In a shocking upset, political novice Dave Brat, a little-known Randolph-Macon College economics professor, defeated then–House Majority Leader Eric Cantor in the 2014 Republican Primary for Virginia’s 7th District congressional seat. The victory came despite Cantor’s campaign outspending Brat’s 40–1 and Brat trailing badly in pre-election polling.

So how did he pull off the stunner? Brat campaigned hard against Cantor’s close ties to large corporations and his support for the Export-Import Bank, a government agency that finances foreign purchases from American firms. Ex-Im has been nicknamed the “Bank of Boeing” because of its extensive role in financing the aircraft maker’s international sales. The bank provided about $50 billion of funding for Boeing sales between 2008 and 2012, and in 2013 two-thirds of Ex-Im’s $12 billion of loan guarantees benefitted the company. Boeing clearly recognized the bank’s importance to its business, because in 2013 it spent $15.3 million lobbying for the bank’s reauthorization.

With Ex-Im requiring reauthorization by September 30, 2014, Cantor’s June 10 loss cast substantial and unanticipated doubt on the bank’s future. It seemed even less secure on June 22nd, when Cantor’s successor as majority leader, Rep. Kevin McCarthy (R–Calif.), said in a television interview that he favored shutting down the bank because the private sector could underwrite exports. McCarthy’s statement was especially noteworthy because he previously had been a supporter of the bank and in 2012 had voted for its renewal and an increase in its lending limit. Yet, despite those developments casting doubt on the bank’s future, news broke on Sept. 3rd that the Republican-controlled House was moving toward a deal that would reauthorize the Export-Import Bank into 2015.

Given the bank's importance to Boeing, it might be expected that Boeing's market value would fall in response to Cantor's defeat and McCarthy's remarks, but then rebound on the news of reauthorization. To test this, we used an event study to examine the effects of Ex-Im news on Boeing's share price.

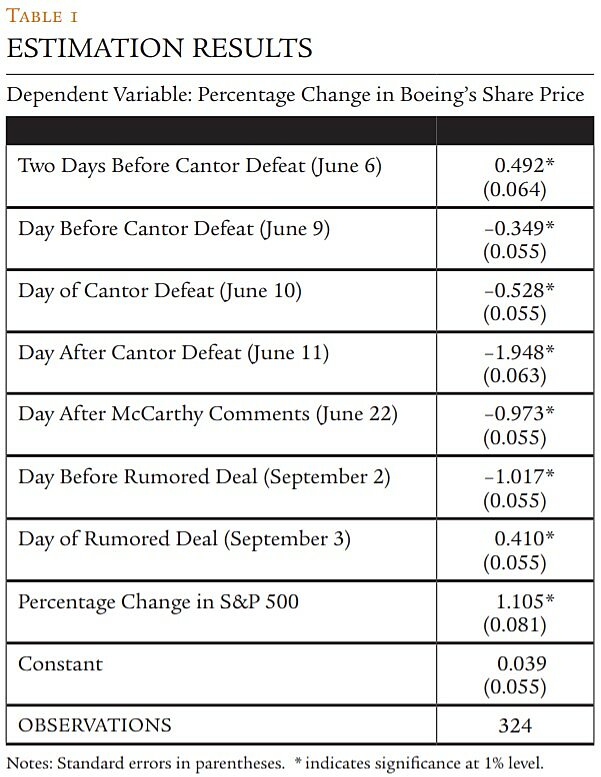

Analysis / As discussed earlier, the events of interest are Brat's unexpected defeat of Cantor on June 10th, McCarthy's comments on June 22nd, and the September 3rd deal among House Republicans to reauthorize the bank. To allow for the leakage of information on Cantor's looming loss, we used dummy variables for the two days immediately before the election, the day of the election (the market closed before the polls), and the day following the election. For McCarthy's comments, we used a dummy variable for the first day of trading after his TV appearance. And for the September 3rd announcement of a deal to renew the bank's charter, we used dummy variables for Sept. 2nd and 3rd, again to allow for information leakage. Our sample period was from May 21, 2013 through September 3, 2014, giving us 324 observations.

Estimation results are reported in Table 1. The negative coefficient on the dummy variable for the day after Cantor's defeat indicates that Boeing had an abnormal loss of nearly 2 percentage points following Brat's election. The dummy variables for election day and the day before the election also have negative coefficients, suggesting that Cantor's defeat may not have been entirely unexpected. The cumulative abnormal return—the sum of the three negative coefficients—is about 2.8 percentage points. Given Boeing's market capitalization of about $100 billion, the cumulative abnormal return of –3 percentage points suggests that Cantor's defeat cost Boeing's shareholders nearly $3 billion.

Turning to the effect of McCarthy's comments about the Export-Import Bank, the estimated coefficient is negative and statistically significant. Since his comments are associated with Boeing's share price falling by nearly 1 percentage point, market participants must have believed that the comments indicated a reduced likelihood that the Export-Import Bank would have its charter renewed.

Concerning the September 3rd news that Ex-Im's extension was in the works, the positive coefficient on the dummy for that day indicates that the news was associated with an increase in Boeing's share price. The estimated effect, about 0.4 percentage points, is considerably smaller than the negative returns associated with Cantor's defeat or McCarthy's remarks. Possible reasons for the small response include uncertainty about whether the news was accurate and the relatively short (less than one year) extension being contemplated. It is also possible that the small magnitude results from a diminished concern over July and August 2014 that the bank's charter would be allowed to elapse; if this is the case, then the rumored deal did not provide new information to the market about the likelihood of the bank's closing or being renewed. The large negative return for the dummy variable for September 2nd, the day before rumors began circulating of a deal to extend the bank, suggests that the rumored deal was not anticipated by market participants.

Finally, the estimated coefficient on the S&P 500 return variable indicates that Boeing shares also tend to move closely with the overall performance of the market. Including this variable in the analysis is important to control for other influences such as macroeconomic events affecting the overall stock market.

Conclusion / The findings indicate that Boeing's shares fell in response to the possibility that the Export-Import Bank would not be reauthorized following Cantor's defeat and McCarthy's comments. Conversely, the finding of a positive return associated with the rumored deal in September 2014 indicates that Boeing was expected to benefit from the bank's extension. Those results are consistent with Ex-Im's moniker as the "Bank of Boeing," though nothing in this analysis can differentiate between proponents' claim that the bank provides financing unavailable from private lenders and opponents' contention that the bank is unnecessary and a manifestation of "crony capitalism." The strong relationship between Boeing's share price and the expected status of the Export-Import Bank also explains why Boeing devoted millions of dollars to lobbying for the continuation of the bank's charter.

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.