Since the Supreme Court’s 2010 decision in Citizens United v. Federal Election Commission, proponents of stricter campaign finance regulation have increasingly prescribed “disclosure” as an antidote to “dark money” in politics. Advocates of more extensive donor disclosure laws typically invoke Supreme Court Justice Louis Brandeis’s famous maxim that “sunlight is said to be the best of disinfectants,” but they seldom acknowledge the harm of excessive sunlight.

This paper urges a more critical and balanced look at the issue, especially concerning disclosure requirements for independent political speech (i.e., speech that is not coordinated with candidates). Of primary focus is the Court’s jurisprudence in this area, which is often invoked to support additional compulsory donor disclosure laws but lacks coherence, especially as it applies to independent speech. Even assuming that the Court’s jurisprudence in this area remains sound, many arguments being advanced for compulsory donor disclosure laws are untethered from the justifications the Court has articulated, rendering them especially susceptible to challenge in litigation. This paper concludes with recommendations on how, and how not, to enact disclosure laws.

Specifically, disclosure laws should be changed to make sure they allow citizens to keep tabs on public officials rather than enable officials to oversee citizens. Current disclosure thresholds should be raised significantly. Disclosure requirements for independent speech should be limited significantly, given that such mandates do not serve traditional justifications for disclosure.

INTRODUCTION

Paraphrasing Martin Luther King Jr.’s immortal words, federal appellate court judge Janice Rogers Brown recently observed that “[t]he arc of campaign finance law has been ambivalent, bending toward speech and disclosure.” But these two values, she noted, “exist in unmistakable tension” with each other. 1 This paper will closely examine this tension between speech and disclosure in the context of compulsory donor disclosure requirements that apply to groups engaged in independent political speech activities. 2

Proponents of more disclosure requirements claim that such laws prevent corruption and the appearance of corruption, while providing the electorate with useful information about candidates and elected officials. Critics, meanwhile, maintain that such laws chill speech that provides equally important information to voters and infringe on the right to anonymous speech and associational privacy.

Laws requiring candidates, political parties, political action committees (commonly known as PACs), and other sponsors of political speech to publicly disclose their spending and donors have existed for decades 3 and even predate the modern-era regulatory scheme. 4 The drumbeat for more disclosure seems to have increased in recent years, however, as the Supreme Court has increasingly circumscribed the other ways in which political speech may be regulated. Beginning with the seminal 1976 Buckley v. Valeo case, running through the landmark Citizens United v. Federal Election Commission case in 2010, and continuing thereafter in the 2014 McCutcheon v. Federal Election Commission decision, the Court has invalidated key campaign finance provisions that restrict spending on and contributions to political campaigns. However, the Court generally has upheld disclosure requirements in some form. Thus, the regulatory fight naturally has narrowed to focus on disclosure.

Congressional opponents of Citizens United wasted no time after the decision was issued to introduce a disclosure bill dubbed, with characteristic Washington kitsch, the “DISCLOSE Act” (Democracy Is Strengthened by Casting Light on Spending in Elections Act). 5 Having failed to pass it initially in the 111th Congress, its supporters have introduced variants of the bill in each of the four successive Congresses. 6 In the current Congress, a new disclosure bill also has been introduced called the “SUN Act” (Sunlight for Unaccountable Nonprofits Act), 7 which appears to have no better prospects at passage than its legislative cousin.

Seeing its legislative attempts at disclosure thwarted repeatedly in Congress, the campaign finance “reform” lobby also has turned to the White House and administrative state. It urged, to no avail, the Obama Administration to implement an executive order that requires government contractors to disclose their political contributions. 8 It also sent political spending disclosure rulemaking petitions to the Federal Communications Commission, 9 the Securities and Exchange Commission, 10 and Federal Election Commission (FEC), again to no avail. 11 At the state level, countless bills to counteract so-called dark money have been introduced. 12

A wealth of resources already details the long-standing tradition and value of anonymous speech in this country, 13 and one need only pay attention to the news to recognize the continuing relevance and importance of anonymous speech in society today. 14 Likewise, abundant literature documents the many harmful social consequences and instances of retribution against donors wrought by compulsory campaign finance disclosure law. 15 I can’t add much to the existing work on these respects.

Rather, this paper will draw on my perspective as a campaign finance attorney who regularly advises clients on federal and state campaign finance disclosure laws. Like many other practitioners, jurists, and scholars who have grappled with this issue, my experience has led me to conclude that the Court’s rulings protecting anonymous speech and First Amendment associational privacy rights on the one hand, and compulsory donor disclosure laws on the other, are impossible to reconcile when applied to organizations operating independently of candidates. The jurisprudence in this area has failed to convincingly demonstrate that the purported societal interest in disclosure outweighs donors’ and speakers’ speech and privacy interests, and the justifications for disclosure also rest on questionable assumptions. What’s more, even if we assume for argument’s sake that the Court’s jurisprudence in this area is sound, many arguments being advanced for disclosure laws have no jurisprudential support and may wither under the light of scrutiny.

Jurisprudential Justifications for Donor Privacy and Disclosure

“Disclosure” is a term with warm and fuzzy connotations. When someone intersperses a “full disclosure” disclaimer in a conversation, we tend to credit the speaker for his or her candor. But privacy also is commonly regarded as a virtue in its own right. The right to privacy is held to be “fundamental” against intrusions by the government, 16 and laws also have proliferated over the years to protect our medical, 17 educational, 18 financial, 19 and online 20 privacy against intrusions by private actors.

These competing interests of privacy and anonymity versus disclosure in the context of political speech are reflected in the Court’s tortured and tortuous jurisprudence.

Jurisprudential Justifications for Donor Privacy. Although the notion of a right to associational privacy certainly preexisted the civil rights movement, the 1958 Supreme Court case NAACP v. Alabama is as good a starting point as any for illustrating the compelling rationale for donor privacy. 21 In that case, state officials seeking to block the National Association for the Advancement of Colored People (NAACP) from operating in Alabama subpoenaed the names and addresses of the group’s members in the state. 22 Although the case did not primarily revolve around the group’s donor list, 23 the Court later would apply the NAACP holding specifically in the context of campaign finance donor disclosure laws. 24

In blocking Alabama’s subpoena of the NAACP’s membership list, the Court noted that “[e]ffective advocacy of both public and private points of view, particularly controversial ones, is undeniably enhanced by group association” under the First Amendment, and “compelled disclosure of affiliation with groups engaged in advocacy may constitute … a restraint on freedom of association.” 25 “[P]rivacy in group association,” the Court reasoned, “may in many circumstances be indispensable to preservation of freedom of association, particularly where a group espouses dissident beliefs.” 26 Moreover, this constitutional protection of associational privacy does not diminish when the resulting reprisals come from “private community pressures” rather than government (though such reprisals often do come from government), “for it is only after the initial exertion of state power [in forcing disclosure] that private action takes hold.” 27

In 1960, in a case involving handbills urging a civil rights boycott, the Court struck down a Los Angeles city ordinance that required such materials to contain a disclaimer disclosing the names of their printers and those “who caused the same to be distributed”—including the identities of “owners, managers, or agents” in the case of organizational sponsors. 28 The Court stated plainly that “[t]here can be no doubt that such an identification requirement would tend to restrict freedom to distribute information and thereby freedom of expression.” 29 The Court recognized that “[p]ersecuted groups and sects from time to time throughout history have been able to criticize oppressive practices and laws either anonymously or not at all,” and that speaker “identification [requirements] and fear of reprisal might deter perfectly peaceful discussions of public matters of importance.” 30

During the post-Watergate era, the Court began subordinating its strong protection for anonymous speech to the government’s purported interest in the disclosure of political spending. Nonetheless, in the seminal 1976 case Buckley v. Valeo, which upheld the constitutionality of certain aspects of the post-Watergate campaign finance disclosure scheme, the Court continued to maintain that “compelled disclosure, in itself, can seriously infringe on privacy of association and belief guaranteed by the First Amendment.” 31 Specifically addressing the issue of donor disclosure, the Court noted the following:

The right to join together for the advancement of beliefs and ideas is diluted if it does not include the right to pool money through contributions, for funds are often essential if advocacy is to be truly or optimally effective. Moreover, the invasion of privacy of belief may be as great when the information sought concerns the giving and spending of money as when it concerns the joining of organizations, for financial transactions can reveal much about a person’s activities, associations, and beliefs. 32

The Court further acknowledged that disclosure “will deter some individuals who otherwise might contribute. In some instances, disclosure may even expose contributors to harassment or retaliation. These are not insignificant burdens on individual rights… .” 33 In light of these concerns, Buckley “narrowly limited” the disclosure requirements at issue in the case to apply only to “organizations that are under the control of a candidate or the major purpose of which is the nomination or election of a candidate,” as well as “spending that is unambiguously campaign related.” 34

Even after Buckley upheld the principle that some campaign finance disclosure laws could be constitutional, the right to anonymous political speech maintained an important place in the Court’s jurisprudence. In the 1995 case McIntyre v. Ohio Elections Commission, the Court again addressed whether “the First Amendment’s protection of anonymity encompasses documents intended to influence the electoral process.” 35 Specifically, the case arose out of a concerned citizen’s printing, financing, and distribution of flyers opposing a local school tax referendum. Some of those flyers did not comply with an Ohio law requiring disclaimers identifying the sponsor of any materials “designed to promote the nomination or election or defeat of a candidate, or to influence the voters in any election, or [to] make an expenditure for the purpose of financing political communications.” 36

In holding the Ohio law unconstitutional, the Court noted that “an author’s decision to remain anonymous, like other decisions concerning omissions or additions to the content of a publication, is an aspect of the freedom of speech protected by the First Amendment.” 37 In addition to protecting against the “threat of persecution, an advocate may believe her ideas will be more persuasive if her readers are unaware of her identity. Anonymity thereby provides a way for a writer who may be personally unpopular to ensure that readers will not prejudge her message simply because they do not like its proponent. Thus, even in the field of political rhetoric … the most effective advocates have sometimes opted for anonymity.” 38 The Court compared anonymous political speech to “the secret ballot, the hard-won right to vote one’s conscience without fear of retaliation.” 39

Jurisprudential Justifications for Compulsory Donor Disclosure. Even as the Supreme Court’s Buckley decision acknowledged the right to associational and donor privacy, the decision nonetheless found that “there are governmental interests [in disclosure] sufficiently important to outweigh” this right:

First, disclosure provides the electorate with information as to where political campaign money comes from and how it is spent by the candidate in order to aid the voters in evaluating those who seek federal office. It allows voters to place each candidate in the political spectrum more precisely than is often possible solely on the basis of party labels and campaign speeches. The sources of a candidate’s financial support also alert the voter to the interests to which a candidate is most likely to be responsive and thus facilitate predictions of future performance in office.

Second, disclosure requirements deter actual corruption and avoid the appearance of corruption by exposing large contributions and expenditures to the light of publicity. This exposure may discourage those who would use money for improper purposes either before or after the election. A public armed with information about a candidate’s most generous supporters is better able to detect any post-election special favors that may be given in return. 40

For sponsors of independent expenditures—that is, political advertising expressly advocating the election or defeat of candidates that is not coordinated with any candidates—the Court acknowledged that “[t]he corruption potential of these expenditures may be significantly different.” 41 Thus, “if the only purpose of [independent spending disclosure requirements] were to stem corruption or its appearance,” such a justification “might have been fatal” to the law’s constitutionality. 42 Nonetheless, the Court held that the “informational interest” in disclosure was sufficient justification, because “disclosure helps voters to define more of the candidates’ constituencies.” 43

In short, after interpreting the law to cut back the scope of disclosure, the Court in Buckley found that the remaining disclosure requirements contained in the Federal Election Campaign Act survived the “exacting scrutiny” standard for judicial review of disclosure laws, which are presumed to impose “significant encroachments on First Amendment rights.” 44 Under this balancing of interests, there must be a “substantial relation between the governmental interest and the information required to be disclosed.” 45

The Court has continued to rely on Buckley’s framework and justifications in subsequent cases involving challenges to campaign finance disclosure laws. In McConnell v. Federal Election Commission, the Court upheld the 2002 Bipartisan Campaign Reform Act’s (BCRA) requirement that sponsors of so-called “electioneering communications” identify themselves in disclaimers and disclose their spending and information about certain donors on campaign finance reports. “[T]he important state interests that prompted the Buckley Court to uphold [the Federal Election Campaign Act’s] disclosure requirements—providing the electorate with information, deterring actual corruption and avoiding any appearance thereof, and gathering the data necessary to enforce more substantive electioneering restrictions—apply in full to BCRA,” the Court held. 46

In Citizens United, a plurality of the Court rebuffed a request by the eponymous group to exempt its commercial advertisements, which had urged viewers in 2008 to watch its documentary on then-candidate Hillary Clinton, from BCRA’s electioneering communication disclaimer and disclosure requirements. 47 “Even if the ads only pertain to a commercial transaction, the public has an interest in knowing who is speaking about a candidate shortly before an election. Because the informational interest alone is sufficient to justify application of [BCRA’s disclosure requirements] to these ads, it is not necessary to consider the Government’s other asserted interests,” the plurality opinion held. 48

Cracks in the Disclosure Jurisprudence. Proponents of expanding donor disclosure requirements for groups engaged in independent political speech rely on the Supreme Court’s disclosure rulings to validate their position. For example, even though Democracy 21 president Fred Wertheimer has lambasted Citizens United as “one of the worst and most damaging decisions in the court’s history,” 49 he has lauded the decision for “affirm[ing] more than three decades of prior Court decisions in making clear that disclosure of money spent ... for campaign-related expenditures is constitutional.” 50 Former FEC commissioner Ann Ravel has called for “the mistaken jurisprudence of Citizens United [to be] reexamined,” 51 even as she has praised the decision’s “rul[ing] that unlimited corporate independent political spending must be accompanied by transparency as to the sources of such spending.” 52

The Court’s disclosure jurisprudence is hardly a model of coherence, however, and proponents of disclosure should be wary of putting too much stock in it. Setting aside the doctrinal inconsistencies, there is also reason to question some of the Court’s assumptions about the purported governmental interests in disclosure.

Internal Inconsistences.

As Judge Janice Rogers Brown has noted, “Both an individual’s right to speak anonymously and the public’s interest in contribution disclosures are now firmly entrenched in the Supreme Court’s First Amendment jurisprudence. And yet they are also fiercely antagonistic.” 53 Even more problematic is how the jurisprudence “treats speech, a constitutional right, and transparency, an extra-constitutional value, as equivalents.” 54 This latter point warrants some additional examination.

First, recall that it is not enough under the Court’s jurisprudence merely for the government to have a legitimate interest in requiring disclosure of political spending. Rather, the interest must be “sufficiently important to outweigh” the constitutional right to anonymous speech. 55

The disclosure debate today primarily revolves around requiring the reporting of funding sources for speech that is made independently of any candidates and political parties 56 (and, in some cases, speech that is not even related to any political campaigns). 57 For such independent speech, the only justification for disclosure the Court has articulated that remains viable and relevant is the “informational interest” in enabling the public to know who is funding political speech. 58 The anti-corruption rationale for disclosure mentioned in the McConnell decision 59 no longer applies as a matter of law, as Citizens United held that independent speech “do[es] not lead to, or create the appearance of, quid pro quo corruption”—which is the only type of corruption relevant here. 60 Indeed, as noted previously, the informational interest is the only interest Citizens United addressed in upholding disclosure requirements for independent speech, 61 and even the 1976 Buckley decision suggested this was the primary justification for this type of disclosure requirement. 62

Admittedly, that anonymity and associational privacy in the exercise of speech have been held to be a constitutional right, while disclosure is merely an “extra-constitutional value,” does not automatically weigh in favor of the former. It is generally accepted that “First Amendment rights are not absolute under all circumstances. They may be circumscribed when necessary to further a sufficiently strong public interest.” 63 Nonetheless, it is difficult to conclude definitively that the informational interests the Court has endorsed for compulsory donor disclosure concerning independent political speech are “sufficiently important to outweigh” (in the formulation of Buckley) the reasons the Court has articulated for protecting the right to anonymous speech and associational privacy under the First Amendment. This is best illustrated simply by presenting these justifications side by side (see box on page 7).64

Even construing these arguments in the light most favorable to disclosure’s proponents, it is difficult to say objectively or conclusively that the justifications for compulsory disclosure outweigh the justifications for donor privacy and anonymous speech. As Judge Janice Rogers Brown put it, these competing interests appear, at best, to be “equivalent.” 65 Per the balancing test Buckley articulated (although not as Buckley applied it), this should not be a sufficient basis to infringe on First Amendment rights, particularly where the “core political speech” that is being burdened falls squarely within “an area in which the importance of First Amendment protections is at its zenith.” 66 As federal appellate judge Frank Easterbrook has noted, rather than engaging in a serious application of the “Constitution to constrain contemporary legislation supported by the social class from which judges are drawn,” the Court’s jurisprudence in this area is tantamount to acting as a “council of revision” in “say[ing] that a law is valid to the extent that it is good ... [a]nd when, as in McConnell, the judgment is supported by a one-vote margin, any Justice’s conclusion that a particular extension is unwise will reverse the constitutional outcome.” 67

|

Justifications for anonymous speech/associational privacy |

Justifications for disclosure of sources of independent political speech |

|

|

Not only is the Court’s general balancing of the competing interests in favor of disclosure questionable, but the specific reasoning and results of its decisions upholding disclosure also are difficult to reconcile with its decisions coming down on the side of anonymity. Of the McConnell decision, Judge Easterbrook has noted “the Justices’ failure to discuss McIntyre, or even to cite Talley” and other decisions protecting anonymous speech. 68 The Buckley, McConnell, and Citizens United decisions in favor of compulsory disclosure are particularly difficult to reconcile with the McIntyre decision in favor of anonymous speech, as well as with other notable decisions, such as Bates v. Little Rock 69 and Pollard v. Roberts, 70 upholding the right to donor and associational privacy.

Attempts to distinguish the holding of McIntyre (including within the McIntyre decision itself) from other precedents upholding compulsory donor disclosure laws also are unpersuasive. First, McIntyre attempts to draw a distinction between the disclosure related to speech about ballot measures at issue in that case and the disclosure related to speech about candidates at issue in Buckley. Although “avoiding the appearance of corruption” justifies disclosure of campaign spending on candidates, the McIntyre decision explained that this concern is irrelevant to ballot measures because ballot measures cannot be corrupted. 71

However, as discussed previously, the anti-corruption rationale is not a relevant basis for distinguishing between disclosure requirements for candidate-related speech and ballot measure–related speech because this rationale—according to Buckley and Citizens United—is insufficient to uphold disclosure requirements for independent speech generally. 72

At the same time, Buckley also upheld disclosure on the basis of its informational or heuristic value—that is, “allow[ing] voters to place each candidate in the political spectrum more precisely.” 73 That same rationale is used to justify requiring disclosure of the identities of speakers about ballot measures and their sources of funding. For example, former FEC commissioner Ann Ravel, who was also a former member of the California Fair Political Practices Commission, has explained that California requires disclosure of donors to groups advocating for or against ballot measures “so that voters can make informed choices at the ballot box.” 74

The McIntyre decision flatly rejected this informational interest for being insufficiently important, however, and it did so in a way that was not limited to speech about ballot measures. Specifically, McIntyre held that “the simple interest in providing voters with additional relevant information does not justify a state requirement that a writer make statements or disclosures she would otherwise omit.” 75 If requiring “additional relevant information” about speakers is insufficient to justify compulsory disclosure in the context of speech about ballot measures, then logically it should also be insufficient to justify compulsory disclosure in the context of independent speech about candidates. And yet the latter was upheld in Buckley, McConnell, and Citizens United. 76

The McIntyre decision also attempted to limit its holding by drawing a distinction between the sponsorship identification disclaimer requirement specifically at issue in that case and the financial reporting requirements at issue in other campaign finance disclosure cases. 77 Lower courts attempting to grapple with McIntyre also have pointed to this distinction. 78 According to McIntyre, financial reporting requirements are less objectionable because “even though money may ‘talk,’ its speech is less specific, less personal, and less provocative than a handbill—and as a result, when money supports an unpopular viewpoint it is less likely to precipitate retaliation.” 79 On the other hand, “A written election-related document—particularly a leaflet—is often a personally crafted statement of a political viewpoint... . As such, identification of the author [in a disclaimer requirement] against her will is particularly intrusive; it reveals unmistakably the content of her thoughts on a controversial issue.” 80

This attempt to limit McIntyre’s holding also is unavailing. In my extensive experience advising clients on campaign finance disclaimer and donor reporting requirements, no organization that engages in political speech would ever regard a sponsorship identification disclaimer requirement as being more intrusive or burdensome than a requirement to report the organization’s donors. It is also not true, as McIntyre claimed, that disclosure of donor information is “less likely to precipitate retaliation.” In practice, opponents of organizations’ political positions typically retaliate against the organizations’ publicly disclosed donors with as much (or greater) zeal as they do against the organizations themselves. 81 Moreover, this risk of retaliation against donors has only increased since McIntyre was decided in 1995, as the Internet has greatly facilitated retrieving disclosure reports and donors’ personal information. 82

And even if the McIntyre ruling is read narrowly to apply only to the enforcement of disclaimer requirements against individuals, 83 the rationale it articulated for the right to privacy when exercising the right to free speech should apply no less to compulsory donor disclosure requirements for groups of individuals. To wit, if an individual speaker has a right to choose whether she wishes to be publicly associated with “provocative” or “controversial” speech that is “likely to precipitate retaliation,” that right also should apply to individuals who choose to speak collectively through an association. Indeed, as discussed previously, the Buckley decision articulated concern about the burdens on “individual rights” imposed by laws requiring disclosure of their contributions to organizations. 84

To the extent anyone may suggest that the disclaimer requirements at issue in McIntyre are not “disclosure” requirements at all, 85 such a position also is untenable. The Supreme Court has described disclaimer requirements as part of a “disclosure regime,” 86 and advocates of compulsory disclosure laws agree. 87

Faulty Assumptions.

The assumptions baked into the Court’s disclosure jurisprudence are at least as tenuous as its internal logic, or lack thereof. The “informational interest” theory the Court has endorsed rests on two basic interrelated premises: (1) that information about the sources of financial support for candidates or ballot measures is generally salient to voters, and (2) that voters will be able to draw a meaningful connection between that information and the candidates or issues they are voting on. Empirical research and real-world experiences call both premises into question.

It is important to note at the outset the apparent paucity of empirical data showing that voters use donor disclosure information to inform their votes. Writing in 2007, Professor Ray La Raja of the University of Massachusetts at Amherst noted, “There have been no empirical studies ... about the effect of disclosure on important political outcomes such as voter knowledge and trust. Indeed, we have a weak understanding about the mechanism through which voters learn about money in politics.” 88 Ten years later, that still appears to be the case, and what little research there is undercuts the case for disclosure.

This lack of evidence for compulsory disclosure should be fatal under the “exacting scrutiny” standard of judicial review held to apply to disclosure laws, under which the government typically is required to justify any impositions it places on speech. 89 Relatedly, in other campaign finance law contexts, the Court has warned that it has “never accepted mere conjecture [in defense of a speech restriction] as adequate to carry a First Amendment burden.” 90 However, as discussed previously, when it comes to campaign finance disclosure laws, the Court tends to put its thumb on the scales in favor of compulsory disclosure—including its acceptance of the conjectural “informational interest” to justify such laws.

As the Court noted in McIntyre, “in the case of a handbill written by a private citizen who is not known to the recipient, the name and address of the author add little, if anything, to the reader’s ability to evaluate the document’s message.” 91 This point is likely true of disclosure of campaign donor information generally: although certain donors may be recognizable to a small minority of the public (including a subset that is prone to using disclosure information to harass and retaliate against donors), for most Americans, disclosure information is probably meaningless.

For example, a 2014 poll found that more than half of Americans didn’t know who the Koch brothers were, 92 even though Charles and David Koch have been two of the country’s best-known political donors for at least the past decade or two. And this poll was taken after Democratic Party leaders had undertaken a highly public and concerted effort to demonize the Koch brothers for their political giving and to hold them up as foils to the Democrats’ agenda. 93 Other relatively prominent donors across the political spectrum, such as George Soros, Tom Steyer, or Sheldon Adelson, likely enjoy comparable obscurity among the general public. If the donors disclosed under campaign finance laws are unknown to most of the public, this certainly calls into question the heuristic value or “informational interest” these laws are purported to advance.

Not only do average voters seem not to know who most political donors are, but they also don’t seem to care, even when this information is filtered through the news media, and notwithstanding the purported strong public support for disclosure laws in the abstract. 94 In 2011, Professor David Primo of the University of Rochester presented Florida voters with a hypothetical ballot measure based on an actual Colorado ballot measure, as well as 15 sources of information about the ballot measure comprising newspaper articles and editorials, a voter guide, and campaign ads. The study found that the two newspaper articles containing campaign finance disclosure information related to the ballot measure were the least viewed, and of those two articles, the one whose headline clearly indicated a story about campaign finance information drew the least interest. 95 On this basis, Primo concluded that “campaign finance information, in particular, is not of much interest to respondents.” 96

Moreover, the voters who chose to read the articles containing campaign finance disclosure information also read three times more articles in total than those who ignored the campaign finance articles. 97 Primo interpreted this as “suggesting that voters who access campaign finance information are the least likely to need it to make informed choices.” 98 Put another way, this finding corroborates Judge Easterbrook’s observation (discussed earlier) that the campaign finance disclosure jurisprudence reflects a bias of the “social class from which judges are drawn.” 99 To wit, those who are the most informed about political issues are the ones who find campaign finance disclosure information to be the most meaningful, while most Americans appear to be indifferent to such information.

Primo’s study is consistent with La Raja’s earlier study, in which La Raja analyzed newspaper articles about state politics in states with campaign finance laws of varying robustness. La Raja found only a “slight” increase in the number of articles about campaign finance in states with “good disclosure regimes.” La Raja attributed this finding to the “inelastic” public demand for articles containing campaign finance information, and thus newspapers’ reluctance to provide more coverage on the issue. 100

Moreover, many of the newspaper articles La Raja analyzed only provided superficial “horserace” coverage of where candidates stood relative to each other in terms of their campaign funds, or focused on discussions of general “campaign finance policy” 101—not the type of heuristic information that the Buckley court postulated would “allow[] voters to place each candidate in the political spectrum more precisely” or “alert the voter to the interests to which a candidate is most likely to be responsive and thus facilitate predictions of future performance in office.” 102

Both the Primo and LaRaja studies are consistent with a self-assessment the National Institute on Money in State Politics (NIMSP) commissioned the RAND Corporation to perform in 2014. 103 As NIMSP’s report pointed out, the Court’s McCutcheon decision cited NIMSP’s website, FollowTheMoney.org, as an example of the “massive quantities of information [that] can be accessed at the click of a mouse,” thus making “disclosure[] effective to a degree not possible at the time Buckley, or even McConnell, was decided.” 104 However, the NIMSP report cited almost no examples of how its donor disclosure data, which it compiles from state records, is actually used in a way that advances the heuristic theory postulated in Buckley of “aid[ing] the voters in evaluating those who seek [public] office.”

Conceding that “the actual impact” of donor disclosure data on the general public likely “is rather low,” the NIMSP report begins by arguing that the “value” of donor disclosure data “can ... be found in the writings of [Supreme Court Justice Louis] Brandeis; the past opinions of the Supreme Court; and in the public campaigns toward greater electoral transparency, as evinced by the creation and operations of the [Federal Election Commission].” 105 This places the cart before the horse, though. Legal regimes requiring disclosure are not, in and of themselves, evidence of the efficacy of disclosure; rather, empirical evidence should be required to justify the existence of such legal regimes.

The NIMSP report then goes on to provide a vague account of how journalists use disclosure data, and little can be concluded from this section of the report about the social value of disclosure. 106 The report’s discussion of how advocacy groups use the disclosure data is quite telling, however. With the exception of one group that purported to use disclosure data to draw a link between campaign funding and elected officials’ positions on criminal justice reform, all other advocacy groups cited appeared to use the disclosure information to advocate on campaign finance disclosure policy, and the list of groups themselves is a who’s who of campaign finance policy lobbying outfits ranging from Americans for Campaign Reform to Transparency International. 107 In short, the NIMSP report suggests that donor disclosure data is being used primarily as the main ingredient in a “self-licking ice cream cone” 108 to advocate for more disclosure, rather than to provide meaningful information to voters.

Real-world examples also suggest that campaign donor information often does not accurately “predict[] future performance in office.” During the 2013 federal government shutdown, the New York Times and the Washington Post both ran articles remarking on how business interests, which had financially supported Republicans and opposed the shutdown, had been “spurned” by or had “los[t] sway” over congressional Republicans who backed the shutdown. 109 Perhaps if the “social class” that finds campaign finance donor disclosure so alluring had focused more on the substance of what certain congressional members and candidates had actually campaigned on, rather than who their financial supporters were, the result would have made more sense to the Times and Post.

Another example of the lack of correlation between the sources of candidates’ financial support and their policy positions is the controversy over the Target Corporation’s 2010 contribution to a Minnesota state super PAC that supported gubernatorial candidate Tom Emmer. 110 Although Target maintained that the contribution was made to support the super PAC’s economic policy positions, the disclosure of the retailer’s contribution was met with a wave of protests and a petition signed by more than 240,000 individuals threatening to boycott Target because of Emmer’s opposition to same-sex marriage. 111 (Hypocritically, the protest was orchestrated by MoveOn.org, an organization comprised in large part of a 501(c)(4) “dark money” arm that is not required to disclose its own donors. 112)

In fact, Target had a strong record of supporting gay rights 113 and likely did not support Emmer’s position on the issue. Had the disclosure of Target’s political contribution worked the way the Court’s jurisprudence postulated, one would have drawn the wrong conclusion about Emmer’s position on same-sex marriage based on Target’s position on the issue. However, no protesters opposing Target’s contribution likely were laboring under the Court’s misimpression that the disclosure of this information had any heuristic value in determining the candidate’s position on social issues. In fact, the protesters were using disclosure for the opposite purpose: to pressure the contributor to distance itself from the candidate based on positions of the candidate already known to the protestors. Regardless of whether one believes this is a legitimate or socially valuable use of disclosure data, it is important to recognize that this is a use of disclosure that is far afield from the justifications the Court has endorsed for compulsory disclosure.

NON JURISPRUDENTIAL JUSTIFICATIONS FOR DONOR DISCLOSURE

If one goes in search of better justifications for compulsory donor disclosure beyond the Supreme Court’s holdings, the landscape is still rather bleak. The arguments put forward for disclosure often are illogical on their face, contrary to actual experience, inconsistent with other First Amendment precepts, or downright invidious.

For example, former state senator Larry Martin (R-SC), who had been the subject of advertisements criticizing his legislative record during his failed primary bid for reelection, recently explained his support for compulsory disclosure as follows: “They’re able to put a spin on things that you can’t really refute because you don’t know who they are.” 114

U.S. Senator Heidi Heitkamp (D-ND) makes a similar case for disclosure: “When it’s clear who’s behind an ad ... [w]e can take the sales pitch with a grain of salt, and make an informed decision about whether or not to buy it. The same is true with political ads—to understand them, we need to know who’s behind them.” 115

But readers of the pseudonymous Federalist Papers seemed to have no trouble understanding the arguments presented therein without knowing who “Publius” was. 116 And Anti-Federalists writing as “Cato,” “Centinel,” “The Federal Farmer,” and “Brutus” also apparently faced no impediment in rebutting “Publius” without knowing the latter’s identity. 117 If these examples come across as antiquated, consider the ubiquity of anonymous sources in news reporting in the modern age. Notwithstanding that “Deep Throat’s” identity remained secret for more than 30 years after the Watergate scandal, no one ever claimed an inability to understand the substance of his allegations, which helped bring down a president. 118

Sen. Chris Van Hollen (D-MD) made a somewhat more cogent and perhaps more candid—although no more persuasive—argument for disclosure in his (unsuccessful) lawsuit challenging what he alleged to be the FEC’s insufficient disclosure regulations for so-called electioneering communications. Because, according to Van Hollen, the FEC’s rules permit sponsors of such ads to be funded by “anonymous donors,” he claimed injury because he would “not be able to respond by, inter alia, drawing to the attention of the voters in his district the identity of persons whose donations are used to fund” such ads. 119

In other words, unlike his colleague Senator Heitkamp and former state senator Martin, Senator Van Hollen (wisely) did not make the fanciful claim that he would literally be unable to respond to substantive criticism of his public record without knowing the sources of funding for such speech. Rather, what Van Hollen appears to have meant is that he could not refute his critics’ speech by resorting to responses about “the[ir] identity.” For those yearning for more substantive debates in our politics, this argument for ad hominem attacks is hardly a ringing endorsement for compulsory disclosure. Under the framework of our First Amendment jurisprudence, this justification would require a finding that there is a legitimate governmental interest in facilitating the logical fallacy of the argumentum ad hominem. 120

Senator Heitkamp also claimed that “undisclosed money ... makes our democratic process nastier and more divisive.” 121 Likewise, Connecticut state representative Livvy Floren has pointed to a laundry list of “dirty politics and divisiveness, bombast and blasphemy, lies and libel, negativity and nastiness, anger and animosity—all paid for with millions of dollars from anonymous donors” as justification for more compulsory donor disclosure laws. 122 As a counterpoint to this, Professor Charles Kesler of Claremont McKenna College has called the pseudonymously written Federalist Papers a “model of candor, civility, and deliberation for future American political disputes.” 123 And it is not as if candidates have any trouble coarsening the political debate entirely on their own without any anonymous outside help. 124 Moreover, if anything has made our politics “nastier and more divisive,” certainly compulsory disclosure laws are partially responsible, as evidenced by those instances discussed earlier of donors being threatened and harassed as a result of their political contributions having been disclosed. 125

West Virginia state senator Mike Romano has argued for passing a state campaign finance disclosure bill on the grounds that “[p]eople have a harder time lying when they can’t hide behind their checkbooks.” 126 However, speech laws that seek to root out false speech are generally frowned upon as a form of content-based speech regulation, and the Court has endorsed “the common understanding that some false statements are inevitable if there is to be an open and vigorous expression of views in public and private conversation,” as well as the notion that “[t]he remedy for speech that is false is speech that is true.” 127 But this may not matter much; as demonstrated previously, the jurisprudence on campaign finance disclosure laws does not appear to be particularly concerned about consistency with other areas of First Amendment law.

Every so often, compulsory disclosure supporters reveal their true intention of deterring speech. In introducing the DISCLOSE Act in 2010, Sen. Chuck Schumer warned that the bill’s “deterrent effect should not be underestimated.” 128 And just to be clear that Senator Schumer was not quoted out of context, when confronted with his quote in 2014, he not only didn’t disavow it, but he doubled down and reiterated his belief that “when somebody is trying to influence government for their purposes, directly with ads and everything else [in other words, engage in political speech], it’s good to have a deterrent effect.” 129 Senator Heitkamp, somewhat more circumspect than her colleague, has argued that “there’s too much money in politics” (in other words, too much spending on political speech) as a reason for cosponsoring the SUN Act disclosure legislation, which is presumably designed to reduce the amount of speech. 130

This sometimes not-so-subtle effort to use compulsory donor disclosure laws to limit speech runs head-on, however, into what the Court has long held to be our “profound national commitment to the principle that debate on public issues should be uninhibited, robust, and wide-open, and that it may well include vehement, caustic, and sometimes unpleasantly sharp attacks on government and public officials.” 131 Not only that, but the deterrence of speech diminishes the public’s “right to hear, to learn, to know” 132—a right that also has been held to be fundamental. 133

Moreover, as the Court recognized in McIntyre, compulsory disclosure laws tend to “place[] a more significant burden on advocates of unpopular causes than on defenders of the status quo.” 134 Thus, the deterrent effect that Senator Schumer touts also functions as a de facto content regulation of speech. 135 As Justice Scalia noted in the McConnell case, “[T]his is an area in which evenhandedness is not fairness... . any restriction upon a type of campaign speech that is equally available to challengers and incumbents tends to favor incumbents.” 136 Certainly, Justice Scalia was writing in McConnell about a categorical prohibition of certain “electioneering” speech, and he was elsewhere a full-throated supporter of campaign finance disclosure laws. 137 However, to the extent that the Court has recognized the significant burden disclosure requirements impose on political speech, Scalia’s suspicions about an incumbency protection scheme should apply equally against disclosure laws that all too often are touted by incumbents (as evidenced by the comments of the various federal and state legislators discussed earlier).

Even if these miscellaneous justifications for disclosure were remotely cogent or persuasive, none of these rationales fits within the “informational interest” in helping “voters to place each candidate in the political spectrum” that the Court has endorsed in upholding disclosure laws. Thus, if legislators are designing disclosure laws to further one of these other interests, they should not count on those laws being upheld in litigation.

Nor do these justifications fit within the anti-corruption rationale for disclosure that the Court has endorsed for disclosure of contributions to candidates, and which I have argued no longer justifies disclosure requirements for independent speech in light of recent jurisprudence. However, to the extent advocates of disclosure continue to press the anti-corruption rationale even for disclosure related to independent speech, this point merits a brief response. 138

To reiterate: Under the “exacting scrutiny” standard for judicial review of disclosure laws, the government bears the burden of demonstrating that disclosure of the funding sources of independent political speech helps prevent corruption. 139 Not only does it not appear that the government has met this burden, but it also seems that disclosure could just as easily have the opposite effect. As Judge Easterbrook has observed, disclosure laws “make[] it easier to see who has not done his bit for the incumbents, so that arms may be twisted and pockets tapped.” 140

Similarly, a U.S. Court of Appeals for the D.C. Circuit opinion noted that when a contribution made to a candidate is disclosed, “the recipient’s competitor will notice, and if the competitor should win the spender will not be among his favorite constituents.” 141 This logic applies equally to a contribution made to an independent super PAC supporting a particular candidate. For example, in 2013, when former New York governor Eliot Spitzer was trying to make a political comeback from his prostitution scandal by running for New York City comptroller, donors reportedly were terrified of contributing to a super PAC supporting his opponent, for fear that the disclosure of their contributions would result in retribution if the famously vindictive Spitzer were elected. 142 The flip side of disclosure’s deterrent effect is that donors seeking to ingratiate themselves with a candidate will have greater incentive to contribute to an independent expenditure effort if their contributions will be disclosed.

Alabama state senator Arthur Orr cited “‘mischievous situations,’ such as a donor contributing to a candidate as an individual and then anonymously giving to a group running ads against that same candidate,” as a reason to require additional disclosure. 143 This is mischievous indeed, since the contribution to the candidate (which is disclosed) would help the donor ingratiate himself or herself with an elected official, while the undisclosed contribution would allow the donor to speak his or her conscience. If a compulsory disclosure law were to close the door on donor privacy in Orr’s example, then the only door left for the donor would be ingratiation.

Although the Democratic Party in recent years generally has supported disclosure laws more than the Republican Party has, several Democrats opposed President Obama’s proposed government contractor disclosure executive order out of concerns that it would facilitate corruption. “We are concerned that requiring businesses to disclose their political activity when making an offer risks injecting politics into the contracting process,” Sen. Claire McCaskill and then-senator Joe Lieberman wrote in a letter to the president. 144

These consequences of disclosure, even if they do not necessarily fall within the definition of quid pro quo corruption that the Court articulated in Citizens United, certainly fit within the broader concept of “corruption” that opponents of Citizens United subscribe to. 145 And they are all counterpoints to the anti-corruption rationale for expanded disclosure laws.

Recommendations

Much of the modern campaign finance disclosure regime presupposes the verity of Supreme Court Justice Louis Brandeis’s famous maxim that “[s]unlight is said to be the best of disinfectants.” 146 But just as excessive sunlight also may cause damage, such as blinding, cataracts, and melanoma, 147 the key point that readers should take away from this paper is that there are proper and improper ways to implement disclosure, and a balanced approach is required.

Disclosure’s purpose should be to “allow[] citizens to keep tabs on their elected officials”—not for “the government to monitor its constituents.” 148 The legitimacy of disclosure laws is at its zenith when they focus on government transparency. Open government is essential to representative government and holding officials accountable and responsive to the public. When disclosure laws’ purpose is to monitor private individuals and groups exercising their First Amendment rights, however, such laws become an authoritarian tool for intimidation, retribution, and the suppression of democratic debate.

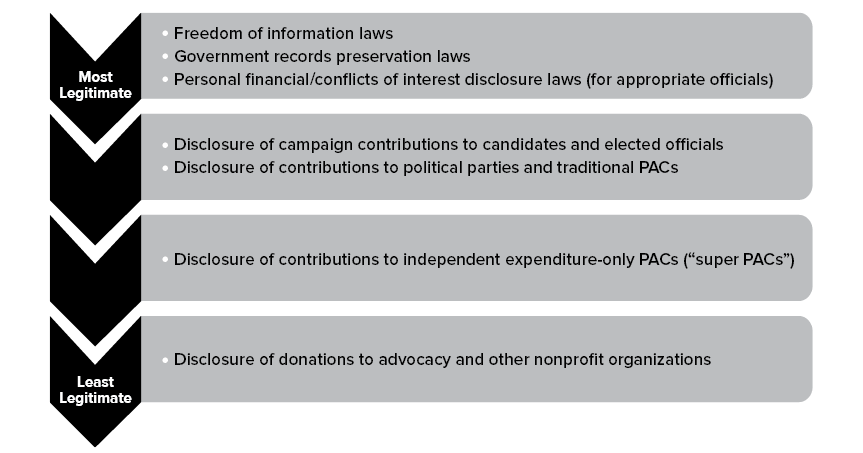

Thus, if we were to diagram a hierarchy of disclosure laws in decreasing order of legitimacy, it might look something like Figure 1.

With these principles in mind, I recommend the following for how disclosure laws should be amended or implemented:

Retain Disclosure of Contributors to Candidates’ Campaign Committees, Political Party Committees, and Traditional PACs, But Raise Disclosure Thresholds. The anti-corruption rationale is much stronger for requiring donor disclosure for campaign contributions made directly to candidates and elected officials than it is for requiring disclosure of donors to independent groups. Politicians exercise complete or ultimate control over the funds that are given directly to their campaign committees. Although most jurisdictions now prohibit campaign funds from being used for personal expenses, 149 such funds are still highly valuable to politicians, most of whom seem to be motivated by getting elected or reelected as much as (or more than) anything else in life. 150 To the extent that political party committees and traditional PACs (i.e., those that are not super PACs) coordinate with and make contributions directly to candidates, requiring such entities to report their donors also is appropriate. 151

Figure 1

Legitimacy of disclosure laws

Nonetheless, the existing law requires excessive disclosure of small donors. The current threshold for disclosure of donors applies to anyone who gives more than $200 during a calendar year to a federal candidate, political party committee, or PAC, 152 and some states even purport to require disclosure of donors who give so much as a penny. 153 These days, no one believes that giving $201 (much less a penny) to a congressional or presidential candidate is going to get donors more than a thank you note signed by an autopen (if even that). Relatedly, an organization that merely accepts contributions or makes expenditures totaling more than $1,000 could be required to register as a federal PAC, which in turn triggers broad donor disclosure requirements. 154 Most disclosure thresholds are not adjusted for inflation. Even ardent supporters of more compulsory disclosure laws agree that the donor disclosure thresholds should be raised so that small donors are not unnecessarily disclosed. 155 These thresholds also should be pegged to inflation so that they are not eroded over time.

Limit Disclosure Requirements for Independent Speech. As the Court has postulated of independent political speech: “The absence of prearrangement and coordination of an expenditure with the candidate or his agent not only undermines the value of the expenditure to the candidate, but also alleviates the danger that expenditures will be given as a quid pro quo for improper commitments from the candidate.” 156 Real-world examples corroborate this assessment. Individuals have long been permitted to make independent expenditures in unlimited amounts urging the election or defeat of candidates, 157 and since 2010 have been permitted to contribute unlimited amounts to super PACs. 158 Nonetheless, we have seen donors regularly risking and incurring serious criminal penalties to make “straw contributions” to candidates (i.e., reimbursing others for making contributions to circumvent per-individual contribution limits). 159 This is strong evidence that donors agree with the Court’s view that contributions given directly to candidates’ campaign coffers may have more ingratiation value than independent spending.

Relatedly, absent compulsory disclosure requirements, there is an inherent information asymmetry between direct contributions to candidates and funds given to and spent by independent speakers. Regardless of any disclosure laws, politicians certainly know who is contributing to their campaign accounts. However, without campaign finance reports, politicians generally would not know, and would have difficulty verifying, whether donors are giving to independent groups unless they were looking at the groups’ bank statements and canceled checks. Given concerns about running afoul of coordination laws, this seems unlikely.

In short, when applied to independent speech, disclosure laws serve, at best, an attenuated societal interest in preventing corruption, and may even facilitate corruption by enabling politicians to verify who is and is not contributing to independent efforts to support their campaigns. 160 As explained earlier, there also does not appear to be any evidentiary support for the heuristic or “informational interest” in disclosure. Thus, compulsory donor disclosure laws should be applied as sparingly as possible to independent political speech.

If disclosure requirements for independent speech must be enacted:

- Requiring a group to publicly report how much it has spent on independent expenditures is less burdensome and less intrusive than, and thus preferable to, requiring a group to also publicly disclose its donors. 161

- “One-time, event-driven report[s]” that must be filed only when particular independent expenditures are made are less burdensome, and thus preferable to, ongoing, periodic reports that must be filed even when there is no campaign finance activity. 162

- Limiting disclosure only to donors who have clearly earmarked their funds to further the reported independent expenditure is less burdensome and less intrusive than, and thus preferable to, a requirement that an organization’s general-purpose donors be disclosed indiscriminately. 163

The use of “census or other standard government occupation categories” on disclosure reports in lieu of a donor’s name and other personal information, as Stanford professor Bruce E. Cain has suggested, also warrants further consideration. 164 This may better serve the purported heuristic or “informational interest” in disclosure (to the extent that real-world evidence shows this interest exists), while shielding individual donors from the threat of harassment and retaliation.

CONCLUSION

We live in an age in which support for free speech is under siege. The very idea of free speech has come to be associated with white supremacists and other odious causes. 165 Hundreds of speakers have been disinvited from institutions of higher education because of disagreements with their viewpoints. 166 Beating opponents in debate is no longer enough; instead, they have to be physically beaten—or even killed—if we don’t like what they have to say. 167 Objectionable speech must be preceded by “trigger warnings,” 168 and the liberty to speak is banished to designated “free speech zones.” 169 Forty percent of millennials support laws to prohibit certain offensive speech—far more than any other generation polled. 170 Both sides of the ideological spectrum denounce the other side’s news sources as “fake news.” 171

In this environment, it is more important than ever for individuals to have the option to speak collectively without the fear of reprisals and threats that too frequently result from having their names, addresses, and employer information posted on the Internet as a result of compulsory donor disclosure laws. Unfortunately, the debate over disclosure and donor privacy has become just as polarized as the debates over the substantive issues that donors wish to engage in. The FEC, for example, for more than 20 years used to routinely approve exempting the Socialist Workers Party from donor disclosure requirements. 172 But lately, certain commissioners at the agency caught in the disclosure fever have deadlocked on renewing this exemption for the Socialist Workers. 173

Such an absolutist stance in favor of disclosure is unwarranted. Disclosure is not an unalloyed good. Rather, it is a policy prescription that must be approached with more nuance, especially in light of the serious constitutional concerns and tangible harms that are implicated. Judicial holdings underpinning the present-day push for more compulsory disclosure laws should be examined more critically, especially for outdated or unsupported assumptions. And policy justifications for disclosure should be viewed with more skepticism, especially when they are advanced by incumbent lawmakers who have a conflict of interest in passing laws that hinder speech unfavorable to them.

NOTES

Any opinions expressed in this paper should not be attributed to any of Eric Wang’s clients, or those of his firm. The author wishes to thank Jan Witold Baran, David Keating, and Bradley A. Smith for reviewing this work and offering invaluable insights and suggestions.

- Van Hollen v. Federal Election Commission, 811 F.3d 486, 488 (D.C. Cir. 2016).

- The author uses the term “political speech” throughout this paper as shorthand for the full range of political activities protected under the First Amendment. This may include not only verbal speech such as mass media advertising but also expressive activities such as door-to-door canvassing; voter registration; and get-out-the-vote drives, rallies, marches, protests, and so forth. R.A.V. v. City of St. Paul, Minnesota, 505 U.S. 377, 385 (1992) (explaining that the First Amendment protects “nonverbal expressive activity”); Martin v. City of Struthers, 319 U.S. 141 (1943) (holding that the First Amendment protects door-to-door activity).

- Federal Election Campaign Act of 1971, Pub. L. 92-225, Tit. III and Federal Election Campaign Act Amendment of 1974, Pub. L. 93-443, Tit. II.

- Buckley v. Valeo, 424 U.S. 1, 61 (citing Act of June 25, 1910, c. 392, 36 Stat. 822 and Act of February 28, 1925, Tit. III, 43 Stat. 1070).

- H.R. 5175 (111th Congress).

- S. 3369 (112th Congress), S. 2516 (113th Congress), S. 229 (114th Congress), H.R. 1134 (115th Congress).

- S. 300 (115th Congress).

- Perry Bacon Jr. and T.W. Farnam, “Obama Weighs Disclosure Order for Contractors,” Washington Post, April 20, 2011; and Eric Wang, “Members of Congress Propose Politicization of Government Contracts,” The Hill Congress Blog, June 25, 2015, http://thehill.com/blogs/congress-blog/politics/246056-members-of-congress-propose-politicization-of-government.

- Petition for Rulemaking in re Amendment of 47 C.F.R. § 73.1212 (filed March 22, 2011), https://ecfsapi.fcc.gov/file/7021236093.pdf.

- Committee on Disclosure of Corporate Political Spending Petition for Rulemaking (filed August 3, 2011), https://www.sec.gov/rules/petitions/2011/petn4-637.pdf; and Petition for Rulemaking on Disclosure by Public Companies of Corporate Resources Used for Political Activities (filed April 15, 2014), https://www.sec.gov/rules/petitions/2014/petn4-637-2.pdf.

- Petition for Rulemaking to Revise and Amend Regulations Relating to Disclosure of Independent Expenditures (filed April 21, 2011), http://sers.fec.gov/fosers/showpdf.htm?docid=61143; and Petition by Ann M. Ravel and Ellen L. Weintraub (filed June 8, 2015), http://sers.fec.gov/fosers/showpdf.htm?docid=335637.

- N.M. S.B. 96 (2017 Legis. Sess.); S. Carolina S. 255 (2017 Legis. Sess.); N.J. A. 3639 and A. 3902 (2016–2017 Legis. Sess.); Minn. H.F. 2727 and S.F. 3117 (2016 Legis. Sess.); Ala. S.B. 356 (2016 Legis. Sess.); Ga. H.B. 370 (2016 Legis. Sess.); Wash. S.B. 5153 (2016 Legis. Sess.); Tex. H.B. 37 (2015 Legis. Sess.); Mo. H.B. 188 (2015 Legis. Sess.); Mont. S.B. 289 (2015 Legis. Sess.); Ark. H.B. 1425 (2015 Legis. Sess.); and Mass. H.B. 4226 (2014 Legis. Sess.), and others.

- McIntyre v. Ohio Elections Commission, 514 U.S. 334, 343 n.6 (1995) (discussing the robust debate between the pseudonymous authors of the Federalist Papers and the Anti-Federalists); Brief of Constitutional Law, Political Science, and Economics Professors as Amici Curiae at 10–18, Independence Institute v. Federal Election Commission, No. 16-743 (U.S. 2017) (judgment of district court affirmed per curiam, Feb. 27, 2017) (discussing debates between Federalists versus Anti-Federalists; Pacificus versus Helvidius; A Friend of the Constitution versus Amphictyon and Hampden; seditious libel laws; and disclosure laws aimed at abolitionist materials); and Talley v. California, 362 U.S. 60, 64 (1960) (discussing how a colonial press licensing and disclosure law was aimed at “lessen[ing] the circulation of literature critical of the government”).

- For example, career executive branch employees have used anonymous speech to criticize the Trump administration’s policies, while the Obama administration came under fire for its efforts to prosecute anonymous sources within the executive branch who exposed alleged government wrongdoing to journalists. Haley Tsukayama, “The Government Is Demanding to Know Who This Trump Critic Is. Twitter Is Suing to Keep It a Secret,” Washington Post, April 6, 2017; and Glenn Greenwald, “Climate of Fear: Jim Risen v. the Obama Administration,” Salon, June 23, 2011, http://www.salon.com/2011/06/23/risen_3/.

- Kimberly Strassel, The Intimidation Game: How the Left Is Silencing Free Speech (New York: Hatchette, 2016); Citizens United v. Federal Election Commission, 558 U.S. 310, 480–82 (Thomas, J. concurring in part and dissenting in part); and Bradley A. Smith, Scott Blackburn, and Luke Wachob, “Compulsory Donor Disclosure: When Government Monitors Its Citizens,” The Heritage Foundation, 2015, http://www.heritage.org/report/compulsory-donor-disclosure-when-government-monitors-its-citizens.

- Stanley v. Georgia, 394 U.S. 557, 564 (1969) (“For also fundamental is the right to be free, except in very limited circumstances, from unwanted governmental intrusions into one’s privacy.”).

- U.S. Department of Health and Human Services, “The HIPAA Privacy Rule,” https://www.hhs.gov/hipaa/for-professionals/privacy/index.html?language=es.

- U.S. Department of Education, “Family Educational Rights and Privacy Act,” https://www2.ed.gov/policy/gen/guid/fpco/ferpa/index.html?src=rn.

- Federal Deposit Insurance Corporation, “Your Rights to Financial Privacy,” https://www.fdic.gov/consumers/privacy/yourrights/.

- California Online Privacy Protection Act, California Business & Professions Code §§ 22575–22579.

- Thomas v. Collins, 323 U.S. 516 (1945).

- NAACP v. Alabama, ex rel. Patterson, 357 U.S. 449, 451–52 (1958).

- The case did arise in part, however, from the organization’s solicitation of contributions within Alabama. Ibid., p. 452.

- Buckley, 424 U.S. at 65–66.

- NAACP, 357 U.S. at 460, 462.

- Ibid.

- Ibid., p. 463.

- Talley, 362 U.S. 60.

- Ibid., p. 64.

- Ibid., pp. 64–65.

- Buckley, 424 U.S. at 64 (collecting authority)

- Ibid., p. 65 (internal quotation marks and citations omitted).

- Ibid., p. 68.

- Ibid., pp. 79–81.

- McIntyre, 514 U.S. at 344.

- Ibid., pp. 337–38.

- Ibid., p. 342.

- Ibid., pp. 342–43 (internal quotation marks and citations omitted).

- Ibid., p. 343.

- Buckley, 424 U.S. at 66–67 (internal quotation marks and citations omitted). The Court also cited a third justification for disclosure: to “detect violations of the contribution limitations” contained in the campaign finance laws. Ibid., pp. 67–68. Because contribution limits are not the focus of this paper, and the recent push for disclosure legislation and rulemakings also does not relate to contribution limits, this paper does not address this third justification.

- Ibid., p. 81.

- Ibid., pp. 80–81.

- Ibid., p. 81.

- Ibid., p. 64.

- Ibid.

- McConnell v. Federal Election Commission, 540 U.S. 93, 196 (2003).

- Justice Thomas voted to invalidate the disclaimer and disclosure requirements at issue. Citizens United v. Federal Election Commission, 558 U.S. 310, 480–85 (2010) (Thomas, J. concurring in part and dissenting in part).

- Citizens United, 558 U.S. at 369. Although many have interpreted this holding as endorsing disclosure requirements generally, it was predicated on the opinion’s characterization of the ads at issue as “containing pejorative references to [Clinton’s] candidacy.” Ibid., p. 368 (emphasis added). The documentary on Clinton that the ads related to also was held to be “the functional equivalent of express advocacy” for her defeat. Ibid., p. 326. Thus, this holding on disclosure was in the context of a clear electoral effort. Moreover, the “informational interest” identified in Buckley that the Citizens United plurality relies on to justify the “electioneering communications” disclosure requirement was actually limited in Buckley to apply “only [to disclosure of] those expenditures that expressly advocate a particular [electoral] result.” Buckley, 424 U.S. at 80–81. Thus, it is not at all clear that the Citizens United holding may even be relied on to uphold disclosure requirements related to speech that is not “unambiguously campaign-related.”

- Fred Wertheimer, “Citizens United and Its Disastrous Consequences: The Decision,” Huffington Post, January 14, 2016, updated January 14, 2017, http://www.huffingtonpost.com/fred-wertheimer/citizens-united-and-its-d_b_8979252.html.

- Letter from Fred Wertheimer, President, Democracy 21, to Members of the U.S. House of Representatives, June 24, 2010, http://www.democracy21.org/uploads/%7BCC1B3F57-C02F-4A28-9095-798CFB8A7819%7D.PDF.

- Letter from Ann M. Ravel, Commissioner, Federal Election Commission, to President Donald J. Trump, February 19, 2017, https://medium.com/@AnnMRavel/departing-the-federal-election-commission-fee0ae9d63a1.

- Ravel and Weintraub, “Petition,” p. 5.

- Van Hollen, 811 F.3d at 500.

- Ibid., p. 501.

- Buckley, 424 U.S. at 66 (emphasis added).

- DISCLOSE Act of 2010, S. 3295 (111th Congress) §§ 211-213 and 301 (requiring additional disclosure of “campaign-related activity”) and § 325 (defining “campaign-related activity” to include independent expenditures and electioneering communications). Under preexisting campaign finance rules, electioneering communications, to the extent they are coordinated with candidates, are in-kind contributions that may not be made by incorporated entities and unions and generally would exceed the contribution limits even for permissible sources. See 11 C.F.R. § 109.2(c)(1). Thus, as a practical matter, any additional disclosure requirements targeting electioneering communications also are aimed at independent spending.

- N.Y. Executive Law § 172-f (requiring social welfare groups to disclose their donors if they sponsor certain public communications that “refer[] to and advocate[] for or against . . . the position of any elected official . . . relating to the outcome of any vote or substance of any legislation, potential legislation, [or] pending legislation . . . by any legislative, executive or administrative body.”

- Buckley, 424 U.S. at 81.

- McConnell, 540 U.S. at 196. It is unclear what exactly the McConnell decision meant with respect to the last justification it mentioned for disclosure: “gathering the data necessary to enforce more substantive electioneering restrictions.” McConnell, 540 U.S. at 196. To the extent it appears the Court was suggesting disclosure could help monitor any violations of the prohibition against corporate sponsorship of electioneering communications, that prohibition also was invalidated in Citizens United. Citizens United, 558 U.S. at 365–66.

- Citizens United, 558 U.S. at 359–361. As the Court held: (1) The fact that sponsors of independent speech “may have influence over or access to elected officials does not mean that those officials are corrupt”; (2) “The appearance of influence or access, furthermore, will not cause the electorate to lose faith in our democracy”; and (3) “In fact, there is only scant evidence that independent expenditures even ingratiate. . . . Ingratiation and access, in any event, are not corruption.” Many, of course, dispute this holding of Citizens United. See Wertheimer, “Letter to Members of the U.S. House of Representatives.” For the purposes of this paper, however, this holding is taken as a given in illustrating the Court’s incoherent holdings on the disclosure issue. Moreover, even if addressing corruption remains a viable rationale for requiring disclosure, that rationale is not without its own deficiencies, as discussed in more detail elsewhere in this paper.

- Citizens United, 558 U.S. at 369. The decision’s reference to how disclosure enables the public to “see whether elected officials are ‘in the pocket of so-called moneyed interests’” is not to the contrary. Ibid., p. 370 (quoting McConnell, 540 U.S. at 259 (opinion of Scalia, J.)). Indeed, in the passage Citizens United quotes from Justice Scalia’s opinion in McConnell, Justice Scalia explains that he does not regard this as corruption. McConnell, 540 U.S. at 259 (opinion of Scalia, J.) (“allies will have greater access to the officeholder, and [] he will tend to favor the same causes as those who support him (which is usually why they supported him). That is the nature of politics—if not indeed human nature—and how this can properly be considered ‘corruption’ (or ‘the appearance of corruption’) . . . is beyond me.”).

- Buckley, 424 U.S. at 80–81.

- Greer v. Spock, 424 U.S. 828, 842–43 (1976) (Powell, J. concurring).

- As discussed in more detail elsewhere in this paper, only the “informational interests” identified by the Court for disclosure remain relevant to independent political speech, and, accordingly, only those interests are presented in this chart.

- Van Hollen, 811 F.3d at 501.

- Meyer v. Grant, 486 U.S. 414, 422, and 425 (1988) (internal citations and quotation marks omitted).

- Majors v. Abell, 361 F.3d 349, 357 (7th Cir. 2004) (Easterbrook, J. dubitante).

- Ibid., p. 356 (Easterbrook, J. dubitante).

- 361 U.S. 516 (1960). Bates invalidated laws in two Arkansas municipalities requiring public disclosure of organizations’ dues-paying members and contributors.

- 283 F. Supp. 248 (1968) (E.D. Ark.), aff’d 393 U.S. 14 (1968) (per curiam). Pollard quashed a subpoena for a state political party committee’s bank records and contributor information, recognizing that “the disclosure of the identities of contributors to campaign funds would subject at least some of them to potential economic or political reprisals,” and that “disclosure well may tend to discourage both membership and contributions thus producing financial and political injury to the party affected.” Ibid., p. 258.

- McIntyre, 514 U.S. at 354. This is consistent with the Court’s prior holding in First National Bank of Boston, et al. v. Bellotti, 435 U.S. 765 (1978).

- Buckley, 424 U.S. at 81 and Citizens United, 558 U.S. at 359–61.

- Buckley, 424 U.S. at 67.

- Ann M. Ravel, Former Chair, California Fair Political Practices Commission, Testimony before the U.S. Senate Commission on Rules and Administration, April 30, 2014, https://www.rules.senate.gov/public/?a=Files.Serve&File_id=21D56592-DC49-44AA-A057-7213CE247480.

- McIntyre, 514 U.S. at 348.

- Buckley, 424 U.S. at 80–82 (upholding independent expenditure reporting requirement, including donor disclosure); McConnell, 540 U.S. at 196–201 (upholding electioneering communication reporting requirement, including donor disclosure) and 231 (upholding electioneering communication sponsorship identification disclaimer requirement); and Citizens United, 558 U.S. at 366–369 (upholding electioneering communication sponsorship identification disclaimer requirement and electioneering communication reporting requirement, including donor disclosure).

- McIntyre, 514 U.S. at 355. McIntyre portrays the independent expenditure reporting requirements upheld in Buckley as being limited to disclosure of “the amount and use of money expended in support of a candidate” (emphasis added); and ibid., p. 355n19. In fact, Buckley upheld Section 434(e) of the Federal Election Campaign Act of 1971, 424 U.S. at 74–82, a provision which also required sponsors of independent expenditures to report their donors, ibid., pp. 155–60.

- Majors, 361 F.3d at 354.

- McIntyre, 514 U.S. at 355.

- Ibid.

- Casey Sullivan, “After Clinton Donation, Legal Recruiter Complains of Death Threat,” Bloomberg Law, October 11, 2016, https://bol.bna.com/after-clinton-donation-legal-recruiter-complains-of-death-threat/; Brad Stone, “Prop 8 Donor Web Site Shows Disclosure Law Is 2-Edged Sword,” New York Times, February 7, 2009; and Americans for Prosperity Foundation v. Harris, Case No. CV 14-9448-R (C.D. Cal. April 21, 2016) (unpublished opinion) at 7–8.

- Institute for Justice, “Danger of Disclosure: The Government Tells the World How You Vote & Where You Live,” March 4, 2009, http://ij.org/press-release/danger-of-disclosure-the-government-tells-the-world-how-you-vote-a-where-you-live/ (describing eightmaps.com, “a ‘mash-up’ of Google maps and a list of donors to Proposition 8—the referendum to end same-sex marriage in [California]. The website provides the name, occupation, donation amount and exact location of the Prop 8 donor.”).

- As the Oregon Attorney General has pointed out, there is “no consensus” on whether McIntyre should be read narrowly in this manner, and “[r]ead broadly, [McIntyre] applies to all anonymity prohibitions.” Oregon Attorney General Opinion No. 8266 (March 10, 1999). Oregon has interpreted the holding of McIntyre to apply to all disclaimer requirements, regardless of whether the speaker is an individual or an organization.

- Buckley, 424 U.S. at 65, 68.

- Majors, 361 F.3d at 354 (alluding to “the distinction the Supreme Court has drawn between ‘disclosure’ (reporting one’s identity to a public agency) and ‘disclaimer’ (placing that identity in the ad itself”).

- McConnell, 540 U.S. at 231.