Singapore pulled off a brilliant Trump-Kim summit in all respects, including the bottom line. Indeed, the government of Singapore spent $15 (USD) million, and according to estimates by Meltwater, that expenditure generated $568 (USD) million for the city-state. Not a bad return for a few days’ work. But, it’s not surprising. Singapore is run like a business. Singapore, Inc. is entrepreneurial, not parasitical.

Singapore validates Adam Smith’s counsel on economic development: “Little else is requisite to carry a state to the highest degree of opulence from the lowest barbarism, but peace, easy taxes, and a tolerable administration of justice.”

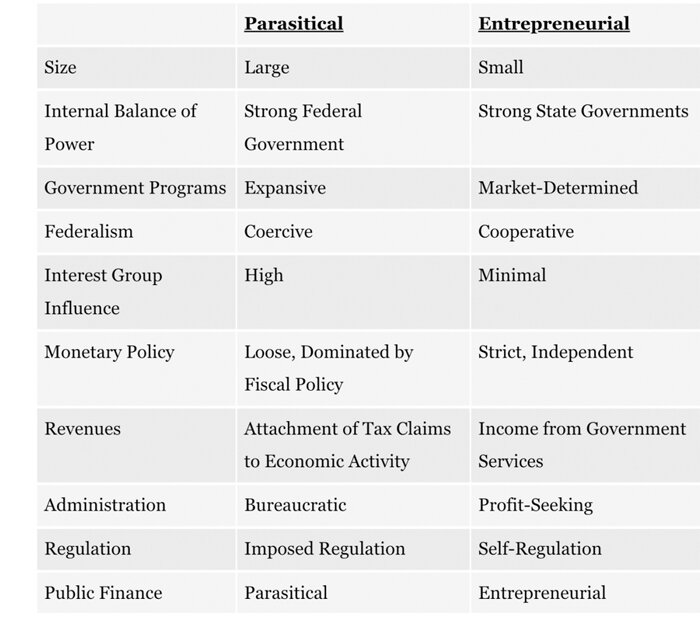

To understand the Singapore Strategy (read: Singapore, Inc.), we must examine two systems of public finance: entrepreneurial and parasitical. The parasitical system is the familiar system whereby political entities derive revenues by attaching legally enforceable tax claims to the private economic activities of market-based entities. In contrast, under the entrepreneurial system of public finance, political entities derive revenues directly from the provision of services.

To trace the development of the entrepreneurial and parasitical public finance systems from economic theory to institutional arrangements, it is necessary to sketch the historical development of public finance. The origins of public finance, as a field of scholarly inquiry, can be traced to the cameralists who arose in the German speaking lands in the 16th century. The cameralists’ proto-entrepreneurial conception of the state and public finance viewed the prince as a business person. As a business person, the prince managed his various lands and estates to generate the revenues required to finance the provision of public services. In cameralist thought, the main instruments of public finance were fees and charges, not taxes.

With respect to leagues of city-states and city-states specifically, the Hanseatic League and the Italian city-states provide historical illustrations of the entrepreneurial, commerce-centered character of those regimes. These cooperative, multi-state systems arose largely out of a desire to protect and facilitate commerce, and reduce trade frictions.

Contemporarily speaking, Singapore, Hong Kong, and even the Cayman Islands exemplify commerce-oriented city-states. How can such a small player, like Singapore, achieve prominence on the world’s stage? Since the projection of military power is not an option, prominence must be secured through commerce.

States, like Singapore, face a choice between following the lead of the imperialist powers and embracing parasitical public finance, or acting as a commercial republic and embracing a regime of entrepreneurial public finance. The table below depicts the main differences between these two frameworks of state organization.

Two Frameworks of State Organization

It is clear that the culture of an entrepreneurial inclined city-state — like Singapore — differs significantly from that of a parasitical state that feeds on tax extractions. No wonder the organization of the Trump-Kim Summit went so smoothly and generated such outsized benefits.