Two decades ago Canada suffered a deep recession and teetered on the brink of a debt crisis caused by rising government spending. The Wall Street Journal said that growing debt was making Canada an “honorary member of the third world” with the “northern peso” as its currency. But Canada reversed course and cut spending, balanced its budget, and enacted various pro-market reforms. The economy boomed, unemployment plunged, and the formerly weak Canadian dollar soared to reach parity with the U.S. dollar.

In some ways the United States is in even worse fiscal shape today than Canada was two decades ago. For one thing baby boomers are now retiring in droves, which is pushing the federal government deeper into debt every year. America risks becoming a “first world” country like those in Europe, where huge deficit spending is wrecking economies and ruining opportunities for young people.

America needs to get its fiscal house in order, and Canada has shown how to do it. Our northern neighbor still has a large welfare state, but there is a lot we can learn from its efforts to restrain the government and adopt market-oriented reforms to spur strong economic growth.

FROM MARKETS TO SOCIALISM AND BACK

Canada has a long history of stable government and general prosperity. Like the United States, it enjoyed a relatively limited government before the mid-20th century. Early Canadian leaders leaned toward classical liberal beliefs, and they tried to keep taxes at least as low as U.S. taxes in order to attract immigrants and investment.

In The Canadian Century, Brian Lee Crowley, Jason Clemens, and Niels Veldhuis discuss how Wilfrid Laurier — prime minister from 1896 to 1911 — was a strong supporter of spending restraint, low taxes, free trade, and civil liberties. Laurier was one of the country’s greatest leaders, and he envisioned Canada as a decentralized federation that supported individual liberty. That sounds like the vision of America’s Founders.

That vision, of course, faced major setbacks in both countries in the 20th century. In some cases Canada resisted the rising tide of big government longer than the United States. The United States was the first to establish a central bank, an income tax, a capital gains tax, and a number of social welfare programs. Until the 1960s, government spending relative to the size of the economy was about the same in the two countries.

Unfortunately, Canada veered sharply left in the late 1960s, beginning a 16-year spending binge and expansion of the welfare state. The Canadian leader during most of that time was Pierre Trudeau, who was a brilliant man but favored left-wing economic policies. He expanded programs, raised taxes, nationalized businesses, and imposed barriers to international investment. Canada also suffered from high inflation during the 1970s and early 1980s.

Trudeau’s socialist grip on public policy began to weaken in the 1980s. The policies of Ronald Reagan and Margaret Thatcher were ascendant, and globalization was putting pressure on Canada to make reforms.

In the mid-1980s, the Canadian central bank adopted a goal of price stability, which greatly reduced inflation and has kept it low and stable ever since. And following U.S. tax reforms in 1986, Canada enacted its own income tax cuts under Progressive Conservative prime minister Brian Mulroney.

Thatcher’s privatization revolution also inspired reforms in Canada. The government privatized Air Canada in 1988, Petro-Canada in 1991, and Canadian National Railways in 1995. All in all, Canada privatized about two dozen “crown corporations” in the late 1980s and early 1990s. In 1996 it even privatized the air traffic control system, which provides a good model for possible U.S. reforms. Privatization reduced government debt and helped spur economic growth by creating a more dynamic industrial structure.

The other major reform of the late-1980s was the free trade agreement with the United States. The debate over the 1988 agreement was a titanic political struggle in Canada. But in the years following passage, the success of the agreement has been a powerful force in reorienting Canada toward market-based policies.

SPENDING REFORMS OF THE 1990S

Canada was starting to move in the right direction, but rising government spending and debt were undermining growth and creating financial instability. By the early 1990s combined federal, provincial, and local spending peaked at more than half of gross domestic product (GDP). In the 1993 elections, Prime Minister Jean Chretien’s Liberals gained power promising fiscal restraint, but this was the party of Trudeau, and so major reforms seemed unlikely. In the first Liberal budget in 1994, Finance Minister Paul Martin provided some modest spending restraint. But in his second budget in 1995, he began serious cutting.

In just two years, total noninterest spending fell by 10 percent, which would be like the U.S. Congress chopping $340 billion from this year’s noninterest federal spending of $3.4 trillion. When U.S. policymakers talk about “cutting” spending, they usually mean reducing spending growth rates, but the Canadians actually spent less when they reformed their budget in the 1990s.

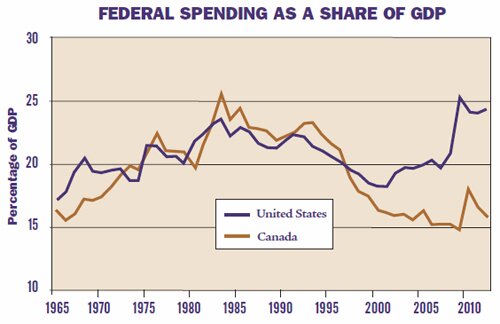

The Canadian government cut defense, unemployment insurance, transportation, business subsidies, aid to provincial governments, and many other items. After the first two years of cuts, the government held spending growth to about 2 percent for the next three years. With this restraint, federal spending as a share of GDP plunged from 22 percent in 1995 to 17 percent by 2000. The spending share kept falling during the 2000s to reach 15 percent by 2006, which was the lowest level since the 1940s.

The nearby chart contrasts the fall of federal spending in Canada since the 1990s with the rise of federal spending in the United States. In recent years, spending spiked upward in both countries because of the recession, but while U.S. spending remains at elevated levels, Canadian spending is now back down to 15.9 percent of GDP and is expected to fall further in the government’s current forecast.

The spending reforms of the 1990s allowed the Canadian federal government to balance its budget every year between 1998 and 2008. The government’s debt plunged from 68 percent of GDP in 1995 to just 34 percent today. In the United States federal debt held by the public fell during the 1990s, reaching a low of 33 percent of GDP in 2001, but debt has soared since then to reach more than 70 percent today.

Data from the Organization for Economic Cooperation and Development show that total federal, provincial, and local government spending in Canada plunged from a peak of 53 percent of GDP in 1992 to just 39 percent by the mid-1990s. In 2012, spending will be 42 percent of GDP, which compares to total government spending in the United States of 41 percent. Government spending in both countries is too high, but Canada has at least been moving in the right direction on fiscal reforms.

Aside from budget cuts, Canada improved its fiscal outlook by fixing the Canada Pension Plan, which is like our Social Security system. In 1998 Canada began moving the CPP from a pay-as-you-go structure to a partially funded system. Today the CPP is solvent over the foreseeable future, which contrasts with Social Security’s huge unfunded obligations. Note, however, that Canada supplements the CPP with additional retirement subsidies out of general tax receipts.

Canada’s fiscal reforms undermine the Keynesian notion that cutting government spending harms economic growth. Canada’s cuts were coincident with the beginning of a 15-year boom that only ended when the United States dragged Canada into recession in 2009. The Canadian unemployment rate plunged from more than 11 percent in the early 1990s to less than 7 percent by the end of that decade as the government shrank in size. After the 2009 recession, Canada has resumed solid growth and its unemployment rate today is about a percentage point lower than the U.S. rate.

Another lesson from Canada is that the rise of groups outside of the major political parties can pressure governments to make reforms. Canada’s version of the Tea Party was the Reform Party, which arose in the early 1990s and pushed the major parties to support spending cuts, tax cuts, decentralization, and parliamentary reforms.

The Reform Party elected numerous members to parliament in 1993, and it became the main opposition party in parliament in 1997. In the 2000s, the party went through structural changes and ultimately merged with the Progressive Conservatives to become the Conservative Party of current Canadian prime minister Stephen Harper.

TAX REFORMS OF THE 2000S

As the new millennium dawned, a slimmed-down Canadian government under the Liberals enjoyed large budget surpluses and pursued an array of tax cuts. The Conservatives continued cutting after they assumed power in 2006. During the 2000s the top capital gains tax rate was cut to 14.5 percent, special “capital taxes” on businesses were mainly abolished, income taxes were trimmed, and income tax brackets were fully indexed for inflation. Another reform was the creation of Tax-Free Savings Accounts, which are like Roth IRAs in the United States, except more flexible.

The most dramatic cuts were to corporate taxes. The federal corporate tax rate was cut from 29 percent in 2000 to 15 percent in 2012. Most provinces also trimmed their corporate taxes, so that the overall average rate in Canada is just 27 percent today. By contrast, the average U.S. federal-state rate is 40 percent.

U.S. policymakers are currently considering a corporate tax cut, but they are concerned that the government may lose revenues. But Canadian experience shows that governments don’t lose money when they cut high corporate tax rates. That’s because rate cuts induce an expansion in the tax base as economic activity increases and tax avoidance decreases.

Canada’s federal corporate tax rate has been cut from 38 percent in the early 1980s to just 15 percent today. Despite the much lower rate, tax revenues have not declined. Indeed, corporate tax revenues averaged 2.1 percent of GDP during the 1980s and a slightly higher 2.3 percent during the 2000s.

Now compare Canada with the United States. In 2012, Canada is expecting to collect 1.9 percent of GDP in federal corporate income taxes with a 15 percent corporate tax rate. The United States is expecting to collect 1.6 percent of GDP at a 35 percent corporate tax rate. Thus, the high U.S. rate is not only bad for the economy, but it also doesn’t help the government collect any added revenue.

THE FEDERALISM ADVANTAGE

One of Canada’s strengths is that it is a decentralized federation. The provinces compete with each other over fiscal and economic matters, and they have wide latitude to pursue different policies. Federalism has allowed for healthy policy diversity in Canada, and it has promoted government restraint.

Government spending has become much more centralized in the United States than it has in Canada. In the United States, 71 percent of total government spending is federal and 29 percent is state-local. In Canada it’s the reverse — 38 percent is federal and 62 percent is provincial-local.

The federalism difference between the countries is striking with regards to K‑12 education. While federal control over U.S. schools has increased in recent decades, Canada has no federal department of education. School funding is left to the provinces, which seems to work: Canadian school kids routinely score higher on international comparison tests than do U.S. kids.

The countries also differ with regards to the amount of top-down control exerted on subnational governments through federal aid programs. The United States has a complex array of more than 1,000 aid-to-state programs for such things as highways and education. Each of these aid programs comes with a pile of regulations that micromanage state and local affairs.

By contrast, Canada mainly has just three large aid programs for provincial governments, and they are structured as fixed block grants. It is true, however, that one of these grants helps to fund the universal health care system, which is a big exception to the country’s generally decentralized policy approach. Nonetheless, having just a few large block grants is superior to the U.S. system of a vast number of grants, each with separate rules and regulations.

A final federalism advantage in Canada is that provincial and local taxes are not deductible on federal individual tax returns. That structure promotes vigorous tax competition between the provinces. In the United States, state and local income and property taxes are deductible on federal income tax returns, which has the effect of blunting competition by essentially subsidizing hightax states and cities.

MORE REFORMS NEEDED

While Canada has made a great deal of progress, it still has a large welfare state. One problem is the huge government-run health care system. Health care spending is soaring, and wait times for medical procedures are a serious problem.

Another problem is the large deficit spending in some of the provinces. Unlike U.S. states, Canadian provinces can freely borrow and spend without having to balance their budgets each year. During the 1990s many provinces trimmed their budgets and enacted reforms such as cutting welfare. Spending as a share of GDP fell. But over the past decade spending has risen again. Ontario, for example, has a spendthrift premier who has driven the provincial debt up to 37 percent of provincial GDP.

Canada’s structure of high individual income tax rates is another weakness. The top federal-provincial rate is 46 percent, according to the Organization for Economic Cooperation and Development.

That is higher than the top U.S. federal-state rate of 42 percent, although the U.S. rate would exceed Canada’s next year under President Obama’s proposals. Either way, the top rates in both countries are too high. Higher rates penalize the most productive people in the economy, who respond by working and investing less, which in turn stunts overall growth.

Canada is thus far from being a free-market nirvana. However, its reforms have been impressive and its economy has grown strongly. Its score on “economic freedom” in the Fraser Institute’s Economic Freedom of the World report is now higher than the score for the United States.

All this raises a question: Why can’t U.S. policymakers make major fiscal reforms like the Canadians have? One answer is that the U.S. governing structure — with its separated powers — makes rapid policy change more difficult than does the Canadian parliamentary system.

A more important factor, however, has been that the Democrats in the United States have moved so far to the left on economic issues that it makes the type of pro-market reforms Canada enacted very difficult to achieve. Many of the Canadian reforms were enacted by a Liberal Party that moved from the political left to the center. At the same time, the rising Reform Party essentially displaced the old Progressive Conservative Party, which had moved too far to the left. Voters did their part by supporting the reform-minded parties at the ballot box.

In 2010, American voters demanded cuts to government spending and debt. Some members of Congress are heeding the call and introducing plans to restructure entitlements and terminate programs. However, most policymakers are still resisting the major spending cuts, privatization, and other Canadian-style reforms that we need to avert a fiscal crisis and restore strong economic growth to the United States.