What many Americans aren’t aware of, however, is just how much financial information banks already report to the federal government.

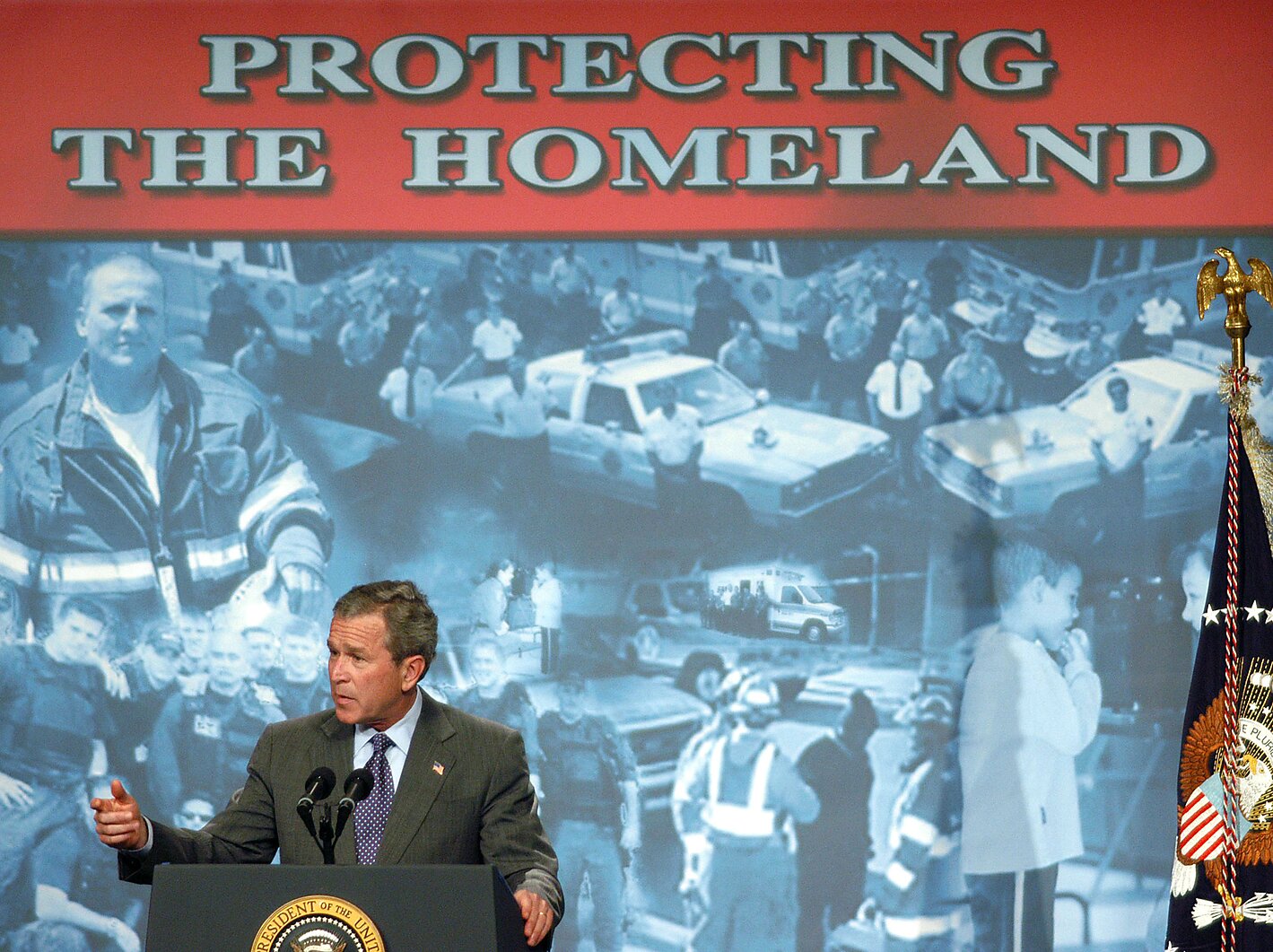

Most of those reporting requirements come from The Bank Secrecy Act (BSA), which requires financial institutions to help federal agencies detect and prevent money laundering and other crimes. This essentially forces private financial companies to act as law enforcement agents. If judged by the standard of reducing criminal activities, there is virtually no empirical evidence to suggest that the approach has worked.