Like Saint Augustine, Republicans want chastity and continence — but not yet.

The federal debt is $30 trillion, equal in size to the U.S. economy. Existing law threatens to add another $20 trillion by 2034. Surging health care subsidies are driving toward a potentially devastating debt crisis. Avoiding one requires drastic spending cuts and entitlement reforms.

Small-government advocates say the budget bill that Senate Republicans just approved 51 to 50 and sent to the House would at least limit federal spending. But would it? Three factors say no.

First, like the House budget, it would not cut spending. Not even a little. It would let federal spending rise from $7 trillion this year to $10 trillion in 2034.

Official projections suggest the House budget would increase spending by a mere $774 billion less than current law. (Comparable estimates aren’t available for the Senate budget, but it’s probably similar.) That’s less than 1 percent of the $86 trillion that current law would spend over the next decade — and even that tiny sliver of savings is unlikely.

Second, over the coming decade, the Senate budget, like the House budgets, would add $3.3 trillion to federal deficits and thus the federal debt. That’s in addition to the $50 trillion mark that the federal debt will hit under current law.

Deficit spending pushes government spending higher. It creates the illusion that government is less expensive than it is, which leads voters to demand more of it. That effect alone could wipe out either bill’s tiny sliver of savings.

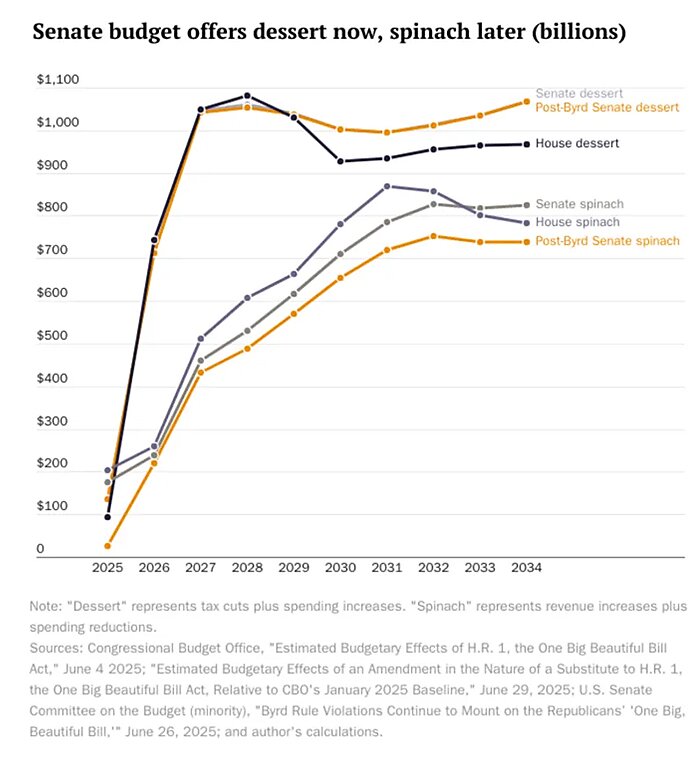

Third, while both bills epitomize “dessert now, spinach later” budgeting, the Senate bill appears even worse. Each rolls out its tax cuts and spending increases quickly, which ensures that those provisions will take effect. But they schedule most of the revenue increases and spending reductions for the second half of the ten-year budget window.

In the first year of the Senate budget, dessert outweighs spinach by a ratio of 5 to 1. Under each bill, dessert would peak in 2027 at 3.2 percent of GDP. But the Senate bill pushes 68 percent of its spinach into the second half of the ten-year budget window, versus 65 percent for the House.

Postponing spending cuts often means they won’t occur, because Congress constantly reneges. Congress has reneged on statutory cuts to farm subsidies and military spending. It enacted cuts in 2011, partially reneged on them in 2013 and 2015, and then fully reneged in 2018 and 2019. In 2023, it limited future spending, then immediately undermined those limits. Earlier this year, it again waived cuts that otherwise would have occurred.

Even more than the House budget, the Senate budget would achieve most of its savings by slowing the explosive growth of health care subsidies — where Congress is especially likely to renege. The health care industry lobbies Congress more heavily than anybody does, outspending the defense industry by nearly 6 to 1. It has convinced Congress to delay or rescind cuts to subsidies for doctors, hospitals, and clinical labs, and convinced former President Barack Obama to renege on cuts to health insurers. Postponing spending cuts tells lobbyists, “Don’t worry, you’ll have plenty of time to work your magic.”

The surest sign that the Senate budget’s dessert would occur and its spinach would not is how Congress has behaved in the past. Congress’s tendency to devour dessert and send back spinach is what produced a $30 trillion debt in the first place, plus existing laws that threaten another $20 trillion of debt. It produced not one but two budget proposals this cycle that each offer another $3.3 trillion of dessert when they should be serving up $20 trillion of spinach.

If that tendency makes future spending reductions just 8 percent less likely to take effect with each passing year, a $774 billion sliver of savings vanishes. All that remains is $86 trillion of spending — and a fiscal illusion that spurs voters to demand even more.

History is screaming at us not to take the official projections at face value. The Senate budget is not a government-limiting measure.

At a moment when taxpayers need real spending cuts and entitlement reform, the Senate budget would perpetuate a system in which politicians impose massive tax burdens on future generations to enrich today’s special interests.