As part of its 2018 budget proposal, the Trump administration has introduced a plan to improve the nation’s infrastructure.1

The administration intends to reduce regulatory barriers that delay infrastructure projects and raise project costs. It also intends to encourage private investment in infrastructure through privatization and public-private partnerships. And the administration aims to increase federal spending on infrastructure by $200 billion over the next 10 years.

This bulletin provides input to the discussion by examining infrastructure ownership and funding. Some people assume that the federal government plays the main role in infrastructure. But, by one measure, state and local governments and the private sector own 97 percent of the nation’s nondefense infrastructure, and they fund 94 percent of it. That decentralized approach to ownership and funding is a strength of the American economy — a strength that would be undermined by increased federal spending and intervention.

WHAT IS INFRASTRUCTURE AND WHO OWNS IT?

Economists agree that robust infrastructure investment is important for economic growth. Infrastructure generally refers to long-lived fixed assets, such as highways, that provide a backbone for production and consumption activities in the economy.

However, economists have no clear criteria to decide which assets should be considered “infrastructure.”2

Economic studies often use all government-owned fixed assets as a measure of infrastructure. But that definition includes assets that people may not think of as infrastructure, such as schools, and it excludes private assets that people do think of as infrastructure, such as electric utilities. The widely cited “Infrastructure Report Card” from the American Society of Civil Engineers examines 16 types of public and private infrastructure, but the report’s coverage is ad hoc.3

It includes public schools but not private schools or universities. It includes public parks but not private recreational facilities. It includes railways and electric utilities, which are network industries, but leaves out the huge telecommunications industry.

To find hard and consistent data on infrastructure, we need to look at the national income accounts produced by the Bureau of Economic Analysis (BEA). For the public and private sectors, the BEA calculates the net stock of fixed assets, which is a very broad but uniform measure of infrastructure.4

Fixed assets accumulate over time from investments in structures, equipment, and intellectual property. Those investments less depreciation form the net stock of fixed assets. Fixed assets are combined with labor and other inputs to produce the nation’s gross domestic product.

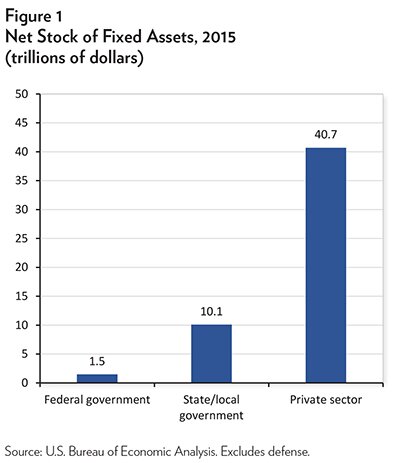

Figure 1 shows that the private sector owns most of the nation’s nondefense infrastructure. In 2015, private infrastructure assets of $40.7 trillion were four times larger than state and local assets of $10.1 trillion, and 27 times larger than federal assets of $1.5 trillion, according to the BEA data.5

Private capital stock consists of $19 trillion in residential assets and $22 trillion in nonresidential assets. The latter includes a vast array of infrastructure, such as pipelines, power stations, railways, factories, satellites, and telecommunications networks. State and local infrastructure includes assets such as highways, roads, bridges, schools, and prisons. Federal nondefense infrastructure includes assets such as dams, postal buildings, and the air traffic control system.

While the federal government owns relatively little infrastructure, its policies have a large effect on the infrastructure owned by the state, local, and private sectors. The federal government is the tail that wags the dog on the nation’s infrastructure — and not in a good way.

Federal laws and regulations raise the costs and slow the construction of infrastructure such as highways and pipelines. Federal subsidies for infrastructure distort the capital investment choices made by state, local, and private owners. And federal taxes reduce the return to investment in private infrastructure across every industry.

Although some federal interventions may be beneficial, the accumulated mass of regulations, subsidies, and taxes has created a growing hurdle to efficient investment. For example, the average time for states to complete reviews for highway projects under the National Environmental Policy Act increased from 2.2 years in the 1970s to at least 6.6 years today.6

The number of environmental laws and executive orders affecting transportation projects has increased from 26 in 1970 to about 70 today.7

The upshot is that rather than increasing federal spending, the Trump administration and Congress could spur added infrastructure investment by reducing barriers to state, local, and private projects. Consider taxation. By one estimate, cutting the corporate tax rate from 35 percent to 15 percent, combined with other business tax reforms, would increase the private capital stock by $10 trillion within a decade.8

That increase to the capital stock would be productive because the investment would be allocated in a decentralized manner by market supply and demand.

Some analysts say that increased federal infrastructure spending would create a “multiplier” or leveraged effect on GDP.9

But policymakers would exercise more leverage by reducing federal barriers to nonfederal infrastructure investments because those investments are so large.

A CLOSER LOOK AT GOVERNMENT INFRASTRUCTURE

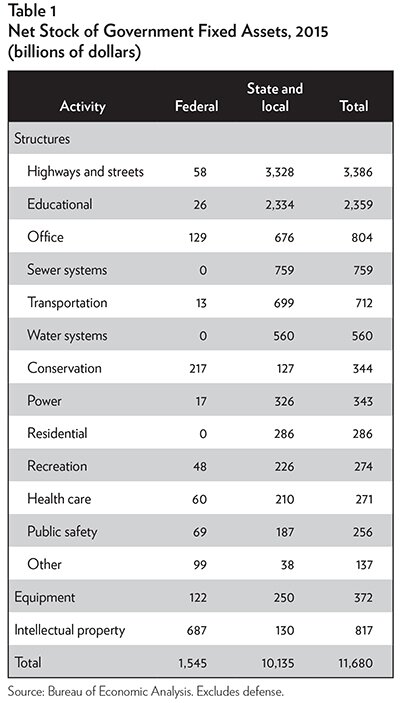

Table 1 shows the infrastructure assets owned by governments in the United States.10 The federal government owns 13 percent of the total, while state and local governments own 87 percent.

State and local governments dominate ownership in almost every area in the table. They own 98 percent of highways and streets, including the entire interstate highway system.11 They own schools, water and sewer systems, police and fire stations, and transit systems.

The federal government dominates infrastructure ownership in just two main areas, intellectual property and conservation. The former mainly includes research and development assets, whereas the latter includes items such as dams and park infrastructure.

Figure 1 and Table 1 indicate that decentralized ownership is a central feature of infrastructure in the United States. Just 3 percent of U.S. infrastructure is federally owned. Decentralization makes sense in a large country because dispersed decisionmakers can balance the costs and benefits of local capital investments better than faraway officials in Washington can.

Nonetheless, many commentators have called for a “national” plan to boost infrastructure, in the sense of a topdown strategy for the country.12 Yet, given that the federal government owns just 3 percent of infrastructure, such a plan would amount to federal intervention in state, local, and private investment decisions in the belief that federal officials can make superior choices.

President Trump’s spokesman, Sean Spicer, said, “Dams, bridges, roads and all ports around the country have fallen into disrepair... . In order to prevent the next disaster we will pursue the president’s vision for an overhaul of our nation’s crumbling infrastructure.”13 Bridges, roads, and seaports are owned by the states, so Spicer is implying that federal officials are better able to manage this infrastructure than the current owners.

However, federal management of its own infrastructure is widely regarded as inefficient: the air traffic control system is falling behind on technology; the national park system has a huge repair backlog; and federal dams have a long history of pork barrel politics and inefficient operation. Increased federal intervention offers little more than the imposition of federal politics and bad federal management on state and local governments.

In addition, increased federal intervention blurs accountability for infrastructure across multiple levels of government. When the New Orleans levees failed during Hurricane Katrina in 2005, each level of government blamed the other levels. Similar political finger pointing occurred after Minnesota’s I-35W bridge collapsed in 2007 and during the recent Flint, Michigan, water crisis.

In each case, responsibility has become confused over time because ownership, funding, and regulatory control are shared between federal, state, and local governments. Increased federal intervention encourages “learned helplessness” on the part of state and local governments. For example, we often see states delaying projects when slow federal bureaucracies or the uncertain federal budget process hold up part of the funding.14

The states are entirely capable of owning and funding infrastructure without federal aid and direction. States can tax, borrow, collect user charges, and attract private investment to fund their highways, bridges, airports, seaports, and other infrastructure. State decisionmakers are closer to infrastructure users than are federal officials, and they are better suited to make those calls.

Reducing the federal role would free the states from costly rules and increase state incentives to fix their own infrastructure in a proactive manner. Asset ownership conveys responsibility; federal intervention diffuses it.

FEDERAL INFRASTRUCTURE INVESTMENT

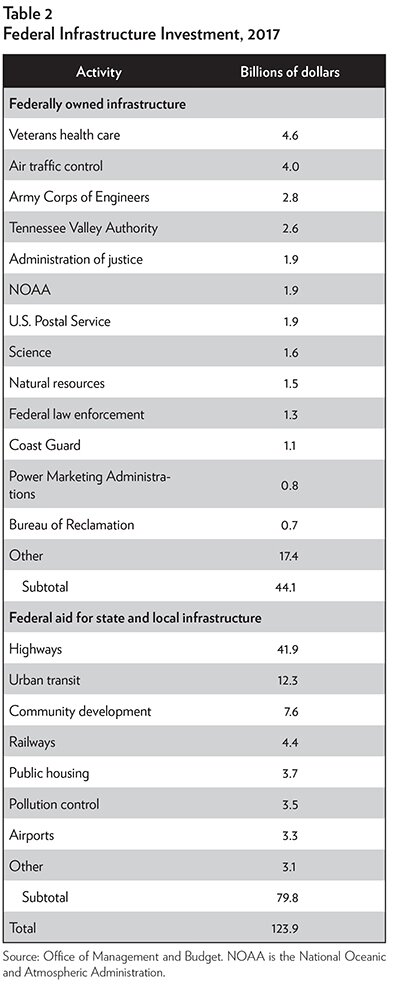

The nation’s infrastructure stock is replenished by annual spending on capital investment. Aside from defense, total U.S. capital investment was $3.5 trillion in 2016, of which 86 percent was by the private sector, 8 percent was by state and local governments, and 6 percent was by the federal government.15 The federal share includes federal spending on its own infrastructure and federal spending on aid for state and local infrastructure.

Table 2 summarizes estimated federal infrastructure investment in 2017.16 Spending on federally owned infrastructure — such as veterans hospitals and the air traffic control system — was $44 billion, while spending on aid for state and local infrastructure — such as highways and urban transit — was $80 billion.

In Washington, debate is ongoing about the proper funding levels for each item in Table 2. Each item has spawned supportive lobbies that push for higher spending. These groups often complain that their favored infrastructure is crumbling, congested, or underfunded, and in some cases they are right.

However, rather than haggling over annual spending levels, policymakers should consider fundamental reforms to the federal role in infrastructure. They should think about what the best institutional structure for each item in Table 2 might be to ensure efficient funding and management over the long term. They should consider whether state, local, or private ownership and funding might produce the best result for each item in the table.

For many items in the table, a good reform option is privatization, which means transferring the ownership of organizations and their assets to the private sector.17 Governments abroad have privatized a vast array of assets in recent decades, including railroads, airports, and energy utilities.18 Alternatively, partial privatization and public-private partnerships (P3s) are good reform options for some infrastructure. When possible, such reforms should be combined with ending subsidies and opening infrastructure businesses to competition. Policymakers should consider privatizing the following activities:

• Air Traffic Control (ATC). The Federal Aviation Administration has struggled to modernize America’s ATC system.19 Meanwhile, Canada privatized its ATC in 1996 in the form of a self-funded nonprofit corporation. Today, the Canadian system is on the leading edge of ATC efficiency and innovation.

• Tennessee Valley Authority (TVA). This electric utility has a bloated cost structure and poor environmental record, and it has wasted billions of dollars on its nuclear program.20 Electric utilities have been privatized around the world, so privatizing TVA should be a no-brainer.

• Army Corps of Engineers: Civil Works. The civilian portion of the Army Corps constructs and maintains water infrastructure such as harbors, locks, waterways, levees, and beaches.21 It fills roles that state and local governments and private companies could perform. When states need to improve their water infrastructure, they should hire private engineering and construction firms to do the work. The civilian part of the Army Corps should be privatized and compete for such work.

• U.S. Postal Service (USPS). The USPS has more than 30,000 retail offices and 200,000 vehicles. With the rise of email, paper mail volume has plunged, and the giant bureaucracy is losing billions of dollars a year.22 The USPS has a legal monopoly over first-class mail, which prevents entrepreneurs from competing to reduce costs and improve quality. Other countries, including Germany and the United Kingdom, have privatized their systems and opened them to competition. America should follow suit.

• Power Marketing Administrations (PMAs). The federal government owns four PMAs, which transmit wholesale electricity in 33 states. The power is mainly generated by hydropower plants owned by the Army Corps and Bureau of Reclamation. The PMAs receive numerous subsidies and sell most of their power at below-market rates.23 Congress should privatize the PMAs.

• Bureau of Reclamation. This agency builds and operates dams, canals, and hydropower plants in 17 Western states. It is the nation’s largest wholesaler of water, which it generally sells at below-market prices, thus distorting the economy and causing harm to the environment.24 The agency’s facilities should be privatized or transferred to the states.

• Amtrak. The government’s passenger rail company has a costly union workforce and a poor on-time record.25 Many of its routes have low ridership, and the system loses more than a billion dollars a year. Congress should privatize Amtrak and allow entrepreneurs to reduce costs and improve service.

• Highways. Some states are using public-private partnerships to add capacity to their highway systems. These arrangements shift various elements of financing, management, operations, and project risks from the public sector to the private sector. Federal policymakers should remove hurdles to the expanded use of P3s.26

• Airports. The nation’s major airports are owned by state and local governments, but they receive federal aid for capital improvements. Hundreds of airports around the world have been privatized, including almost half of those in Europe.27 Airports should be moved to the private sector and self-funded from charges on aviation users, retail concessions, advertising, and other private revenues.

Table 2 showed that federal aid for state and local infrastructure will be an estimated $80 billion in 2017. None of that aid is crucial because the states can fund infrastructure by themselves. Some state and local infrastructure should be privatized and self-funded, while other infrastructure should be funded by state and local taxes, not federal aid. Consider highways. Fast- and slow-growing states vary in their need to expand capacity. Thus, it makes more sense for each state to adjust its own gas tax to fit its highway revenue needs than for the federal government to impose a single gas tax on the whole country. The states own the highways and are close to the users; they can best balance the costs and benefits of revenues and investments.

Federal aid for infrastructure is inefficient for a variety of reasons.28 To begin with, aid allocations are based on political and bureaucratic factors, not marketplace demands. Also, federal aid replicates bad infrastructure ideas across the nation — for example, high-rise public housing in the past and costly light-rail projects today.

Another problem is that federal aid comes bundled with costly regulations. Davis-Bacon rules, for example, raise labor costs on highway projects. Also, the states have a disincentive to be frugal on projects when a substantial share of the funding comes “free” from Washington.

A final disadvantage of federal aid for infrastructure is that it discourages state and local privatization. Aid typically goes only to government-owned projects, which makes it difficult for unsubsidized private projects to compete. Put another way, federal aid “crowds out” private investment in facilities such as airports and transit systems.

CONCLUSIONS

The federal government owns just a small share of the nation’s infrastructure, but it exercises control over state, local, and private infrastructure through taxes and regulations. Federal policymakers should reduce these interventions to spur an increase in investment, and they should reform federal policies that bias state and local governments against privatization.29

Furthermore, policymakers should cut federal spending on infrastructure, not increase it, by privatizing some federally owned assets and phasing out federal aid to the states. Those two reforms would cut federal infrastructure spending by three-quarters — from about $124 billion a year to $31 billion.30

A reduced federal role would allow for increases in private investment and more efficient state and local investment. Everyone agrees that improving America’s infrastructure would raise living standards and improve our business competitiveness. The way to get there is through decentralization and market-based reforms.

NOTES

1. Budget of the U.S. Government, Fiscal Year 2018 (Washington: Government Printing Office, 2017), p. 19.

2. The following two quotations provide views from economists on the definition of infrastructure. From Kevin Kliesen and Douglas Smith: “The nation’s infrastructure can be thought of as its tangible capital stock (income-earning assets), whether owned by private companies or the government. This can include everything from the Toyota manufacturing plant in Indiana to the FedEx and UPS warehousing and distribution facilities in Memphis and Louisville, respectively. However, to most people, infrastructure is the nation’s streets, highways, bridges and other structures that are typically owned and operated by the government.” Kevin L. Kliesen and Douglas C. Smith, “Digging into the Infrastructure Debate,” Regional Economist, Federal Reserve Bank of St. Louis, July 2009. From Edward Gramlich: “There are many possible definitions of infrastructure capital. The definition that makes the most sense from an economics standpoint consists of large capital intensive natural monopolies such as highways, other transportation facilities, water and sewer lines, and communications systems. Most of these systems are owned publicly in the United States, but some are owned privately. An alternative version that focuses on ownership includes just the tangible capital stock owned by the public sector. Broader versions include successively human capital investment and/or research and development capital. Most econometric studies of the infrastructure problem have used the narrow public sector ownership version of infrastructure capital as their independent variable. This is in large part because it is very hard to measure anything else. It is difficult to measure privately owned infrastructure capital, and even if good measures were available, it would be difficult to distinguish private infrastructure capital from other private capital. It is difficult to distinguish human investment spending for health and education from consumption spending, difficult to know whether to count all research and development expenditures as investment, and difficult to know how to depreciate either of these types of spending in defining capital stocks. Hence for these purposes I follow others in using a relatively narrow public sector ownership definition of the stock of infrastructure capital.” Edward M. Gramlich, “Infrastructure Investment: A Review Essay,” Journal of Economic Literature 32, no. 3 (September 1994): 1176–96.

3. American Society of Civil Engineers, “Infrastructure Report Card,” 2017, www.infrastructurereportcard.org.

4. Bureau of Economic Analysis capital stock data are at https://bea.gov/iTable/index_FA.cfm. See Tables 1.1 and 7.1B. The category “fixed assets” excludes consumer durable goods.

5. The net stock of defense assets in 2015 was $1.7 trillion.

6. Toni Horst et al., 40 Proposed U.S. Transportation and Water Infrastructure Projects of Major Economic Significance (Los Angeles, CA: AECOM, 2016), p. 7. The report was prepared under contract to the U.S. Department of Treasury, Build America Investment Initiative.

7. Chris Edwards, “Infrastructure Investment,” https://www.downsizinggovernment.org, Cato Institute, January 13, 2017.

8. Alan Cole, “Details and Analysis of Donald Trump’s Tax Plan,” Tax Foundation, September 19, 2016. The capital stock is estimated to increase about 20 percent in a decade with Trump’s business tax cuts, or about $10 trillion.

9. See Ryan Bourne, “Would More Government Infrastructure Spending Boost the U.S. Economy?” Cato Institute Policy Analysis no. 812, June 2017.

10. Bureau of Economic Analysis capital stock data are at https://bea.gov/iTable/index_FA.cfm. See Table 7.1B.

11. Federal Highway Administration, “Interstate Frequently Asked Questions: Who Owns It?” November 18, 2015, www.fhwa.dot.gov/interstate/faq.cfm.

12. In his February 28, 2017, address to Congress, President Trump spoke of “national rebuilding” and a “national infrastructure program.” A 2015 infrastructure report by the Business Roundtable called for federal “leadership in making investment in infrastructure a national priority; leadership in thinking strategically and long term about the services and benefits that U.S. transportation infrastructure should provide; and leadership in mobilizing, facilitating and coordinating resource deployment across the various levels of government.” That quotation reflects a very favorable view of federal competency. See Business Roundtable, Road to Growth: The Case for Investing in America’s Transportation Infrastructure (Washington: Business Roundtable, 2015), p. 10. A 2012 infrastructure study from Michael Bloomberg, Edward Rendell, and Arnold Schwarzenegger called for a “national vision” for infrastructure. It said, “The U.S. should develop a national infrastructure strategy for the next decade that makes choices based on economics, not politics. The U.S. should adopt a 10-year national plan for making strategic investments in our nation’s infrastructure.” See Brina Milikowsky, Building America’s Future: Falling Apart and Falling Behind, Transportation Infrastructure Report 2012 (Washington: Building America’s Future Educational Fund, 2012), p. 5.

13. The White House, Press Briefing by Press Secretary Sean Spicer, February 24, 2017.

14. One example is the delay in funding for a Charleston seaport expansion because of the slowness and uncertainty in federal decisionmaking. See Chris Edwards, “Infrastructure Spending and the Charleston Seaport,” https://www.downsizinggovernment.org, Cato Institute, September 23, 2016.

15. U.S. Bureau of Economic Analysis, “National Income and Product Accounts,” Table 1.5.5, https://bea.gov/iTable/index_nipa.cfm.

16. Table 2 is based on “physical capital investment” data from the federal budget. Budget of the U.S. Government (Washington: Government Printing Office, 2017). See “Analytical Perspectives,” Table 17.2, and “Historical Tables,” Table 9.5. The data differ somewhat from BEA data on federal investment spending. For purposes of Table 2, I have excluded the research and education parts of federal investment. The data are official estimates for fiscal 2017.

17. Sometimes people use “privatization” to mean the government contracting out for a needed good or service. But in this report, the term means transferring ownership of a government activity to a private nonprofit group or a for-profit business.

18. Chris Edwards, “Privatization,” https://www.downsizinggovernment.org, Cato Institute, July 12, 2016.

19. Chris Edwards, “Privatizing Air Traffic Control,” https://www.downsizinggovernment.org, Cato Institute, April 8, 2016.

20. Chris Edwards, “Privatizing the Tennessee Valley Authority,” https://www.downsizinggovernment.org, Cato Institute, October 14, 2016.

21. Chris Edwards, “Cutting the Army Corps of Engineers,” https://www.downsizinggovernment.org, Cato Institute, March 1, 2012.

22. Chris Edwards, “Privatizing the U.S. Postal Service,” https://www.downsizinggovernment.org, Cato Institute, April 4, 2016.

23. Edwards, “Privatization.”

24. Chris Edwards and Peter J. Hill, “Cutting the Bureau of Reclamation and Reforming Water Markets,” https://www.downsizinggovernment.org, Cato Institute, February 1, 2012.

25. Chris Edwards, “Privatizing Amtrak,” https://www.downsizinggovernment.org, Cato Institute, October 17, 2016.

26. Edwards, “Infrastructure Investment.” See also Robert W. Poole, Jr., and Austill Stuart, “Federal Barriers to Private Capital Investment in U.S. Infrastructure,” Reason Foundation, January 2017.

27. Chris Edwards and Robert W. Poole, Jr., “Privatizing U.S. Airports,” https://www.downsizinggovernment.org, Cato Institute, November 28, 2016.

28. Edwards, “Infrastructure Investment.”

29. One hurdle to privatization is that states receiving federal aid for their facilities are generally required to repay it if they privatize. Another hurdle is the federal income tax exemption on municipal bond interest, which makes public projects cheaper to finance than private projects. Finally, tolling is generally prohibited on existing interstate highways, but P3 projects rely on tolling.

30. Ending aid for infrastructure would save $80 billion a year; privatizing the federal assets discussed here and ending related subsidies would save about $13 billion a year. The government would also raise revenues from the asset sales in some cases.

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.