Learn more about Cato’s Amicus Briefs Program.

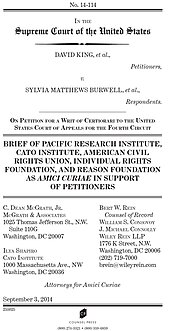

When the Affordable Care Act was being debated in Congress, former House Speaker Nancy Pelosi infamously insisted that “we have to pass the bill to find out what’s in it.” It turns out, however, that the Obama administration — which has been making it up as it goes along with regard to ACA enforcement — doesn’t care “what’s in it.” The IRS in particular has been implementing Obamacare as it thinks the law should be, not as it is. The ACA encourages states to establish health insurance exchanges by offering people who get their health coverage “through an Exchange established by the State” a tax credit — a subsidy to help them pay their premium. In the event a state declines to establish an exchange, Section 1321 further empowers the Department of Health and Human Services to establish federal exchange in states that decline to establish their own exchanges (without providing for the premium subsidy). When, contrary to the expectations of the law’s architects, 34 states declined to establish an exchange — 2 more have since failed — the IRS decided that those getting their insurance on federally established exchanges should qualify for tax credits regardless of the statutory text. In conflict with the U.S. Court of Appeals for the D.C. Circuit in a similar case called Halbig v. Burwell, the Fourth Circuit found the legal text to be ambiguous and thus deferred to the IRS interpretation. The so-called Chevron doctrine counsels that statutory text controls when Congress has spoken clearly on an issue. But where Congress is ambiguous or silent, the agency can fill the regulatory gap with its own rules and policies. The problem here is that the ACA’s text was not ambiguous and there is no evidence that Congress intended to delegate to the IRS the power to determine whether billions of taxpayer dollars should annually be dispersed to those purchasing health care coverage on federal exchanges. That the Fourth Circuit has bent over backwards to accommodate the administration’s latest Obamacare “fix shows that it, too, is not so concerned with “what’s in” the law. To that end, Cato joined four other organizations in supporting the plaintiffs’ petition for review by the Supreme Court. Our brief argues that the Court should hear the case because it offers the opportunity to reverse potentially grave harm to the separation of powers, to correct a misapplication of the Chevron doctrine, and to restore the idea that drastically altering the operation of a major legislative act belongs to the political process and not in a back rooms of an administrative agency. Just because those who voted for the ACA didn’t care what it said doesn’t mean that the executive and judicial branches should also turn a blind eye.