A lot of publicity usually surrounds the signing of agreements removing tariffs on international trade—especially when done in exotic places with plenty of photo ops. But such agreements are not sufficient for advancing trade. Adequate and appropriate transportation networks are also necessary—we cannot conduct international trade without transportation regardless of the number of times that politicians sign agreements. That means politicians must be willing to remove the manifest barriers that block international transportation. Unfortunately, such political will is often weak or outright lacking.

Why do international transportation barriers exist? Countries often find that providing international transportation is a very lucrative business, especially when they have a degree of monopoly power in its supply. There is nothing novel in this; in classical times there were high port fees and use of the Silk Road was expensive. There also is a tendency for countries to impose conditions favorable to their native transportation firms.

Manipulating international transportation markets and protecting a country’s own transportation suppliers are rationalized as methods of supporting military and civil requirements for times of emergency. For example, there is the Civil Reserve Air Fleet in the United States: commercial airlines are committed to providing airlift when needed in exchange for the guaranteed paid carriage of government employees and cargo at other times. Similar arrangements exist for the maritime sector under such institutions as “cargo preference,” which, for example, favors U.S. ships for the carriage of food aid. Those policies create standby capacity supported by cross-subsidies, but they come at a cost.

In this article, I examine such barriers in one particular transportation sector: I describe the attempts in recent decades to reduce the barriers to trade in international airline services and the effect those reductions have had on the U.S. economy.

THE CHANGES

Bilateral air service agreements governed much of the global international air transportation market from the mid-1940s. In part because air transportation technology was still fairly basic, the pre–World War II period saw limited international air transportation. What transportation existed was governed by ad hoc arrangements between the countries involved. World War II saw considerable advances in aviation, and policymakers appreciated the potential importance those advancements would bring once peace returned.

The Chicago Convention of 1944 was convened to develop an institutional framework that would allow the economic benefits of international air transportation to be exploited for the common good. Unfortunately, the conference led only to a series of bilateral agreements on services rather than a broader multilateral framework. A major issue in preventing greater coordination was the disparate views of the countries involved over how a global system would work. At one extreme, Australia wanted one global airline, controlled centrally, whereas the United States wanted open competition (a not entirely impartial position given its near monopoly on long-range aircraft at the time).

The result was a myriad of quite diverse bilateral agreements between countries covering, among other things, which airlines could supply services between them, the capacities involved, the fares and cargo rates to be charged, and the way revenues were to be shared. The agreements did little to keep costs down. Most of the competition that did exist between carriers on a route was over service quality in terms of refreshments, leg-room, etc., and not in terms of frequency or scheduling of services. The system effectively ruled out fare competition. In addition, outside of the United States, most airlines were state-owned, with no strong commitment to economic efficiency.

Open Skies / Beginning in the 1970s, however, countries have reconsidered international transportation, with a much greater emphasis placed on its role as an input in economic development. The United States initiated liberal international air service agreements as a logical extension of the regulatory reforms of its domestic market; the term “Open Skies”—often used internationally to describe air transportation liberalization—was first coined by Alfred Kahn, the chairman of the Civil Aeronautics Board, in 1979 when discussing wider objectives to be pursued after the enactment of the 1978 Airline Deregulation Act.

The U.S. strategy was to negotiate very liberal air services agreements with countries one at a time, based largely on a common template. The hope was that once a deal was struck with one country, neighboring counties would follow suit. While early efforts in Asia proved disappointing, by the late 1990s many major European aviation countries such as the Netherlands (1992) and Germany (1996) had signed Open Skies agreements with the United States. The agreements allowed flights to any point in the signatory countries, with no restriction on fares, service level, or the right to fly between two foreign countries on a flight originating or ending in the country (so-called “fifth freedom operations”). Parallel measures involving antitrust and competition policy allowed code sharing and other strategic alliance activities.

Open Skies bilateral agreements do not mean entirely open markets in an economic sense. There are “nationality clauses” that affect the carriers that may enter markets; they must be “substantially and effectively controlled” by the designated state or by its nationals. There also are rules regarding “cabotage”; e.g., domestic services can only be provided by an airline “established” in the country.

Not all European countries entered into Open Skies agreements with the United States, and some of the agreements are not fully operational. For a time, the highly important United Kingdom–U.S. air services market—New York to Heathrow being the most traveled transatlantic route, and Los Angeles to Heathrow the second—still operated under the earlier “Bermuda II” agreement originally signed in 1977, although periodically revised. This agreement limited, among other things, the number of carriers that could serve Heathrow to two from each country, and the number of U.S. gateways served. Greece, Ireland, and Spain also had—albeit it less stringent—restrictions; e.g., Ireland required one U.S. flight through Shannon for every one to Dublin, and limited fifth freedom rights; Greece, besides limiting fifth freedom rights, also restricted the gateways served, the number of airlines on some routes, and fares.

While the bilateral Open Skies regime introduced greater flexibility into the transatlantic market—the pre-2008 agreements covered 22 European countries, with seven increasing transatlantic service levels, six reducing, five countries seeing no significant change, and four yet to receive direct transatlantic flights—it still did not cover important markets such as the UK–U.S. In addition, from the late 1990s and after the liberalization of the internal European air transportation market, legal issues emerged regarding extra–European Union authorities, specifically regarding matters of the respective responsibilities of the EU and of the individual member states that transcend narrow aviation considerations.

The European Commission questioned the legality of the existing Open Skies agreements that effectively gave preferential treatment, through the nationality rules, to the European national carriers involved. The ruling of the European Court of Justice, although not precluding strategic alliances and revised Open Market agreements, effectively resulted in the EC gaining power in June 2003 over regulation of extra-EU air services involving the United States, and in negotiating transatlantic aviation treaties.

The initial agreement between the United States and the then-27 member-states of the EU was signed in Washington on April 30, 2007, to become effective in March 30, 2008. A second phase of the agreement, incorporating Iceland and Norway (both non-EU members), was signed in June 2010. When Croatia joined the EU in July 2013, it also became part of the arrangement. With the EU–U.S. agreement, any EU or U.S. airline can fly between any two points in the two regions without any restrictions on capacity or pricing, regardless of the airline’s country of registration. But the agreement does not allow cabotage or significant foreign ownership of a U.S. carrier.

This is not to say that the EU–U.S. agreement has entirely freed the North Atlantic airline market for competition. Unlike either the internal Europe market or, to a lesser extent, the U.S. market, there are still few low-cost services on transatlantic routes. Where there have been efforts to initiate such services, they have been hindered by vested interests such as incumbent airlines and labor unions that want to protect their positions. For example, Norwegian Air Shuttle has been trying to obtain permanent approval to offer low-cost flights between London’s Gatwick Airport and New York, but has been opposed by groups such as the U.S. Air Line Pilots Association and airlines including American, Delta, United, Air France, and Lufthansa (all members of the major airline alliances that carry 85 percent of the traffic over the North Atlantic). This opposition has been justified on the grounds that Norwegian Air Shuttle may be unsafe because it will provide services under Irish certification, a country it does not operate from. The claim is that Irish certification is analogous to the practice of flags of convenience in ocean shipping. But Ireland is part of the EU, carriers such as Aer Lingus provide safe transatlantic services, and Irish regulatory oversight has an extremely good regulatory record—indeed, the United Nations International Civil Aviation Organization’s safety audit ranks it one the best in the world, just above the United States.

REFORM AND AIR TRAVEL

The EU‑U.S. agreement opened London Heathrow Airport to full competition, ending the exclusive right for two U.S. (United and American Airlines) and two UK (British Airways and Virgin Atlantic) airlines to fly transatlantic services from it. This right also existed for third-country carriers with incumbent fifth freedom rights to carry passengers between Heathrow and specified U.S. airports—namely, Air New Zealand, Air India, and Kuwait Airways. After the EU‑U.S. agreement, Delta Air Lines began services to Heathrow from Atlanta and New York, and US Airways from Philadelphia. Northwest and Continental Airlines had also begun services to Heathrow, but ceased independent operations under those names following mergers.

Nevertheless, expansion of transatlantic flights involving Heathrow continue to be limited by lack of runway capacity (its two runways operate at over 98 percent of capacity), uncertainty about expansion plans (especially when plans to build a third runway and a sixth terminal were canceled in May 2010), and the fact that many takeoff slots are “owned” by incumbent airlines or alliance partners. The benefits of reform have been in the form of allowing better use of capacity, rather than in increasing Heathrow’s capacity.

The changes that have occurred in the transatlantic airline market since 2007 have also been influenced by factors besides the Open Skies agreement. For example, in April 2008 the EC clarified the EU position on secondary takeoff and landing slot trading, previously thought not to be acceptable, by saying that legislation did not prohibit it. In a subsequent analysis of slot trades in 2009, Airport Coordination Limited found in a sample of Heathrow trades very large increases in the average number of seats per aircraft deployed, the average sector length, and the average number of air service kilometers per slot. The change to the EU approach has also seen an increase in slot trading activity at Heathrow, with summer transfers rising from 68 in 2005, to 235 in 2007, 449 in 2010, and 526 in 2012. While not all related to transatlantic traffic, much of this flexibility would not have been possible without the EU‑U.S. agreement.

Continuing turbulence / The transatlantic market is still far from perfectly competitive, although the competition between three major airline networks engenders more downward pressure on fares and more choice of carriers than the partially regulated regime prior to 2008. Three European and two U.S. mega-carrier groups, for example, control 59 percent of the North Atlantic seat capacity, and the share is higher if alliances are considered. If allowances are made for the merger of American Airlines and US Airways, and with the latter transferring to the oneworld Alliance, and if Virgin joins SkyTeam, then the market shares of seats attributable to the main alliances (including traffic to Canada) are: Star Alliance, 33.4 percent; SkyTeam, 29.9 percent; and oneworld, 25.2 percent. Added to this, mergers and acquisitions have also been important for transatlantic services after the move to Open Skies, with Delta and Northwest joining in 2008, United and Continental in 2010, and American and US Airways in 2013.

Those mergers, and some of the juggling of alliance groups that have accompanied them, have been influenced by the EU–U.S. agreement, but by how much is difficult to say. The mergers were a function of the internal decisionmaking of the carriers and inevitably involved their views on domestic and wider international markets as well as European routes. But, given that the mergers also affect feeder routes to the transatlantic gateways, as well as transatlantic services themselves, it is inevitable that network adjustments were made to more closely reflect consumer demands and to economize on costs.

Of particular importance for Heathrow was the British Airways (technically its holding company, the International Airlines Group) takeover of the short-haul airline British Midland International (BMI). BMI held the second largest number of slots at Heathrow in 2012; the takeover increased British Airways/Iberia holdings by 56 slots, even after a divestiture of 14. The implications of this are still being digested.

This ability for airlines to interact and adjust their schedules may explain their increased load factor, which rose from about 70 percent in the early 1990s to almost 85 percent in 2012, with a 3.5 percent annual gain after 2009.

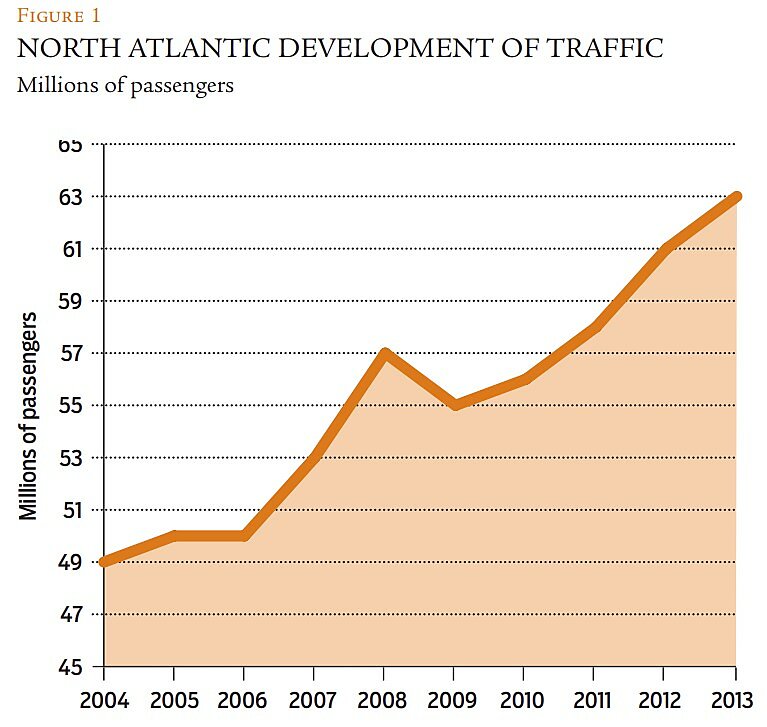

The overall effects of the EU–U.S. agreement are made particularly murky by the global recession of 2008. Airline Monitor data relating to U.S. carriers’ North Atlantic yields indicate high volatility, including an 18 percent decline in 2009, the first full year after the EU–U.S. agreement, with North Atlantic traffic falling 6.2 percent; much heavier than the 2 percent seen globally. Strong recovery in North Atlantic yields since 2009 reflects a tightening of capacity growth that would seem related to greater levels of coordination allowed by the increase in joint-venture operations that antitrust immunity under Open Skies allows and the greater flexibility airlines enjoy. This ability for airlines to interact and adjust schedules may explain the increased load factor, which rose from about 70 percent in the early 1990s to almost 85 percent in 2012, with a 3.5 percent annual gain in the four years after 2009.

WIDER ECONOMIC EFFECTS

The changes that have taken place in the regulation of transatlantic air transportation have been the subject of limited research, with much of the analysis being ex ante in nature and often focused on the effects on airlines rather than economic development. In some ways this is understandable; airlines and related industries have vested concerns about effects on their businesses. There is additional interest from antitrust authorities that are responsible for the institutional environment in which this business takes place. But air transportation is an input into wider economic activities; indeed, the demands for its services are derived from such activities

There has been considerable analysis of the effects of strategic alliance, the structures of which the transatlantic agreement changed. This is particularly germane because of the inability of British Airways and American Airlines to fully ally within oneworld until the EU–U.S. Open Skies was signed. The alliances have taken a variety of forms, but essentially entailed code shares and coordinated frequent-flier programs that have, as air service agreement reforms progressed, resulted in rationalization of schedules. All the major international carriers over the North Atlantic now belong to the three global strategic alliances (Star Alliance, oneworld, and SkyTeam) that dominate aviation.

Studies of the transatlantic alliances tend to focus on the implications for the airlines involved, their competitors, and the traveling public. In part because it takes time for the effects of alliances to be fully realized, many other things happen in between, and the alliances evolve over time, the studies do not paint an entirely consistent picture of what is occurring. There are indications that the alliances have, to date, largely had positive effects for air travelers and, one would expect, economic development. This is not to say that further consolidation will continue in this way.

While there were several specific ex ante forecasts of the probable effects of the North Atlantic Open Skies policy, ex post economic analyses are scant. Much of the former work is based largely on extrapolating the effects of existing liberal bilateral air service agreements between individual EU countries and the United States, with simpler assessments of the economic impacts of network effects within the European and American markets of open intercontinental services. In a 2000 study I conducted with Samantha Taylor, for example, we found that the effects of national Open Skies initiatives on 41 U.S. metropolitan areas included positive links between the economic performance of surrounding areas and the availability of international air services to EU markets.

Specifically related to the EU–U.S. agreement, the Brattle Group in 2002 forecast a potential annual transatlantic passenger traffic increase of between 4.1 and 11 million. That forecast was based on the idea of an “Open Aviation Area” embracing the removal of all foreign ownership and cabotage restrictions, as well as initiating a liberal EU–U.S. air service agreement. This would result in an increase in consumer benefits of some €2.7 billion (which would be doubled if intra-EU and intra‑U.S. traffic were considered), and an annual increase in economic output in directly related industries, such as airlines and airports, of €3.6–€8.1 billion per year. In 2007, Booz Allen Hamilton updated the Brattle research and estimated an extra 26 million passengers over the first five years of implementation, producing a consumer benefit of €6.4–€12 billion. This, combined with cargo effects, was predicted to generate between 77,000 and 81,000 new jobs over the period.

At the industrial level, my 2006 study with Jonathan Drexler examined the potential effects of an EU–U.S. Open Skies agreement on high-technology employment in European regions. We estimated that such an agreement would result in some 30,000 jobs for EU regions that already have good aviation links with the United States, although employment would be highly variable across those regions. Regarding tourism, a 2008 study conducted at the Economic and Social Research Institute in Dublin, Ireland, predicted the EU–U.S. Open Skies would increase competition between transatlantic carriers and reduce fares, resulting in an increase of passengers flying into the EU of 1–14 percent.

In other words, while the details differ, there is strong evidence prior to the transatlantic agreement that it would have important positive economic effects on both sides of the Atlantic.

EFFECTS ON THE U.S. ECONOMY

Getting a firm handle on the details of the actual effects of more Open Skies on the U.S. economy—as opposed to mere forecast—is not easy. The transatlantic Open Skies came into effect in March 2008, just as the “Great Recession” struck. The recession’s effect in Europe was slightly delayed; while American unemployment topped 10 percent by late 2009, Eurozone unemployment reached record levels in September 2012 at 11.6 percent, up from 10.3 percent the prior year, although this varied significantly by country. Put simply, the severe economic recessions on both sides of the Atlantic overshadowed any immediate net gain in traffic that the EU–U.S. Open Skies initiative might have generated. Structural changes in the airline industry from mergers and the changing composition of strategic alliances, as well as the EU clarifying policies regarding such things as airport slot trading, further muddied the effects of Open Skies.

Given the inevitable complexity of the entwined forces at work, it is difficult to tease out the exact implications of the transatlantic agreement on the air transportation industry, let alone its wider effects on the U.S. economy. In particular, at the regional level, several hub airports and the local economies linked to them have found themselves affected as legacy carriers have undergone mergers and accordingly have restructured their operations. In particular, the joining of United and Continental seems to have affected traffic flows to Washington’s Dulles Airport (a traditional United hub), and the merger between Delta and Northwest affected transatlantic traffic flows to Atlanta’s Hartsfield Airport (Delta’s main hub).

The EU–U.S. Open Skies Agreement provides for more flexibility in terms of the route structures offered by the airlines. Thus the lower de facto fares exert a positive effect on airports’ regional economies.

Added to this, the EU–U.S. agreement embraces all United States international airports. Thus, because of the hub-and-spoke airline networks involved, this has also meant some inevitable interactions of capacity provisions between East Coast airports and inland and West Coast gateways.

Some hubs are likely affected more than others; one of the most affected in the longer term is likely to be New York’s John F. Kennedy Airport, a large American Airlines hub. The agreement, by affording antitrust immunity to the American–British Airways alliance oneworld, permits coordination of fares and services. That puts oneworld services on a competitive footing with Star Alliance and SkyTeam carriers and, with that, changes the competitive position of New York’s main airport.

The air traffic at the main East Coast airports, in terms of available seats, was adversely affected following the terrorist events of 2001 and again with the onset of the Great Recession in 2008. That adversity occurred despite the transatlantic agreement, with the larger airports relatively more affected. Recovery since the nadir of the recession and the almost coincidental enactment of the EU–U.S. Open Skies agreement has been mixed, with some facilities moving back to their pre-2008 level of traffic but others struggling to regain business.

A recent study that I conducted with Rui Neiva and Junyang Yuan of East Coast airports found that liberalized policy that increased air passenger traffic was coincidental with increases in employment in the relevant metropolitan area in the post-agreement period. The EU–U.S. Open Skies Agreement provides for more flexibility in terms of the route structures offered by the airlines. Thus, the lower de facto fares offered to potential passengers and the resultant changes in the increasing numbers of passengers exert a positive effect on those airports’ regional economies.

Conclusion

The EU–U.S. Open Skies Agreement came about at a time of global economic recession and when other commercially driven reforms, such as mergers, were being enacted by the airlines most affected. Isolating the effects of the agreement on the airlines, and ultimately on regions around the large U.S. hub airports that are likely to have been most affected, is difficult; in a way it statistically represent noise in the overall macroeconomic system. What does seem to have happened is that the airlines have been recovering from the Great Recession and that the agreement has provided some boost to this, and ipso facto to the U.S. East Coast economies that have been examined. Given the overriding strength of macroeconomic conditions, and the fact that air traffic has barely recovered to its pre-recession levels, the changes in the relationship between international air transportation seems to have less to do with its aggregate supply than with the quality of that supply in terms of fares levied and the service networks supplied.

Readings

- “Economic Development and the Impact of the EU–U.S. Transatlantic Open Skies Air Transport Agreement,” by Kenneth Button, Rui Neiva, and Junyang Yuan. Applied Economics Letters, Vol. 21, No.11 (2014).

- “International Air Transportation and Economic Development,” by Kenneth Button and Samantha Taylor. Journal of Air Transport Management, Vol. 6, No. 4 (2000).

- The Economic Impact of an EU‑U.S. Open Aviation Area, published by the Brattle Group. 2002.

- The Economic Impacts of an Open Aviation Area between the EU and the U.S., published by Booz-Allen Hamilton. 2007.

- “The Effects of Open Skies Agreements on Transatlantic Air Service Levels,” by Alex Cosmas, Peter Belobaba, and William Swelbar. Journal of Air Transport Management, Vol. 16, No. 4 (2010).

- “The Impact of the EU–U.S. Open Skies Agreement on International Travel and Carbon Dioxide Emissions,” by Karen Mayor and Richard S. J. Tol. Journal of Air Transport Management, Vol. 14, No. 1 (2008).

- “The Implications on Economic Performance in Europe of Further Liberalization of the Transatlantic Air Market,” by Kenneth Button and Jonathan Drexler. International Journal of Transport Economics, Vol. 33, No 2 (2006).

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.