One of the main reasons for the drop in oil prices that began in 2014 was a rapid increase in U.S. oil production—it reached the level of the other two biggest producers, Russia and Saudi Arabia, that same year. That, in turn, decreased U.S. demand for imported petroleum and hence put downward pressure on the oil price worldwide. There is one aspect of the shale revolution that gets much less attention than geopolitical or environmental issues: What were the institutional conditions that allowed the technological innovation to happen? In essence, it was a combination of secure property rights, a favorable tax regime, minimal red tape, and a strong entrepreneurial culture (there were around 13,000 small U.S. oil companies fiercely competing with each other).

This paper explains how the quality of institutions determines whether natural resource abundance is a blessing or a curse: Will it boost or stifle innovation and economic development? Institutional deficiency in resource economies perpetuates rent-seeking, autocracy, and slower economic growth as illustrated by multiple examples. One of the most alarming among them is Venezuela. While the country possesses the largest oil reserves in the world it is at a brink of economic collapse and is struggling with mass food shortages.

Nonetheless, the evidence presented in this paper is at odds with the “resource curse” hypothesis that mineral-exporting countries are doomed to stagnation. A number of countries with high levels of economic freedom, such as Australia, Canada, Chile, and Norway, demonstrate that it is possible to build a prosperous and innovative economy with a significant share of income from the sale of minerals. Furthermore, sound institutions can help diversify the economy and weather the storm of low commodity prices. As exemplified by several countries in the 1980s and in later years, petroleum exporters with strong institutions can achieve positive growth even during oil price drops.

Introduction

Although more than half a century has passed since the creation of the Organization of the Petroleum Exporting Countries (OPEC) and its redistributive model of "resource nationalism," many OPEC countries have not lived up to expectations and have not experienced an acceleration of growth.1 In general, the results were negative: private investment was crowded out, rent-seeking and corruption increased, and overall productivity fell.

Employing a barrage of populist anti-colonial rhetoric, authorities in the developing countries that account for most of the global production of hydrocarbons seized control of resources through expropriation, nationalization, and abrupt changes in the terms of contracts with international companies. Effective government control in the mineral industry, which was higher than in other sectors, created numerous opportunities to extract rents. The peak of "resource nationalism" came in the 1960 — and in its wake OPEC was created. Institutional development in those countries then began to decline. And the lower the quality of institutions, the more profitable it became to engage in rent-seeking, and the less profitable it became to engage in productive entrepreneurship.

In the first decade of the 21st century, high oil prices served to prop up inefficiencies in public administration in a number of oil economies. Over time, even high prices became insufficient for boosting economic development because of corruption and institutional deterioration. As a result, economic and social stagnation occurred in many petrostates even during the long period of inflated oil prices (2002–14). Such stagnation is one of the reasons for growing discontent in several petroleum-based economies.

July 2014 marked the beginning of the most significant decline in oil prices since the 1980s (see Figure 1.) Several factors that increased supply and slowed demand have changed the global oil market. One of the main reasons for the drop in oil prices was a rapid increase in U.S. oil production, which in 2014 reached the level of the other two biggest producers, Russia and Saudi Arabia. Greater reliance on domestic production has decreased U.S. demand for imported oil and hence has put downward pressure on the oil price worldwide.

Figure 1. Real and Nominal Oil Price (monthly) since January 1972

Source: U.S. Energy Information Administration, author's calculations,

www.eia.gov/forecasts/steo/realprices/real_prices.xlsx.

In addition, the rapid increase in shale gas production, accompanied by a drop in domestic gas prices in the United States, has increased the share of gas in the overall U.S. energy mix, lessening U.S. dependence on oil in particular.2 All in all, the U.S. "shale revolution" is having a major impact on global energy markets. Moreover, the drop in oil prices is a result not only of the rapid increase in production but also of the slowdown in consumption. The world as a whole and Western countries in particular have made a big leap toward efficient energy consumption. For instance, one major development has been the decrease in the volume of liquid fuel consumption in engines. Various types of technological innovations have occurred simultaneously that have contributed to the drop in oil prices.

Since oil prices began to fall in 2014, economic and institutional deterioration in many petrostates has accelerated. Other mineral commodities, such as metals and coal, have also experienced depressed prices since 2011. That factor has put many mineral-exporting countries under significant pressure to adjust their policies and institutions. In recent years, Russia, Venezuela, Nigeria, Brazil, and Malaysia all saw civil protests. All in all, low commodity prices push governments to improve public administration and seek alternatives to old models of governance and the redistribution of rents.

This paper argues that resource economies (economies reliant on exports of natural resources)3 with better economic and political institutions manage their revenues better than countries with poor institutions and can achieve superior results in economic growth and social development. The evidence presented here is at odds with the "resource curse" hypothesis that stipulates that mineral-exporting countries are doomed to stagnation. The quality of institutions is what essentially determines whether natural resource abundance is a blessing or a curse. Furthermore, strong institutions can help achieve long-term growth during periods of low commodity prices. To support that argument, the performance of resource economies in different parts of the world is compared in relation to their institutional rankings, the property structure of their extractive industries, and other key parameters.

The first section provides an overview of major studies of resource economies. It compares various approaches to such issues as the "Dutch disease" and the effects of commodity price volatility. Experience shows that mineral-exporting countries are by no means cursed by their resource wealth. An alternative to the resource curse hypothesis emphasizes the positive influence of the rule of law and strong property rights and the negative role of rent-seeking, which appears to be one of the main hindrances to economic development in resource economies.

The second section looks at policy choices facing resource-based economies. It examines such policy areas as the institutional climate, the government's share in oil companies, stabilization funds, and government investments. The economic and social performance of resource economies depends primarily on the strength of their institutional framework, of which economic freedom is a key component.

The third section looks at the institutional conditions for major innovations in extractive industries, such as the shale revolution and breakthroughs in the development of other unconventional resources. It then briefly summarizes the experience of four countrie — Australia, Canada, Chile, and Norway — and looks at particular policies that allowed them to achieve more rapid growth and higher levels of social development compared with peer countries with resource-based economies. Finally, this section looks at the experiences of oil-exporting countries that managed to maintain high growth rates during the crude price drop in the 1980s.

Rent-Seeking and the Quality of Institutions

This section provides an overview of major studies of resource economies and compares various approaches to problems associated with dependency on mineral rents. It analyzes the phenomenon of rent-seeking, which appears to be one of the main obstacles to economic development in resource-exporting states.

The Resource Curse Hypothesis vs. the Institutionalist Approach

Although some economists have raised doubts about the role of natural resources in economic development, up until the late 20th century, no significant efforts had been made to study the possible negative impact of resource dependency. One of the possible reasons for that was the commonsense view that a country's natural resources should positively affect its economic growth. Several authors have argued that natural resource — notably coal as a source of energy — were among the primary drivers of the Industrial Revolution.4

That approach started to change in the 1990s with the publication of several notable studies. American scholar Terry Lynn Karl spent two decades studying the experience of troubled petrostates. The results of that research are contained in her 1997 book The Paradox of Plenty: Oil Booms and Petro-States.5 She identified some of the resource economies with the most evident institutional failures. One of the most notable cases is that of Venezuela. Venezuela's economy is remarkable in several ways. With regard to its real gross domestic product (GDP) per capita, Venezuela went from being one of the most well-off countries in Latin America and worldwide in the 1950s to a period of stagnation and even decline. Over two decades, its real income per capita declined by 25 percent. In 1988, 2.4 percent of Venezuelans were living below the poverty line. But by 1998, when Hugo Chávez was elected president, that figure had risen to 18.5 percent.6

Few people realize that Venezuela's current oil reserves are the largest in the world. They are about a dozen times larger than what Venezuela had at its disposal in the 1980s. An oil-abundant and oil-dependent autocratic government need not concern itself with income per capita, poverty, inequality, and other indicators of the well-being of its general population, but one would imagine that it would at least maintain oil production in order to fill government coffers. Yet Venezuela's example refutes even that intuitive assumption. It is hard to believe, but Venezuela's overall oil production is actually lower today than it was half a century ago.7

Venezuela is not the only country that has failed to realize its hydrocarbon potential. Iran is another peculiar case. It possesses the largest combined oil and gas reserves in the world and is second only to Russia in natural gas reserves. It could clearly have been a frontrunner in natural gas exports with a booming economy. But although sitting on enormous reserves, in 2014 it was actually a net gas importer.8 Something must be wrong with a country's institutions and policies if even its own oil and gas industry, a government cash cow, can go into stagnation. Apart from Venezuela and Iran, Libya represents one of the most unfortunate examples of institutional failure among oil-exporting countries. As shown in Figure 2, Libya's GDP per capita went through a rapid adjustment from six times the world average in 1977 to below the global median income in a quarter of a century.

Figure 2. Real GDP per Capita (PPP) as Percentage of World Average in Three Oil & Gas Economies since 1963

Source: World Bank Open Data, author's calculations,

http://data.worldbank.org/topic/economy-and-growth.

One of the first significant systematic studies of economic problems associated with natural resources was published in 1995 by Jeffery Sachs and Andrew Warner.9 That study laid the foundation for what later became known as the resource curse hypothesis. The study's main finding was that economies with a high ratio of natural resource exports to GDP grew more slowly than the world average during the 20 years from 1970 to 1990. Even after accounting for a number of variables that correlate positively with economic growth, a negative relationship between economic growth and resource dependence was still evident. They also found that lowering the share of natural resources in overall exports by 10 percent causes an increase in growth of 1 percentage point.

A number of economists conducted similar analyses to test their findings. For example, Xavier Sala-i-Martin published a 1997 paper, provocatively titled "I Just Ran Two Million Regressions,"10 in which he confirmed the findings of Sachs and Warner. Sala-i-Martin identified 22 variables that had a statistically significant influence on economic growth — natural resources were one of those identified as having a negative effect.

In the 1990s many economists agreed on the existence of a "resource curse." The phrase itself was coined by Richard Auty, an economist who specializes in the influence of natural resources on economic development. But simply stating that mineral resources have a negative effect on growth was insufficient. An explanation was needed. Hence, several approaches emerged that emphasized various channels through which resource dependency hinders growth. The earliest explanations focused on economic channels. Sachs and Warner concluded that it was the effect of the "Dutch disease"11 that economists had studied since the 1970s.12 The expression stems from the Dutch economic crisis of the 1960s following the discovery of North Sea natural gas. It refers to the effect of an inflow of foreign currency from commodity exports. The resulting local currency appreciation makes the country's nonmineral products less competitive on the global market. Cheaper imports can also suppress domestic manufacturing. In the 2000s, a group of authors still following the economic channel approach also investigated the influence of commodity price volatility on growth and development.13

In recent years, as more rigorous econometric analysis has been conducted using new, more extensive data sets, doubts about the resource curse hypothesis have begun to emerge. Several economists arrived at different conclusions concerning the effects of natural resources. First, there were doubts about the particular time period that Sachs and Warner chose to analyze. In 2001 Osmel Manzano and Roberto Rigobon14 argued that in the historical period used by Sachs and Warner (1970–90), a significant commodity price drop that started in the 1980s lasted for 20 years (this period is sometimes referred to as the "1980s oil glut"). That price decrease might have had a negative effect on economic growth. Furthermore, they argued that the high commodity prices of the 1970s allowed governments of resource-exporting countries to go on a borrowing spree, which created a debt overhang that in turn further slowed growth. After correcting for those factors, the resource curse was no longer identifiable.

In 2007, two economists at the World Bank, Daniel Lederman and William Maloney, raised doubts over the very attempt to generalize about the effect of natural resources on growth and development.15 They suggested that some of the indicators used in previous analyses might be unrelated to relative natural resource endowments.16 They concluded that economists have been trying to generalize about the effect of resource abundance while failing to discover precisely which characteristic is affecting growth negatively. A number of other economists looked at more extensive data sets covering longer time periods and discovered that natural resources had either no influence or a very weak influence on growth.17

Doubts about the direct economic impact of resource abundance encouraged a number of authors to look for a hidden channel through which natural resources might affect development. Although the macroeconomic explanation emphasized such issues as the Dutch disease and price volatility, a dissenting group of institutional economists developed an alternative approach, one that considered institutional deficiencies as the main factor inhibiting growth in resource economies.

It is important to stress the difference between two schools of thought within the institutional approach. One stems from the resource curse hypothesis and sees natural resource abundance as a cause of institutional degradation and corruption within the ruling elite, which consequently affects growth and development. Essentially, the resource curse becomes an "institutional curse."

The other school of thought, "institutionalism," also emphasizes institutions, but the causality works in the opposite direction: countries abundant in natural resources are not condemned to develop deficient institutions, but rather weak institutions are themselves the reason for the slowdown in growth and development. Figure 3 displays the various approaches to examining resource economics. The two schools of thought — the resource curse hypothesis, which emphasizes the institutional channel for the "curse," and institutionalism, which considers weak institutions to be the primary issue — have a lot in common. Both stress the vital role of institutions. Yet the practical policy implications of the two approaches are distinctly different. It is easy to see why. For the resource curse hypothesis, natural resources are the problem, and hence the solution is essentially to decrease economic reliance on resource sales. For the institutionalist approach, resources per se are not the issue or at least, one could argue, not the main issue. A number of countries illustrate how a large proportion of natural resource exports can exist alongside a developed institutional framework (I will look closer at such examples later). Institutions are thus viewed as the key factor determining the development trajectory of resource economies, and therefore policy recommendations are aimed mostly at improving the institutional framework.

Figure 3. Resource Abundance and Economic Growth: Major Schools of Though

The two schools of thought — the resource curse hypothesis, which emphasizes the institutional channel for the "curse," and institutionalism, which considers weak institutions to be the primary issue — have a lot in common. Both stress the vital role of institutions. Yet the practical policy implications of the two approaches are distinctly different. It is easy to see why. For the resource curse hypothesis, natural resources are the problem, and hence the solution is essentially to decrease economic reliance on resource sales. For the institutionalist approach, resources per se are not the issue or at least, one could argue, not the main issue. A number of countries illustrate how a large proportion of natural resource exports can exist alongside a developed institutional framework (I will look closer at such examples later). Institutions are thus viewed as the key factor determining the development trajectory of resource economies, and therefore policy recommendations are aimed mostly at improving the institutional framework.

The institutionalist approach has practical and analytical advantages. It looks at the root of the problem and provides a better foundation for long-lasting policies. As with any issue, however, it is not black and white. Limiting oneself to a single school of thought is not a very practical position. Although institutions are essential, that is not to say that natural resources per se do not matter. A balanced institutionalist position would acknowledge that although countries reliant on resource exports are not doomed to fail or stagnate, they may face certain difficulties in implementing pro-growth policies. Certain institutions in resource economies may play a greater role than in resource-poor economies; consequently, weak implementation of those institutions may have a stronger negative effect. This subject will be discussed in more detail later. It would therefore be more accurate to speak of a "resource challenge" rather than a "resource curse."

It is clear, however, that the institutional approach has been gaining ground in the field. The reason the institutional approach is starting to replace the resource curse hypothesis was well captured by Andrew Rosser.18

Scholars have been asking the wrong question: rather than asking why natural resource wealth has fostered various political pathologies and in turn promoted poor development performance, they should have been asking what political and social factors enable some resource abundant countries to utilize their natural resources to promote development and prevent other resource abundant countries from doing the same.

The outcomes of analyses of resource-abundant countries' performances vary significantly depending on the data used and the time periods examined. As a result, the conclusions of different authors range between a negative effect19 of resource abundance on growth and no significant effect20 or even a positive effect.21

Those findings raise another important question: What actually is resource abundance and which countries qualify as resource economies? That question has many possible answers. The two most common measurements of resource abundance are the ratio of natural resource exports to overall exports and the ratio of natural resource exports to GDP. This paper uses both criteria in the following way: a country is resource dependent if over 25 percent of its exports consist of natural resources and the ratio of natural resource exports to GDP exceeds 10 percent. A number of authors use the former criterion, which is consistent with the definition of resource-dependent countries used by the International Monetary Fund (IMF). The latter criterion is added to ensure that countries with very low volumes of overall exports do not fall into the abundance category. The Appendix provides a full list of countries that qualify as resource economies, on the basis of data from both the IMF and the United Nations Conference on Trade and Development (UNCTAD).

The Dutch Disease and Its Impact

At the end of the 1950s, several significant offshore natural gas discoveries were made in the Netherlands. Gas exports had a strong economic effect, causing an appreciation of the Dutch guilder and a contraction in the nonextractive industries. That effect gave rise to the term "Dutch disease," which was coined in 1977 by The Economist.22 The Dutch disease was the first instance where this economic phenomenon was thoroughly studied.23 To be more precise, the Dutch disease is not just a single consequence of increased mineral exports but a series of several effects.

The impact of the oil or gas boom on the broader economy can be divided into three main effects: the "resource movement effect," the "spending effect,"24 and the "exchange rate effect." Let's assume that a small open economy has three major sectors: a manufacturing sector, a nontradable (service) sector, and a resource sector, which emerges quickly as a result of, say, a major oil discovery, causing a boom in oil exports. The "resource movement effect" produces a shift of labor and capital to the resource sector from the rest of the economy as profits and wages in the resource sector begin to rise. The "spending effect" occurs when — as a result of windfall earnings in the resource sector — demand for both tradable and nontradable goods rises. However, the effects on the two sectors differ. In the nontradable sector, increased demand for services is met by an increase of supply and a consequent rise in both prices of nontradables and wages in the nontradable sector. But increased demand for tradable goods is met by increased imports, not by an increase in demand for domestic manufacturing goods.

Here the "exchange rate effect" comes in. It occurs as a result of an increased inflow of foreign currency (U.S. dollars in the case of oil exports), which causes the domestic currency to appreciate. The appreciation of the real exchange rate of domestic currency has a double effect on the manufacturing sector: (a) it suppresses demand for domestically manufactured goods, as imported goods become more affordable; and (b) it decreases exports of manufactured goods, as they also become less competitive in the international market as the relative value of domestic currency increases.

The Dutch disease is a well-studied and well-documented phenomenon. The fact that it exists and that there are certain mechanisms through which it affects a resource-exporting country's economy is accepted by almost all economists who study the issue. What is much less clear is whether it has any considerable negative effect on overall economic growth as such or on social development. If it has a negative effect in either area, then it is important to determine how that effect, or effects, can be mitigated through public policies.

It is worth clarifying any confusion between two distinctively different questions. One is, does the Dutch disease change labor and capital allocation in a resource economy and thus its very structure? Based on the evidence, the answer to that question is yes. However, a different question is, are those structural changes negative and, more specifically, do they have a negative effect on growth? Although it may appear to many people that the Dutch disease slows down economic growth and is therefore an unambiguously negative phenomenon, some commonsense analysis casts doubts over that conventional view.

In essence, the Dutch disease is an adjustment to a new economic situation that emerges as a result of increased commodity exports. Such economic adjustments happen in all open economies, not just in resource-exporting ones, as a reaction to higher returns on both labor and capital in specific industries. A contraction in the manufacturing tradable sector is simply evidence of relatively higher returns in other industries (extractive and nontradable). Such shifts in economic equilibriums occur constantly because of technological progress and global competition. A major business or technological innovation may shift the balance of labor and capital allocation if an economy gets a boost from developing a new export product.

An example is a high-tech product that matches a certain trend in global technological development and thus rapidly increases international demand for it (Finnish corporation Nokia's mobile phones in the 1990s and 2000s come to mind). Few would see that as a negative development. Yet when a boom happens in the natural resources sector, it is received with a mixture of anxiety and suspicion. It is true that some empirical evidence points to cases of economic and institutional failure in resource-dependent countries. And the Dutch disease may exacerbate the state of such an economy through the channels described above. But that is different from saying that the Dutch disease is to blame for such misfortunes in the first place.

An increase in income through the sale of natural resources, other things equal, accounts for a proportionate increase in GDP. Although it may be accompanied by a contraction in nonresource manufacturing, that does not mean that GDP growth will unavoidably suffer from this reallocation of sources of income. It is, in fact, much more likely to increase. Furthermore, undermining the argument about the Dutch disease as a source of stagnation in many resource economies, Dutch disease effects are very limited because there is either a very small or practically nonexistent manufacturing sector to start with, such that, by definition, no reallocation can occur. Nonetheless, countries with only resource and nontradable sectors have experienced slowdowns and even negative growth (for example, several Middle Eastern countries in the 1980s). To understand the nature of stagnation in some resource economies, one must seek a different explanation, which is explored later.

A number of economists subsequently reached the conclusion that the effects of the Dutch disease were not the primary drivers of resource economies' growth trajectories. For instance, Raymond Mikesell25 analyzed the performance of a group of resource-exporting economies and concluded that for the majority of them the Dutch disease had no effect on their growth patterns. Gary McMahon comes to similar findings in his study.26 Ragnar Torvik argues that output and productivity can either increase or decrease in both tradable and nontradable sectors, depending on the structural and institutional characteristics of the economy.27 The latter view appears more accurate. An open-market economy with low entry barriers and minimal obstacles to businesses will adjust to both the "resource movement effect" and the "spending effect" of increased commodity exports, just as it adjusts to any other changes in its export structure.

Thus, the Dutch disease can be looked at in different ways. In a narrow sense, it is about the reallocation of resources among various sectors. To view it is a "disease" — a problem in and of itself — means to apply a certain value judgment and a preference toward a certain way of generating income, that is, the nonresource tradable sector, usually concentrated in manufacturing. It then essentially becomes much more of a political than an economic issue. And that is indeed what has happened in many resource economies. In an attempt to "save" the contracting nonresource manufacturing sector, governments created subsidized dependent industries, which dragged their respective economies into an economic slowdown. Thus, what is initially marketed as a remedy for the Dutch disease often becomes a source of economic problems itself.

The question, then, is whether any corrective action is required for the Dutch disease and specifically for the exchange rate effect. That question has no straightforward answer. It depends on the degree of resource dependence, the size of the economy, and its share in the production of a particular commodity on the world market. Furthermore, the exchange rate effect is not entirely negative either. It may make some exported goods less competitive, but it does have the effect of making all imported goods more affordable. The net effect depends on a variety of factors that are specific to each individual economy.

To prevent abrupt hikes of the nominal and real exchange rate of the domestic currency, it would be advisable for a government to have a mechanism in place to sterilize excess inflows of foreign currency, such as a stabilization fund or another similar venture. That practice has been widely adopted throughout the world and has generally allowed governments to keep a lid on the exchange rate of their respective currencies, as well as to save money for a rainy day when commodity prices go down. Since the sharp drop of oil prices in 2014, the relevance of commodity price volatility and the importance of having enough government savings to weather the storm of low prices have risen tremendously. Consequently, worries about the Dutch disease and adverse effects of windfall profits have diminished significantly as profits themselves have fallen sharply.

The Economic Influence of Commodity Price Volatility

Given the above-mentioned doubts about the negative influence of the Dutch disease, several economists sought an alternative economic channel that could have a negative effect on some resource-dependent countries. That led to the emergence of what can be described as the "volatility curse" hypothesis. The main idea is that the problem is not resource dependence per se, but rather the volatility of mineral commodity prices in the global market. Observation of the harmful effects of commodity price volatility was one of the outcomes of broader research into resource economics in the 1990s. Raymond Mikesell found that economies with a high proportion of natural resource exports over the two decades between 1972 and 1992 experienced an overall trade volatility three times greater than nonresource economies.28 Both Mikesell and Auty suggested that revenue volatility may be one of the major causes of economic slowdowns in resource economies.29 Other studies published later focused specifically on the price volatility effect.30

For example, regression analyses conducted by Tiago Cavalcanti, Kamiar Mohaddes, and Mehdi Raissi showed that, for 62 primary commodity-exporting countries, price booms themselves had a positive impact on GDP growth.31 However, volatility of prices and consequent volatility of export earnings affected it negatively. For the remaining resource-poor countries, volatility of commodity prices had no effect on their total factor productivity, investment patterns, or GDP growth. Given that resource-poor countries are still consuming natural resources and thus are also affected by price volatility as consumers and importers of oil, gas, and other minerals, Cavalcanti, Mohaddes, and Raissi's findings suggest that price volatility can harm growth only at a sufficiently high level of economic dependency on income from a certain export product. Thus, the more sophisticated argument is that only a sufficiently high degree of price volatility, often seen in natural resources, is distractive.

The price volatility hypothesis seems to make somewhat more sense than the Dutch disease hypothesis. The Dutch disease hypothesis essentially argues that through several channels, high income from the sale of natural resources harms rather than accelerates growth. But common sense would lead us to the opposite conclusion: extra income generates extra growth. And many, though not all, economic regressions demonstrate exactly that. The price volatility hypothesis makes a different argument: reliance on mineral commodity exports harms growth through the external volatility of prices. Such fluctuations do not allow the economy and its main players, both private and public, to adjust; thus, such fluctuations impede innovation, investment, and development. Volatility harms fiscal policies, public spending in particular, as the government is left with less money to spend at times of low prices.

Although it raises legitimate questions, the volatility curse hypothesis suffers from several problems. First, exactly as with the Dutch disease, it is difficult to see how natural resources generally differ from other commodities traded in an open international market. Some degree of volatility is inherent in the very nature of all commodity prices or indeed any prices in a free market. Second, many goods, such as certain consumer goods, medicines, and high tech devices, are subject to intense price volatility. Nonetheless, one never hears about a "gadget price volatility curse."

There is another reason to be skeptical about the volatility curse hypothesis. If one is to believe that commodity price volatility is the source of trouble for economic growth in general, then that implies that the firms that are most exposed to that harmful volatility — that is, companies in extractive industries, refining, petrochemicals, and so forth — would be affected to an even greater extent. Oil companies, for example, suffer from a 100 percent exposure to oil price volatility, whereas governments of oil-producing countries are exposed to it only to the degree to which their budgets are dependent on oil incomes (that can be higher or lower, but only in a handful of countries does it come close to 100 percent). However, if we look at long periods of time, oil companies demonstrate roughly the same returns on investment as firms in other sectors. Evidently, extractive industries have developed mechanisms to mitigate commodity price volatility and avoid a volatility curse.

Governments of resource economies could benefit from studying such mechanisms and applying them to government finances. Some of the methods used by private companies include hedging through various financial instruments, insurance, scenario analysis, corporate planning, and cost reductions. Using such instruments in a competent and strategic manner could be generally described as efficient management. This efficient management is precisely what allows some businesses to thrive under price volatility. And the lack of it is what makes other businesses go under.

Price fluctuations are just one of the many risks that any business has to take into account and manage. All of that seems to be self-evident when applied to businesses, but somehow it disappears entirely when economists look at countries and, particularly, their governments. Then volatility suddenly changes from a risk to a "curse." In that sense, the price volatility hypothesis does not fundamentally differ from the Dutch disease or any other similar approach that essentially falls into the resource curse paradigm.

One example of successful hedging policies in an oil-exporting economy is Mexico. Agustin Carstens, a Chicago University–trained economist and the current governor of the Central Bank of Mexico, has been pursuing a persistent and sophisticated hedging strategy in Mexico. Since the beginning of the decade, Mexico has been selling 25 percent of its annual crude output forward (about 200 million barrels). During the latest oil price plunge, the Mexican government benefited from the hedge quite substantially: although the price at which it hedged its sales in 2015 was $76.40 per barrel, the actual average price that year fell about a third below that number.32

The basic argument — explored in the following section — is that instead of fighting various "curses" and "diseases," governments would do much to look inward and analyze their own performance, along with the shape and role of the institutions that they create, maintain, and occasionally destroy. In that sense, both the Dutch disease and the effect of commodity price volatility are essentially institutional rather than purely economic problems. Both become obstacles under specific circumstances, which are usually associated with the lack of certain institutions. It would also be helpful to supplement public administration tools with those already successfully employed by companies (for example, those for managing price volatility). Various governments have done exactly that by creating stabilization funds and other similar measures.

Mikesell captured the role of price volatility and the effects of the Dutch disease in resource-reliant economies in the following way:

A legitimate question is whether the shocks caused by primary commodity export booms are more serious than the shocks experienced by resource poor countries. Perhaps they are, but they can be handled by adopting appropriate policies.33

On a more fundamental level, although adopting private-sector practices may alleviate some of the difficulties that publicly owned corporations face, it won't solve multiple problems inherent in state-dominated industries. The more efficient solution (which is often also more politically cumbersome) is to introduce more actual private management into resource industries through the process of privatization. For instance, a study by Erika Weinthal and Pauline Jones Luong argues that more private ownership in the industry would increase overall efficiency and also boost government income. Thus, in their view, to avoid the resource nationalism problem, domestic private ownership by national private companies is a more feasible solution.34

Producers vs. "Grabbers": Rent-Seeking under Different Institutional Frameworks

Rent-seeking is a prominent feature of many petrostates. It is certainly not unique to petrostates, but it does appear to have a particularly strong effect on them and to cause institutional weaknesses. Rent-seeking is not just corruption through bribery. Although bribery is very often part of rent-seeking, it is helpful to distinguish between illegal and legal rent-seeking activities. Corruption and bribery are in the first category, whereas the second includes a broad range of activities, such as creating regulatory barriers to entry, ring-fencing mineral licenses for a certain group, or channeling state subsidies.

Several authors have explored the phenomenon of rent-seeking.35 In 2006, Halvor Mehlum, Karl Moene, and Ragnar Torvik suggested an analytical model for examining which economic forces are at play in resource economies.36 They also went one step further and looked at why some countries are negatively affected by rent-seeking and some are not. Mehlum, Moene, and Torvik's model suggests how rent-seeking can influence economic growth under different institutional conditions.

They begin by establishing the distinction between production and special forms of rent-seeking. They argue that all forms of rent-seeking can be harmful to economic development but not to the same degree. The productive economy and rent-seeking can be either complementary or competing, and it is the latter that is more harmful to growth and development. Rent-seeking competes with production when institutional quality is poor. The authors provide some illustrations:

Dysfunctional democracies invite political rent appropriation; low transparency invites bureaucratic corruption; weak protection of property rights invites shady dealings, unfair takeovers and expropriation; weak protection of citizens’ rights invites fraud and venal practices; weak rule of law invites crime, extortions and mafia activities; a weak state invites warlordism.37

Mehlum, Moene, and Torvik call the most harmful type of rent-seeking "grabbing" and call institutions that increase returns on such rent-seeking "grabber-friendly." The better the quality of institutions, the less profitable it is to be engaged in grabbing, and the more profitable it is to be engaged in production.

They then go on to establish two possible frameworks: a resource economy with grabber-friendly institutions and one with producer-friendly institutions. Let us imagine that in both of those economies, a major new oil discovery is made, which swiftly increases income from oil exports. In an economy with grabber-friendly institutions, resource income provides a new source of income for grabbers, bringing their profits up, while producers' profits remain unchanged. The result is fewer producers, more grabbers, and lower income for all. That is exactly the situation that is described as "the paradox of plenty," when higher resource income reduces total income.

Under grabber-friendly institutions, the sequence of developments is as follows: high resource rents pull entrepreneurs into grabbing. That causes profits in production to go down, which in turn pushes even more entrepreneurs into grabbing. Grabbers generate negative externalities, and producers generate positive externalities. This explains why the negative income effect from this reallocation of entrepreneurs dominates the direct positive income effect of more resources.

In an economy with producer-friendly institutions, increased receipts from the sale of natural resources provide an additional source of income for producers and consequently shift production profits upward. The result is more producers and fewer grabbers. Furthermore, in a producer-friendly system, increased income from natural resources stimulates overall production. Its boost to overall incomes is higher than the incremental increase from the sale of minerals alone. That happens because positive complementarities exist between various producers. Thus, Mehlum, Moene, and Torvik's model has a multiplier effect in resource economies, such that both positive and negative tendencies get amplified. In essence: "With producer-friendly institutions natural resources stimulate production. With grabber-friendly institutions natural resources hamper production."38

Mehlum, Moene, and Torvik suggest a visual representation of patterns of growth in different economies (see Figure 4). They compare four hypothetical countries: resource-poor countries A and A*, where country A has grabber-friendly institutions, and country A* has producer-friendly institutions; and resource economies B and B*, where country B has grabber-friendly institutions and country B* has producer-friendly institutions. The four countries initially have the same income level Y0. The country with producer-friendly institutions, A*, grows faster than the country with grabber-friendly institutions, A. Similarly, country B* has a higher growth rate than country B. One of the main features of this model is that resource economies with producer-friendly institutions outperform resource-poor countries with producer-friendly institutions (B* and A*, respectively), whereas among grabber-friendly countries, it is the other way round: resource economies (B) end up lagging behind all other groups. Hence, Mehlum, Moene, and Torvik's main conclusion is that the quality of institutions determines whether natural resource abundance is a blessing or a curse.

Figure 4. Growth Paths of Resource-Rich and Resource-Poor Economies According to the Mehlum, Moene and, Torvik Model

Source: Halvor Mehlum, Karl Moene, and Ragnar Torvik," Cursed by Resources or Institutions?" World Economy 29 (2006): 1117–31,

http://onlinelibrary.wiley.com/doi/10.1111/j.1467-9701.2006.00808.x/abstract.

Empirical Data Analysis

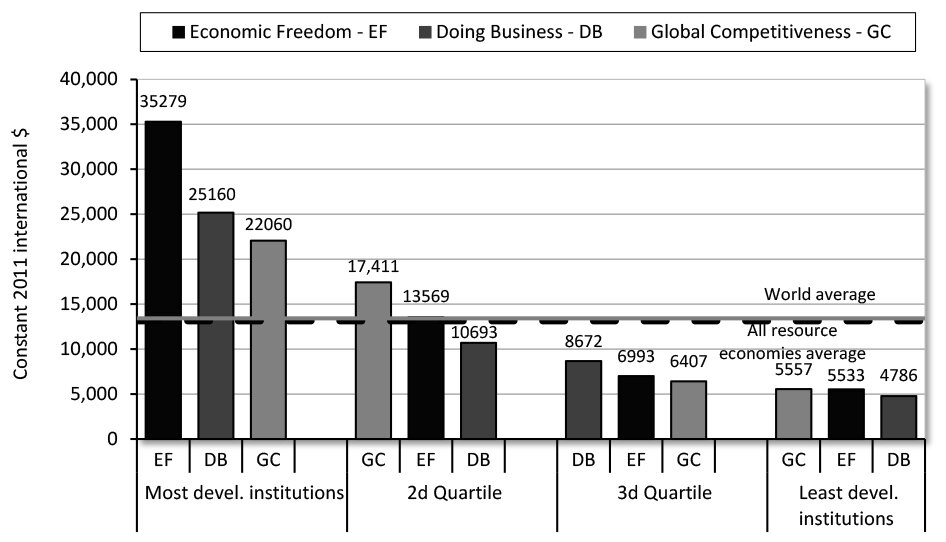

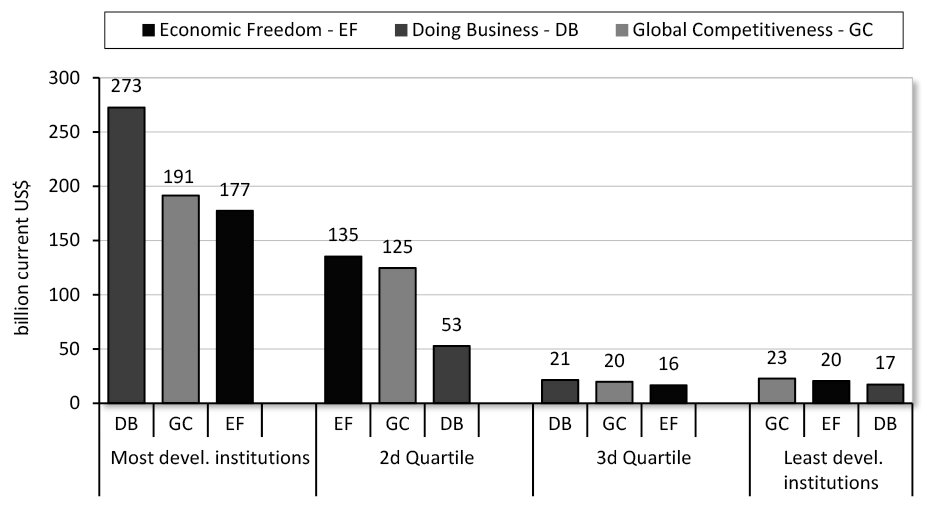

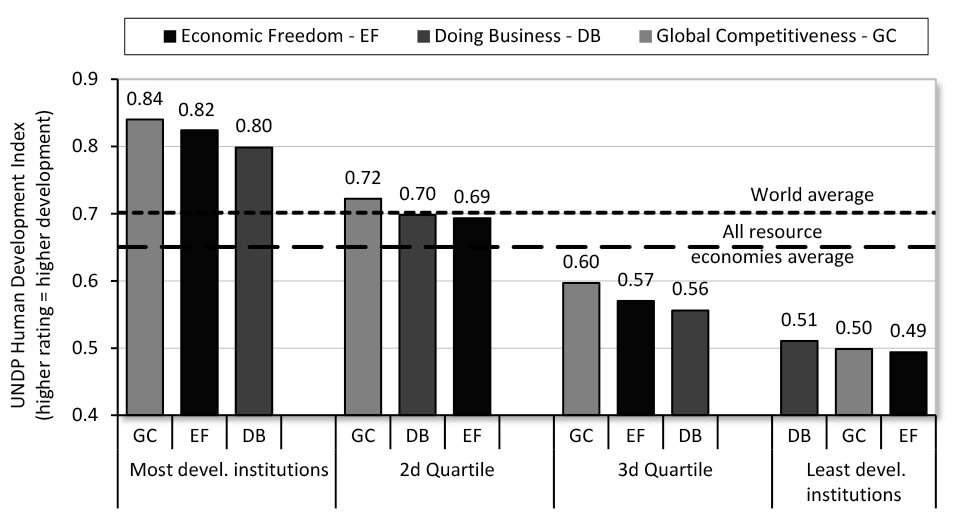

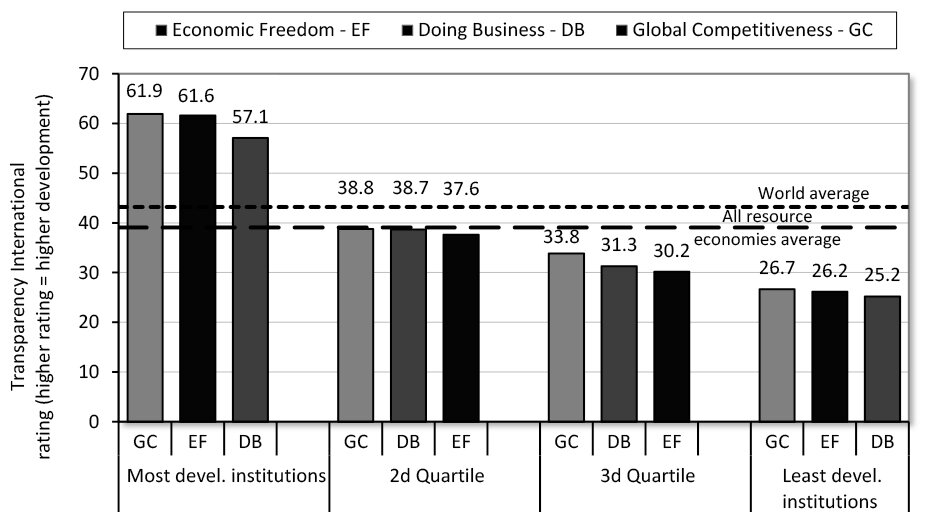

To examine the performance of different resource economies depending on the strength of their institutions, I analyzed empirical data that illustrate their economic and social development. I then took the three most frequently quoted indexes, deliberately using three different reports, to assess the effect of institutional quality as measured by different research teams. I grouped the economies according to their score on the global indexes. The following three indexes were used:

- The Fraser Institute's Economic Freedom of the World report

- The World Bank's Doing Business report

- The Global Competitiveness Report of the World Economic Forum

The list of resource economies includes 68 countries. The Appendix provides a full list of the countries that qualify, based on IMF and UNCTAD data, as well as groups of countries according to their scores on the three indexes used. This list does not include some of the world's major oil and gas producers, such as the United States, Mexico, and Brazil. The reason is that although those countries produce a significant amount of hydrocarbons (as well as other mineral commodities), their share as a percentage of GDP and overall exports is lower than the criteria for resource economies (10 percent of GDP and 25 percent of exports).

The resource economies are divided into four quartiles in accordance with their performance on the three indexes. The performance of those quartiles is then compared using five parameters as measures of economic and social development:

- Real GDP per capita (PPP)

- Foreign direct investment

- Human Development Index (HDI)

- Freedom from corruption

- Violations of civil liberties

A trend is visible in all groups and for all parameters. That trend confirms a previous hypothesis: a better institutional environment in resource countries correlates with higher income per capita, higher living standards, and more social development. Comparing groups with the most developed institutions (the first quartile) with the world average also demonstrates that development levels in resource countries with strong institutions are greater than that of the world average. The strong performance of that first quartile is particularly important, as it refutes the popular resource curse hypothesis. The findings of this empirical research are demonstrated in Figures 5 through 9.

The Role of Government

This section looks at policy choices facing resource-based economies. It examines such policy areas as the institutional climate, the government's share in oil companies, stabilization funds, and government investments. In this section I argue that economic and social performance of resource economies depends primarily on the strength of their institutional framework, of which economic freedom is a key component.

The Influence of Economic Freedom on Development in Resource Economies

How should economic freedom be defined? The Economic Freedom of the World (EFW) report provided a definition:

Individuals have economic freedom when property they acquire without the use of force, fraud, or theft is protected from physical invasions by others and they are free to use, exchange, or give their property as long as their actions do not violate the identical rights of others. An index of economic freedom should measure the extent to which rightly acquired property is protected and individuals are engaged in voluntary transactions.39

The EFW measures 42 government policies that affect economic freedom.40 The Fraser Institute measures those policies using quantifiable characteristics and independent surveys. The data are organized into five main categories, which, broadly speaking, define the institutional framework that constitutes economic freedom:

- Rule of law and property rights

- Size of government and taxation

- Soundness of money

- Trade regulation and tariffs

- Regulation of business, labor, and capital markets

Economic freedom is important because it is a major prerequisite for economic growth and development. Economic growth is strongly associated with economic freedom.41 It is also strongly related to certain other parameters of human development. Higher economic freedom is positively correlated with such indicators as life expectancy, literacy, and civil and political rights. It is negatively correlated with poverty and corruption.42 And since economic rights and, more narrowly, property rights are an inalienable part of fundamental human rights, political and civil liberties are incomplete in the absence of economic freedom.

Where do resource economies stand in relation to economic freedom? If one first looks at the bottom 10 global economies' economic freedom scores, they may appear to prove the resource curse hypothesis. Eight out of 10 qualify as resource economies: Mozambique, Algeria, the Democratic Republic of Congo, Angola, the Republic of Congo, Zimbabwe, Myanmar, and — closing the global list as least economically free — Venezuela.

However, this gloomy picture for resource economies is somewhat improved when one then switches to the top 10 most free economies. Half of them are resource economies to varying degrees: Australia, Canada, Bahrain, Finland, and Chile. What seems to be the case here is not the "resource curse" but rather "resource polarization," consistent with Mehlum, Moene, and Torvik's producers vs. grabbers model, in which resource economies with institutional deficiencies perform worse than resource-poor countries with the same level of institutional development. At the same time, mineral resources can boost those economies with more developed institutions.

A number of economists have analyzed the role of institutions, which determines the overall level of economic freedom and influences growth in resource economies.43 Overwhelmingly, those authors concluded that institutional development is both positively and strongly correlated with economic success in resource economies. The mechanisms through which economic freedom fosters growth and development are largely related to its effect on rent-seeking. Secure property rights, fair and efficient enforcement of contracts, freedom of trade, and limits on the government's ability to transfer wealth through subsidies and regulation in effect reduce the rate of return on unproductive economic activities.

On the other hand, the stronger those institutions are, the more profitable it is to generate wealth through productive entrepreneurship instead of grabbing. One other channel through which economic freedom can stimulate growth and development is the reduction of conflict. Erik Gartzke found that economic institutions are by far more effective than noneconomic institutions in diminishing violence.44

A study by Louis-Philippe Béland and Raaj Tiagi45 looks at how economic freedom, as measured by the EFW index, correlates with economic growth in countries with a high share of income from exports of metals and ores (in mining but not oil and gas economies). The study examined real GDP per capita from 1970 to 2006.

Béland and Tiagi indicate that, in countries with low scores for economic freedom, natural resources hamper growth, whereas countries with high levels of economic freedom perform significantly better.46 They even outperform their resource-poor peers with the same score in economic freedom. Those results also show that a mineral-exporting country can catch up in its economic development if it improves its level of economic freedom. Even with relatively small improvements in economic freedom, the effect on growth and development is positive and quite significant. All of that is consistent with Mehlum, Moene, and Torvik's model, which suggests a multiplier effect in resource economies, so that both positive and negative tendencies are amplified, as producer-friendly institutions stimulate production, whereas grabber-friendly institutions hamper production.47

Figure 5. Real GDP per Capita (PPP) in Resource Economies, 2014 Countries Grouped According to Their Rankings in Three Reports Measuring Institutional Strength Fraser Institute, World Bank, and World Economic Forum)

Source: World Bank Open Data, author's calculations,

http://data.worldbank.org/topic/economy-and-growth.

Figure 6. Foreign Direct Investment in Resource Economies, 2013 Countries Grouped According to Their Rankings in Three Reports Measuring Institutional Strength (Fraser Institute, World Bank, and World Economic Forum)

Source: World Bank Open Data, author's calculations,

http://data.worldbank.org/topic/financial-sector.

Andrei Illarionov of the Cato Institute and the Institute for Economic Analysis undertook a number of studies examining the role of institutions and economic freedom in various groups of countries, including oil producers. He used both the Economic Freedom of the World index and other measures of institutional development. Illarionov divided various groups of economies into subgroups according to their rating of economic freedom. In particular, he looked at the performance of oil-producing countries in the Arab world and concluded that the main reason for slow growth in many of those countries is insufficient progress in economic freedom.48 Illarionov analyzed the performance of other petrostates, specifically Russia, and came to similar conclusions.

Figure 7. Human Development Index (HDI) in Resource Economies, 2013 Countries Grouped According to Their Rankings in Three Reports Measuring Institutional Strength (Fraser Institute, World Bank, and World Economic Forum)

Source: United Nations Development Program, author's calculations, http://hdr.undp.org/en/data.

As shown in Figures 5–9, there is a strong positive correlation between economic freedom in resource economies and the level of real GDP per capita (PPP) and other economic and social indicators. Similar to the other two institutional ratings, in all groups and for all parameters, in countries with higher levels of economic freedom, both real per capita income and human development scores are higher, and there is more investment and more civil rights. Greater economic freedom also correlates with lower crime and corruption. The most important conclusion is that the economic and social performance of resource economies depends primarily on the strength of their institutional framework, of which economic freedom is a key measurement.

Figure 8. Freedom from Corruption in Resource Economies, 2014 Countries Grouped According to Their Rankings in Three Reports Measuring Institutional Strength (Fraser Institute, World Bank, and World Economic Forum)

Source: Transparency International, author's calculations, http://www.transparency.org/cpi2014/results.

Figure 9. Violations of Civil Liberties in Resource Economies, 2014 Countries Grouped According to Their Rankings in Three Reports Measuring Institutional Strength (Fraser Institute, World Bank, and World Economic Forum)

Source: Freedom House, author's calculations, https://freedomhouse.org/report/freedom-world-aggregate-and-subcategory….

Resource Economies, Excessive State Interference, and Associated Inefficiencies

Government interference in resource economies is often more significant than in nonresource economies. The most important reasons, in my view, are the following four:

- Immobility. A specific feature of extractive industries is their intrinsic dependence on mineral resources that are immovable while they remain underground. As a result, effective government control is much higher than in other sectors. Globalization has allowed companies to choose jurisdictions in both the manufacturing and service industries, establishing their offices, production lines, and call centers where conditions are best. In contrast, a company cannot relocate a mine or an oil well. Businesses have a limited choice of location before the start of operations. Once investments are made and drilling or digging has started, such choice no longer exists. That factor gives bureaucrats much more control. An additional characteristic of natural resources that allows higher levels of control is the fact that they can be easily accumulated in one place, concentrated through refining, and stored for long periods.

- Resource nationalism. In practically all countries (with the exception of the United States and very limited cases in Canada), underground natural resources are the property of the state. That factor creates a strong bias toward government down the entire chain of mineral extraction, refining, and distribution. This paradigm is often referred to as "resource nationalism," and the resources are often referred to as the "property of the people," but that does not change their actual status, which is government ownership. Consequently, the government tightly controls any business activity related to minerals, which generates vast opportunities for extorting rents.

- Redistribution. Extractive industries employ a small percentage of the population but often generate the lion's share of the gross national income. Thus, redistribution in its many forms (transfers, subsidies to the nonresource sector, large scale state-run infrastructure projects, privileges, etc.) constitutes a very significant function of a rentier state. One key rent-seeking activity is capturing such transfers to satisfy private interests. High levels of redistribution tend to increase both the intrusiveness of the state and the size of government spending as a share of GDP. That practice is often supplemented by economies of scale for rent-seeking that emerge in large petrostates operating massive budgets. In such countries, even a minor position in the rent-seeking hierarchy can generate significant returns.

- Insulation of the elite. For reasons mentioned above, rents from natural resources are easily extractable and thus can greatly enhance the wealth of the ruling elite. A portion of those profits are also redistributed among the rest of the population. Consequently, dissatisfaction among the population with the status quo of a rent-seeking elite may be stifled for a time by creating dependency on various government transfers. That situation develops into a vicious cycle of rent-seeking, which pervades the society from top to bottom and does so in a very unequal measure. Rents from natural resources can be used either as carrot — through transfer — to buy loyalty or as sticks, if discontent persists and develops into political protest. Thus, many petrostates spend a significant part of their budgets on police, the military, and intelligence.

Although government interference in resource economies is often more significant than in nonresource economies, certain features of state intervention have universal characteristics across all countries. All in all, various types of government involvement in the economy fall into three broad categories: regulation, redistribution, and ownership.

Some areas of regulation are essential for a well-functioning institutional system (as discussed earlier), such as independent courts or law enforcement agencies. However, the further a specific area of regulation is removed from the core functions of government, the more likely it is to have negative effects on economic growth. Regulation possesses a "multiplier effect," which can be either positive or negative: efficient regulation, which reinforces the rule of law, can boost economic development, whereas even small regulatory agencies can slow down growth through red tape, bottlenecks, and market distortions. In resource economies, the multiplier effect for both positive and negative aspects of regulation tends to be especially pronounced.

The second category of government activity is redistribution. The process of taxing individuals and business and spending the receipts through various government programs has several costs associated with it. Among such costs, as outlined by Daniel J. Mitchell, are the following three.49

- Displacement cost. The government cannot spend money without first taking that money from someone; thus, government spending displaces private-sector activity.

- Behavioral subsidy cost. Government spending subsidizes choices that would otherwise not be desirable, such as high unemployment benefits encouraging some people to stay out of work.

- Stagnation cost. Subsidies often hamper innovation by constraining Schumpeterian "creative destruction," as government programs are inflexible because of their centralization and bureaucracy.

In resource economies, redistribution often takes the form of government direct investments, which are typically large-scale infrastructure developments and are commonly "white elephant" projects with low rates of return. Government investment initiatives often boost politicians' popularity and not coincidentally provide excellent opportunities for extracting rents and committing outright misappropriation.

Since direct government investment is often hard to defend because of its poor reputation, some governments in resource economies embrace a somewhat more sophisticated policy, which is often referred to as "diversification." That policy entails supporting companies in certain sectors through subsidies and loans. It is defended on the grounds that a more diversified economy is less vulnerable to commodity price volatility and is thus more sustainable. The general premise is reasonable and may even seem to derive from the same concerns articulated above. Other things being equal, diversified economies usually have a more balanced growth trajectory and often enjoy higher growth rates. But the devil is in the details. Diversification is a means to an end, namely, to higher growth through increased economic efficiency. The problem with government-subsidized diversification is that it reverses this logic by making diversification a goal of government policies in itself.

Diversification makes sense only when it actually increases overall efficiency, which is hardly possible if the government is picking winners. When a given economy is not diversified, it is usually the result of economic inefficiency and bureaucratic red tape in certain sectors, which prevents businesses from making a profit. By pouring money into those sectors, the efficiency problem is not resolved but rather aggravated, because greater capital is allocated to inefficient businesses without alleviating their inefficiency. As Maria Sarraf and Moortaza Jiwanji point out, "Governments tend to invest in projects with low rates of return compared to the private sector."50 And government-driven diversification suffers from the same rent-seeking and corruption problem as direct investments and infrastructure programs.

Apart from redistribution by the state, another category of government involvement is direct ownership of companies: when the government owns certain enterprises, either creating a monopoly or competing with private companies. Lower efficiency of government-owned enterprises can affect the overall economy in several ways, including by underperforming relative to the private sector, by crowding out private investment, and by monopolizing a certain industry. In many countrie — for instance, many members of OPEC — the natural resources sector is the most state-dominated among all industries. It is worth looking at how different structures of ownership in the extractive industries (private, state, or mixed) and various policies related to redistribution (such as stabilization funds) can affect overall economic growth and development in resource economies.

The Influence of the Government's Share of Ownership in Extractive Industries on Overall Economic Performance

OPEC was founded in 1960. It developed into a club of countries with mostly government-dominated oil sectors. Since then, the world oil and gas industry has gone through a profound evolution of ownership. In the many developing countries that account for most of global hydrocarbon production, governments took control of their oil and gas sectors by expropriations, nationalization, or renegotiations with international companies. Such takeovers resulted in an industry in which not only the reserves in the ground were owned by governments, but also most of the oil and gas was produced by government-controlled corporations. The latter are usually referred to as national oil companies, whereas major privately owned transnational corporations are called international oil companies.

National oil companies dominate the industry for various reasons, including particularly the appeal to resource nationalism. For the purposes of this paper, however, what interests us is the relative economic performance of oil companies that adopted different models of ownership and sector organization. It is helpful to separate the issue of overall management efficiency from political sentiments. As Thorvaldur Gylfason from the University of Iceland argued:

What seems to matter for economic growth is not the abundance of natural resources per se, but rather the quality of their management, and of economic management and institutions in general.51

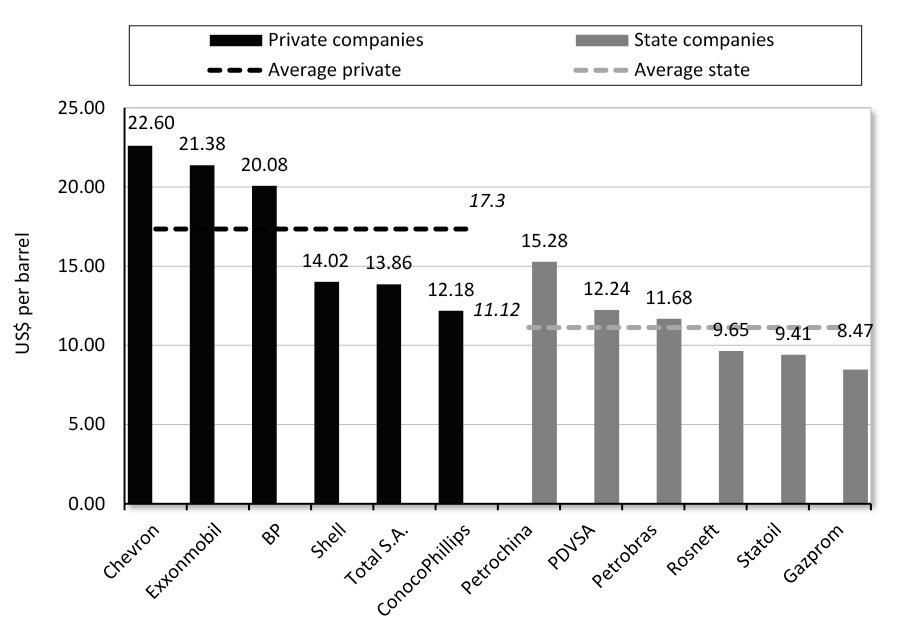

Figure 10. Net Income per Barrel of Leading Oil Companies in 2013

Source: Companies' annual reports, U.S. Energy Information Administration, author's calculations.

One way to evaluate the efficiency of various ownership models is to compare the world's largest oil companies by one key parameter that characterizes their performance: net income per barrel of oil equivalent produced (which includes combined production of both oil and gas). The average net income per barrel of the six leading privately owned oil companies in 2013 was 56 percent higher than that of the six leading state-owned oil companies ($17.35 and $11.12 per barrel, respectively, as shown in Figure 10). That number includes leading oil companies with production above 2 million barrels a day for which detailed financial reporting is available. It is worth noting that for many government-owned oil companies such reports are unavailable, specifically companies in Gulf countries.

Moreover, most private international oil majors demonstrate more resilience during the collapse of oil prices (see Figure 11). Consider companies' performance in 2014, the year when Brent lost half its value — from a peak $115 per barrel to $58 per barrel by the end of the year. In 2014, the performance gap broadened even further: the net income per barrel of leading privately owned oil companies was as much as 87 percent higher than that of leading state-owned oil companies ($15.28 and $8.19 per barrel, respectively). Remarkably, three out of six of the private corporations had even higher incomes per barrel in 2014, the year of the oil price crash, than they did in 2013. These results demonstrate not simply the higher efficiency of privately owned companies but also their stronger resilience to oil price fluctuations, which is an important attribute in this industry, given significant commodity price volatility.

Figure 11. Net Income per Barrel of Leading Oil Companies in 2014

Source: Companies annual reports, U.S. Energy Information Administration, author's calculations.

Oil companies differ in various ways, including in their property structures and organizational models. Their portfolios have varying ratios between production and refining, their fields have distinct geological characteristics, and they operate under different regulatory regimes. The above-mentioned results are largely achieved in otherwise unequal circumstances as well. Most of the state-owned companies operate in their home territory, where they enjoy favorable conditions and access to more reserves with higher quality, which is not the case with most privately owned companies. The latter nonetheless manage to outperform government producers while normally facing tougher environments, which often include abrupt changes of contract terms, higher taxes, and occasional license revocations and expropriations.

Despite such telling evidence, the balance of ownership has even of late continued to shift in the direction of state oil companies. Although the peak of nationalizations of the 1960s and 1970s is long gone, the idea of resource nationalism is still going strong. The irony is that, from the available evidence, not only the income per barrel is significantly higher among private companies, but also the earnings that governments receive in taxes from the operations of private firms are often higher on a per-barrel basis than the earnings from the operations of government-owned enterprises. As demonstrated by the cases of Iran, Venezuela, and Mexico, a prolonged state monopoly of the oil industry results in its stagnation and an overall fall of government income. Mexico's Pemex is a very powerful example. Mexico's petroleum sector was nationalized in the 1930s, which makes Pemex one of the longest-surviving state oil monopolies. Overall results are telling: even under the high oil price of 2012, the company was on the verge of receiving a negative return on a barrel of oil produced (its net profit was only 10 U.S. cents per barrel). Before 2012 it had actually been operating at a loss.

At the same time, the shale revolution in the United States demonstrates the efficiency of private ownership in the energy sector. The examples of Australia and Canada also show how, on the back of a surge in hydrocarbon production, they enjoyed rapid economic growth even in the aftermath of the financial crisis of 2007–08, whereas many other member countries of the Organisation for Economic Co-operation and Development (OECD) have struggled with a recession.

It is worth noting that although evidence argues strongly in favor of private resource production, privately owned companies are not a universal remedy. Without strong and transparent institutions, private companies are quickly corrupted through rent-seeking, as returns on grabbing outweigh returns on productive enterprise. The result is a structure that may look privately owned on the surface but is actually a system of state-affiliated interest groups and clans. That is the case in a number of petrostates with poor ratings on the corruption index.52

The importance of institutional quality is once again highlighted when we compare oil and gas production in resource economies grouped by their ratings in the World Bank's Doing Business report. Production volumes are only partially determined by reserves in a particular country; institutions play a crucial role. That factor is evident particularly when we recall that Iran and Venezuela are among the top three countries with hydrocarbon reserves. Both lag far behind several other countries in production because of low investment and industry mismanagement.

The superior results of private firms are not limited to oil economies; they are also evident from the experiences of countries with substantial mining industries.53 As a consequence of opening its mining sector to private investment, Indonesia was able to boost its production of gold, tin, nickel, and copper by about 50 percent in less than 10 years. The Indonesian government increased its revenues from the mining sector almost fivefold, from $700 million in 2000 to $3.4 billion in 2006, while (not coincidentally) actually reducing its overall tax and royalty rates on mining companies, from 60 percent to 45 percent.54 Armenia managed to become one of the main global producers of molybdenum after the government sold the country's largest processing complex to a private consortium of Armenian and German companies, which led to higher output. Today, 12 private companies operate functioning mines in Armenia, which account for 17 percent of industrial production and make a significant contribution to economic development.55

Finally, there is the difficult question of how to analyze the unique models that exist in the six Gulf Cooperation Council (GCC) countrie — Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates. Their main characteristic is a combination of unmatched hydrocarbon reserves and production, and small (sometimes very small, as in Qatar or Bahrain) populations. The exception is Saudi Arabia, which has a population of 28.8 million. The overall reliance on expatriate labor is unparalleled: immigrants represent between 30 percent (in Oman and Saudi Arabia) and over 80 percent (in Qatar and the United Arab Emirates) of the population.56

Oil and gas production in GCC countries is predominantly state controlled, but it relies heavily on international service companies and highly skilled expat specialists working for Gulf national companies. GCC oil companies are arguably the most cosmopolitan in the world — even more so than international oil corporations. Although the hydrocarbon sector is state controlled, in many of the Gulf countries overall economic policies outside of the oil industry are very open and favorable to foreign investors. Gulf states generally rate highly on the Economic Freedom of the World index. At the same time, high levels of economic freedom coexist with very low ratings on civil liberties. Governments of all Gulf Arab countries are organized as traditional monarchies.

Given the proportion of foreign nationals, most of whom do not integrate into the social and cultural fabric of the host nation, it is possible to argue that GCC countries have, in fact, not one but two parallel societies that coexist and codepend on each other. Whatever one might think of the unusual economic and social arrangement that exists in the Gulf Arab states, one thing is certain: that particular system is largely an anomaly and is unlikely to be replicated elsewhere for a variety of economic, political, and cultural reasons. It would therefore be fair to look at Gulf Arab countries as outliers that need to be analyzed separately from most other resource economies.

Stabilization Funds and Alternative Solutions

The idea of stabilization funds has certainly gained popularity over the past several decades, as some countries have successfully developed such national entities. Comparing economies with and without them, the overall results moderately favor stabilization funds.

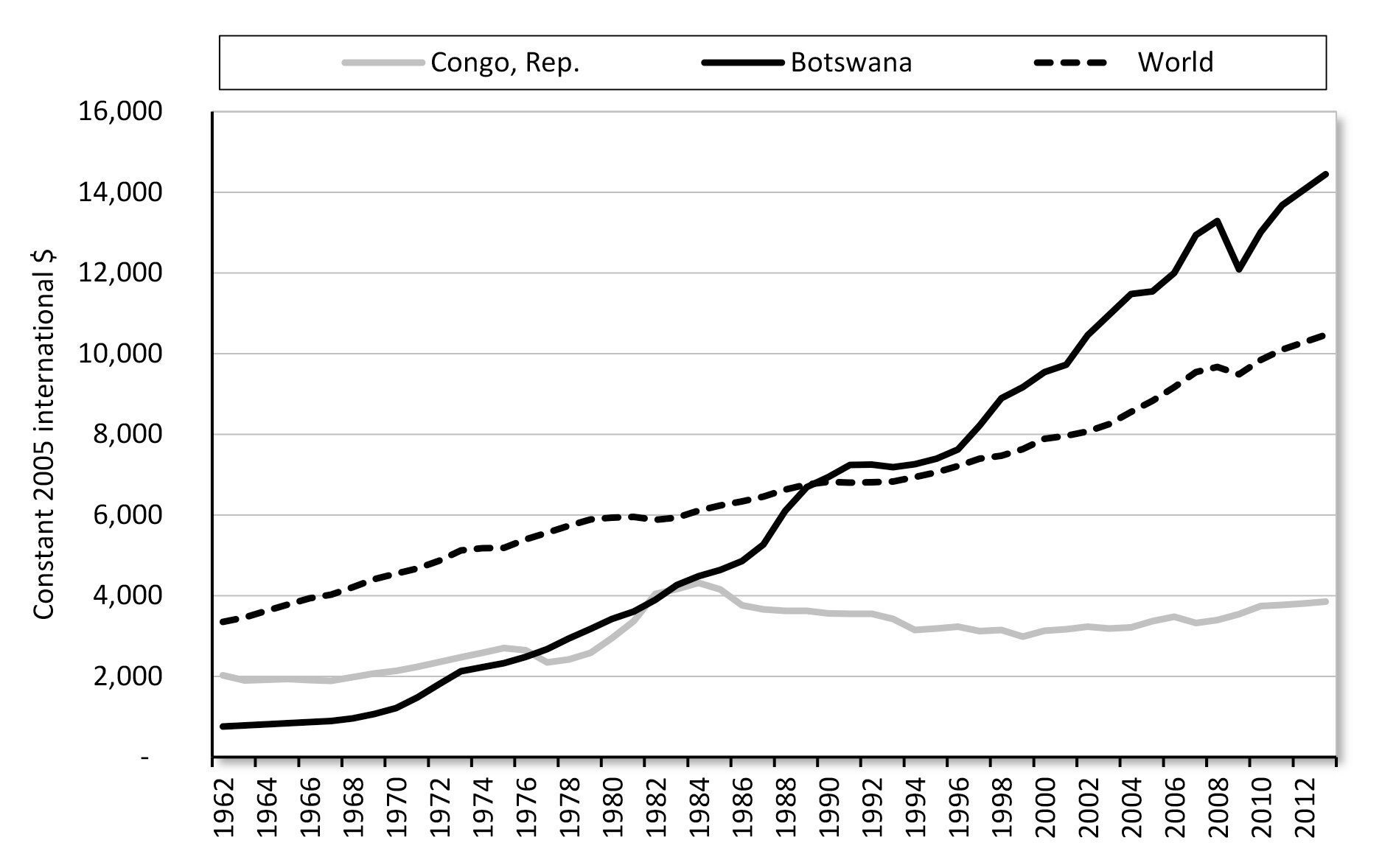

From 1966 to 1989, Botswana was the fastest-growing economy in the world, transforming itself over that period from one of the poorest states to an upper-middle-income country (its performance over half a century relative to another African mining economy, the Republic of the Congo, is shown in Figure 12). That success has largely been due to both strengthened institutions and prudent management of Botswana's diamond revenues (nearly a quarter of the world's diamond reserves are located in Botswana).

Botswana follows a strategy of fixed public spending, allowing the government to accumulate revenue surpluses during boom years. Recurrent revenue surpluses that are not spent are transferred into Botswana's Foreign Reserves Fund. By the mid-1990s, interest payments on those reserves became the largest source of Botswana's government revenue after diamond sales. Between 1976 and 2008, foreign exchange reserves grew from $75 million to $10 billion, which equaled 33 months of import cover. Those reserves mitigate the impact of price volatility, allowing the government to maintain public spending when commodity markets turn bearish.

In Norway, a large part of the state income from oil and gas exports is diverted into the Government Pension Fund of Norway. It is the second-largest sovereign fund in the world, only after the Abu Dhabi Investment Authority. The overall value of its assets is 1.5 times Norwegian GDP, and it controls over 1 percent of all publicly traded shares in the world. Stabilization and sovereign funds have significantly aided public administration in a diversity of countries, such as Malaysia and Oman. In Russia, the Stabilization Fund helped the country weather the storm of the financial crisis and the oil price drop in 2008–09 by providing an emergency reserve for the economy.

Figure 12. Real GDP per Capita (PPP) in Two African Resource Economies since 1962

Source: World Bank Open Data, author's calculations,

http://data.worldbank.org/topic/economy-and-growth.

In summary, governments usually allocate some part of receipts from mineral exports to a special fund in order to alleviate the Dutch disease and to save for a rainy day. Stabilization funds, if designed and run properly, can serve the following purposes:

- Sterilize revenue inflows57 when commodity prices are high, to mitigate upward pressure on the national currency exchange rate, which is one of the main effects of the Dutch disease;

- Manage price volatility risks and maintain public spending levels during downturns; and

- Introduce some budgetary discipline by capping government spending.

Whether a stabilization fund achieves those goals depends on whether it is sufficiently insulated from political pressures. With weak institutions, a stabilization fund will simply become another vehicle for redistributing mineral revenues into the hands of political cronies.