advanced economies. Our federal gap is 2.9 percent of GDP, and if we assume the same nonpayment rate for state-local taxes, the overall U.S. tax gap is about 4.4 percent of GDP.16 That figure is no higher than typical tax gaps in other countries.

- In a 2018 study, Konrad Raczkowski and Bogdan Mroz estimated that the tax gap for the United States was 3.8 percent of GDP and the gap for 28 European Union (EU) countries was 7.7 percent of GDP.17

- In a 2015 study, Konrad Raczkowski estimated that the tax gap for 28 EU countries was 10.7 percent of GDP.18

- In a 2019 study, Richard Murphy estimated that the tax gap for 28 EU countries was 5.6 percent of GDP.19

The overall EU tax burden is higher than the U.S. burden. If we adjust the EU gap estimates down using the ratio of U.S. to EU taxes, the EU gaps are 5.1 percent for Raczkowski‐Mroz, 7.1 percent for Raczkowski, and 3.7 percent for Murphy.20 These EU figures are similar or higher than the U.S. gap.

Some studies estimate the size of shadow economies that escape taxation. In a 2018 study across 158 countries, Leandro Medina and Friedrich Schneider found that the U.S. shadow economy is the second smallest as a percent of GDP.21 From 2010 to 2015, the U.S. shadow economy of 7.7 percent compared to the European average of 20.2 percent. That supports the view that the U.S. tax gap is on the low side compared to other countries.

Boosting Tax Compliance

Rather than increasing enforcement spending, there are three better ways to boost tax compliance that would benefit taxpayers and the economy.

First, keep tax rates low to reduce incentives for cheating. The average statutory corporate tax rate in the major industrial countries has been slashed almost in half since the 1980s, but corporate tax revenues as a percentage of GDP have risen since then.22 One reason is that lower rates encourage compliance and reduce avoidance and evasion.

Second, improve taxpayer services, technologies, and employee training at the IRS to reduce filing and audit errors. The National Taxpayer Advocate (NTA) said, “Tax compliance depends on prompt, high-quality customer service, and when compliance becomes unduly burdensome, the IRS runs the risk that taxpayers will simply quit trying.”23

IRS customer service needs major improvements. One survey ranked the IRS last among 221 private companies and public agencies on customer service.24 The NTA argued that “the most efficient way to improve compliance is by encouraging and helping taxpayers to do the right thing on the front end. That is much cheaper and more effective than trying to audit our way out of the tax gap one taxpayer at a time on the back end.”25

Third, simplify the tax code. Rising complexity is an invitation to errors and abuse, and it is straining IRS resources. In a 2022 report on the IRS, GAO found, “Since fiscal year 2010, average audit hours have more than doubled for returns with income of $200,000 and above.”26 That is, returns are taking twice as long for IRS auditors to examine.

The past NTA said that tax complexity “facilitates tax avoidance by enabling sophisticated taxpayers to reduce their tax liabilities and by providing criminals with opportunities to commit tax fraud.”27 She concluded that tax reforms to simplify the code would “reduce the likelihood that sophisticated taxpayers can exploit arcane provisions to avoid paying their fair share of tax; enable taxpayers to understand how their tax liabilities are computed and prepare their own returns; improve taxpayer morale and tax compliance.”28

Unfortunately, Congress has not heeded the NTA’s advice. The IRA added or expanded a slew of energy tax breaks, all with complicated rules. The IRS Strategic Operating Plan says that the energy breaks will cost $3.9 billion to administer. The IRA tax breaks will also boost planning, compliance, and lobbying costs in the private sector since $1 trillion in benefits are at stake.29

The IRA’s energy tax breaks have many complex features. Some of the breaks have bonus credits on top of basic credits if recipients jump through hoops related to prevailing wages, low-income communities, energy communities, or domestic content.

Some of the energy breaks are “direct pay” going to recipients that don’t pay taxes, such as nonprofit groups. And some of the breaks are “transferrable” between entities. The IRS rules and guidance for the new breaks are already hundreds of pages in length. The new energy breaks will likely induce substantial fraud and abuse, and they will pull IRS resources away from administering the rest of the code.

The tax code is an increasing mess. The number of official tax expenditures has risen from 53 in 1970 to 205 today, making IRS administration and enforcement ever more difficult.30 We know from experience that complex tax expenditures, such as the low-income housing tax credit and earned income tax credit, generate substantial errors and abuse.

Congress should use the coming expiration of the Tax Cuts and Jobs Act as an opportunity to pursue major tax-code simplification.31

Fiscal Responsibility

CBO projects that federal debt will rise continuously as a percentage of GDP in coming years, which could trigger a major economic crisis. Rising interest rates and new spending proposals are adding to federal budget pressures.

Congress should offset any new spending and pursue reforms to get deficits under control. Jacking up IRS enforcement may raise some revenue but would harm taxpayers and the economy. There are other ways to start reducing deficits, such as the following proposals.

Spending Reforms

- Social Security. CBO has proposed reform options to reduce retirement benefits for high earners. One option would phase in reductions for the top half of earners to save $184 billion over 10 years.32

- Medicaid. The federal government should require states to take greater responsibility for funding federal-state programs. CBO estimates that reducing the high matching rate for the Affordable Care Act’s Medicaid expansion to normal matching rates would save $604 billion over 10 years.33

- Supplemental Nutrition Assistance Program. America is suffering from an obesity crisis, yet almost one-quarter of SNAP spending—about $25 billion a year—goes toward junk food.34 Restricting purchases, or allowing states to make such reforms, could create substantial budget savings.

Revenue Reforms

- Energy tax breaks. The IRA’s energy tax breaks were originally expected to cost $391 billion over a decade.35 Experts now believe the breaks could cost $1 trillion or more. Congress should at least scale back the breaks to the originally proposed costs to save about $600 billion over 10 years.

- Municipal bond tax exemption. The interest on state and local government bonds is tax-free under the income tax, which is a benefit heavily slanted toward high earners. Repealing the exemption would reduce deficits by about $400 billion over 10 years and improve investment efficiency.

- Low-income housing tax break. The LIHTC is hugely complex and generates substantial fraud and abuse.37 Repealing the credit would reduce deficits by $77 billion over 10 years.38

These sorts of tax-code reforms would not only reduce deficits but also free IRS resources to handle its normal tax administration and enforcement activities.

Conclusions

IRS estimates show that the tax gap is stable relative to the size of the economy, and the U.S. tax gap appears to be modest by international standards. Nonetheless, policymakers can reduce the tax gap by cutting statutory tax rates, improving IRS management, and simplifying the tax code. Those policies would be a win for taxpayers, the government, and the economy.

The IRS National Taxpayer Advocate argued that IRA funding “is disproportionately allocated for enforcement activities, and I believe Congress should reallocate IRS funding to achieve a better balance with taxpayer service needs and IT modernization.”39 Congress should shift the new enforcement funding to customer services and technology upgrades.

There are many good ways to offset new spending and reduce deficits. Congress should pare back tax loopholes, trim entitlement programs, and move program funding responsibilities to the states.

Thank you for holding this important hearing.